CH 5 Derivatives (DONE)

1/67

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

68 Terms

An ________ is a contract that gives the buyer the right, but not the obligation, to buy or sell the underlying asset at a specified price within a specified period of time

option

__________ gives the buyer the right to buy an underlying security (e.g., a stock) at a prespecified price called the exercise or strike price (K)

In return, buyer of call option must pay the writer (or seller) an up-front fee known as a call premium (C)

Call seller is obligated to sell

Call option

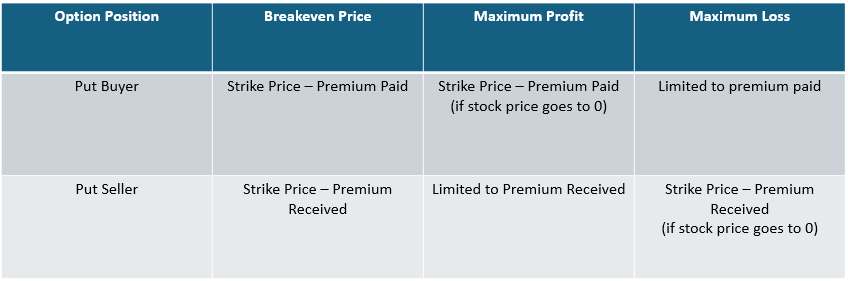

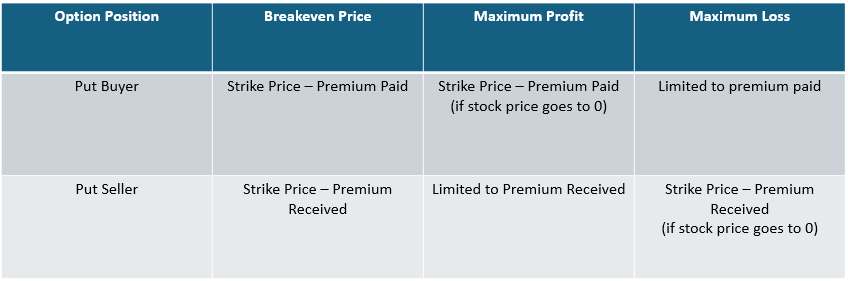

_____________ gives the option buyer the right to sell an underlying security (e.g., a stock) at a prespecified price to the writer of the put option

In return, the buyer of the put option must pay the writer (or seller) the put premium (P)

Put seller is obligated to buy

Put option

If you buy a call or a put, you are considered _____________

long the option

If you sell a call or put, you are considered ______________

short the option

If you buy a call, you are considered _______________

long the stock

If you sell a call, you are considered _____________

short the stock

If you buy a put, you are considered _____________

short the stock

If you sell a put, you are considered ______________

long the stock

Option Buyers

Call option buyer wants the stock price to increase

Call option buyer has the right to buy the shares

Put option buyer wants the stock price to decrease

Put option buyer has the right to sell the shares

Option Sellers

Call option seller wants the stock price to decrease

Call option seller has the obligation to sell the shares

Put option seller wants the stock price to increase

Put option seller has the obligation to buy the shares

Option contract characteristics

Option type – either a call or put

Strike price – the predetermined price at which the underlying asset can be exercised at

Calls give the buyer the right to buy at the strike price

Puts give the buyer the right to sell at the strike price

Expiration date – the date at which the option contract expires

At expiration, an option is either exercised or expires worthless

Exercise style – European style or American style

European-style options can only be exercised at expiration

American-style options can be exercised before expiration

Option type

either a call or put`

Strike price

Calls give the buyer the right to buy at the strike price

Puts give the buyer the right to sell at the strike price

the predetermined price at which the underlying asset can be exercised at

Expiration date

At expiration, an option is either exercised or expires worthless

the date at which the option contract expires

Exercise style

European-style options can only be exercised at expiration

American-style options can be exercised before expiration

European style or American style

The relationship between the price of the underlying asset and the strike price is known as _____________. An option’s moneyness can be:

moneyness

In-the-Money (ITM):

A call option is ITM when the underlying asset's price is above the strike price, and a put option is ITM when the underlying asset's price is below the strike price.

Out-of-the-Money (OTM):

A call option is OTM when the underlying asset's price is below the strike price, and a put option is OTM when the underlying asset's price is above the strike price.

At-the-Money (ATM):

An option is ATM when the underlying asset's price is equal to or very close to the strike price.

The time value of an option is the difference between the option’s price and its _________

intrinsic value

An option’s intrinsic value is the difference between the ___________________________

strike price and the underlying asset’s price

Suppose stock ABC is currently trading at $60 and a call option with a strike of $50 is trading at $12.50 with 30 days to expiration

The intrinsic value of the option is $60 – $50 = $10

The time value of the option is $12.50 - $10 = $2.50

The time value of an option is a function of the price volatility of the underlying asset and the time until the option matures

As price volatility in the underlying asset increases, the probability that the stock will go up or down in price increases, the price of an option contract increases.

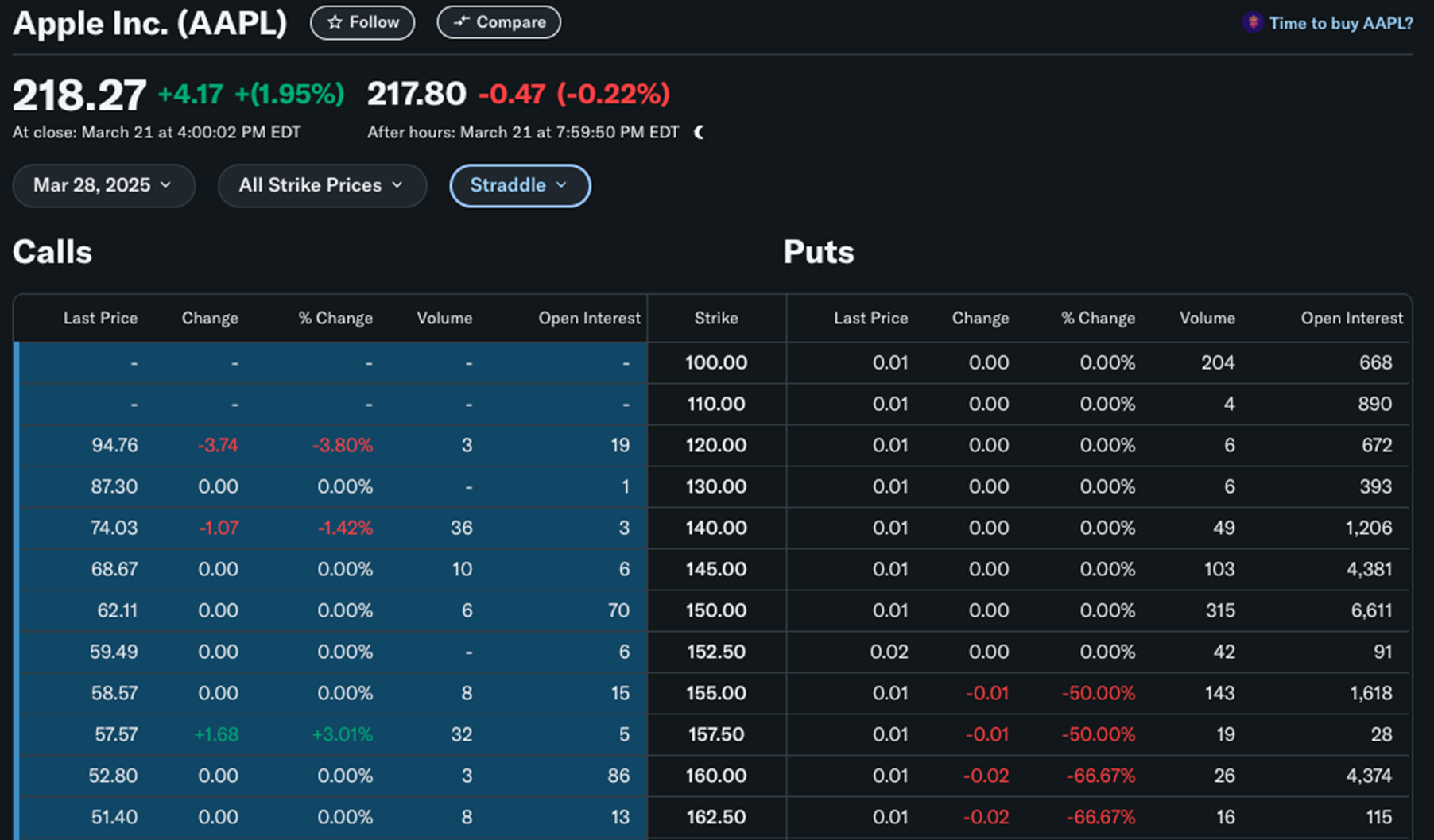

An options chain is a display of all available option contracts for a _______________________

specific underlying asset.

Information displayed in the options chain:

The underlying asset

The option type

Expiration date

Strike prices

Bid and ask prices

Last price

Volume – the number of contracts traded during the current day

Open interest – total number of outstanding contracts

Greeks – advanced option chains include option Greeks, which are measures of the sensitivity of an option’s price to its underlying parameters (such as the stock’s price or volatility)

Volume

the number of contracts traded during the current day

Open interest

total number of outstanding contracts

Greeks

advanced option chains include option Greeks, which are measures of the sensitivity of an option’s price to its underlying parameters (such as the stock’s price or volatility)

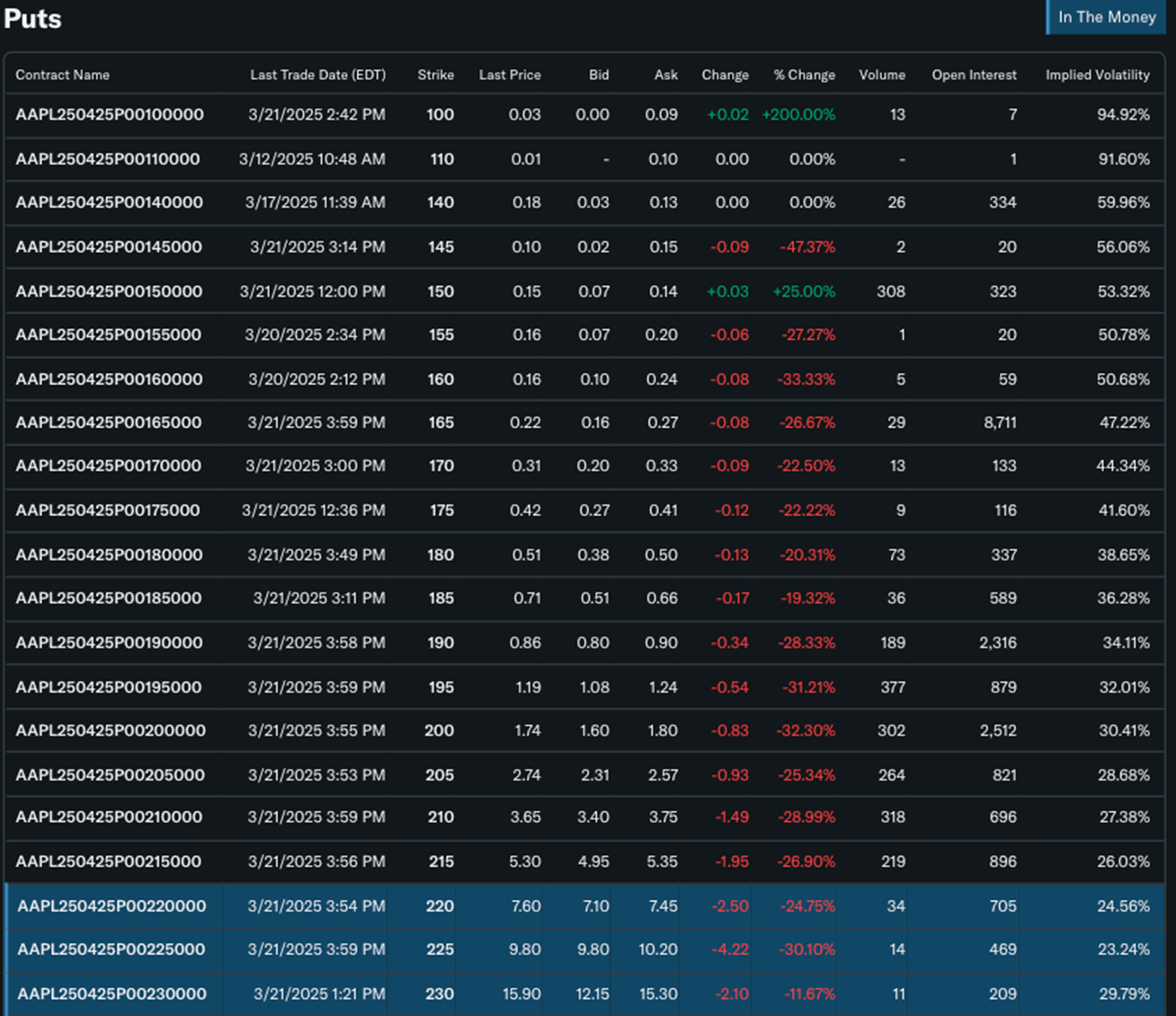

Apple Call and Put Options

Apple Puts

Apple Calls

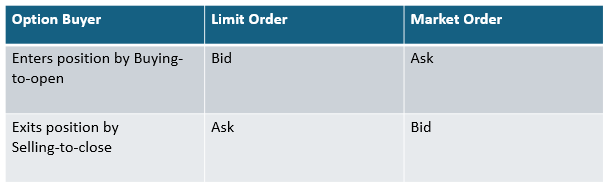

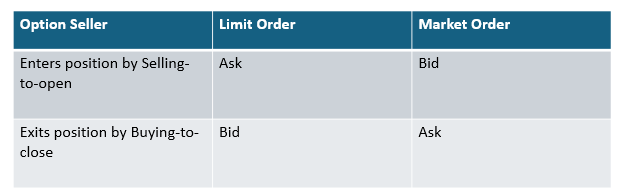

Entering and exiting an options position

An option buyer enters their position by buying-to-open and exists by selling-to-close

An option seller enters their position by selling-to-open and exits by buying-to-close

Bid/ask spreads are typically wider in options markets compared to equities; therefore, it is important to use limit orders to enter/exit a position to prevent large slippage

An options contract can be executed upon, sold to another buyer, or expire worthless

An option ___________ enters their position by buying-to-open and exists by selling-to-close

buyer

An option __________ enters their position by selling-to-open and exits by buying-to-close

seller

____________ are typically wider in options markets compared to equities; therefore, it is important to use limit orders to enter/exit a position to prevent large slippage

Bid/ask spreads

An options contract can be executed upon, sold to another buyer, or expire __________

worthless

Option Buyer

Option Seller

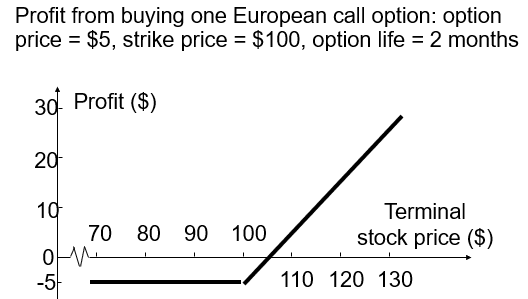

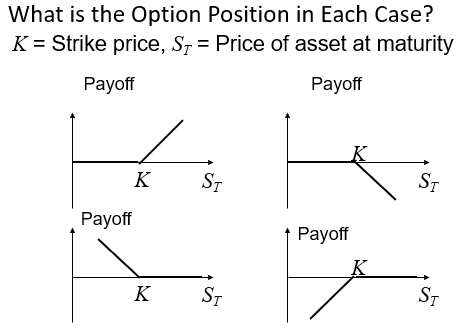

Long Call (Figure 10.1)

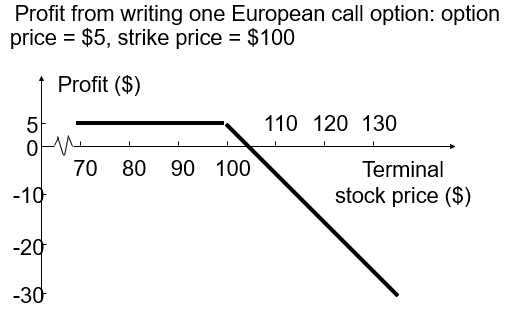

Short Call (Figure 10.3)

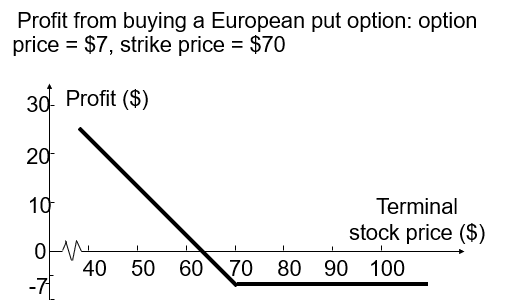

Long Put (Figure 10.2)

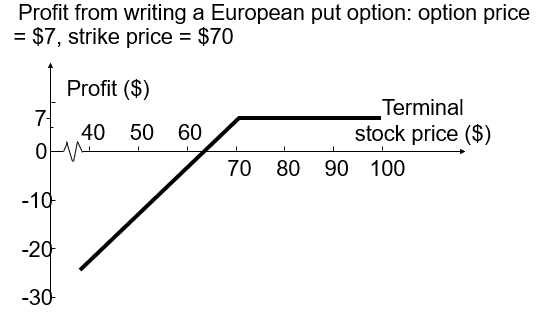

Short Put (Figure 10.4)

Payoffs from Options (Figure 10.5)

What is the Option Position in Each Case?

Inherent leverage of options

Suppose stock XYZ trades at $100 per share and a call option with a strike of $100 that expires one month from now is trading at $2.

You think the price will increase next month. You can do two things:

Buy 100 shares of XYZ at $100 per share, which would cost $10,000

Buy 50 option contracts, which would also cost $10,000

Suppose at expiration XYZ is now trading at $120 and the call option is worth $20

100 shares of XYZ is would net you ($120 – $100) x 100 shares = $2000

50 option contracts would net you ($20 – $2) x 100 shares x 50 contracts = $90,000

Suppose stock XYZ trades at $100 per share and a call option with a strike of $100 that expires one month from now is trading at $2.

You think the price will increase next month. You can do two things:

Buy 100 shares of XYZ at $100 per share, which would cost $10,000

Buy 50 option contracts, which would also cost $10,000

Suppose at expiration XYZ is now trading at $120 and the call option is worth $20

100 shares of XYZ is would net you ($120 – $100) x 100 shares = $2000

50 option contracts would net you ($20 – $2) x 100 shares x 50 contracts = $90,000

Apple stock is trading at $218, and a $200 strike call option with 33 days to expiration is trading at $20.10, what is the intrinsic value of the option and the time value of the option?

Intrinsic value of the call option: $218 - $200 = $18

Time value of the option = $20.10 - $18 = $2.10

Apple stock is trading at $218, and a $200 strike call option with 33 days to expiration is trading at $20.10, what is the intrinsic value of the option and the time value of the option?

A $240 strike put option with the same expiration is trading at $25.37

Intrinsic value of the put option: $240 - $218 = $22

Time value of the option: $25.37 - $22 = 3.27

Apple stock is trading at $218, and a $230 strike call option with 33 days to expiration is trading at $2.54, what is the intrinsic value of the option and the time value of the option?

Intrinsic value of the call option is $0 since the strike > current price (the call option is out-the-money)

Time value of the option is $2.54

Apple stock is trading at $218, and a $230 strike call option with 33 days to expiration is trading at $2.54, what is the intrinsic value of the option and the time value of the option?

A $210 strike put option with the same expiration is trading at $3.65

Intrinsic value of the put option is $0 since the strike < current price (the put option is out-the-money)

Time value of the option is $3.65

Apple stock is trading at $218, and a $225 strike call option with 33 days to expiration is trading at $4.33

If you buy the call, then:

Your breakeven price is Strike + Premium paid = $225 + $4.33 = $229.33 (After Apple stock price passes above $229.33, you start profiting)

Your maximum profit is theoretically unlimited

Your maximum loss is limited to the Premium paid, $4.33 x 100 = $433 per contract

Apple stock is trading at $218, and a $225 strike call option with 33 days to expiration is trading at $4.33

If you sold the call naked, then:

Your breakeven price is Strike + Premium paid = $225 + $4.33 = $229.33

(After Apple stock price passes above $229.33, you start losing money)

Your maximum profit is limited to the Premium received, $4.33 x 100 = $433 per contract

Your maximum loss is theoretically unlimited

Apple stock is trading at $218, and a $225 strike call option with 33 days to expiration is trading at $4.33

Suppose you bought shares at $200, if you sold the covered call, then:

Your breakeven price is Stock purchase price – Premium received = $200 - $4.33 = $195.67 (After Apple stock price falls below $195.67, you start losing money)

Your maximum profit is [(Strike price – Purchase price) + Premium] = [($225 – $200) + $4.33] = $29.33 x100 = $2,933 per contract

Your maximum loss is Purchase price – Premium Received = $200 – $4.33 = $195.67 x100 = $19,567 if the price goes to $0 per share

Apple stock is trading at $218, and a $210 strike put option with the 33 days to expiration is trading at $3.65

If you buy the put, then:

Your breakeven price is Strike – Premium paid = $210 – $3.65 = $206.35

(After Apple stock price falls below $206.35, you start profiting)

Your maximum profit is Strike – Premium paid = $206.35 per contract if the price goes to $0 per share

Your maximum loss is limited to the Premium paid, $3.65 x 100 = $365 per contract

Apple stock is trading at $218, and a $210 strike put option with the 33 days to expiration is trading at $3.65

If you sold the put, then:

Your breakeven price is Strike – Premium Received = $210 – $3.65 = $206.35

(After Apple stock price passes above $206.35, you start losing money)

Your maximum profit is limited to the Premium Received, $3.65 x100 = $365 per contract

Your maximum loss is Strike – Premium Received = $206.35 x100 = $20,635 per contract if the price goes to $0 per share

Suppose you want to write a call option on Apple. The ATM closest expiry call option had a last price of $2.42, a bid of $2.38 and an ask of $2.47

You sell-to-open using a limit order

Assuming the order is immediately executed upon, your entry is at $2.47, so you collect $2.47 x100 = $247 in premium (minus fees)

You sold a call option, meaning you think the price of Apple will decrease.

Suppose the next day Apple has fallen in price, therefore the value of the call option has also decreased.

The call option you sold is now trading at $1.75 with a bid of $1.72 and an ask of $1.78

You buy-to-close using a limit order and you pay $1.72 x100 = $172 to close the position

Your total profit on the trade is $247 - $172 = $75

Suppose you want to buy a call option on Apple. The ATM closest expiry call option had a last price of $2.42, a bid of $2.38 and an ask of $2.47

You buy-to-open using a limit order

Assuming the order is immediately executed upon, your entry is at $2.38, so you pay $2.38 x100 = $238 in premium (plus fees)

You bought a call option, meaning you think the price of Apple will increase.

Suppose the next day Apple has increased in price, therefore the value of the call option has also increased.

The call option you bought is now trading at $3.75 with a bid of $3.72 and an ask of $3.78

You sell-to-close using a limit order and you receive $3.78 x100 = $378 to close the position

Your total profit on the trade is $378 - $238 = $140

Dividends & Stock Splits

Suppose you own N options with a strike price of K :

No adjustments are made to the option terms for cash dividends

When there is an n-for-m stock split,

the strike price is reduced to mK/n

the no. of options is increased to nN/m

Stock dividends are handled similarly to stock splits

Consider a call option to buy 100 shares for $20/share

How should terms be adjusted:

for a 2-for-1 stock split?

for a 5% stock dividend?

Market Makers

Most exchanges use market makers to facilitate options trading

A market maker quotes both bid and ask prices when requested

The market maker does not know whether the individual requesting the quotes wants to buy or sell

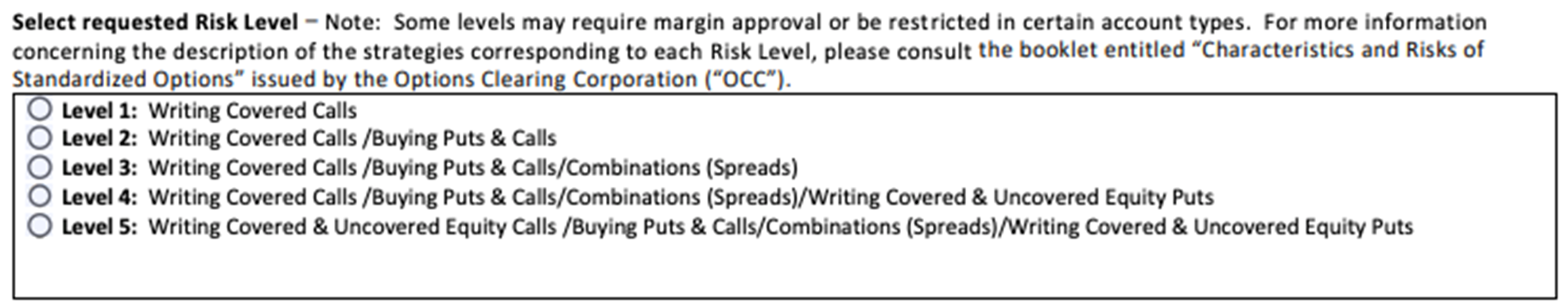

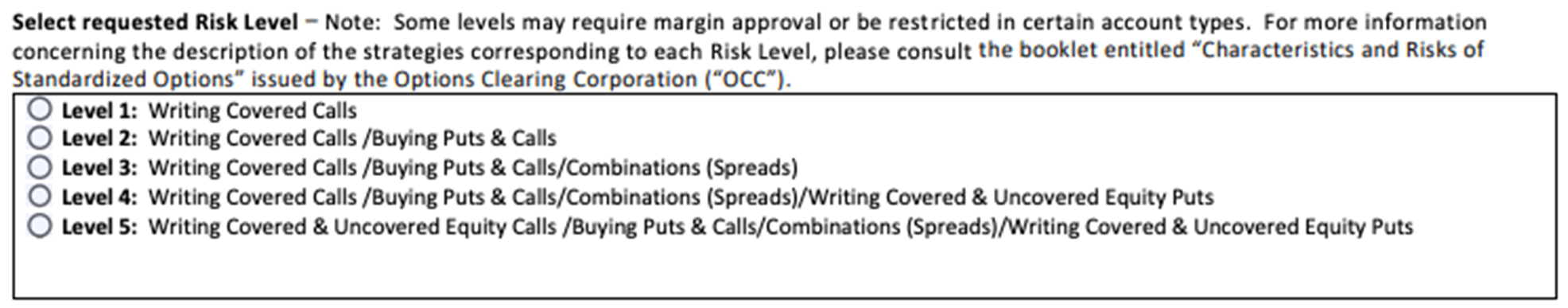

Margin

Margin is required when options are sold

When a naked option is written the margin is the greater of:

A total of 100% of the proceeds of the sale plus 20% of the underlying share price less the amount (if any) by which the option is out of the money

A total of 100% of the proceeds of the sale plus 10% of the underlying share price (call) or exercise price (put)

For other trading strategies there are special rules

Warrants

Warrants are options that are issued by a corporation or a financial institution

The number of warrants outstanding is determined by the size of the original issue and changes only when they are exercised or when they expire

The issuer settles up with the holder when a warrant is exercised

When call warrants are issued by a corporation on its own stock, exercise will usually lead to new treasury stock being issued

Employee Stock Options (see also Chapter 16)

Employee stock options are a form of remuneration issued by a company to its executives

They are usually at the money when issued

When options are exercised the company issues more stock and sells it to the option holder for the strike price

Expensed on the income statement

Convertible Bonds

Convertible bonds are regular bonds that can be exchanged for equity at certain times in the future according to a predetermined exchange ratio

Usually a convertible is callable

The call provision is a way in which the issuer can force conversion at a time earlier than the holder might otherwise choose