Fixed Income (Formulas)

1/22

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

23 Terms

Full Price

Converting from from 90 day to 360 day

365/90 times Price change

If given %DR then it would be the 90/360 (or whatever convention) times %DR

The outcome is divided by 100 - the outcome itself

If given price values then it is the same as 365/90 times Price Change

The price change is actually divided by FV not PV

FRN Discount/Required Rate

It is not the YTM but rather the YTM = MRR (Market Rate) + DR

Forward rates from spot rates

2Y1Y (In 2 years, the one year forward rate is)

= (3 year spot)³ / (2 year spot)²

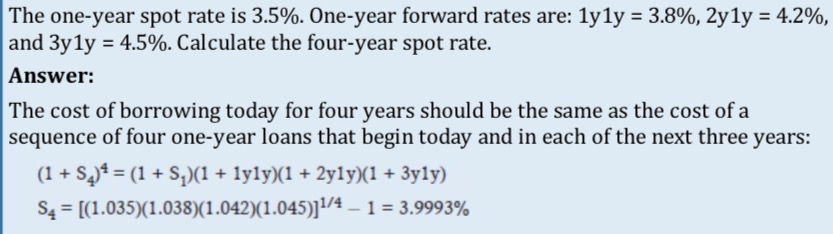

Spot rates from forward rates

Multiple the one year spot by one year forward rates up until the year you are calculating and root by the year you are calculating

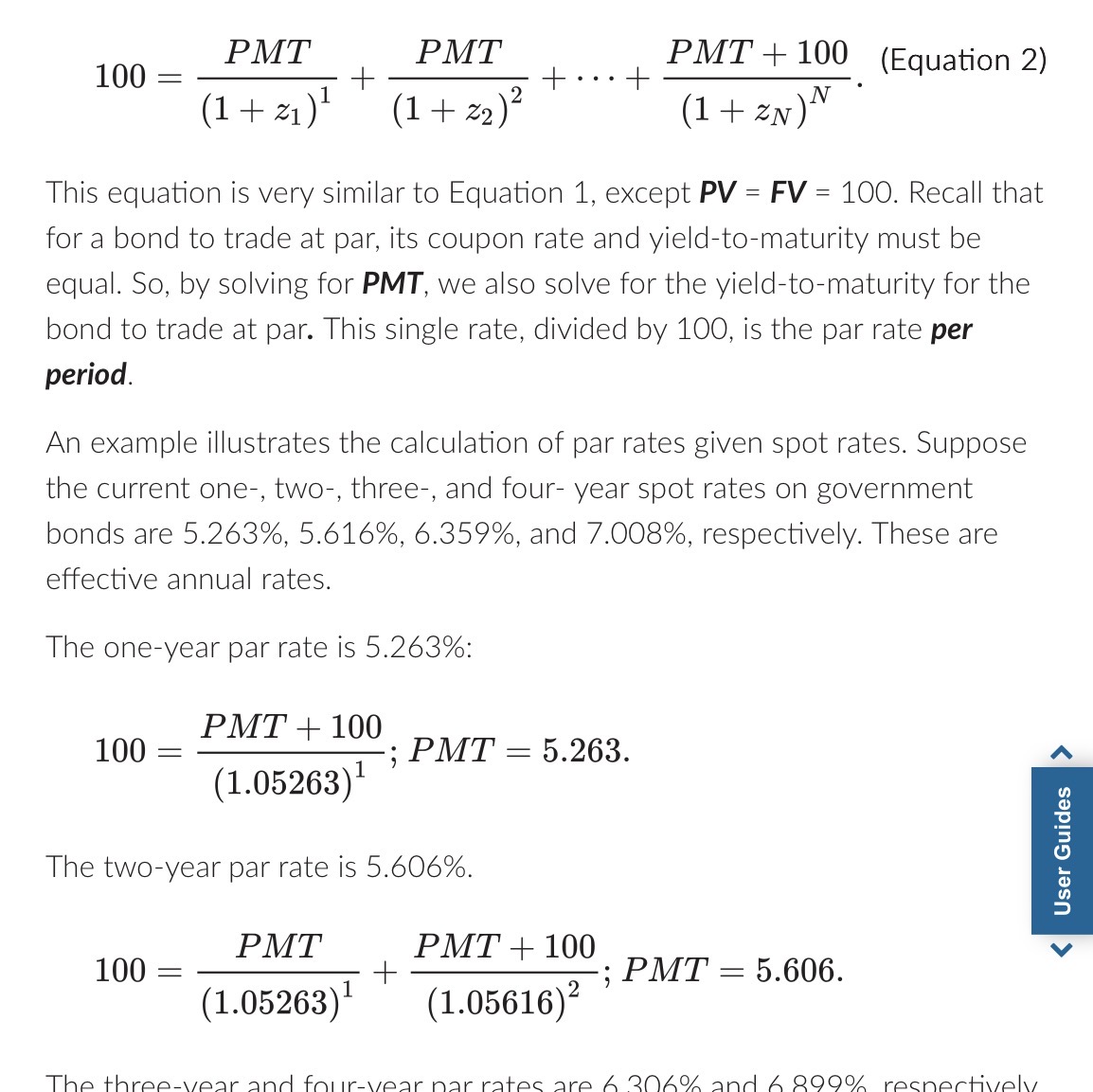

Par rate (The coupon rate which sets the price to 100)

approximate percentage change in bond price

= –modified duration × ΔYTM

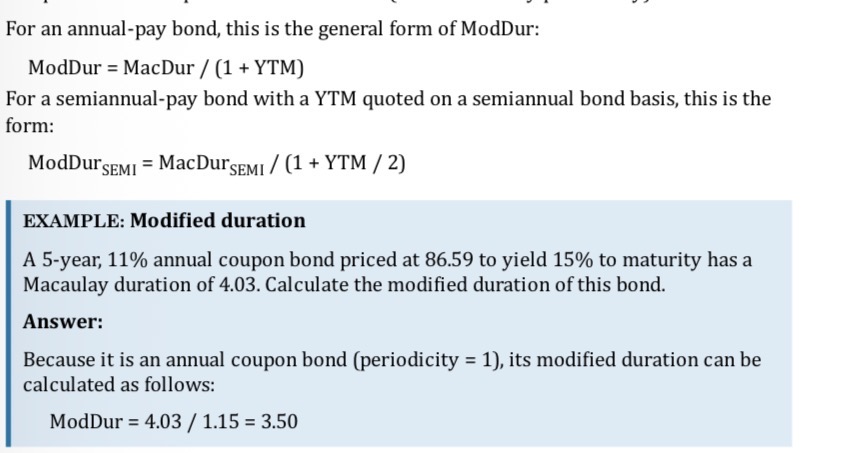

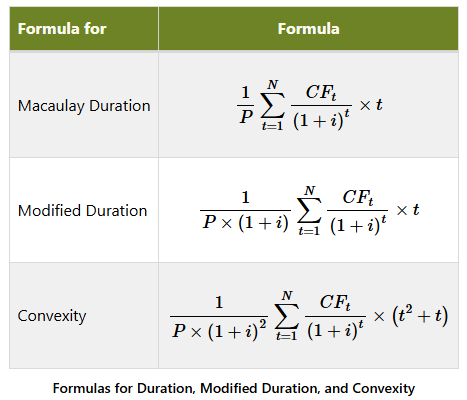

.Modified duration (ModDur)

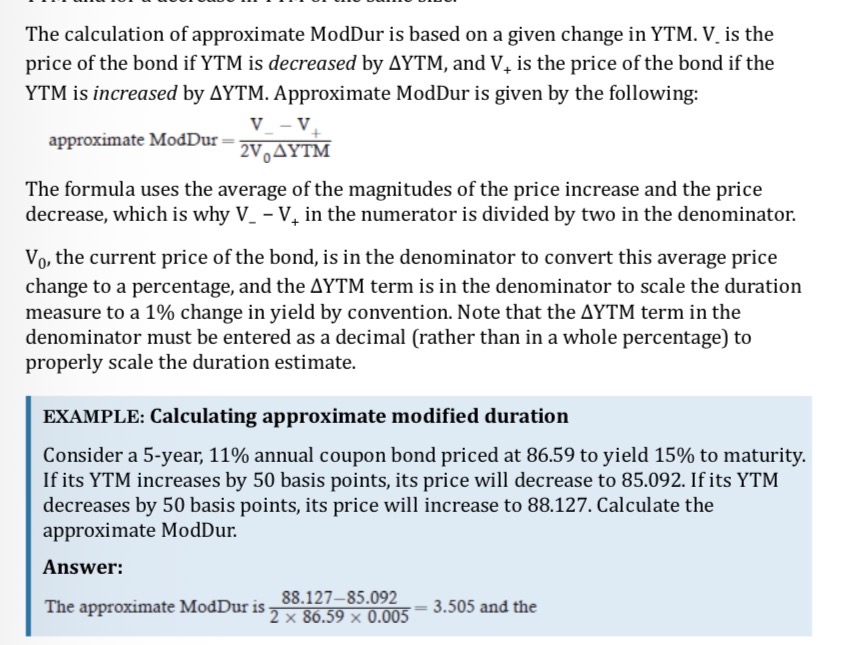

approximate modified duration

Can also be calculated by rearranging the approx change in bond price formula

approximate percentage change in bond price

−ModDur × ΔYTM

Based on a ModDur of 3.50, in response to an 0.5% increase in YTM the price of the bond should fall by approximately 3.50 × 0.5% = 1.75%.

Money duration

= annual ModDur × full price of bond position

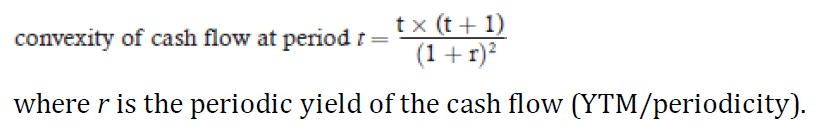

Convexity

Better way of understanding formulas

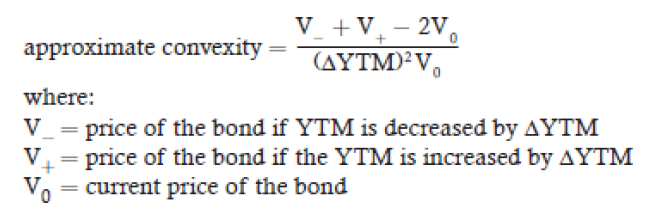

Apx convexity

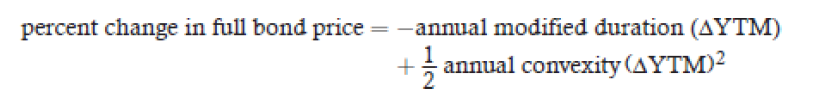

percentage price change of a bond for a specified change

in yield, given the bond’s duration and convexity.

money convexity

annual convexity × full price of bond position

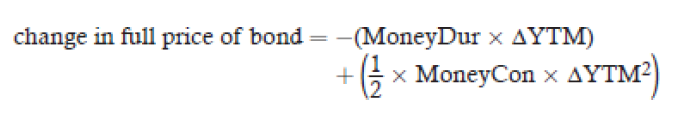

money duration and money convexity to estimate the change in price of a

bond as follows

Convexity effect

1/2 × convexity × (ΔYTM) ²

expected loss =

probability of default × loss given default

Bond’s recovery rate

proportion of a claim an investor will recover if

the issuer defaults. The proportion an investor will not recover, or one minus the

recovery rate, is known as loss severity.

expected exposure or exposure at default i

the difference

between the amount the investor is owed (principal and accrued interest) and the value

of the collateral available to repay the inve

credit migration risk

the risk that a credit rating downgrade will

decrease the value of the bonds and potentially trigger other contractual clauses.