EC10B: PSET 1-11 Final Prep

1/181

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

182 Terms

Which of the following statements best describes the relationship between microeconomics and macroeconomics?

A. Microeconomics and macroeconomics are two completely separate disciplines that don't relate to each other.

B. Core microeconomic principles like optimization and equilibrium don't apply to the study of macroeconomics.

C. The mutual optimization of agents in an economy results in equilibrium for the economy as a whole.

D. Macroeconomic models always pay explicit attention to the optimization of individuals and firms.

C

Why is it difficult to have clear empirical evidence about causal relationships in macroeconomics?

A. In most cases, it is infeasible to run randomized control trials or find natural experiments on the scale necessary to answer important macroeconomic questions.

B. Causation runs in many directions in a complex global economy.

C. Economies change over time, so what works in one decade may no longer work in the next.

D. All of the above.

E. None of the above.

D

The accounting identity that is used to estimate the gross domestic product of a country is given by

A. Production equivalent Expenditure equivalent Income

B. Production equivalent Expenditure equivalent Consumption

C. Income equivalent Production minus Consumption

D. Consumption equivalent Income minus Saving

A

Suppose that a sofa is manufactured in Germany using $300 of leather that is imported from Portugal. The sofa is then sold to a German retailer for $1,000 and purchased by a consumer in Germany for $1,500.

How much does this contribute to Germany's GDP?

A. $500

B. $900

C. $1,200

D. $1,500

E. $2,200

C

Which of the following would be included in a country's GDP?

A. Shares of a company's stock purchased by an investor.

B. Transfer payments from the government to families with low income.

C. Unpaid care provided to an elderly relative.

D. Salaries paid to guards working in federal prisons.

D

Which of the following statements is about GDP is FALSE?

A. As per-capita GDP has risen in the U.S., self-reported happiness has risen too.

B. Economists use GDP as a useful, summary measure of societal well-being even though it has a number of limitations.

C. Countries with higher per-capita GDP also have, on average, better health and higher self-reported happiness.

D. Ec10 survey data reveals a correlation between family income and self-reported

life satisfaction, but income alone predicts only 4% of the variation in self-reported well-being.

A

Inflation is the ____________.

A. ratio of money supply to nominal GDP

B. average increase in prices across the economy

C. growth rate of real GDP

D. growth rate of nominal GDP

B

Which of the following are costs of inflation?

A. People experience the hassle of having to hold less cash (because inflation erodes its value).

B. Inflation can produce arbitrary redistributions of purchasing power, especially when it is unanticipated.

C. Even if people are not financially harmed or even gain from inflation, they tend to deeply dislike inflation.

D. If employment contracts are set in advance, unexpectedly high inflation can reduce real wages.

E. All of the above.

E

Which of the following are benefits of (moderate) inflation?

A. The government can raise revenue by printing money.

B. Inflation facilitates the adjustment of real wages.

C. Inflation gives central banks more scope to use monetary policy to fight recessions.

D. All of the above.

D

The real wage is the ____________.

A. amount of money an individual keeps after paying all taxes.

B. inflation-adjusted wage.

C. wage that would prevail in the absence of government intervention, such as a minimum wage.

D. price level divided by the nominal wage.

B

Nominal wages in the country of New Cambridge have risen by 5% in the last year. Which of the following statements is definitely true?

A. Labor demand in New Cambridge has shifted to the left in the last year.

B. Workers in New Cambridge receive larger paychecks than they did a year ago.

C. Workers in New Cambridge have greater purchasing power than they did a year ago.

D. Prices in New Cambridge rose by 5% in the last year too.

B

According to the quantity theory of money, ____________.

A. the ratio of the money supply to nominal GDP fluctuates widely over long periods of time.

B. in the short run, the growth in the money supply is directly related to the inflation rate.

C. in the long run, the growth in the money supply is directly related to the inflation rate.

D. the inflation rate will stay constant over the long run.

C

Which of the following economies will have the highest inflation rate?

A.Growth rate of money supply = 9%; growth rate of real GDP = 8%

B.Growth rate of money supply = 2%; growth rate of real GDP = 8%

C.Growth rate of money supply = 5%; growth rate of real GDP = 1%

D.Growth rate of money supply = 3%; growth rate of real GDP = 0%

C

Identify the category in which the Department of Labor would classify the following people.

Bella retired from the military last month and has been actively looking for work since.

Sven is a full-time Harvard student who does not work or look for work.

Daisy is working part-time at company Y but is looking for more work for extra income.

Dorothy lost her job last year but has not tried to find a new job due to concerns about her health.

Unemployed

Not in labor force

Employed

Not in labor force

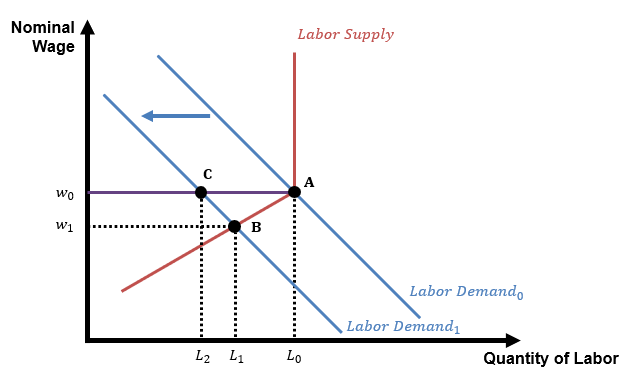

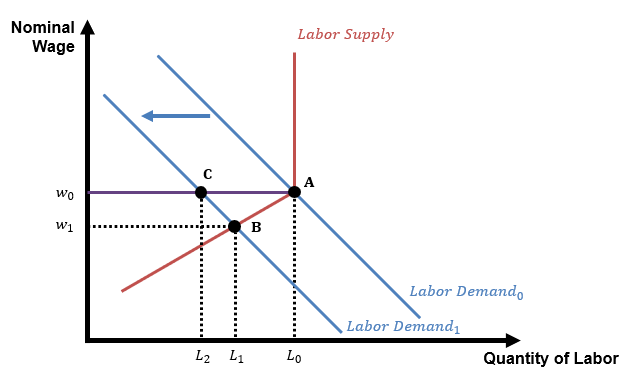

The graph on the right shows a labor market that is initially in equilibrium. The market then experiences a shock to labor demand. Suppose the market is initially in equilibrium at A, where the labor supply curve intersects the Labor Demand 0 curve. A shock to the market causes the labor demand curve to shift leftward to Labor Demand 1.

If nominal wages are completely flexible and can adjust freely and quickly, what would be the change in employment caused by the shock to labor demand?

A. Since the nominal wage is flexible and can adjust freely, the shock to the labor market would have no impact on employment.

B. The labor market would move from A to C, resulting in a decrease in employment from Upper L 0 to Upper L 2.

C. The labor market would move from A to B which would result in a decrease in employment from Upper L 0 to Upper L 1.

C

If nominal wages, instead, are downwardly rigid and remain at w 0, what would be the change in employment caused by the shock to labor demand?

A. Since the nominal wage is flexible and can adjust freely, the shock to the labor market would have no impact on employment.

B. The labor market would move from A to C, resulting in a decrease in employment from Upper L 0 to Upper L 2.

C. The labor market would move from A to B which would result in a decrease in employment from Upper L 0 to Upper L 1.

B

Using the empirical relationship known as Okun's Law and the specific numerical parameters that Jason showed in lecture, if the unemployment rate rose by 3% you would expect the growth rate of real GDP to be (_________)

From the supply perspective on the economy, how would we explain this change in output?

A.Unemployed workers have less income, so a higher unemployment rate leads to less consumption.

B.Higher unemployment accompanies periods of high output because people choose to return to the labor force when times are good.

C.With higher unemployment, there are fewer workers and more idle capital, so the economy produces less output.

D.Higher unemployment increases the costs of producing output because it reduces the supply of labor.

3

C

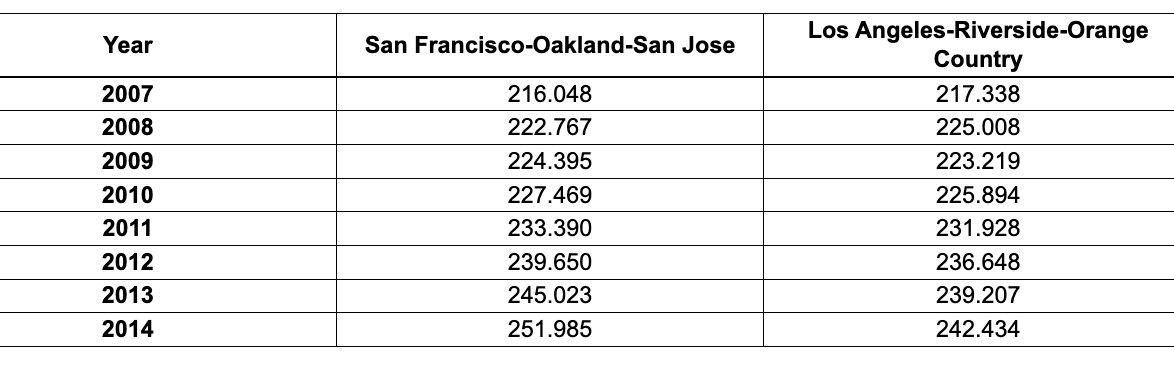

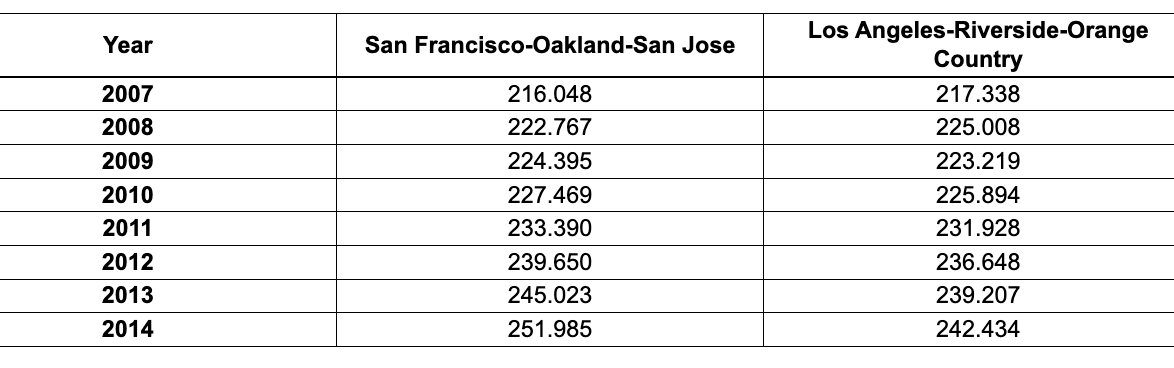

In addition to the national Consumer Price Index (CPI), the Bureau of Labor Statistics produces several regional CPI indices. These are constructed in the same way as the national CPI, just at a smaller scale: in a given city, researchers gather prices for a bundle of goods every month and then construct an index to track price changes of that bundle within the city. The following table shows the CPI indices (base period 1982-1984 = 100) for San Francisco-Oakland-San Jose and Los Angeles-Riverside-Orange County, from 2007 to 2014:

In 2014, the San Francisco-Oakland-San Jose CPI was 251.985, while the Los Angeles-Riverside-Orange County CPI was 242.434.

Using the information given above, which of the following statements is true?

A.Prices have increased more in San Francisco-Oakland-San Jose than in Los Angeles-Riverside-Orange County since the base period.

B.Prices are higher in San Francisco-Oakland-San Jose than in Los Angeles-Riverside-Orange County.

C.Prices have increased more in Los Angeles-Riverside-Orange County than in San Francisco-Oakland-San Jose since the base period.

D.Prices are lower in San Francisco-Oakland-San Jose than in Los Angeles-Riverside-Orange County.

A

Suppose a San Francisco resident and a Los Angeles resident each make the same nominal wage every year from 2007 to 2014: $60 comma 000.00 a year.

Using the table above, the real wage of the San Francisco resident fell by (???) percent between 2007 and 2014. The real wage of the Los Angeles resident fell by (???) percent between 2007 and 2014. (Enter your answer as a positive number expressed in percentage points and round to the nearest two decimal places. Do not enter the "%" sign.)

Hint: First convert the 2014 nominal wage to 2007 dollars, and then calculate the percent change between the two wages expresed in 2007 dollars.

14.26

10.35

Catch-up growth (or convergence) is the ____________.

A.

process where GDP per capita grows at a positive and relatively steady rate for long periods of time.

B.

type of growth that occurs when growth is compounded on the rate of growth in the prior period of measurement.

C.

process by which relatively less wealthy nations rapidly increase their incomes by taking advantage of existing technologies and by increasing their saving, efficiency units of labor, and efficiency of production.

D.

pattern of growth that occurs when workers in relatively less wealthy nations work extra hours so that their GDP per capita catches up with wealthier nations.

C

Sustained growth is the ____________.

A.

process where GDP per capita grows at a positive and relatively steady rate for long periods of time.

B.

process by which relatively less wealthy nations rapidly increase their incomes by taking advantage of existing technologies and by increasing their saving, efficiency units of labor, and efficiency of production.

C.

type of growth that occurs when growth is compounded on the rate of growth in the prior period of measurement.

D.

pattern of growth that occurs when workers in relatively less wealthy nations work extra hours so that their GDP per capita catches up with wealthier nations.

A

When we decompose labor productivity growth using the tools of growth accounting, we see that U.S. productivity growth is primarily due to growth in _______ and _______.

A.

capital intensity; average human capital

B.

total factor productivity; capital intensity

C.

total factor productivity; population

D.

total factor productivity; average human capital

B

The slowdown in U.S. productivity growth since the early 1970s is primarily attributable to a slowdown in:

A.

population growth

B.

the growth of educational attainment

C.

total factor productivity growth

D.

capital accumulation

C

According to the convergence model:

A.

Countries with lower per-capita income may catch up to countries with higher per-capita income, but only if they have free trade and democratic governments.

B.

Countries with lower per-capita income will eventually catch up to countries with higher per-capita income because they have less capital, and thus higher marginal returns to capital, and because they can adopt ideas from frontier economies.

C.

Countries with lower per-capita income will never catch up to countries with higher per-capita income because countries with higher per-capita income have better technology.

D.

Countries with lower per-capita income will only catch up to countries with higher per-capita income if they receive large amounts of foreign aid.

B

Which of the following observations is NOT consistent with the covergence model by itself?

A.

U.S. states that were poorer in 1880 have grown at a faster rate since 1880.

B.

In 1950, the U.S. had five times the real GDP per capita of Portugal; in 2019 it had only twice the real GDP per capita of Portugal.

C.

Since 2000, low and middle income countries have grown faster on average than high income countries.

D.

Countries like Liberia and Sierra Leone have experienced persistent, negative growth in GDP per capita over the course of several decades.

D

Which of the following is NOT one of the fundamental drivers of growth Jason covered in lecture?

A.

Capital accumulation

B.

Institutions

C.

Geography

D.

Culture

A

Fundamental drivers of growth seek to explain:

A.

Why some countries have experienced catch-up growth but others have not.

B.

Why regions have diverged since 1000.

C.

Why regions that were relatively rich in 1500 have since experienced a reversal of fortune.

D.

All of the above.

D

Which of the following statements is TRUE about institutional explanations for economic growth?

A.

Economics generally consider institutional explanations for economic growth to be less important than geographic or cultural explanations.

B.

Technology is particularly sensitive to institutions because they affect the ability of firms to engage in risky innovation, enter new markets, and challenge incumbent firms.

C.

Extractive institutions are generally better for growth than inclusive institutions.

D.

All of the above.

B

Which of the following statements is TRUE about cultural explanations for economic growth?

A.

Cultures can develop for one reason and then be good, bad or neutral for growth depending on the circumstances.

B.

Jason emphasized the importance of cultures that explicitly honored hard work and timeliness.

C.

It is impossible for economists to study the role of culture in growth because it is not randomly assigned.

D.

Cultures are either always better for growth or always worse for growth.

A

Which of the following statements is NOT true about global inequality?

A.

GDP per capita is positively correlated across countries with life expectancy and self-reported life satisfaction.

B.

The reduction in global income inequality since 2000 has been driven in large part by improving standards of living in China and India.

C.

The reduction in global income inequality since 2000 has been driven in large part by a reduction in inequality within countries.

D.

All of these statements are true.

C

Which of the following statements is TRUE about the relative size of the United States economy and the Chinese economy?

A.

Using PPP, overall GDP in China is larger than overall GDP in the United States.

B.

Using market exchange rates, GDP per capita in China is larger than GDP per capita in the United States.

C.

Using market exchange rates, overall GDP in China is larger than overall GDP in the United States.

D.

Using PPP, GDP per capita in China is larger than GDP per capita in the United States.

E.

All of the above.

A

In 2019, GDP per capita in the Netherlands in 2019 was 47,000 Euros. If you went to a bank, you could exchange 0.9 Euros for $1, but 0.8 Euros could buy as much stuff in the Netherlands as $1 could in the United States.

Using the more accurate method for comparing standard of living across different countries with different currencies, GDP per capita in the Netherlands in 2019 in dollars was

$(–––––––)

(Round

your response to the nearest dollar. Do not include a dollar

sign.)

The United States has a higher GDP per worker than the Netherlands, but suppose its labor productivity was lower. If true, what would this tell you with certainty about the United States and the Netherlands?

A.

The Netherlands has more capital per worker than the United States.

B.

The United States has higher total factor productivity than the Netherlands.

C.

Workers in the United States work more hours, on average, than workers in the Netherlands.

D.

The United States has a larger population than the Netherlands.

58750

C

Doubling the size of the capital stock (K) in the aggregate production function will _____________.

A.

More than double the amount of output that can be produced.

B.

Double the amount of output that can be produced.

C.

Increase the amount of output that can be produced, but by less than double.

D.

Cause no change to the amount of output that can be produced.

C

Doubling the size of the capital stock (K) and the number of effective units of labor (H) in the aggregate production function will ___________.

A.

More than double the amount of output that can be produced.

B.

Double the amount of output that can be produced.

C.

Increase the amount of output that can be produced, but by less than double.

D.

Cause no change to the amount of output that can be produced.

B

Doubling the amount of total factory productivity (A) in the aggregate production function will _____________.

A.

More than double the amount of output that can be produced.

B.

Double the amount of output that can be produced.

C.

Increase the amount of output that can be produced, but by less than double.

D.

Cause no change to the amount of output that can be produced.

B

Which of the following could plausibly be an example of increased technology, or Total Factory Productivity, in the aggregate production function?

A.

The elimination of explicit racial segregation in education, employment, and other areas.

B.

A new idea about how to motivate and retain employees.

C.

The development of increasingly sophisticated artificial intelligence.

D.

All of the above.

D

How do economists measure technology, or Total Factor Productivity, in the aggregate production function?

A.

They use complex models that estimate technology based on dozens of different variables collected in government surveys.

B.

They survey a panel of industry experts each year and construct a measurement based on the responses.

C.

They estimate changes in technology based on the number of new patents filed each year.

D.

They don't. Technology is calculated as the residual after accounting for the observable amounts of labor and capital.

D

In the development accounting exercise Jason did in lecture, India was closest to the U.S. level of __________.

A.

capital per worker (K/L)

B.

average human capital (h)

C.

technology (A)

D.

GDP per worker (Y/L)

B

From the perspective of development accounting, what is the most important difference between high-income countries and low-income countries?

A.

Low-income countries have lower total factor productivity than high-income countries.

B.

Workers in low-income countries have less education than workers in high-income countries.

C.

Low-income countries have less capital per worker than high-income countries.

D.

Low-income countries have less physical capital than high-income countries.

A

Which of the following critiques of the Trump administration's tariff policy did Professor Summers make in his guest lecture?

A.

The enormous uncertainty around the Trump tariffs risks undermining investor confidence in American assets.

B.

Current tariff policy will lead to higher prices and more unemployment.

C.

Current tariff policy will lead to hostility and retaliation from other countries.

D.

Tariffs on steel hurt domestic industries that use steel more than they help the domestic steel-producing industry.

E.

All of the above.

E

Which of the following statements best summarizes Professor Summers's perspective on AI?

A.

AI will cause an economic revolution that will replace a large portion of the human workforce.

B.

The hype around AI is overstated given the limitations of current models.

C.

AI is different from previous revolutionary technologies in its potential to be used for self-improvement, and there is a reasonable chance we will see a discontinuity in the rate of economic growth as a result.

D.

AI is similar to previous revolutionary technologies like electricity, computers, etc., and will have a similar impact on economic growth.

C

Suppose the country of Gakpo is riskier for investors than the country of Jota. Uncovered interest parity (UIP) tells us that:

A.

Interest rates in Gakpo will be lower than interest rates in Jota, adjusting for expected exchange rate movements but not for risk.

B.

Interest rates in Gakpo will be the same as interest rates in Jota, adjusting for expected exchange rate movements but not for risk.

C.

Interest rates in Gakpo will be higher than interest rates in Jota, adjusting for expected exchange rate movements but not for risk.

D.

Not enough information to tell.

C

Spain's official currency is the euro, making its exchange rate effectively fixed to the rest of the euro area. However, interest rates on its government bonds were much higher than interest rates on German government bonds in 2010. How was this possible?

A.

Investors feared that Spain would default on its debt.

B.

Investors feared that Spain would leave the euro area, causing its exchange rate to appreciate.

C.

Investors feared that Spain would leave the euro area, causing its exchange rate to depreciate.

D.

A and B only.

E.

A and C only.

E

If a country faces pressure for its exchange rate to devalue, it can __________.

A.

issue bank reserves to domestic financial institutions

B.

sell domestic currency to accumulate internationtal reserves

C.

buy domestic currency using international reserves

D.

None of the above

C

Which of the following is a TRUE statement about international reserves?

A.

International reserves are typically used to move an economy along the UIP curve.

B.

When using international reserves to prevent a currency from devaluing, the risk is that the country runs out of reserves and is unable to defend its fixed exchange rate.

C.

Buying domestic currency with international reserves causes the domestic currency to depreciate.

D.

International reserves are most commonly used to keep an exchange rate from appreciating, boosting net exports.

B

How do capital controls keep an economy off of its UIP curve?

A.

They limit capital inflows or capital outflows, preventing arbitrage opportunities from being fully eliminated.

B.

They allow central banks to buy domestic currency using international reserves, keeping the exchange rate from depreciating.

C.

They make domestic assets seem riskier to dissuade foreign investors from purchasing them.

D.

They cannot be used to keep an economy off of its UIP curve.

A

Which of the following is a risk of using capital controls?

A.

They can distort the allocation of capital, directing it to areas where the rules are weaker.

B.

They can make a country less attractive to foreign investors over the longer term.

C.

They can lead to black markets and corruption to circumvent the controls.

D.

All of the above.

D

The exchange rate of Ketterdam kruge to U.S. dollars (expressed in kruge/$) changed from 10 kruge/$ to 12 kruge/$. We would say the dollar ________ relative to the kruge, which all else equal will __________ net exports by the United States.

A.

depreciated; increase

B.

appreciated; increase

C.

depreciated; decrease

D.

appreciated; decrease

This is because imports of Ketterdam goods are now _____________ for U.S. customers and exports of U.S. goods are now ___________ for Ketterdam customers.

A.

more expensive; cheaper

B.

more expensive; more expensive

C.

cheaper; more expensive

D.

cheaper; cheaper

D

C

Expansionary monetary policy in a country with a floating exchange rate produces _______________.

A.

a leftward shift in the UIP curve

B.

a rightward shift in the UIP curve

C.

a movement down and to the left along the UIP curve

D.

a movement up and to the right along the UIP curve

E.

no change in the UIP curve or the economy's position on the UIP curve

C

Expansionary fiscal policy in a country with a fixed exchange rate produces a _______________.

A.

a leftward shift in the UIP curve

B.

a rightward shift in the UIP curve

C.

a movement down and to the left along the UIP curve

D.

a movement up and to the right along the UIP curve

E.

no change in the UIP curve or the economy's position on the UIP curve

E

Which of the following statements is not true about the effect of expansionary monetary policy in an open economy with floating exchange rates, all else equal?

A.

Expansionary monetary policy will produce an even larger boost to demand in an open economy with floating exchange rates than in an otherwise identical closed economy.

B.

Expansionary monetary policy will lead to an increase in net exports.

C.

By reducing the nominal interest rate, the central bank will also cause a depreciation in the exchange rate.

D.

The expanding economy will lead to increased demand for imports, but this effect is smaller than the effect of the change in the exchange rate on net exports.

E.

All of these statements are true.

E

Which of the following statements is not true about the effect of expansionary fiscal policy in an open economy with floating exchange rates, all else equal?

A.

If the central bank prevents the interest rate from rising, the fiscal multiplier will be greater than if it does nothing.

B.

Expansionary fiscal policy will produce a smaller increase in demand in an open economy with floating exchange rates than in an otherwise identical closed economy.

C.

If the central bank takes no action in response, expansionary fiscal policy will lead to a currency depreciation.

D.

The Keynesian multiplier effect is smaller in an open economy due to import leakages.

E.

All of these statements are true.

C

A country with a fixed exchange rate cannot use traditional monetary policy, but it can _________ its exchange rate to stimulate demand. In order to do so, the central bank must ___________.

A.

devalue; raise interest rates

B.

revalue; lower interest rates

C.

revalue; raise interest rates

D.

devalue; lower interest rates

D

In practice, changes in currency valuations are not a very commonly used countercyclical tool in countries with fixed exchange rates because:

A.

Investors may require a higher interest rate to invest in a country if they expect the exchange rate may be devalued.

B.

If people expect frequent changes in the exchange rate, it will effectively not be a fixed exchange rate and will introduce uncertainty into trade and supply chains.

C.

Exchange rate devaluations increase the cost of repaying debt denominated in foreign currency, which makes up a large component of total debt in many emerging markets that fix their exchange rates.

D.

All of the above.

D

Governor Kugler emphasized that the inflation and disinflation following COVID could be understood as:

A.

Separate stories for the different components, including factors affecting goods prices, housing prices, and non-housing services.

B.

A Phillips curve model.

C.

Both perspectives are useful.

D.

The inflation has no explanation.

C

What modifications did Governor Kugler suggest to make the Phillips curve match the data better?

A.

Incorporate money supply growth into the model.

B.

Replace the unemployment rate (U) with job vacancies or openings divided by the unemployment rate (V/U).

C.

Add changing corporate markups or “greed” into the model.

D.

All of the above modifications.

B

According to Governor Kugler, the recent tariffs imposed by President Trump are:

A.

A bad policy that should be reversed.

B.

A good policy that should be continued.

C.

Something the Fed should ignore.

D.

Something she would not comment on but the Fed would take into account in setting interest rates.

D

The trade balance is defined as the ___________.

A.

value of a country's imports minus the value of its exports.

B.

value of a country's exports minus the value of its imports.

C.

value of a country's exports plus the value of its imports.

D.

ratio of imports plus exports to GDP.

B

The trade balance is known as ___________.

A.

the balance of payments.

B.

the terms of trade.

C.

the current account balance.

D.

net exports

D

A country has a trade deficit when

the value of (________) is less than the value of (________)

and a trade surplus when

the value of (________) is less than the value of (________)

.

exports|imports

imports|exports

All else equal, if Germany were to increase its national saving rate, its net exports would ______ and its current account surplus would _______.

A.

increase; shrink

B.

increase; grow

C.

decrease; shrink

D.

decrease; grow

B

According to the balance of payments identity:

A.

Current Account + Financial Account equivalent 0

B.

Current Account equivalent NX

C.

Current Account + Financial Account equivalent NX

D.

NX equivalent Financial Account

A

This means that when the U.S. runs a current account deficit:

A.

it is a net lender of funds to the rest of the world

B.

it is a net exporter of financial assets to the rest of the world

C.

its domestic saving exceeds domestic investment

D.

it also runs a financial account deficit

B

The United States runs a trade deficit with Austria. Is Austria taking advantage of the United States? Which of the following statements is most true?

A.

The U.S. trade deficit with Austria is primarily the result of Austria having a low saving rate.

B.

A bilateral trade deficit with another country is not good for an economy as trade is a zero-sum game.

C.

Most countries run deficits with some trading partners and surpluses with other trading partners, so a bilateral trade deficit with one country is not generally meaningful.

D.

In the presence of national redistribution, trade reaps no benefit to an economy.

C

Which of the following is a reason that trade deficits might not cause net job loss?

A.

Empirically, U.S. imports tend to be higher when job growth is higher (not lower), likely because U.S. consumers buy more domestic and foreign goods when the economy is booming.

B.

If an increase in the trade deficit looked like it would lead to job losses, the Federal Reserve would lower the interest rate to stimulate the economy and boost job growth.

C.

Both A and B

D.

Neither A nor B

C

Which of the following statements about tariffs and trade balances is not true?

A.

Tariffs can only affect the trade balance if they alter the balance of domestic saving and investment.

B.

High tariffs tend to reduce the volume of trade.

C.

Despite having identical trade policies, the countries of the European Union have very different trade balances.

D.

High domestic tariffs on imports tend to increase the trade balance (more of a trade surplus or less of a trade deficit).

D

The country of Helios has a trade deficit of 4% of GDP. It should be most worried about the size of its trade deficit if:

A.

It is driven by high domestic investment that will increase its future productive capacity.

B.

It is driven by low domestic saving due to excessive government deficit spending.

C.

It is primarily financed by long-term foreign direct investment.

D.

Helios should never be worried about a trade deficit of 4%.

B

A customer in the U.S. wants to buy a dress made by a Swiss company that costs 50 Swiss francs (SFr). At an (indirect) exchange rate of e equals 0.91 SFr per dollar, the customer will need to spend (______) US. dollars (Round your answer to the nearest cent.)

If the dollar appreciates relative to the Swiss franc, the dress ________ for the U.S. customer.

A.

becomes cheaper

B.

becomes more expensive

C.

stays the same price

54.95

A

An increase in the nominal interest rate in the U.S. with no change to foreign nominal interest rates will produce ____________ the dollar relative to foreign currency, assuming a free-floating exchange rate.

A.

an appreciation of

B.

a depreciation of

C.

no change in the value of

D.

an indeterminate change in

A

Which of the following best describes the intuition for your answer above?

A.

With floating exchange rates, foreign countries are forced to make the same changes to their domestic interest rates as the U.S. to keep exchange rates unchanged.

B.

When the Fed changes the nominal interest rate in the U.S., it also engages in currency swaps in the foreign exchange market to move the exchange rate in line with its policy goals.

C.

Rising interest rates in the U.S. will produce a slowdown in inflation, which will require the exchange rate to adjust to be consistent with the quantity theory of money.

D.

Exchange rates adjust to changes in interest rates to ensure that investors are indifferent between holding domestic and foreign assets. Otherwise arbitrage opportunities would exist.

D

A decrease in foreign nominal interest rates with no change to the nominal interest rate in the U.S. will produce ____________ the dollar relative to foreign currency, assuming a free-floating exchange rate.

A.

an appreciation of

B.

a depreciation of

C.

no change in the value of

D.

an indeterminate change in

A

Countercyclical fiscal policy operates through ______________.

A.

government spending and tax/transfer policy

B.

printing money

C.

interest rates

D.

long-run investments in education and technology

A

Through the lens of our labor market model, expansionary fiscal policy works by ____________.

A.

shifting the labor demand curve to the right

B.

shifting the labor demand curve to the left

C.

shifting the labor supply curve to the right

D.

shifting the labor supply curve to the left

A

The U.S. fiscal response to the COVID-19 pandemic was ________ than the fiscal response to the Great Recession in 2008-2010 and _________ than the fiscal responses of other OECD countries to the COVID-19 pandemic.

A.

smaller; larger

B.

larger; smaller

C.

larger; larger

D.

smaller; smaller

C

A government cuts its purchases of goods and services without changing its tax and transfer policy. What is the direct effect of this policy change?

A.

An increase in G

B.

A decrease in G

C.

An increase in C

D.

A decrease in C

E.

No change to aggregate demand

B

Assuming no special response from the central bank, what will this do to interest rates?

A.

Decreases them

B.

Keeps them unchanged

C.

Increases them

D.

Not enough information to say for sure

A

How might this policy affect private business investment (following the assumption in class about the relative magnitude of the output and interest rate effects on investment)?

A.

Decreases it

B.

Keeps it unchanged

C.

Increases it

D.

Not enough information to say for sure

C

The government of a closed economy (i.e., no exports or imports) increased government purchases by $2 billion. This had a knock-on effect of increasing consumption by $1.5 billion and decreasing investment by $0.5 billion.

The government expenditure multiplier in this case was (_____)

The multiplier might have been even larger if ____________.

A.

the expenditures became income for primarily high-income households

B.

the government purchases were made slowly over the span of several years

C.

the central bank prevented interest rates from rising

D.

All of the above

Why can't a government use fiscal policy to achieve unlimited increases in output?

A.

Fiscal policy increases demand, and as the economy reaches its short-run potential (i.e., maximum employment), further increases in demand will primarily produce rising inflation rather than increased output.

B.

The central bank will likely engage in contractionary monetary policy to keep inflation from rising, offsetting the effect of expansionary fiscal policy on demand.

C.

Increased government spending without corrresponding increases in taxes will require borrowing, and the government may face costs related to rising debt.

D.

All of the above.

1.5

C

D

Which of the following, if true, would lead someone to be more skeptical of active countercyclical stimulus policy?

A.

The economy generally experiences v-shaped recessions.

B.

Countercyclical policies generally cause inflation.

C.

Policies have long and variable lags.

D.

All of the above.

D

Which of the following is generally an advantage of fiscal expansion over monetary expansion?

A.

Fiscal expansions tend to be nimble and reversible.

B.

Fiscal policy is done technocratically.

C.

Fiscal expansions increase private investment.

D.

Fiscal policy can target additional goals than just output, employment, and inflation.

D

What are the automatic and discretionary components of fiscal policy?

A.

The automatic components are limited to government expenditures, while the discretionary components entail changes to both taxes and expenditures.

B.

The automatic components are those fiscal actions that require accommodation from monetary policy, while the discretionary components do not.

C.

The automatic components do not require deliberate action on the part of the government, while the discretionary components do.

D.

The automatic components stimulate the economy, while the discretionary components serve purposes unrelated to the health of the economy.

C

A government engaging in discretionary fiscal policy during a recession might:

A.

Purchase large amounts of Teasury securities.

B.

Increase the generosity of social insurance benefits.

C.

Temporarily halt existing infrastructure projects to save money.

D.

Close tax loopholes that benefit the top 1%.

B

The government deficit is equal to:

A.

G - T

B.

government spending - taxes (taxes only, not counting transfers)

C.

government purchases - taxes (taxes only, not counting transfers)

D.

A and B only

E.

All of the above

D

When a government runs a deficit, ________.

A.

its nominal debt necessarily falls

B.

its nominal debt necessarily rises

C.

inflation necessarily rises

D.

its debt as a share of GDP necessarily rises

B

How was "debt sustainability" defined in the context of debt sustainability analysis in class?

A.

The government only runs a budget deficit when the economy is in a recession.

B.

Total debt as a share of GDP will not be ever-increasing.

C.

The total amount of debt the country has is not rising over time.

D.

Total debt as a share of GDP will eventually fall to zero.

B

Which of the following economic/political trends could make it more difficult to achieve debt sustainability?

A.

The productivity slowdown of recent decades reverses, leading to sustained real GDP growth of between 2 and 3 percent.

B.

Large fiscal stimulus packages become more and more common during times of high unemployment.

C.

Real interest rates stay very low for the foreseeable future.

D.

The government gradually raises taxes.

B

Which of the following factors makes a country more likely to default on its debt?

A.

It consistently runs high budget deficits.

B.

It borrows in a foreign currency like dollars.

C.

It is perceived by potential creditors as being more likely to default.

D.

It is experiencing a recession.

E.

All of the above.

E

The U.S. borrows in its own currency and controls its own monetary policy. What does this mean with regard to its likelihood of defaulting on its debt?

A.

These factors don't matter for the likelihood of a debt default.

B.

The U.S. never needs to default on its debt, so it can spend as much as it wants without negative consequences for the economy.

C.

Although these factors help reduce the likelihood of a U.S. default, it is still possible that it would not be able to pay its bills.

D.

Technically, the U.S. never needs to default, but too much debt could lead to a de facto default through high and rising inflation.

D

The following equation identifies the size of a persistent primary budget deficit that can be maintained, given the debt/GDP ratio a country is willing to tolerate, the nominal interest rate, and the growth rate of nominal GDP:

StartFraction Primary Deficit Over GDP EndFraction equals left parenthesis g minus i right parenthesis StartFraction Debt Over GDP EndFraction

Assume a country runs a primary budget deficit equal to 3% of GDP. If the long-run nominal interest rate is 5%, GDP must grow at (_____) in order to stabilize the debt at 80% of GDP? (Enter your answer as a percent, but without the percent sign, e.g. 10% would be 10.)

What happens if GDP grows more slowly than your answer above, but faster than 5%? (You should assume that interest rates and growth rates stay constant.)

A.

Debt/GDP will stabilize at less than 80% of GDP.

B.

Debt/GDP will fall over time until the debt is paid off.

C.

Debt/GDP will stabilize at more than 80% of GDP.

D.

Debt/GDP will spiral to infinity.

If debt rises well above 80% of GDP, then it is likely that _________.

A.

there will be no change to interest rates or growth rates

B.

interest rates will rise and growth rates will fall

C.

interest rates will fall and growth rates will rise

8.75

C

B

What does it mean for a government to run a primary surplus?

A.

It collects more in taxes than it spends on non-interest expenses.

B.

Its government debt is falling as a share of GDP.

C.

Its government debt is falling in nominal terms.

D.

It collects more in taxes than it spends.

A

Consider a country that has g > i. Assuming that interest rates and growth rates remain constant, which of the following is true?

A.

No matter the size of its primary deficit, this country's debt will stabilize as a share of GDP.

B.

This country's debt will stabilize as a share of GDP, but only if its primary deficit is not too large.

C.

This country must run a primary surplus if it wants to stabilize its debt as a share of GDP.

D.

This country will not be able to stabilize its debt.

A

Consider a country that has i greater than g. Assuming that interest rates and growth rates remain constant, which of the following is true?

A.

No matter the size of its primary deficit, this country's debt will stabilize as a share of GDP.

B.

This country's debt will stabilize as a share of GDP, but only if its primary deficit is not too large.

C.

This country must run a primary surplus if it wants to stabilize its debt as a share of GDP.

D.

This country will not be able to stabilize its debt.

C

Which of the following statements best characterizes former Governor Warsh’s assessment of the Fed’s job performance during the 2008 financial crisis?

A.

If the Fed had been able to save Lehman Brothers, the rest of the crisis would have played out very differently.

B.

The Fed was sounding early alarms about systemic risks to the banking sector, but was unable to persuade Congress to take action.

C.

The Fed’s decision to let Lehman Brothers fail caused the global financial crisis.

D.

In early 2008, the Fed was slow to recognize the implications of the failure of Bear Stearns (3/2008) and the problem of insolvency in parts of the global banking system, but quick to catch up once the depth of the crisis became clear in the fall of 2008.

D

Which point during the 2008 financial crisis did former Governor Warsh identify as the most important because the Fed made a strategic error?

A.

The first round of quantitative easing (QE), because it didn’t have any short-term benefits and carried long-term risks.

B.

The bailout of Bear Stearns, when the Fed should have realized that many banks were insolvent.

C.

The failure of Lehman Brothers, when the Fed should have found a way to provide extraordinary support to save the bank.

D.

The passage of TARP by Congress, because it led to an erosion of public trust in Congress and the Fed.

B

Which of the following best describes former Governor Warsh’s attitude towards quantitative easing (QE)?

A.

He views it as a dangerous blend of monetary and fiscal policy that has been overused by the Fed (because it leads to allocative inefficiency in capital markets).

B.

He views it as a vital monetary policy innovation that has been appropriately used by the Fed.

C.

He thinks that it should replace changing the federal funds rate as the Fed’s primary monetary policy tool.

D.

Both (b) and (c).

A

Which of the following statements best characterizes former Governor Warsh’s assessment of the Fed’s job performance between 2010 and 2019?

A.

The Fed should have done a better job keeping inflation from rising above its 2% target.

B.

The Fed did structural harm to the economy by treating the 2010-2019 period as if the economy was still in a crisis.

C.

The Fed did an excellent job guiding the economy back from the global financial crisis and bringing stability to financial markets.

D.

The Fed did a decent job, but it wasn’t a particularly difficult period because there were no major economic crises.

B

What were the three pillars of former Governor Warsh’s mental model for bank regulation?

A.

Stress tests, auditing of financial statements, and an expansion of the use of quantitative easing.

B.

Capital standards, stress tests, and expanded deposit insurance.

C.

A streamlined regulatory framework, regulatory discipline, and expanded deposit insurance.

D.

Capital standards, regulatory discipline, and market discipline.

D