Putting a business idea into practice - Topic 1.3

1/38

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

39 Terms

What are aims?

Overall goals that they want to achieve

What are financial aims?

Aims based on the amount of money or the number of sales a business wants to use

What are examples of financial aims?

Survival

Enough money to stay open

Maximise profit

Increase market share

The percentage of a markets total sales a particular product or company has made

Having a part of the market share means the business establishes itself, takes sales away from competitors and persuades customers to buy its products

Maximise sales

Increases the sales eg by reducing products price

Not the same as wanting more profit

Achieve financial security

Depend on its own revenue and not external sources

What are examples of non-financial aims?

Accomplishing a personal challange

Achieving personal satisfaction

Follow personal interest

Gaining independence and control

Independence of being their own boss

Doing whats right for society

Moral goals

What are objectives?

Steps that help business achieve their aims

What factors effect a businesses objectives and aims?

The size and age of the business

Small and new businesses are likely to aim for survival or growth

Established businesses may concentrate on achieving finiancial security and a increase in sales

Larger business may have social aims as they have publics attention

Who owns the business

Shareholders may have pressure to have aims on maximising profit

Soletraders may aim for non-financial aims as they are young

The level of competition the business faces

If a business as a competitive market they may aim for survival

Firms that dont have that many competitors may aim for increasing market share and maximising profit

What is revenue? What is the calculation?

The income earned by a business

Revenue = quanity sold x price

What are the costs? What is the equation?

The expenses paid out to run the business

Total costs = total varible costs + total fixed costs

What are fixed cost?

Cost that dont vary with output and must be paid even if the business produces nothing

What are variable cost? What is the equation?

Costs that will increase as the firm expands output

Total varible cost = quantity sold x variable cost per unit

What is interest?

A charge for borrowing money so the business can pay back more then what was borrowed

What is the equation for interest?

Interest (on loans) = total repayment - borrowed amount / borrowed money x 100

What is profit? What is the equation?

The different between revenue and costs over a period of time

Profit = revenue - cost

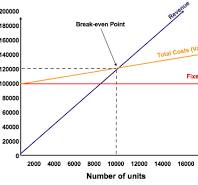

What is the break-even point?

The level of sales a firm needs in order to just cover its costs

What can break-even be measured in?

The number of units that has to be sold to meet it

The revenue the firms needs to cover its costs

What is the equation for break even in units?

Break-even point in units= fixed costs / sales price - variable cost per unit

What is the equation for the break-even point for revenue (or costs) ?

Break-even point for revenue (or cost) = break-even point in units x sales price

What is a loss?

When a firm sells less then its break-even point

Break-even diagrams

What is the margin of safety?

The gap between the current level of output and the break even output (how many units are currently being sold vs what needs to be sold)

What is the equation for the margin of safety?

Margin of safety = actual sales (or budgeted sales) - break-even slaes

What is cash?

The money a company can spend immediately

Why do businesses need cash?

To pay:

Employees

Suppliers

Overheads (on going expenses)

What is cash flow?

The flow of money in and out the business

What is the equation for net cash flow?

Net cash flow = cash inflows - cash outflows for a given period of time

What is positive cash flow?

When there is more cash inflow than cash outflow for a particular period of time

What is the advantage and disadvantage of positive cash flow?

Advantage

No problem making payments

Disadvantage

Losing opportunities to invest in ways that might improve eg new equipment

What is a cash flow forecast?

Lists all the inflows and ouflows of cash that appear in the budget (a forecast of all of the firms likely expenses and revenue)

What is the equation for closing balance?

Closing balance = opening balance + net cash flow

What are credit terms?

Tells you how long after agreeing to buy a product the customer has to pay

Why do firms need finance?

New firms need start-up capital (they money or assets needed to set up a business)

New firms often have poor initial cash flow - means they find it hard to cover their cost

Sometimes customers delay payment so fianances need to cover the shortfall of cash flow

If a business is struggling, it may need additional finance to meet its day-to day running cost

Need finances in order to expand

What is trade credit?

A short-term source

Gives a firm a month or two to pay for certain purchases

Gives them time to earn money to pay it off

However a large fee may be charged if money cant be payed back in time

What is overdraft?

Short-term source

Allows firms to take more money out of their account than it has paid into it

Allow businesses to may payments on times even if they cant afford it

However, they usually have a high interest rate than other loans and the bank can cancle the overdraft at any time

If it hasnt been paid off the bank can take some of the business’ assests

What is a loan?

Long-term source

Bank loans are quick and easy to take out

Repaid with interest

If not paid, the bank can repossess the firms assets

However, the interest rate is usually lower then overdrafts

May pay their bank back in monthly instalments which will increase their fixed costs

Businesses check they can still reach their break-even with this extra cost

What are personal savings?

A business owners own money into the business to get it started or if it is having cash flow problems

Risky as individual could loose their money if the business fails

What is share capital?

Individauls can buy shares in the businss

This means they have part ownership

The business can gain the money through issuing shares

What is venture capital?

Money raised through selling shares to individuals or businesses who specialises in giving finance to new or expanding firms

Venture capitals usually buy shares that are risky but have potential to grow quickly

They will take a stake in the business and may expect returns more quickly than other shareholders would

What is retained profit?

These are profits that are owners have decided to plough back into the business after theyve paid themselves a dividend

What is crown funding?

When a large number of people contribute money towards starting up a business or funding a business idea