macro finalSubprime mortgages were loans made to borrowers with _____ credit and who, as a result, were charged _____ interest rates.

1/48

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

49 Terms

Subprime mortgages were loans made to borrowers with _____ credit and who, as a result, were charged _____ interest rates.

poor; high

According to the Phillips curve, a rise in inflation would correspond to a(n) _____ in unemployment while a rise in unemployment would correspond to a(n) _____ in inflation.

decrease; decrease

A financial instrument backed by a collection of mortgages is called a(n):

collateralized debt obligation.

The 2007–2009 recession was caused by a(n):

decrease in aggregate demand triggered by a financial crisis

Which of these helps explain jobless recoveries?

Increased technology has enabled companies to use fewer workers

The graph that shows the tradeoff between inflation and money wages is called the:

Phillips curve.

When labor demand rises, unemployment _____ and wages _____.

falls; rise

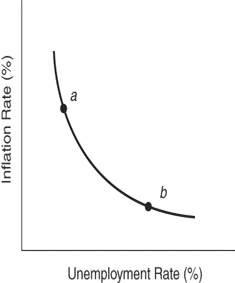

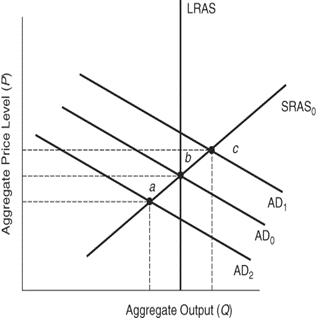

To move the economy from point a to point b in the short run, policymakers implement _____ monetary policy, thereby accepting _____ to reduce _____.

contractionary; more unemployment; the rate of inflation

_____ occurs when both inflation and unemployment increase over time.

stagflation

If policymakers use contractionary policy to reduce inflation, the unemployment rate will be:

higher

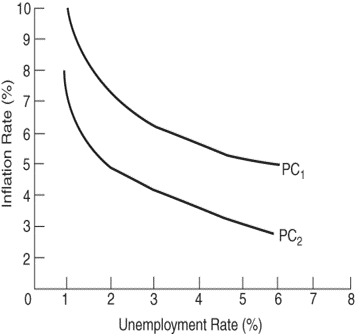

The graph shows two Phillips curves. Suppose the economy originally faced curve PC1. Which of these would cause the curve to shift to PC2?

Workers in the economy are expecting lower inflation.

Suppose the Federal Reserve announces that its policy will increase the supply of money next year. This announcement can be expected to

shift the Phillips curve to the right

in the long run, any demand-side policy that attempts to reduce unemployment below its natural rate will:

cause inflation

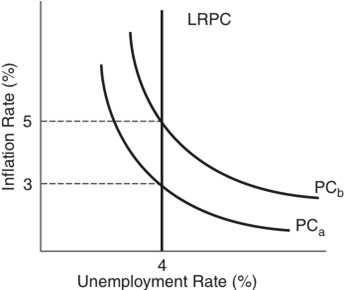

what is the natural rate of unemployment associated with Phillips curve PCa?

4%

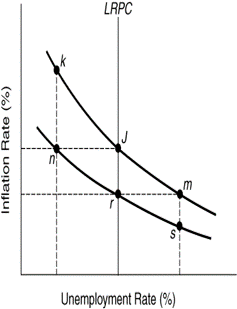

Suppose the economy is at the natural rate of unemployment, but it's an election year and expansionary policies are used to reduce the unemployment rate. If inflation now exceeds expected inflation, real wages have _____ and workers will demand _____ in their nominal wages.

fallen; increases

starting at point r, the economy will move to point _____ in the short run if policymakers successfully increase aggregate demand.

n

Economic expectations formed after individuals make the best possible use of all publicly available information are known as _____ expectations.

rational

Assume the economy is at point c. According to the theory of rational expectations, if the Federal Reserve announces and then starts a plan to practice contractionary policy, the economy will move from point c to point:

d directly

If Costa Rica is able to produce 50,000 pounds of bananas a day, while Nicaragua can produce 30,000 pounds of bananas a day, which statement must be true?

Costa Rica has an absolute advantage over Nicaragua in banana production.

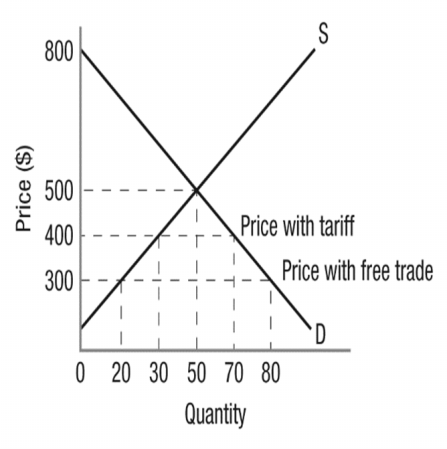

In the market for surfboards seen in the graph, in autarky, this country imports _____ units, while with free trade the country imports _____ units.

0; 60

Suppose Canada forms a free-trade agreement with the Netherlands and increases the quantity of tulips it imports. Canadian tulip consumers will be _____ and Canadian tulip producers will be ____

better off; worse off

in international trade, when we say that Brazil is "dumping" in the United States, this is indicating that:

Brazil's firms are selling goods at prices below what they charge in Brazil or below their production costs.

import 60 widget

A country has an absolute advantage in the production of a good if it can:

produce more of the good than another country, using the same amount of resources.

if Germany used all its resources to produce bread, suppose it could produce 40 million loaves of bread. If it used all its resources to produce milk, it could produce 20 million gallons of milk. Based on this, Germany's opportunity cost of producing a _____ is _____

loaf of bread; 1/2 a gallon of milk

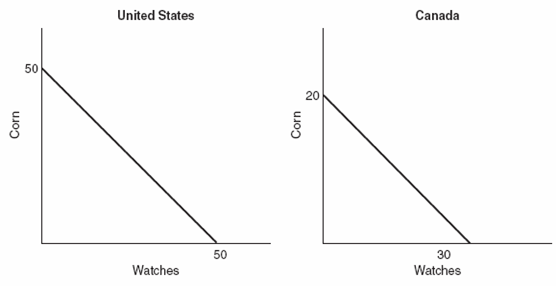

Referring to the graphs, the United States should export _____ to Canada and import _____ from Canada

corn; watches

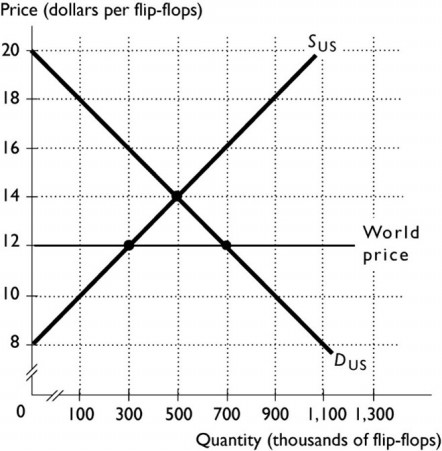

The above figure shows the U.S. market for flip-flops. With international trade, the equilibrium price in the United States is ________ and the United States ________ flip-flops.

$12; imports

A quota is

a government-set limit on the quantity of imports into a country.

A tariff is a tax

on an imported good.

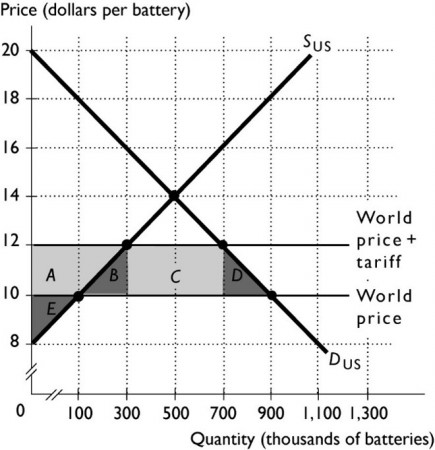

phone batteries. Suppose the U.S. government imposes the tariff illustrated in the figure. The tariff is equal to ________, and the price U.S. consumers pay _______compared to the price paid when there was free trade.

$2; increases

If U.S. exports are $8,300 and its imports are $10,300, what is the trade balace

deficit of $2,000

if exports exceed imports, then the nation has a

trade surplus.

An example of an item included in the financial account is

a Pepsi-Cola bottling plant in Greece.

The rate at which one currency is traded for another is called the

exchange rate

If 1 euro will buy $1.30

$1 will purchase 0.77 euro

If the domestic price level equals the foreign country's price level, the real exchange rate

equals the nominal exchange rate.

suppose an MP3 player sells for $75 in the United States and for £50 in Britain. Which exchange rate is consistent with purchasing power parity?

£0.67 for US$1

The Big Mac index is an attempt to measure

purchasing power parity

If there is a surplus of euros, then euros will

depreciate

In the market for foreign currency exchange, when demand for U.S. goods increases, the U.S. dollar will _____, and the equilibrium exchange rate will shift from _____ to _____.

appreciate; e0; e1

If the dollar depreciates in terms of the euro, what will happen to the prices of European goods in the United States?

They will increase.

Usually, a country with a rapid increase in its interest rate also sees

appreciation of its currency

As the dollar appreciates against the yen, U.S. exports to Japan _____ and U.S. imports from Japan _____

fall; rise

compare the price of a pound of salmon in the United States with a pound of salmon in Japan. If we assume that the price of salmon in the United States is $4 per pound, while in Japan, it is 1,488 yen, and the dollar–yen exchange rate is US$1 = ¥124, then the real exchange in terms of salmon is

0.33

assume that capital is perfectly mobile and substitutable and that the interest rate in the United States and the European Union is currently 5%. Investors expect the euro to rise against the dollar by 2% and they thus demand a _____ in the _____

higher return equal to 7%; United States

Under fixed exchange rates and perfect capital mobility, a fiscal contraction by a country

results in an outflow of capital and an additional reduction in GDP

If exchange rates are fixed and the money supply is held constant, a contractionary fiscal policy leads to a(n) _____ in interest rates and a capital _____

decrease; outflow

in a country that follows a policy of using a _____ exchange rate, the government determines the exchange rates, then adjusts macroeconomic policies to maintain these rates

fixed

Under a gold standard, if a country's exports exceeded its imports

gold flowed into the country.