Loanable funds market

1/16

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

17 Terms

loanable funds

money available for lending and borrowing

demand for loanable funds

The quantity of loanable funds wanted or needed

Real interest rate

The price of borrowing money adjusted for inflation

Changes in demand for loanable funds

foreign exchange, all borrowing, lending, credit; Deficit spending, expectations for the future

foreign exchange

other country converting to USD=Increase in demand

All Borrowing, Lending, and Credit

When there is an increase in loans, credit, and borrowing by consumers and firms, we will see the demand for loanable funds increase. When there is a decrease in loans, credit, and borrowing by consumers and firms, we will see the demand for loanable funds decrease.

deficit spending

situation in which a government spends more money than it takes in ( increase in spending=increase in demand, decrease in spending=decrease in demand)

Expectations for the future

Expect an increase in income, increase in current demand

Expect higher prices, increase in current demand

supply of loanable funds

the relationship between the quantity of loanable funds supplied and the real interest rate (have a positive relationship)

Changes in supply

Savings rate, expectations for the future, lending at the discount window, foreign purchases

Spending Multiplier

an initial change in spending causes a ripple effect through the total economy and leads to more total spending

Marginal Propensity to Consume (MPC)

the increase in consumer spending when disposable income rises by $1

Marginal Propensity to Save (MPS)

the increase in household savings when disposable income rises by $1

Rule for the multiplier effect

Always = 1

spending multiplier equation

1/MPS

Tax Multiplier

MPC/MPS or always one less than the spending multiplier

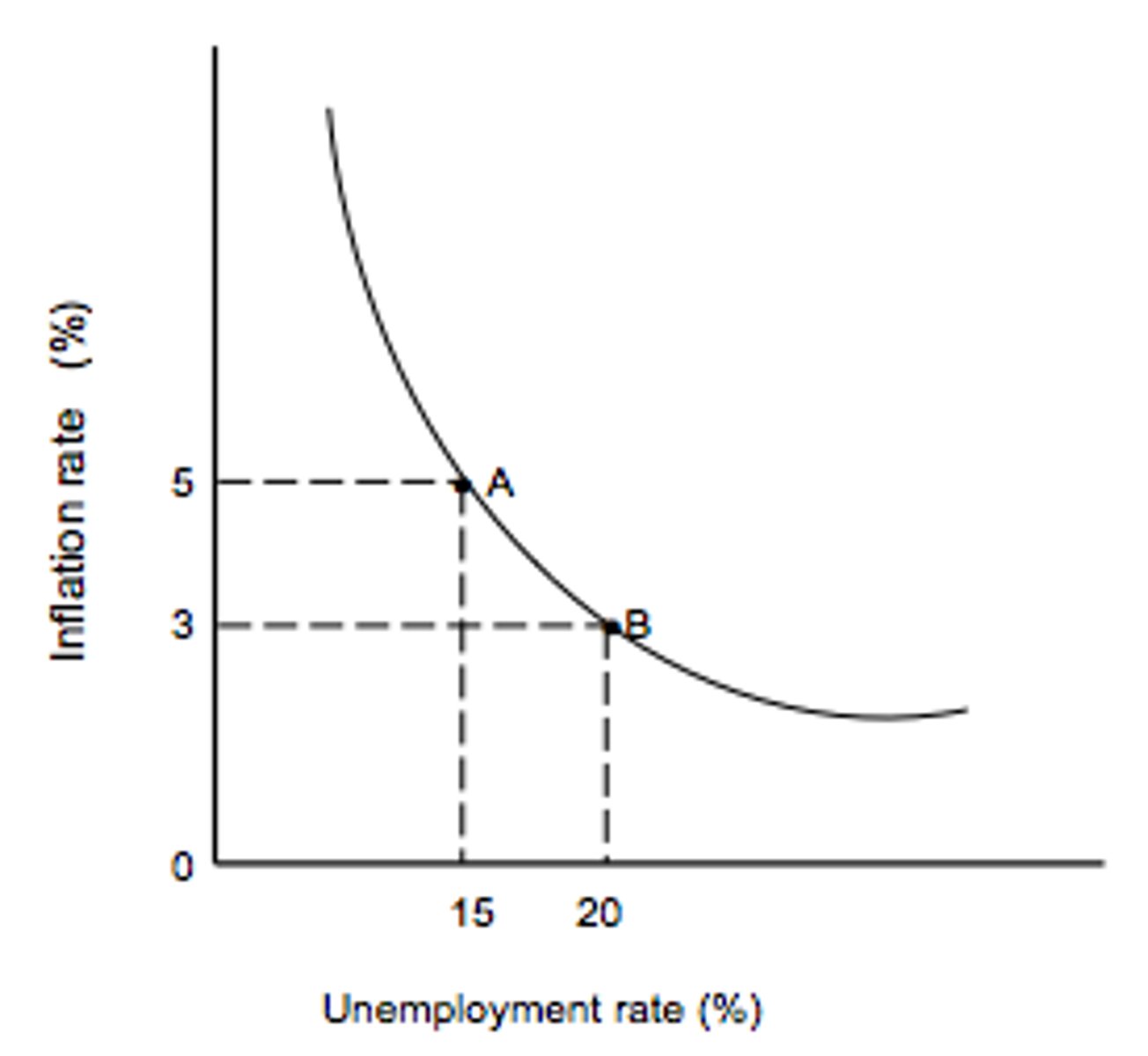

Phillips Curve

indicates a short-run inverse relationship between inflation and unemployment rates