1.4.1 - government intervention in markets

1/25

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

26 Terms

why does government intervention happen

to combat market failure

5 ways governments can deal with an over-allocation of goods

PRIMT:

Provision of information

Regulation

Indirect taxation

Minimum prices

Tradable pollution permits

regulation definiton

government imposes rules regarding the production, sale or use of a product

backs this up legally (prison, fines etc)

regulation examples

illegal drugs

alcohol age limit

warnings on cigarette packets

regulation strengths and weaknesses

easy to understand

simple to administer

possible to achieve international agreements

may be difficult and expensive to enforce

firms may ignore fines if not large enough

indirect taxation definition

a tax on expenditure

placed on the producer to increase costs of production, causing supply to shift left (raises price, reduces quantity)

[see more on 1.2.9a notes]

strengths and weaknesses of indirect taxation

easy to understand

flexible - can be adjusted as the problem changes

internalises the externality

raise revenue that gov can use to further reduce externalities

can affect consumers more than producers (inelastic goods)

inelastic demand = consumption won’t reduce significantly

questions about motive: to raise gov revenue or to deal with the problem to society?

tradable pollution permits definition and process

limit placed on the amount of pollution:

corresponding number of permits are released

permits can be bought and sold (there is a price for pollution)

incentive: low polluters buy less or can sell spares

over time gov reduce number of permits available (less pollution, higher price of pollution)

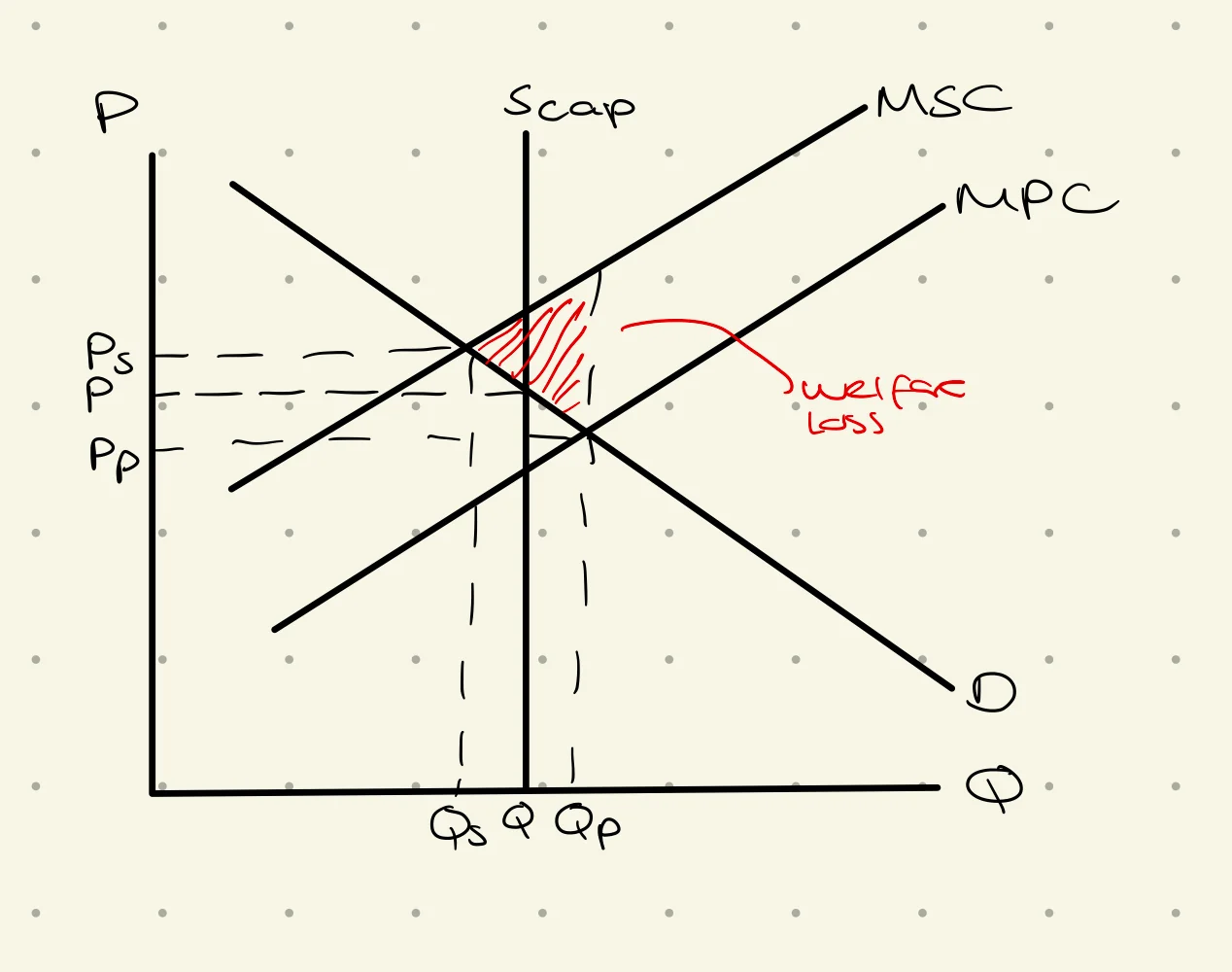

tradable pollution permits diagram

welfare loss reduced when pollution permits introduced

strengths and weaknesses of tradable pollution permits

uses advantages of price mechanism (signals, incentives, rationing) to deal with problem of pollution

will reduce total size of externality

internalises the external cost (makes it a priv cost - polluter is paying for the pollution)

gives message that pollution is ok

difficult to introduce and set right number of permits

expensive to regulate

firms may outsource production to countries without permits

provision of information definition

gov uses advertising campaigns, education and laws to combat information failure

eg. warn ppl ab smoking = shift demand left

strengths and weaknesses of provisions of information

is often easy to understand

simple to administer

ppl may ignore

scientific knowledge may change

may be difficult to understand

no financial disincentives

minimum prices (aka price floor) definition

minimum price set above the equlibirum to reduce demand for demerit goods/goods with neg. externalities

results in excess supply (amount dependent on how far above equilibrium price is set)

ps. minimum wage also counts: minimum price of labour

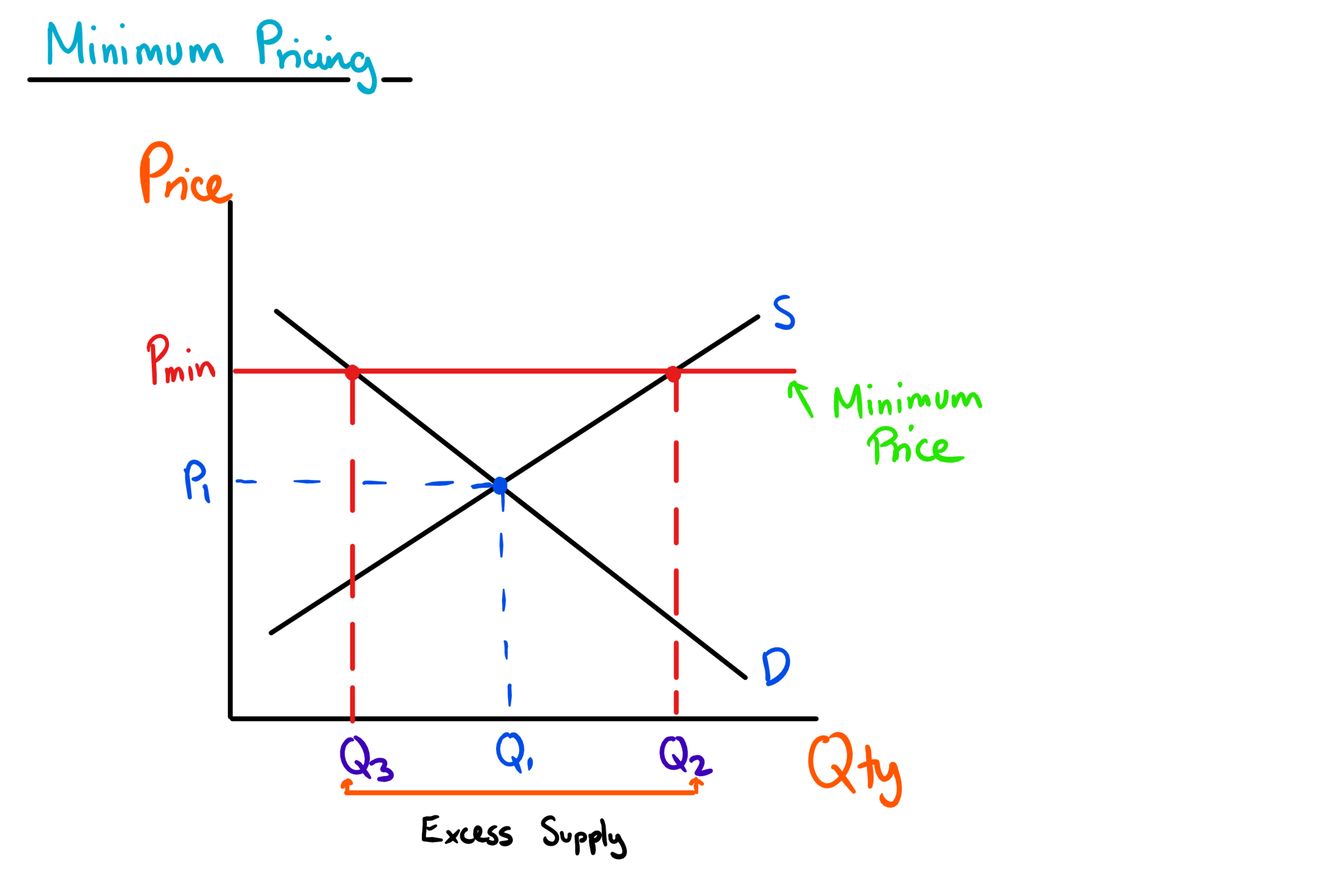

minimum prices graph

more elastic = more excess supply (+vice versa)

not shown in photo but also possible to put minimum price on neg. externality diagram

strengths and weaknesses of minimum prices

internalises the external cost

guaranteed fair price for producers

reduces demand for demerit goods

may be expensive to regulate (gov has to buy up excess supply)

can encourage over-production if the gov will buy excess (easy money for the producers)

inelastic = consumers pay more for a good

can result in black market

5 ways the gov can deal with an under-allocation

PRMSS:

Provision of information

Regulation

Maximum prices

Subsidies

State provision

regulation in underallocation

can make certain services compulsory (eg. education)

provision of information in underallocation

inform ppl of the benefits of merit goods

shift demand right, nearer to marginal social benefits

subsidies definition

reduces costs of production to the producer, therefore inceasing supply and reducing price

encourages consumption of a good with positive externalities

[see more on 1.2.9b notes]

strengths and weaknesses of subsidies

easy to understand

use of the price mechanism (incentives)

expensive for the government

producers may become dependent on the subsidy

opportunity cost for government

inelastic demand = very large subsidy to increase consumption significantly

state provision definition

government directly provide a product at zero price

funded through taxation

either public goods or goods with positive externalities

eg. lighthouses, education

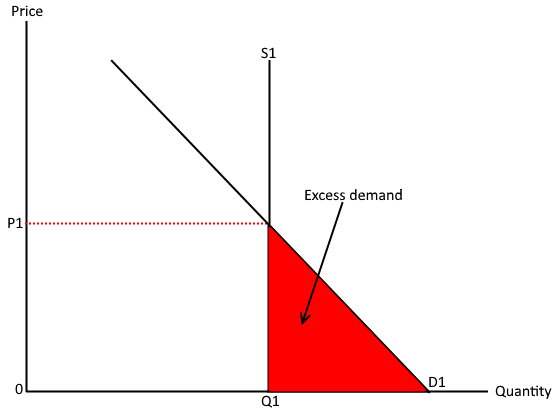

state provision diagram

gov provide smt at 0 price

so everyone who wouldn’t have been willing/able to pay equilibrium price are now using it

so excess demand

strengths and weaknesses of state provision

fair - access to all instead of those who can afford

only way to provide public goods

expensive for the government

opportunity cost for the government

excess demand = rationing, queuing, etc

state monopoly can lead to inefficiency (no incentives bc no price)

maximum prices (aka price cap, price ceiling) definition

set below the equilibrium to set limits on the returns that producers make OR to help consumers afford necessities eg. bread, housing

results in excess demand (how much depends on how far below equilibrium min price is set)

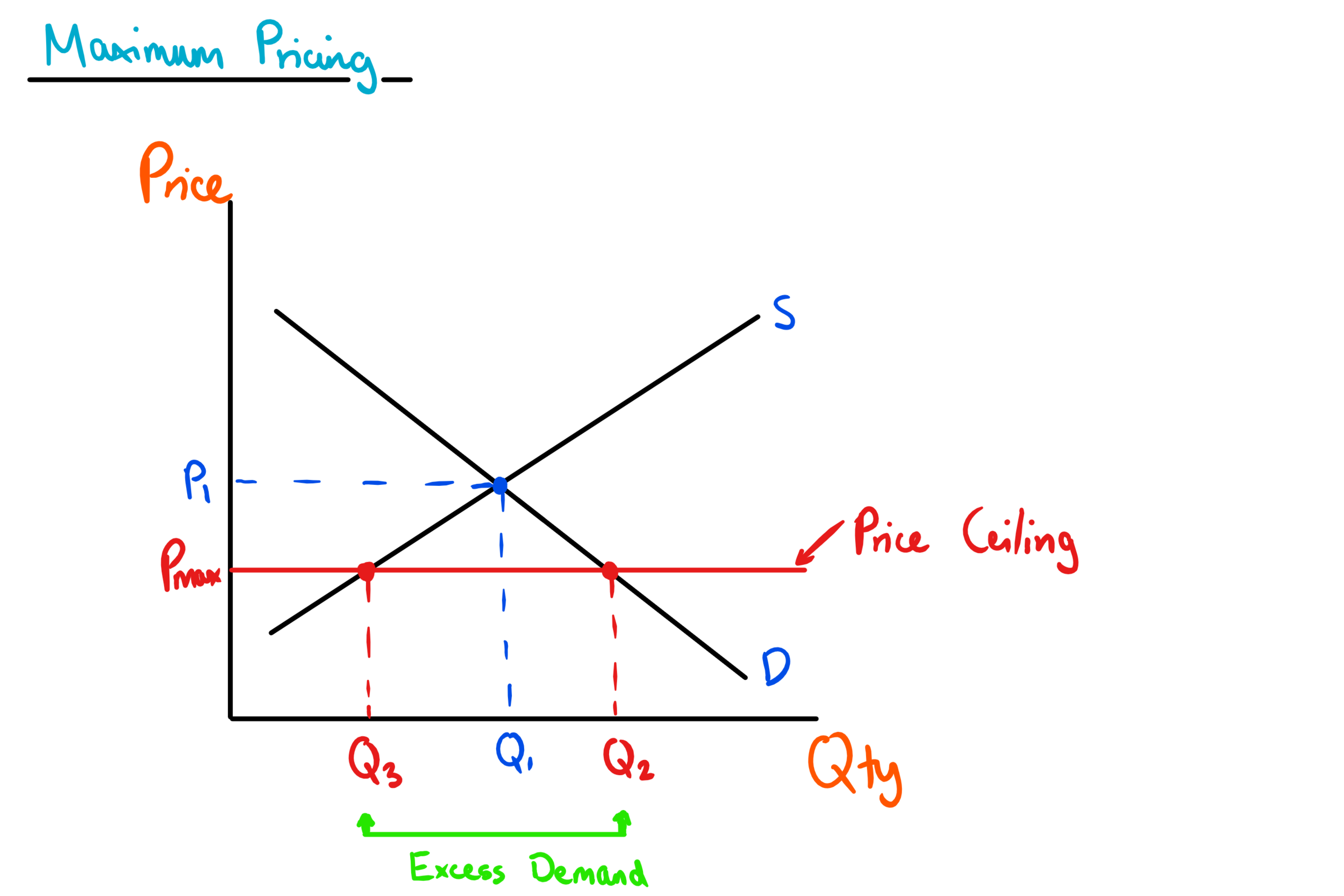

maximum prices graph

excess demand = waiting lists, queues, gov may have to provide (eg. social housing)

strengths and weaknesses of maximum prices

will increase consumption of goods with priv/social benefits

will help solve inequality by ensuring everyone has necessities (eg. housing, food)

excess demand = queues/waiting lists

expensive - state may have to devise systems to allocate based on greatest need

black market may develop