Borrowing costs (IAS23) and Government grants (IAS20)

1/35

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

36 Terms

What does IAS23 define borrowing costs as?

Interest and other costs that an entity incurs in connection with the borrowing of funds.

Interest expense

Amortisation of discounts or premiums on borrowings

Finance charges on lease liabilities

Exchange differences on foreign currency borrowings

What is a qualifying asset?

An asset that takes a substantial period of time to get ready for its intended use or sale.

What are some examples of qualifying assets?

Certain types of inventory (must take a substantial period of time for its intended use)

PPE

Intangibles

Investment Property

Bearer plants

When are borrowing costs capitalised?

Borrowing costs that are directly attributable to the acquisition, construction or production of a qualifying asset are capitalised when:

Probable future economic benefits

The costs can be measured reliably

What happens to the other borrowing costs when they don’t meet the criteria to be capitalised?

They are recognised as an expense in profit or loss in the period in which they are incurred

What are the two types of borrowing costs?

Specific borrowings

General borrowings

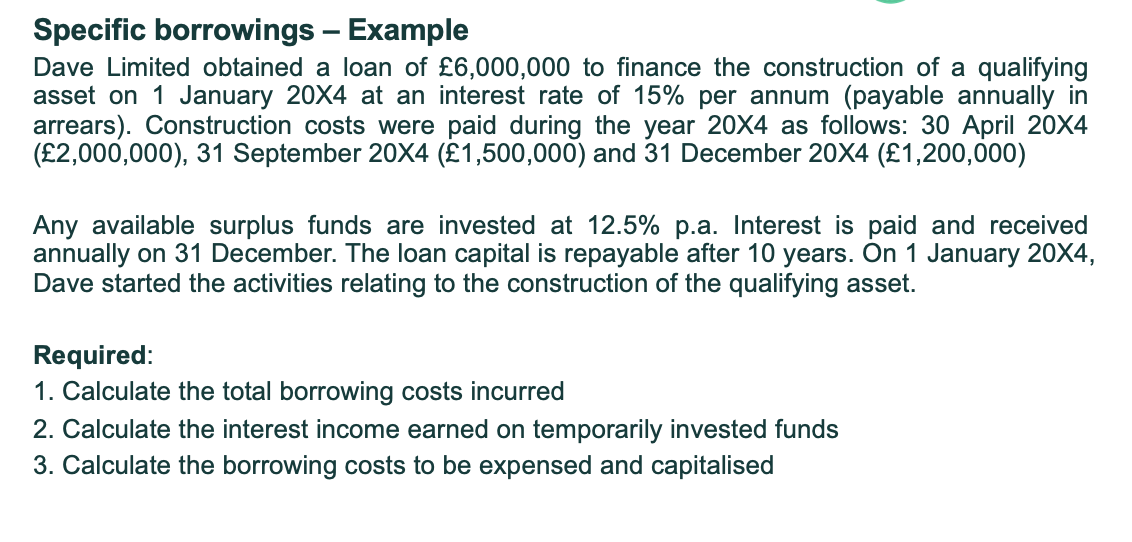

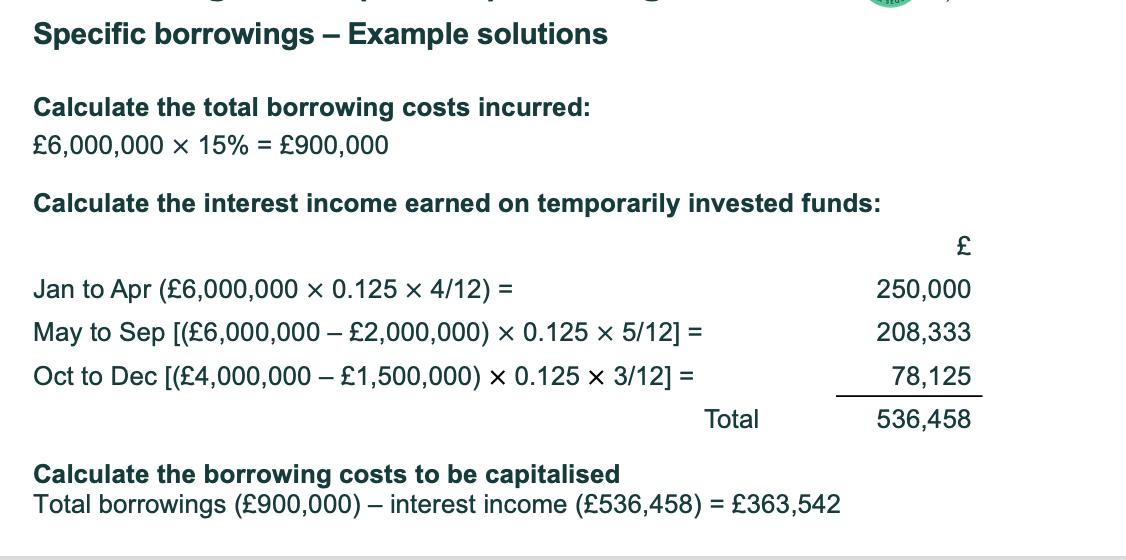

What are specific borrowings?

If funds are borrowed specifically for a qualifying asset.

Capitalise actual borrowing costs incurred less any investment income on temporary investment of the borrowings

What are general borrowings?

If funds are borrowed generally to obtain a qualifying asset

Apply a capitalisation rate ( weighted average rate on outstanding general borrowings)

The amount of borrowing costs that an entity capitalises during a period shall not exceed the amount of borrowing costs it incurred during that period

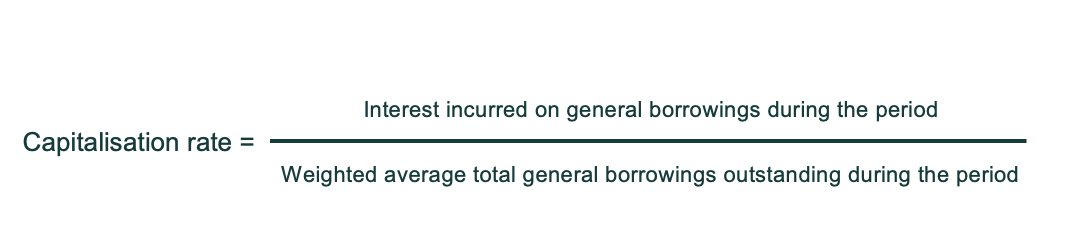

What is the formula for the capitalisation rate?

When does capitalisation start?

Only during the construction period, which is governed by three stages:

Commencement of Capitalisation

Suspension of Capitalisation

Cessation of Capitalisation

What is the commencement period of capitalisation?

This is the point when capitalisation of borrowing costs start. Begins when these conditions are met:

Expenditure on the qualifying asset has been incurred

Borrowing costs are being incurred

Activities necessary to prepare the asset for use or sale are in progress

What is the suspension period of capitalisation?

This is a temporary stop in capitalisation during the construction period.

DO NOT Suspend if the delay is short or if it is long but necessary

What is the cessation period of capitalisation?

This is the point where capitalisation permanently stops.

It ceases when substantially all activities necessary to prepare the asset for its intended use or sale are complete.

What must an entity disclose for borrowing costs?

The amount of borrowing costs capitalised during the accounting period

The capitalisation rate used to calculate the amount of general borrowing costs that are eligible for capitalisation

Explain the term government.

Refers to government, government agencies and similar bodies whether local, national or international

Explain the term government assistance.

Is action by government designed to provide an economic benefit specific to an entity or range of entities qualifying under certain criteria.

What are government grants?

Assistance by government in the form of transfers of resources to an entity in return for past or future compliance with certain conditions relating to the operating activities of the entity.

What are the two types of government assistance?

Government grants- recognise + disclose

Other government assistance- only disclose

What are the two types of government grants?

Grants related to assets

Grants related to income

When can we recognise government grants? (2 step criteria)

The entity will comply with the conditions attaching to them

The grant will be received

How are government grants recognised in profit or loss?

On a systematic basis over the periods in which the entity recognises as expenses the related costs for which the grants are intended to compensate

When is a grant recognised as income?

A grant receivable as compensation for costs already incurred or for immediate financial support with no future related costs

What is IAS23 concerned with borrowing costs in connection with?

The purchase and/or development of “qualifying asset”

Are inventories produced in bulk in a short period of time a qualifying asset?

No, they do not take a substantial period of time to get ready for intended use.

Are inventories that requires a significant time to reach its intended use or saleable condition a qualifiable asset?

Yes, it tells us they do take a substantial period of time to get ready for intended use/sale

How do we determine if the borrowing costs are directly attributable?

Borrowed specifically

Would have been avoided - e.g. if project cancelled we wouldn’t have to borrow anything

When calculating mixed borrowings whats the rule?

Specific borrowings

Then general borrowings

Explain capitalisation of borrowing costs on a qualifying asset would begin.

Expenditures for the asset are being incurred

Borrowing costs are being incurred

Activities necessary to prepare the asset for its intended use or sale are in progress

Explain when capitalisation of borrowing costs on a qualifying asset would cease.

During the cessation period when all necessary activities are complete.

Explain how one accounts for the receipt of a government grant in the form of cash.

The grant is not recognised immediately in profit or loss

Initially recognised as deferred income ( a liability)

The grant is then recognised in profit or loss systematically over the periods in which the related expenditure is incurred

Presented as other income or deducted from the related expense

How do we find the borrowing cost to be capitalised for specific borrowings?

The total borrowing costs - investment income on temporary borrowings

Can all forms of government assistance be recognised as a government grant in the financial statements of the reporting entity?

No

What is the disclosure for government grants?

The accounting policy adopted

The nature and extent of government grants recognised in the financial statements and an indication of other forms of government assistance from which the entity has directly benefited

Unfulfilled conditions and other contingencies attaching to government assistance that has been recognised.

Can the amount of borrowing costs capitalised exceed the total borrowing costs incurred?

No

In terms of IAS23 the capitalisation of borrowing costs ceases when the asset is substantially completed.

True