Saving and investment strategies

1/19

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

20 Terms

saving

the storage of money for future use

investing

using savings to earn more money

how does saving influence the economy

saving benefits the economy by making more money avaliable for borrowing by individuals, businesses and goverments

when this money is spent, demand for goods and services increases resulting in more jobs and more spending by workers

saving categories

saving account- least amount of restriction, low balance

investment categories

securities, stocks, bonds, mutual fund, real estate, commodities, collectibles

what is interests

the fee paid for borrowing money

typically paid as the percentage of the principal (amount borrowed) over a defined period of time

The fee earned for saving or investing money

different types include simple and compound interest

calculating compound interest

start young “snowball effect”

get bigger each year start young

value of $1000 after three years at a rate of 3% (interst compounds)

1000*.03= 30

1030*.03= 31

1061*.03= 32

30+31+32= 93

1000+93=1093

rule of 72

a formula used to estimate the amount of time it takes to double an investment (72/investment rate)

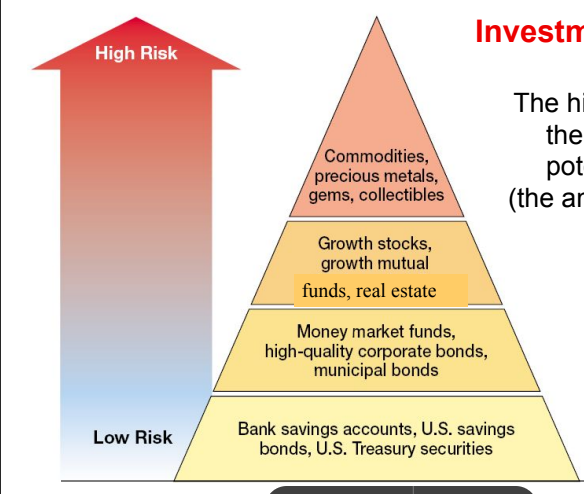

investment pyramid

the higher the risk the potential yield (amount gained)

more risk more chance to gain

less risk less chance to gain

what are four factors to consider when selecting an investment

safety/risk, return, taxes, liquidity

more tax payed, less tax payed is a factor to look for

liquidity

ease at which an investment can be turned into cash

what is security

a financial instrument representing a financial value stocks, bonds, mutual funds

when you buy securities you need to buy through a stock broker

discount broker- you pay less

stock dividend

a portion of profit, second way of income

how do economic factors affect stock prices (generally)

Inflation- causes lower spending by consumers which reduces company profits out of which dividends are paid

falling or rising interest rates can increase or decrease company profits

employment rate- when more people are employed, they spend more money on products and stock prices rise

(high unemployment rate less demand for stuff, economic factors affect stock prices and the economy)

goverment bonds

municipal bonds (state and local), us saving bonds (series ee bonds, series hh bonds, i bonds)

form of investment

municipal- local

corporate and goverment bonds

corporate bonds usually pay for a higher return

the value of a bond is affected by changing interest rates

the goverment or corporation that issued bonds is a debtor to those who buy the bonds

(buy bond from goverment, goverment owes you money later, owes you money- debtor)

mutual funds

a mutual fund is an investment fund (basket of stocks) set up and managed by companies that receive money from many investors

hwen you buy a mutual fund you are buying a basket of stocks

real estate

land or anything attached to land

mortgage- a debt instrument secured by property/ borrowers must pay back loans based upon predefined terms& interest rates

assessed value- the value you local goverment determines your property is worth for tax purposes

(another form of investment, price of house/land mortage- can be fixed or change every year)

fixed or arm mortgage

what types of commodities are commonly used with future contracts

agricultural commodities- sucha s grain and livestock and precious metals

highest risk of investment speculate what might happen in future

what type are common collectibles

stamps, coins, sports trading cards, antiques

average buyers typically do not make huge profits from collectibles

(collectibles- like of interest dont yield high profit)