Government Intervention

1/16

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

17 Terms

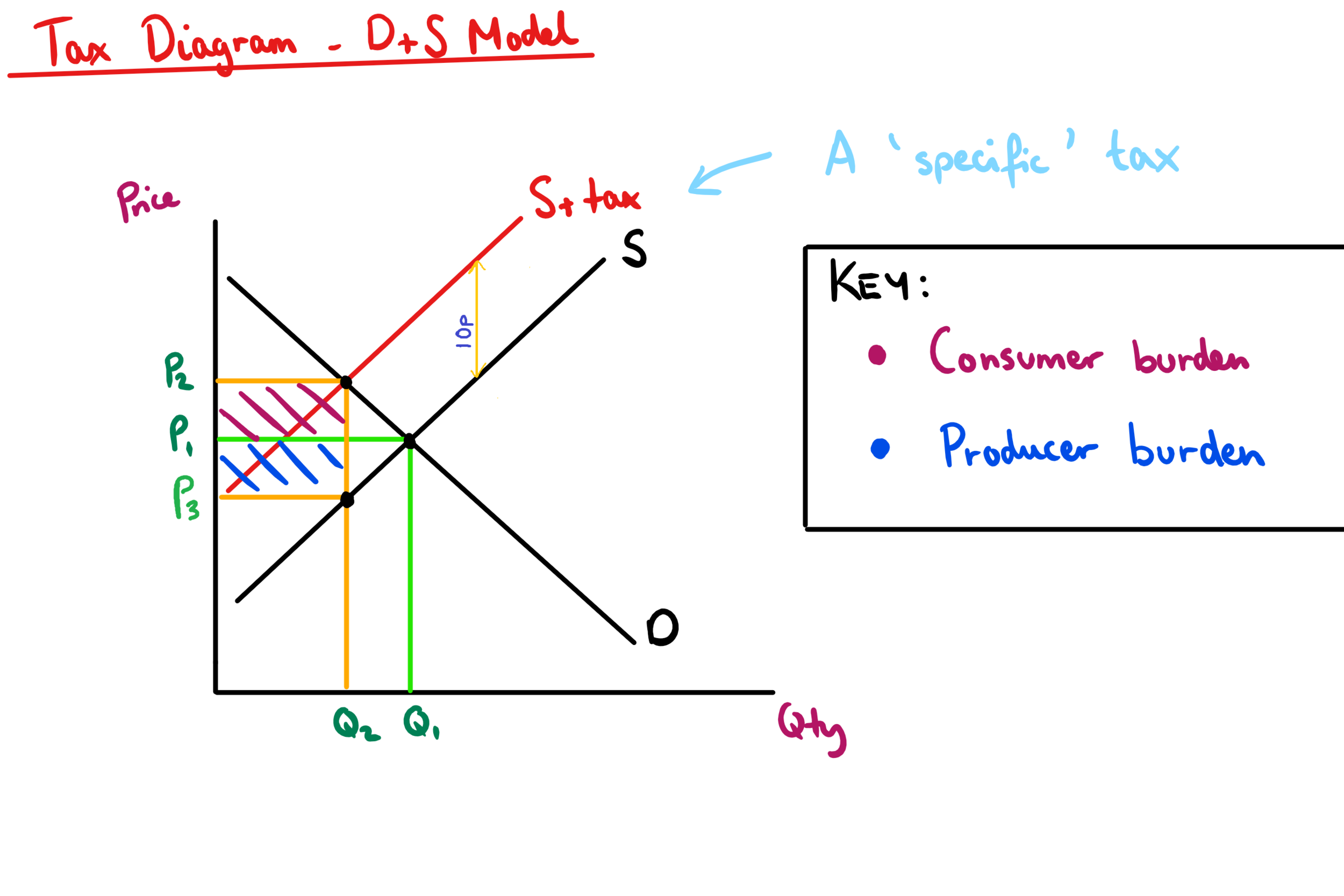

Indirect Tax

A tax levied on goods or services rather than consumers or companies.

Two types of indirect tax

Ad Valorem

Tax per unit

Indirect tax

Things to mention when analyzing a graph

P&Q

Government revenue

Consumer burden

Producer burden

DWL

Deadweight Loss

Loss in the total value of trades that could’ve occurred but didn’t because sometehing interferred with the market.

PED > 1 and Tax

Consumer burden: Lower

Producer burden: higher

Government revenue: higher

PED < 1 and Tax

Consumer burden: Higher

Producer burden: Lower

Government revenue: Higher

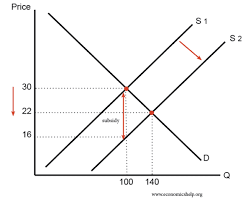

Subsidy

Money granted to firms by the government to reduce costs of production and encourage increase in output

Deadweight loss in subsidies

Area that represents the trades that only happen because of the subsisdy, but shouldn’t from a societal point of view.

Subsidy

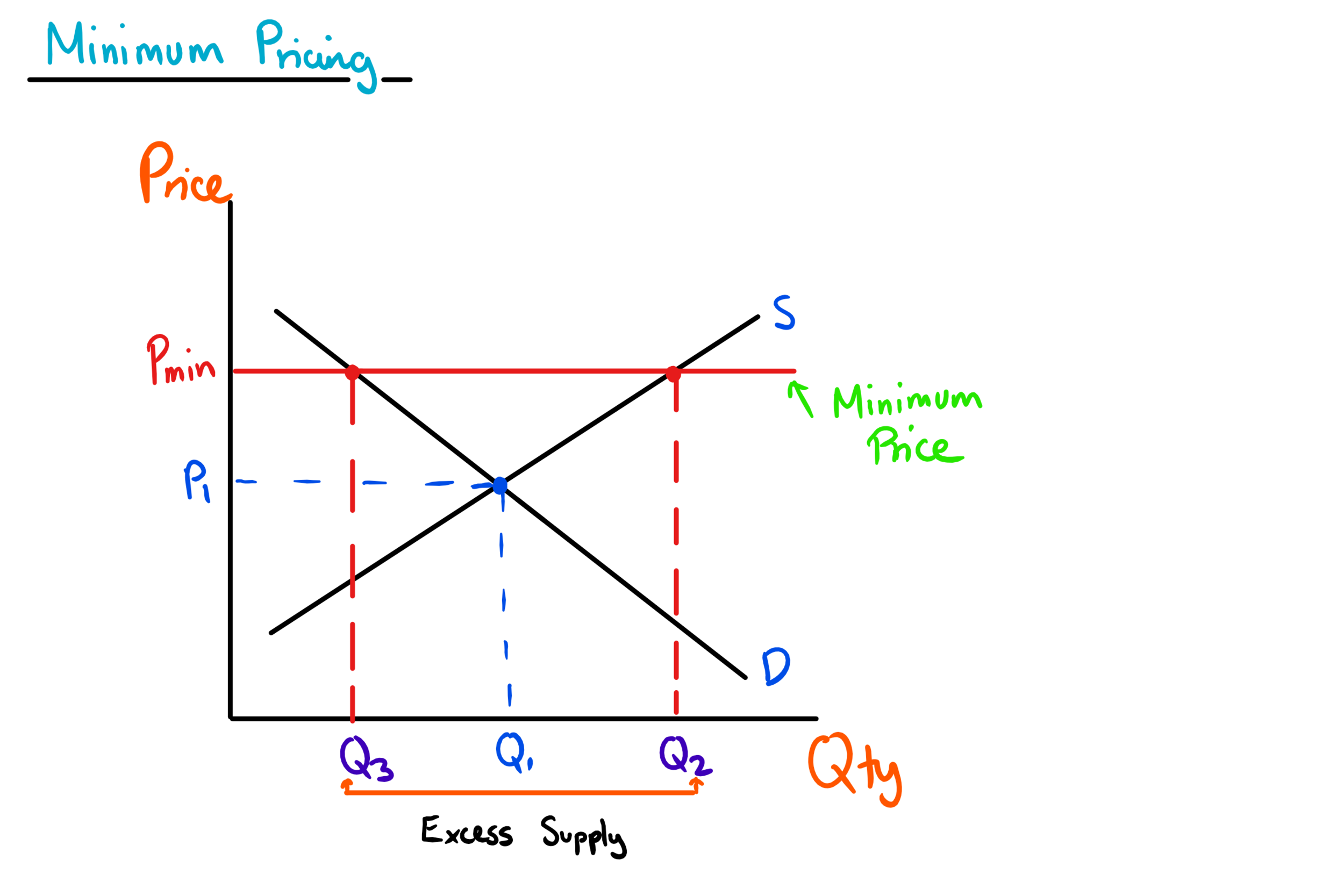

Minimum Price

A fixed price (price floor) enacted by the government usually set above the equilibrium.

Reasons for minimum price

Protect producers from price votality

Solve market failure

Intervention buying

When the government buys the excess supply generated by the price floor.

Price floor

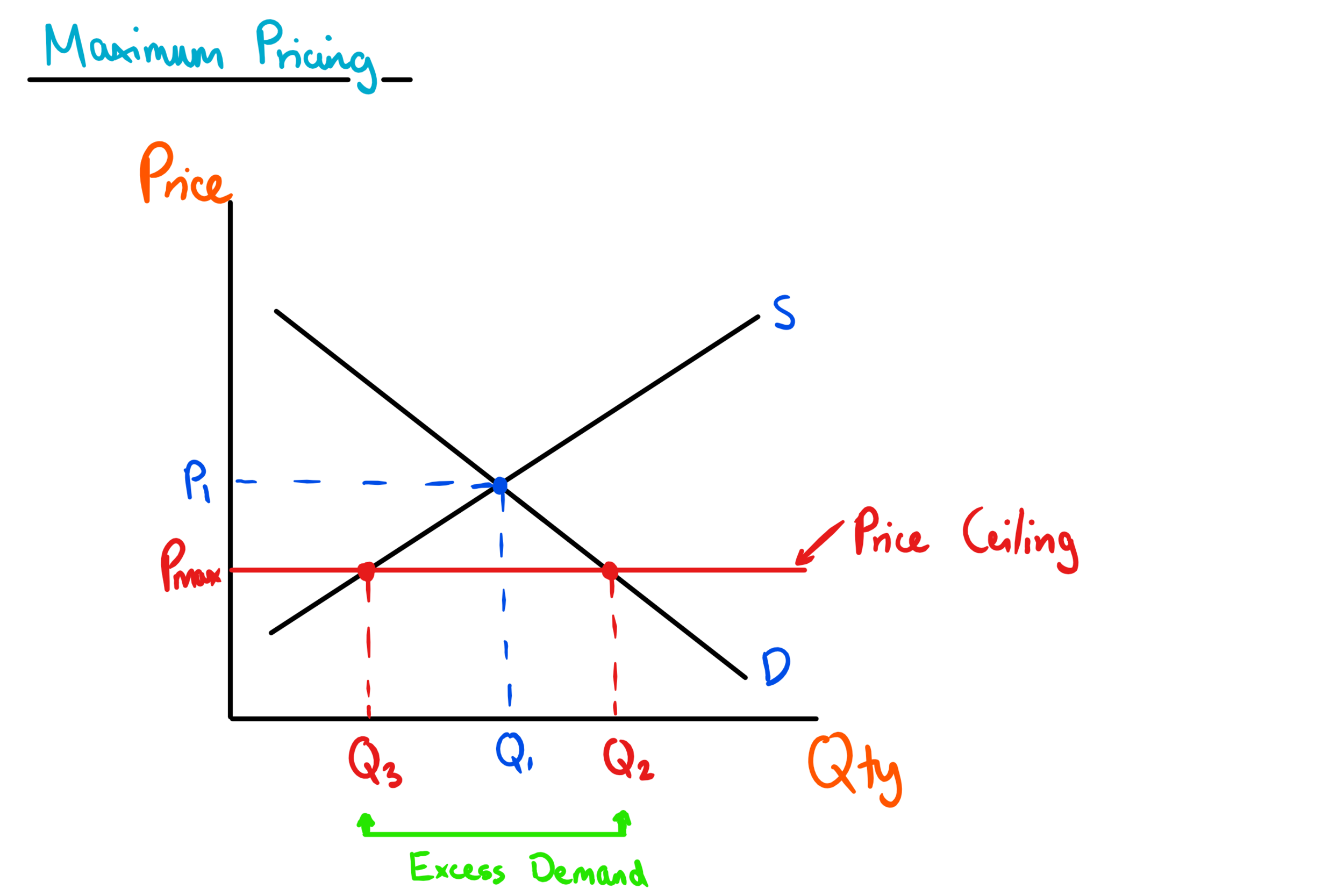

Maximum Price

Doesn’t allow producers to sell at a higher price than that.

Reason for a price ceiling

To increase affordability of necessity goods/services

Price Ceiling