Supply side policies

1/27

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

28 Terms

What are the two types of supply side policy?

interventionist

market base

What is interventionist policy?

when the government increases its intervention in the economy to help increase AS

e.g spending more on infrastructure like roads to reduce firms transportation costs

What is market base policy?

when the government decreases its intervention in the economy and allows the market to operate freely to help increase AS.

e.g decreasing fuel tax to help reduce the cost of fuel

Which type of policy is infrastructure spending an example of?

Infrastructure spending, such as spending on roads and railways, is an interventionist supply side policy as the government is getting actively involved in increasing aggregate supply.

NB Monetary policy is to do with changing interest rates and money supply.

How much is the government spending on HS2?

£75bn

What is the likely impact of government funded infrastructure projects?

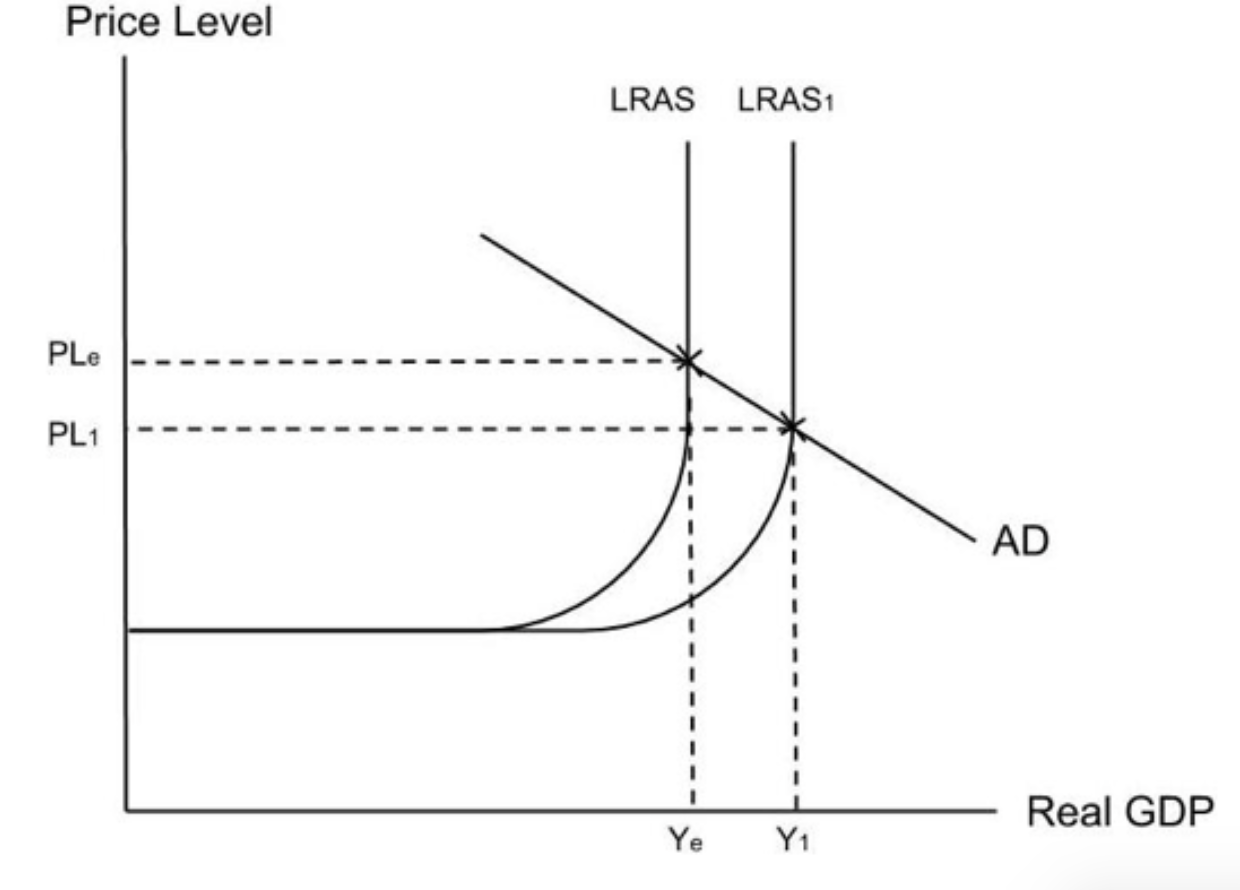

An increase in geographical mobility of labour will shift out the long run aggregate supply curve

What is the likely impact of an increase in long run aggregate supply due to government infrastructure spending?

increase in real GDP

What can negatively occur as a result of an increase in government spending on infrastructure?

Crowding out occurs when government spending pushes up demand for resources which increases their price. For example, they will spend money on workers to build infrastructure which will push up wages. Or they will borrow money which will push up the interest rate. This makes it more expensive for private sector firms to invest and so they have been crowded out.

Explain one advantage and one disadvantage of increased government spending on infrastructure as a supply side policy.

Infrastructure projects such as HS2 improve the geographical mobility of labour, increasing the productivity of labour and causing the LRAS to shift out. Another advantage is that it increases aggregate demand as increases in employment will increase consumption. Both the increase in LRAS and AD will lead to economic growth.

However, a disadvantage is that government spending on infrastructure might crowd out private firms. By borrowing money to spend on new infrastructure, the government is increasing the demand for borrowed money, land, labour and capital. This increases prices for each factor of production, increasing costs for firms. This shifts the SRAS in and reduces real GDP.

What type of supply-side policy is reducing corporation tax an example of?

Reducing corporation tax is an example of a market-based supply side policybecause it involves the government reducing their intervention and allowing the market forces to operate freely.

What are the advantages of reducing corporation tax?

Advantage 1 - A reduction in corporation tax will reduce the cost of production. This will encourage new firms and expansion of existing firms which will shift the SRAS to the right and leads to economic growth and a reduction in the price level.

Advantage 2 - Firms can keep more of their profit and so they are more likely to invest. This will increase the productivity of capital and shift LRAS to the right leading to economic growth and a reduction in the price level.

Advantage 3 - Firms can keep more of their profit and so they are more likely to invest. Investment is a component of AD and so an increase in investment will increase AD which will lead to economic growth.

What is the disadvantage of reducing corporation tax?

Disadvantage 1 - A reduction in corporation tax may reduce tax revenue. There is an opportunity cost as there is now less money available to spend in other areas, such as healthcare or infrastructure.

What type of supply side policy is reducing the national minimum wage?

A reduction in the national minimum wage is a market-based supply-side policy. The government is reducing their intervention and allowing market forces to operate freely.

How might emigration of Polish workers affect the UK economy?

Emigration will mean that the quantity of labour will decrease. This will shift the long-run aggregate supply curve to the left as the productive capacity of the economy has decreased.

What is an advantage of reducing the national minimum wage?

Advantage 1 - a decrease in wage costs will decrease the cost of production for firms, which will increase short run aggregate supply.

What are disadvantages of reducing the national minimum wage?

Disadvantage 1 - a reduction in the minimum wage will reduce disposable income for many households. This will reduce consumption and decrease aggregate demand, which will lead to a reduction in real GDP.

Disadvantage 2 - a reduction in the minimum wage may mean that workers emigrate from the UK in search of higher wages. This will reduce LRAS and reduce economic growth.

What type of policy would deregulation be classed as?

Deregulation affects producers and so it would be classed as a supply-side policy. It is market-based because it involves removing regulations from the market.

What is deregulation?

Deregulation is when regulations are removed from markets to lower barriers to entry.

What is privatisation?

Privatisation is when the government transfers ownership of a public sector firm to the private sector.

Is spending on education a market-based or an interventionist policy?

Spending on education is an interventionist supply-side policy because the government is taking matters into its own hands - increasing intervention by spending on education.

What is an advantage of subsidising university education?

subsidies allow universities to offer their courses at a lower price, which will encourage more students to pursue higher education. Over time, this will make workers more productive and lead to an increase in labour supply. The LRAS shifts to the right and the economy grows.

What is a disadvantage of subsidising university education?

in the short run, education subsidies lead to a decrease in the supply of labour as more people spend their time studying instead of working. This leads to an increase in wages which increases the cost of production and reduces SRAS, leading to a reduction in economic growth in the short run.

Is reducing income tax a market-based or an interventionist policy?

Reducing income tax is a market-based supply-side policy because the government is taking a step back and intervening less.

Explain the impact of a reduction in income tax on aggregate supply

Reducing income tax means that workers get to keep more of their earnings and so disposable income increases. This is likely to increase the number of hours they choose to work and so there will be an increase in labour supply. This will decrease wages which will decrease the cost of production. This will shift the SRAS to the right, increasing real GDP.

However, an increase in disposable income could cause some workers to decrease their labour supply as they now need to work less to earn the same amount of money. This might lead to a decrease in labour supply. This will increase wages which will increase the cost of production. This will shift the SRAS to the left, limiting economic growth.

What type of supply side policy is reducing benefits?

A reduction in benefits is a market-based supply-side policy. The government rolls back their interventions and allow market forces to operate freely.

Explain one advantage and one disadvantage of reducing benefits.

Advantage 1 - A reduction in spending on benefits will increase the incentive to work. This will increase labour supply and reduce wages which in turn will reduce the cost of production. SRAS will increase leading to an increase in economic growth and a decrease in the price level.

Disadvantage 1 - A reduction in spending on benefits means that less money is transferred to unemployed workers and low income households. This means that they will have less disposable income and must reduce their spending. This will decrease consumption which will lead to a decrease in AD.

Is increasing spending on healthcare a market-based or an interventionist policy?

An increase in spending on healthcare is an interventionist supply-side policy. The government is actively getting more involved in the market.

Explain one advantage and one disadvantage of increasing spending on healthcare.

Advantage 1 - increasing spending on healthcare will increase the productivity of labour. This will shift the LRAS to the right, increasing economic growth.

Disadvantage 1 - spending on the NHS may be inefficient and of poor quality. If funding is increased, it is not given that all the extra funds will go towards increasing productivity and so the effects on LRAS will be limited.