ECON 1BB3: CH5

1/43

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

44 Terms

employed

anyone who did paid work, unpaid work for family bus, or worked for themselves

unemployed

don’t have job but are willing & able to work & have looked for work in last 4 weeks

types of unemployment

frictional

structural

cyclical

seasonal

frictional unemp

short term that arises from process of matching workers w job

job search takes time

inc’s econ efficiency

devoting time = workers end up w jobs they find more satis & more production

structural unemp

arises from mismatch btwn skills/attributes worker & reqs of job

geographically e.g. lots reporter jobs in Ottawa but live in Wpg

changes legal reqs/struc e.g. Canada close cod fishing to protect stock = fishers unemp

tech changes

cyclical

lose their jobs bc rec

firms sales fall = cut back prod = lay off workers

fluctuations in rate mostly due to this

seasonal

factors i.e weather or D for products during diff times year

makes unemployment rates artificially high

e.g. ski resorts reduce hiring in summer

full emp

only remaining unemp = frictional & structural

nat rate of unemp

= frictional + structural

represents portion of LF that would be unemp if everything going well & only frictional & structural occur

not in labour force (NILF)

unable or unwilling to do paid work

given up looking

labour force (LF)

all ppl who working or looking

= emp + unemp

deter my phone survey

unemp rate =

(# unemp)/(LF) x 100

unemp rate not perfect measure joblessness bc

discouraged = count as unemp even tho willing & able

part time may want full time, doesn’t measure this & understates LM

phone survey claims may be false = overstates joblessness

labour force participation rate (LFPR) =

(LF)/(adult pop) x 100

deters amnt L that will be avail to econ

↑LFPR =

more L avail = ↑GDP

emp rate =

(# amp)/(adult pop) x 100

emp-pop ratio =

(# emp)/(adult pop) x 100

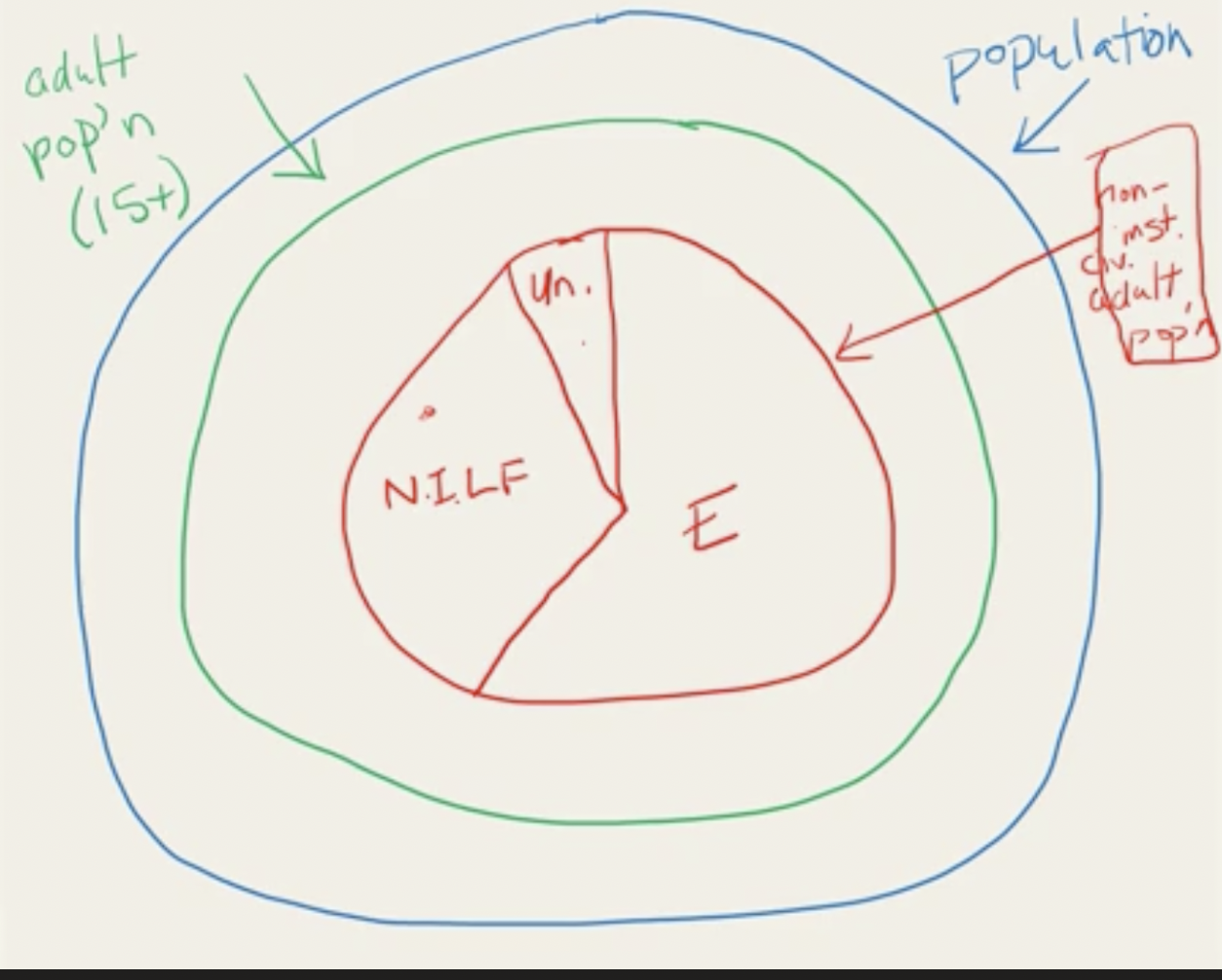

non-institutional civilian (NIC)

not in prison, nursing home, military

circle division pop, adult pop, NIC, NILD, emp, unemp

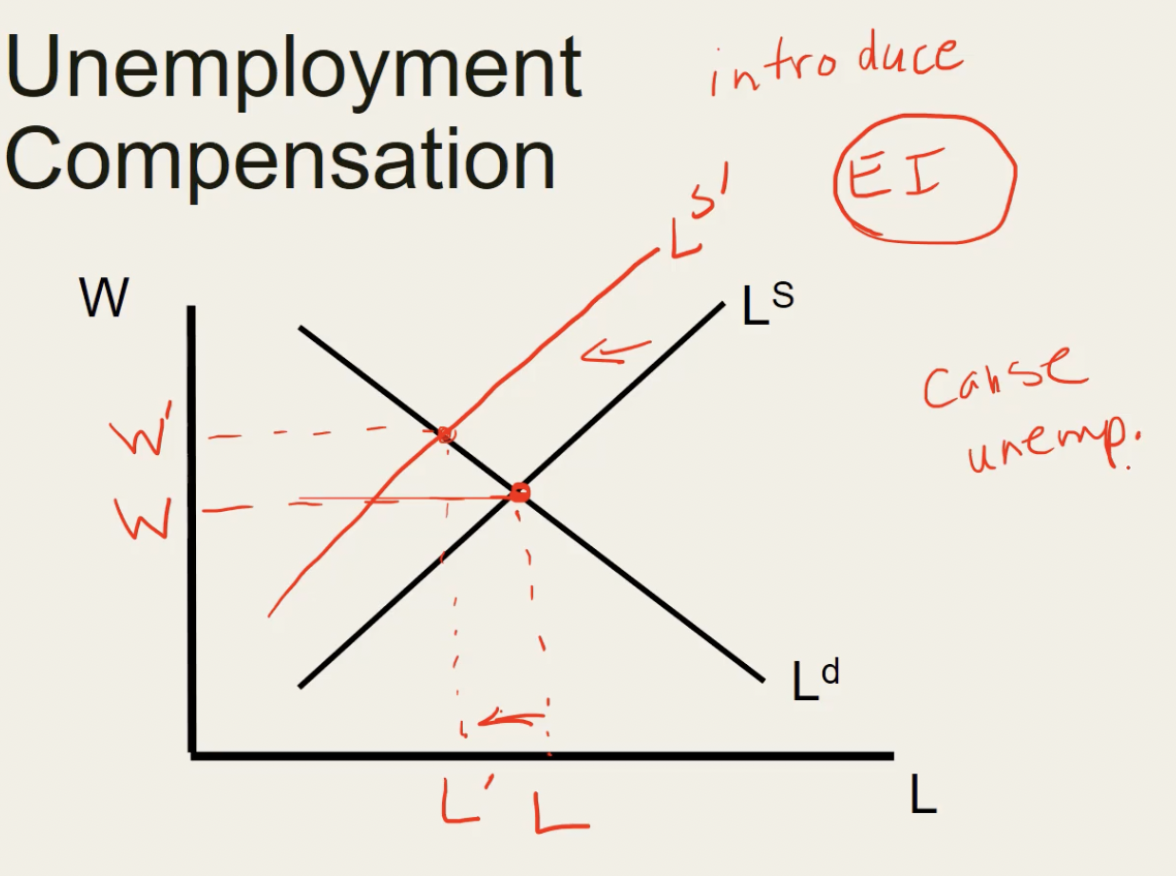

employment insurance (EI)

benefits paid to workers who find themselves unemp

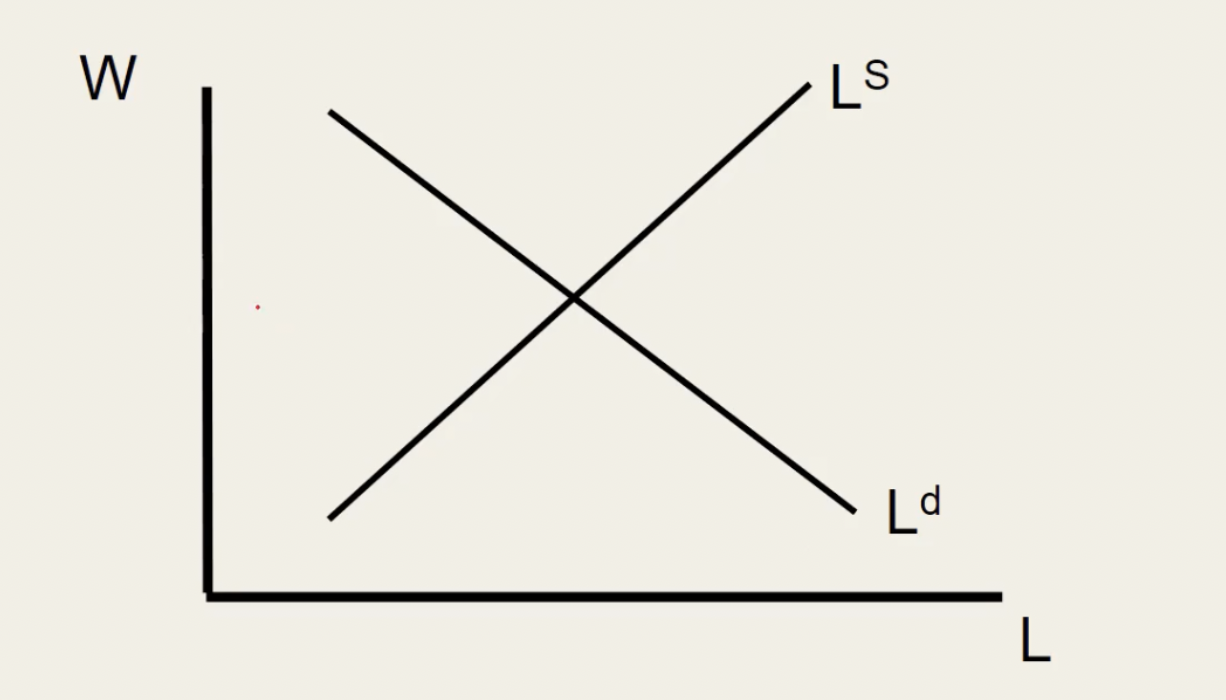

labour market (LM) diagram

W = wage

L = labour

Ls = L supply = from sellers/hhs

Ld = L demand = from firms/buyers

intersection Ls & Ld

how many ppl working in market

introduce EI =

↑OC going to work

= workers want ↑W to justify entering LM

= Ls shift ←

= ↓# ppl workering

= ↓L

= unemp

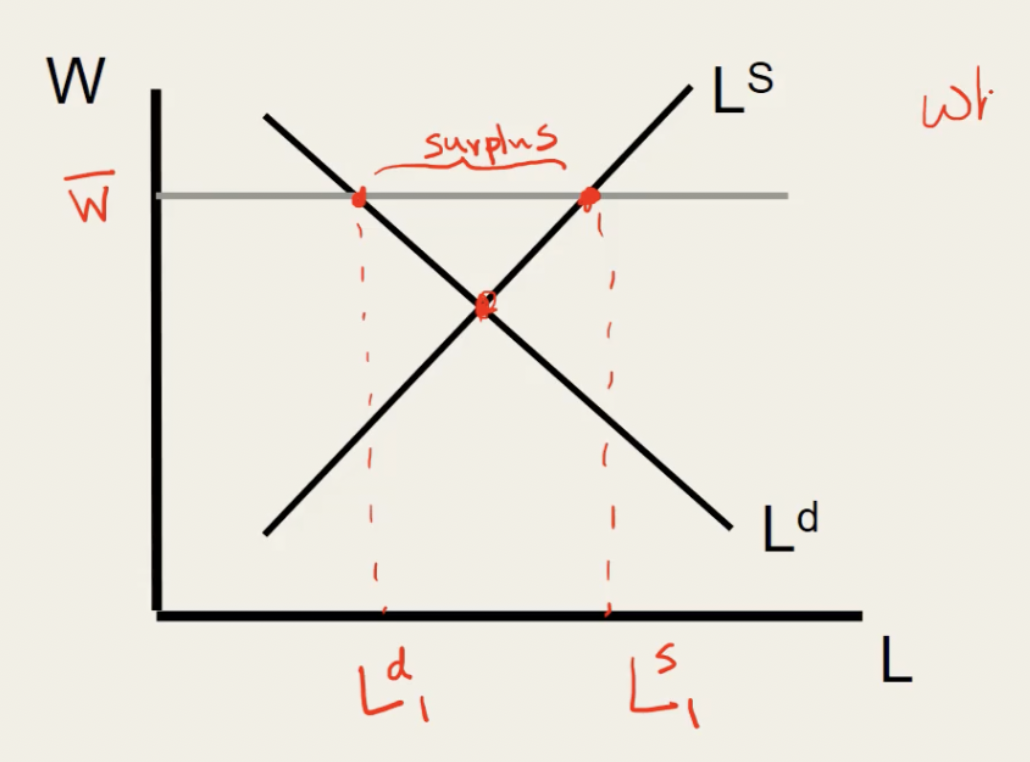

minimum wage (MW)

legal min set by gov

small impact on overall unemp rate

if MW > Eqpt =

binding (Wbar)

= Q Ls > Q Ld

= surplus L

= excess S

= unemp

consumer price index (CPI)

measures overall cost of g/s for typical Canadian hh

reflects cost of living

biases that cause change CPI to overstate rate of inflation experienced by his

substitution: assumes his purchase exact same amnt each product in basket monthly

inc in quality: = inc P = inf

new product: not incl in CPI tf changes in P not captured

outlet: CPI not updated to reflect changes in where ppl buy things

value in future $ =

value in past $ x (CPI future)/(CPI past)

real var =

(nom var)/(P index) x 100

CPI =

(cost basket current yr)/(cost basket base yr) x 100

inf rate =

(CPI yr - CPI yr b4)/(CPI yr b4) x 100

CPI vs GDPdef questions

is it prod in Canada?

y = GDP n = not GDP

does a typical hh buy this?

y = CPI n = not CPI

real W =

(nom W)/(P level) x 100

real W =

nom W - inf rate

real W =

(nom W)/(CPI) x 100

interest rate

cost of borrowing money as %

nom int rate

stated int rate on loan

real int rate

corrects nom for effect inf of purchasing power of money

amnt extra buying power u pay back (or get if lender) when load repaid

real int rate =

nom int rate - inf rate

inf rate higher than expected =

borrowers pay lower real int rate (good 4 them)

lenders receive lower real int rate (bad 4 them)

mortgage

loan typically made for purchase of a house or condo

↑neg int rate =

better off

as if bank is paying u

inf > expected =

wealth moves from lenders → borrowers

inf < expected =

wealth moves from borrowers to lenders