EC330 AT W6: Price vs Quantity instruments, Coase Theorem

1/17

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

18 Terms

What happens if regulator is uncertain about Marginal Abatement Cost function?

Will set a quantity which will get a different price than expected.

Will set a price which will get a different quantity than expected.

By choosing the wrong price or quantity, we will get a deadweight loss

What are Weitzman’s paper key results?

Uncertainty about marginal costs or benefits of abatement will lead to deadweight loss

Uncertainty about marginal social benefits will lead to the same deadweight loss under price or quantity instruments

Uncertainty about marginal abatement costs can lead to differences in the expected efficiency of price versus quantity instruments, which depend on relative slopes of marginal benefit and cost curves

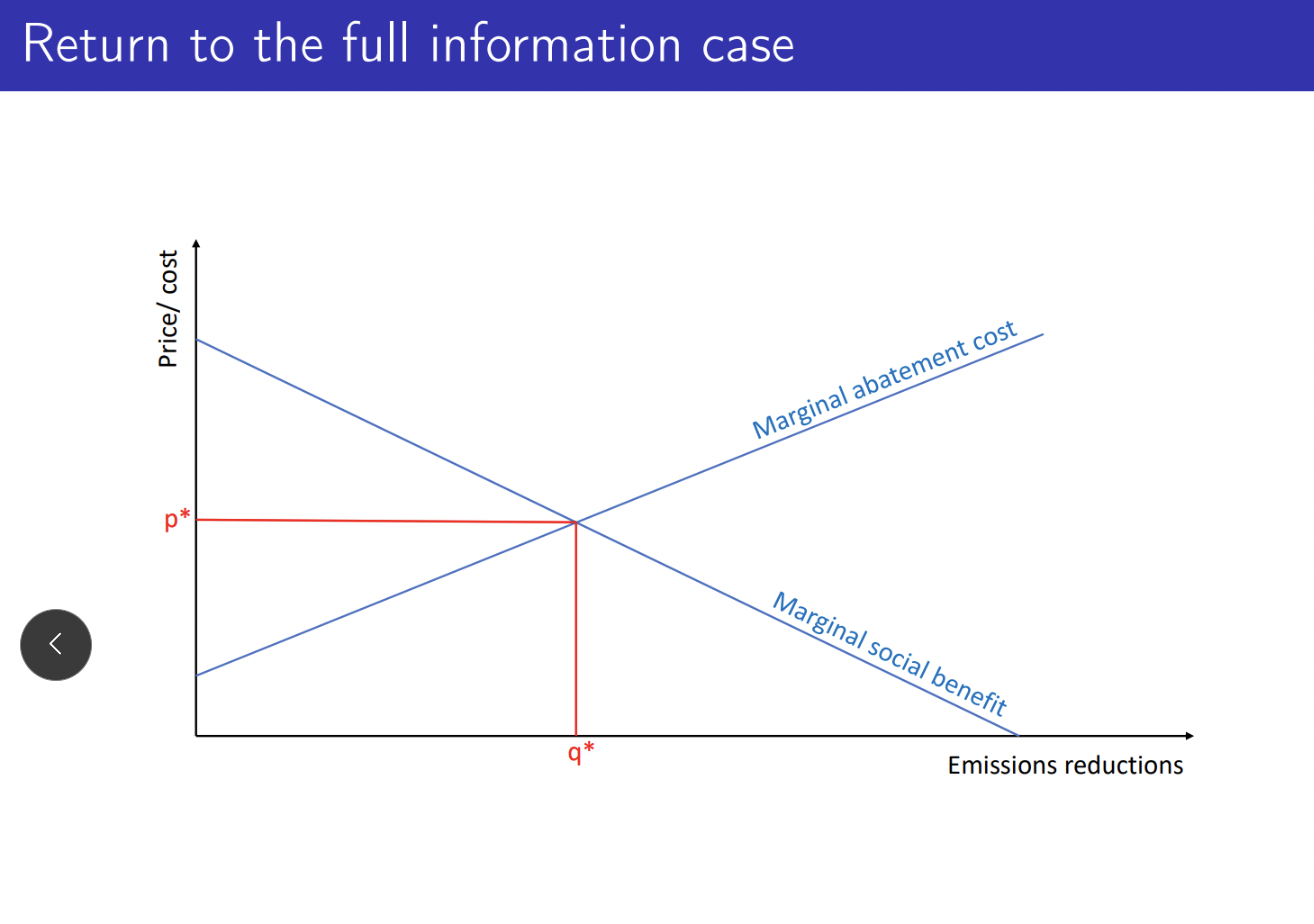

Full information case graph

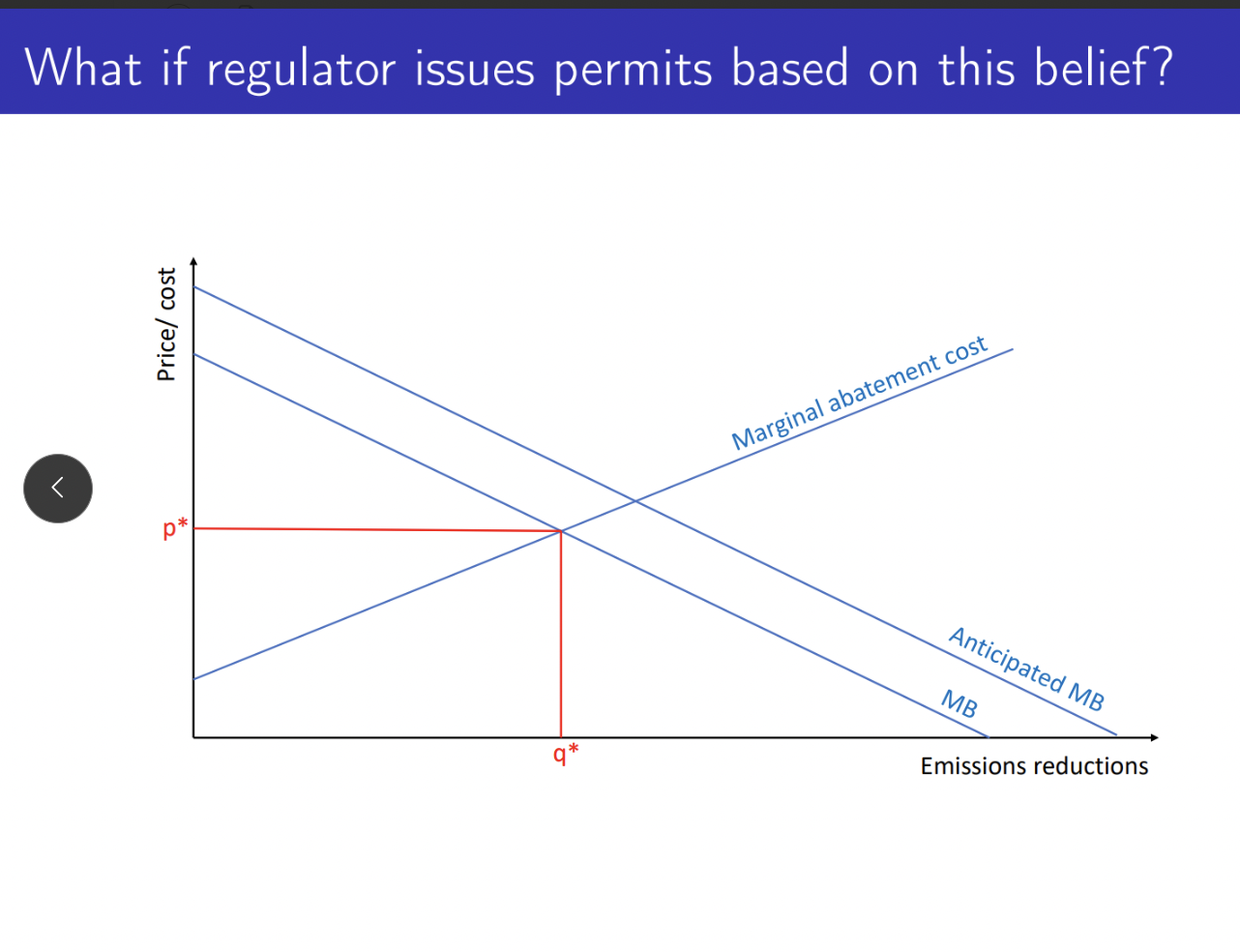

If there is uncertainty about the marginal social benefits, are the outcomes the same under price or quantity instruments?

Yes, they are the same. The emitters respond to instruments along the marginal cost curve. The errors in estimating the marginal benefits curve lead to a social loss.

If there is an uncertainty about marginal abatement cost, are the outcomes the same under price and quantity instrument?

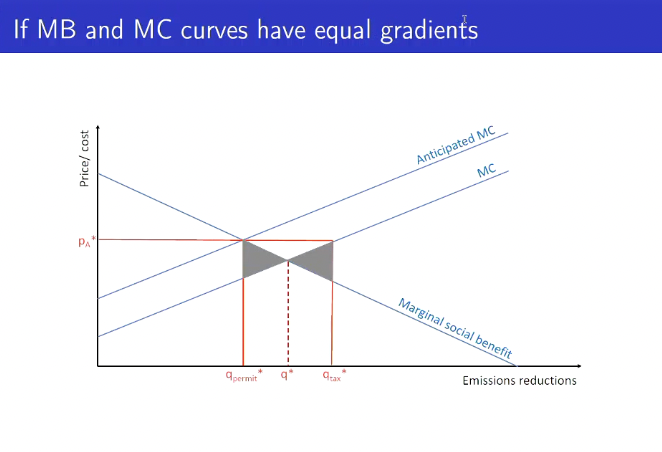

The deadweight loss will be the same if the slopes of linear MB and MC curves are equal

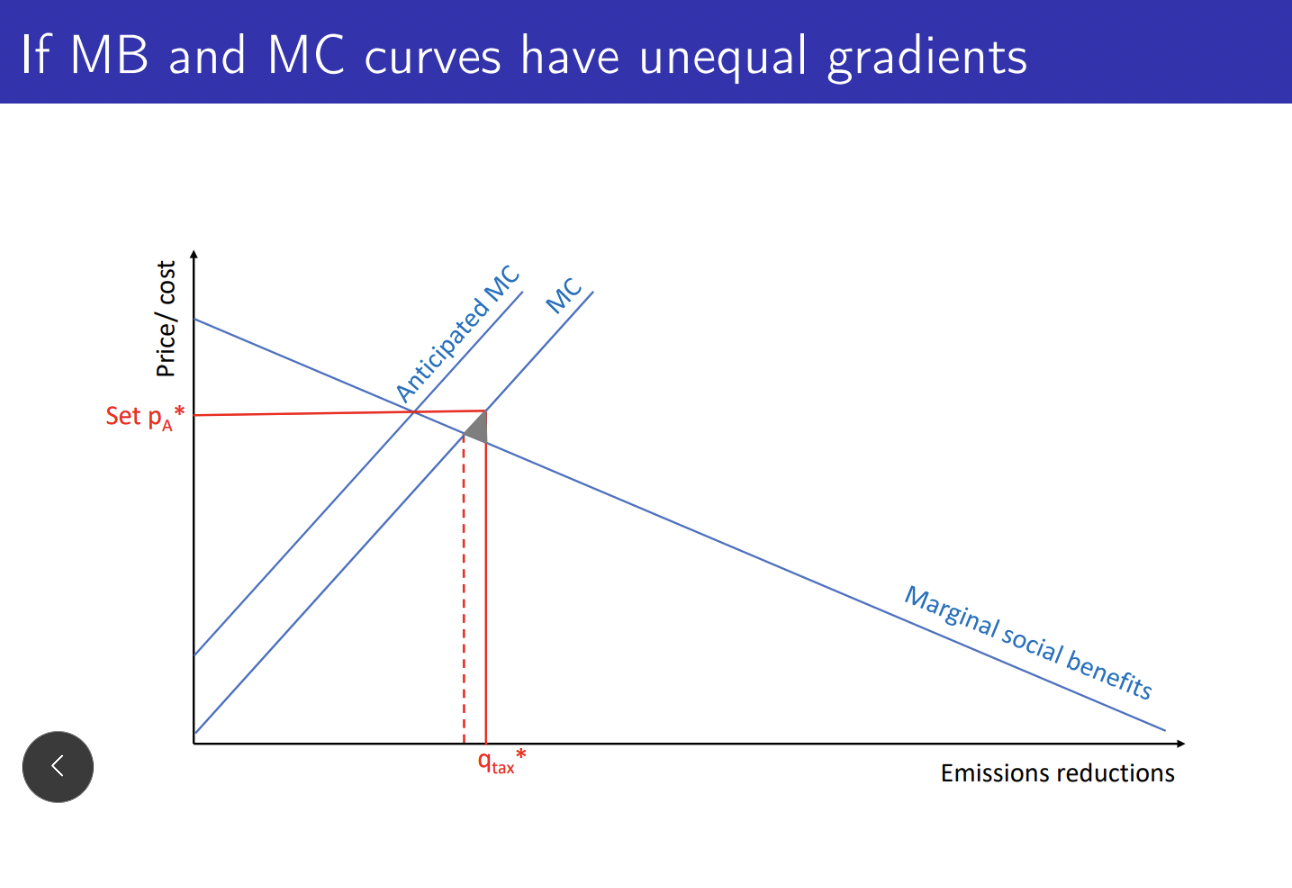

Will the outcomes be the same under price and quantity instrument if the MB and MC curves have unequal slopes? (uncertainty about marginal abatement costs)

No. If the absolute value of the slope of the MC curve > the MB curve, price instruments will lead to a lower distortion

Intuition:

With a steep MC curve, a small mistake in quantity (as would happen under a cap) leads to large cost differences. A tax (price instrument), by contrast, lets firms adjust their behavior more flexibly.

Because forcing firms to cut a bit more pollution than expected becomes very expensive.

When the MB curve is steeper than the MC curve, what happens to the outcomes under price and quantity instrument?

They are not the same.

The price instrument will cause a higher distortion, higher DWL.

A small mistake in the tax can cause big losses in benefit.

For example, if the tax is too low, firms won’t cut enough pollution, and the environment suffers a lot.

A quantity cap forces the exact right amount of pollution reduction, so we still get the big environmental benefit.

So, caps are better when the MB curve is steep, because we can’t afford to get the quantity wrong.

When will MB curve be steeper than the MC curve?

When the environmental damage gets dramatically worse with just a little more pollution.

nuclear leakage

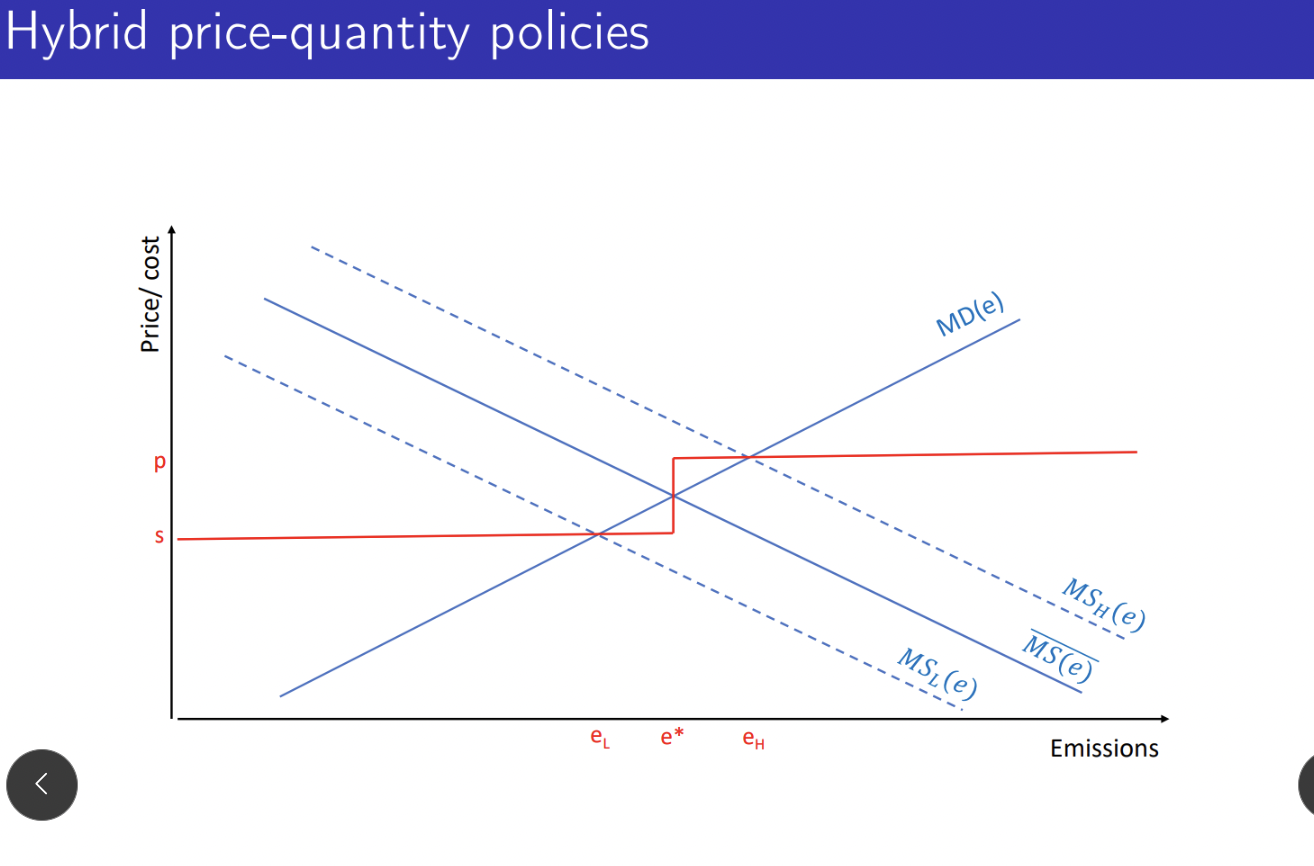

What are hybrid policies?

They combine quantity regulation with a subsidy for emitting less than the firm is required and a penalty for emitting more

Set up of hybrid price quantity policies

MAC are uncertain, so regulators only know the mean value

(MAC = Marginal Savings)

Marginal Social benefits are known with certainty

(MSB = Marginal damages from emissions)

Policy description:

firms are told to emit e*

if it emits less, receives s for each unit of pollution under limit

if it emits more, pays p for each unit of pollution above limit

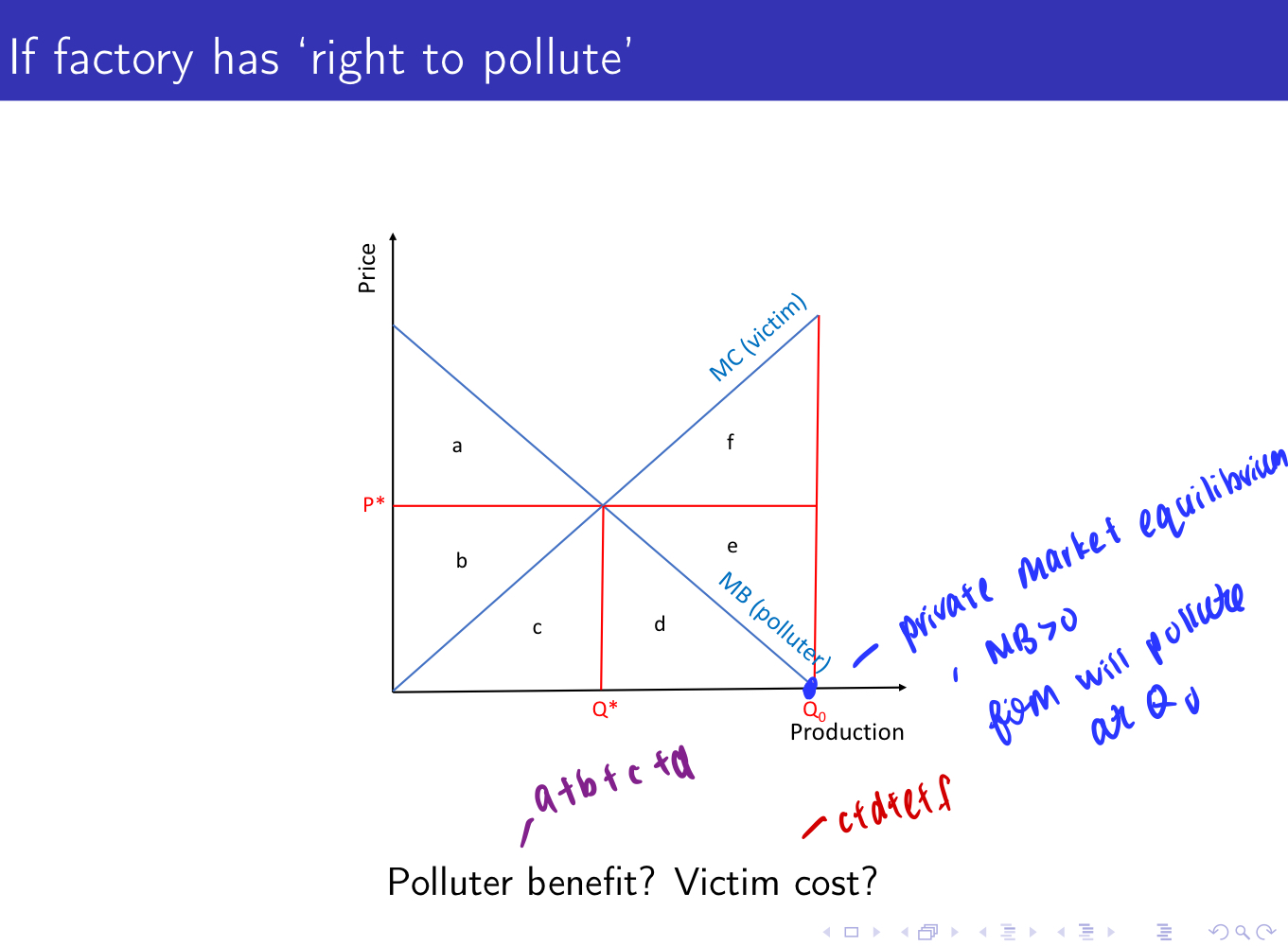

What happens when the firm is given the right to pollute?

Firm will produce at Q_0

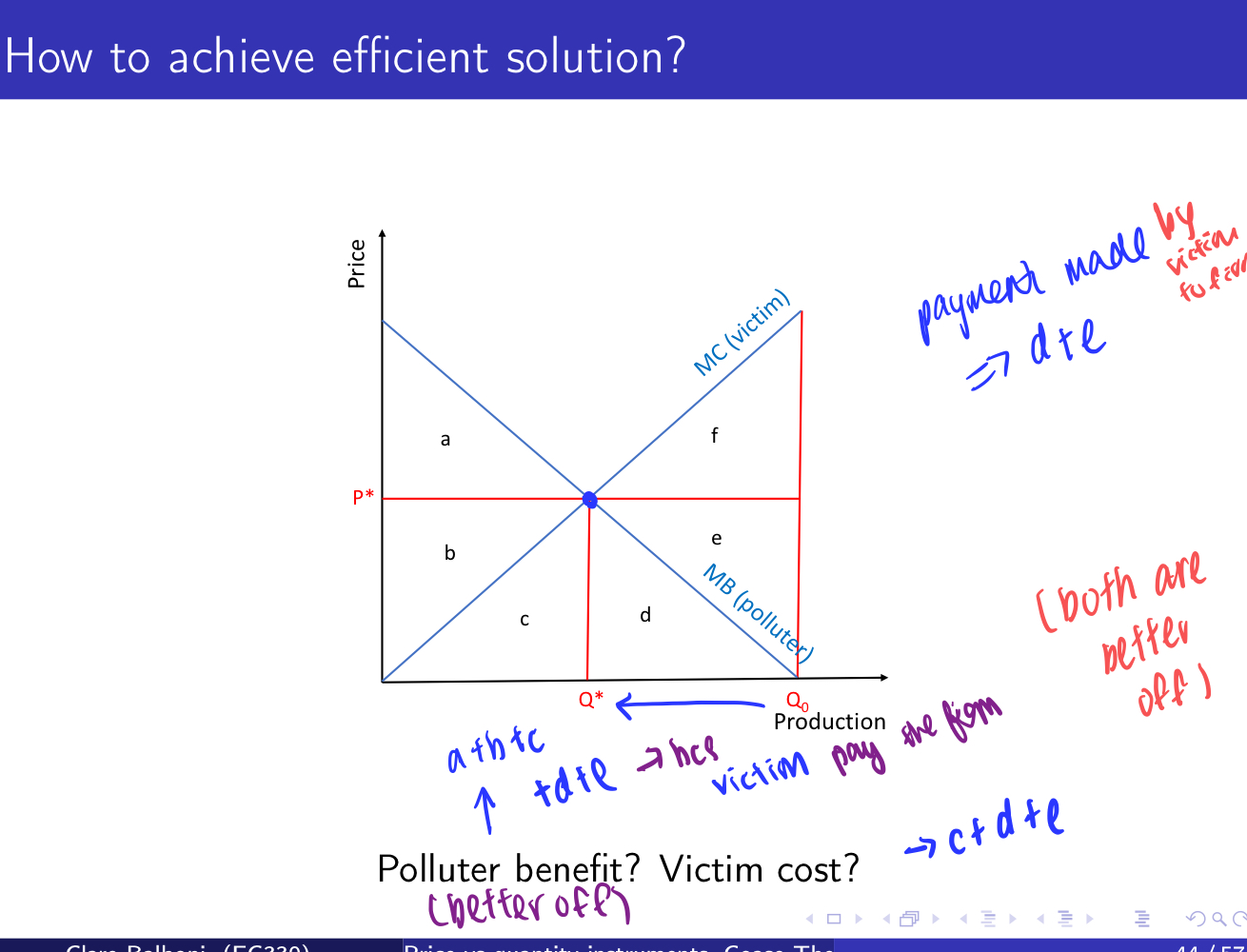

How do you achieve an efficient solution?

With private bargaining, the victim will offer a payment to the firm of d+e to produce at Q*

both polluter and victim are better off

private bargaining achieves efficient outcome

government intervention was not needed

What happens if the laundry was given the right to clean air

Efficient outcome is still achieved but the distribution of profit differs.

Scenario Setup:

If the factory pollutes, it earns £100 in profits.

Pollution causes £60 in damages to the laundry.

If the factory doesn’t pollute, it earns £0.

The laundry always earns £100 if there’s no pollution, and £40 if there is pollution.

Case 1: Factory has the right to pollute

Starting point: The factory pollutes.

The laundry loses £60 in damages, so its profit is £40.

The laundry might offer the factory some money to not pollute.

Suppose the laundry offers £60 to the factory:

Factory gets £60 (instead of £100 from polluting).

Laundry keeps £100 − £60 = £40.

Because the factory has the right, it ends up with all the surplus from the negotiation.

Case 2: Laundry has the right to clean air

Starting point: No pollution.

Factory is earning £0, laundry is earning £100.

The factory may offer the laundry a payment to pollute.

Say the factory offers £60 to pollute:

Factory earns £100 − £60 = £40

Laundry gets £40 + £60 = £100 total

Because the laundry has the right, it ends up with all the surplus from the negotiation.

Total profit will be the same, but who gets what slice of the pie changes depending on who has the right!

When does Coase Theorem hold?

Everyone has perfect information

Consumers and producers are price-takers

There is a costless court system for enforcing agreements

Producers maximize profits and consumers maximize utility

There are no income or wealth effects

There are no transaction costs

If the coase theorem holds, does initial assignment of property rights regarding the externalities matter for efficiency?

No, it does not matter. However, if any of the assumptions don’t hold, then the initial assignment of rights does matter

What happens if you add Pigouvian tax to Coasian bargaining?

If Coasian bargaining already gives the efficient result, then adding a Pigouvian tax can mess things up.

Before the tax:

A and B negotiate over the real harm.

After the tax:

A is also paying the government, so A now sees the cost of pollution as too high.

A might reduce pollution too much, even if B doesn’t really care that much about the extra pollution.

So the Pigouvian tax, which was supposed to correct a market failure, now over-corrects it — and causes inefficiency instead.