VIDEO NOTES (Class 8 & 9) Chapter 7

1/60

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

61 Terms

What is expense recognition?

Expenses should be recorded when you receive the product or good, not when you pay for them

What are the three approaches to expense recognition?

Direct Association

Immediate Recognition

Systematic Allocation

What’s Direct Association?

If an expense is directly tired to earning a specific revenue, you should record the expenses at the same time

ex: if you sell a good for 100, and the inventory cost of that good is directly tied, you should record sales revenue at the same time as COG

Immediate Recognition

some sales aren’t tied directly to a sale, but help support it overall

it should be recorded right away, at the same period

ex: advertisement made in march, sales boost in April. Record it in march, as soon as they are made

What’s systematic allocation?

some costs don’t relate to a single sale/period, like equipment, so instead we record them as assets and spread the cost overtime

ex: depreciation

Where do you report inventories?

On income statement, in Cost of Sales

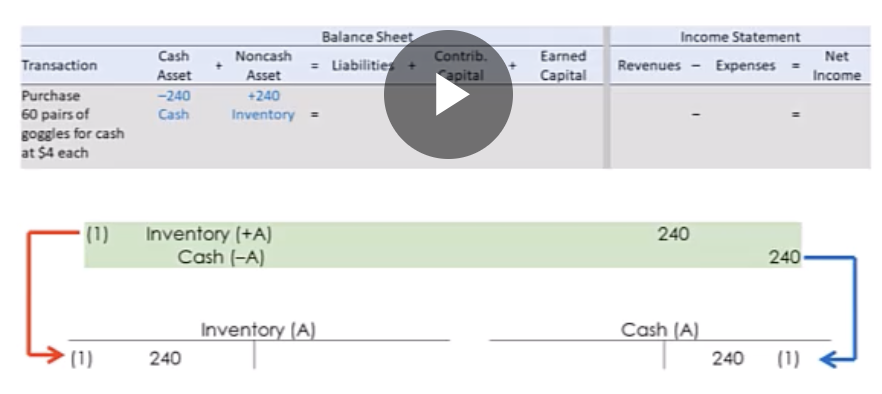

How does inventory work in accounting?

Spoiler: it helps you determine Gross Profit

it appears on the balance sheet under current assets until its sold

then it becomes COG in expense on income statement

Sales Revenue - COG = Gross profit

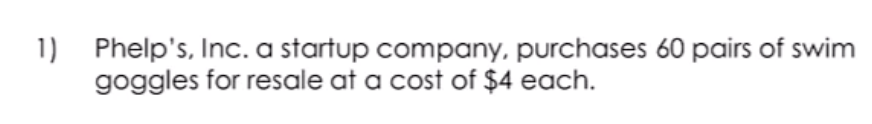

Inventory Purchasing

What are “costs” for inventory?

Cost to acquire

Cost of transportation

Cost for preparing goods for sale

Cost with consideration to incentives

When should a company report inventory?

Only when it is legally owned, not just physically on site

Reported inventory = legal ownership

Buyer recognizes inventory at the time of shipment

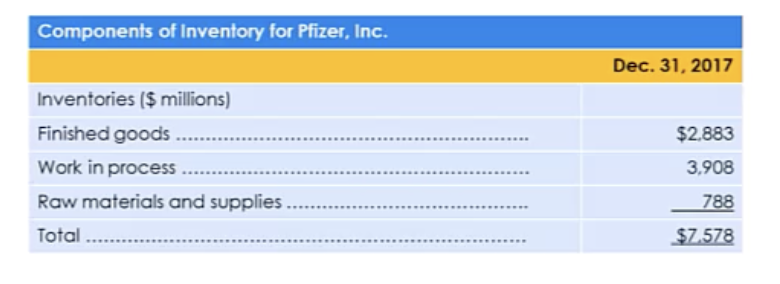

What are the 3 inventory categories for manufactures?

Raw materials

Work in Progress, partially completed goods

Finished goods

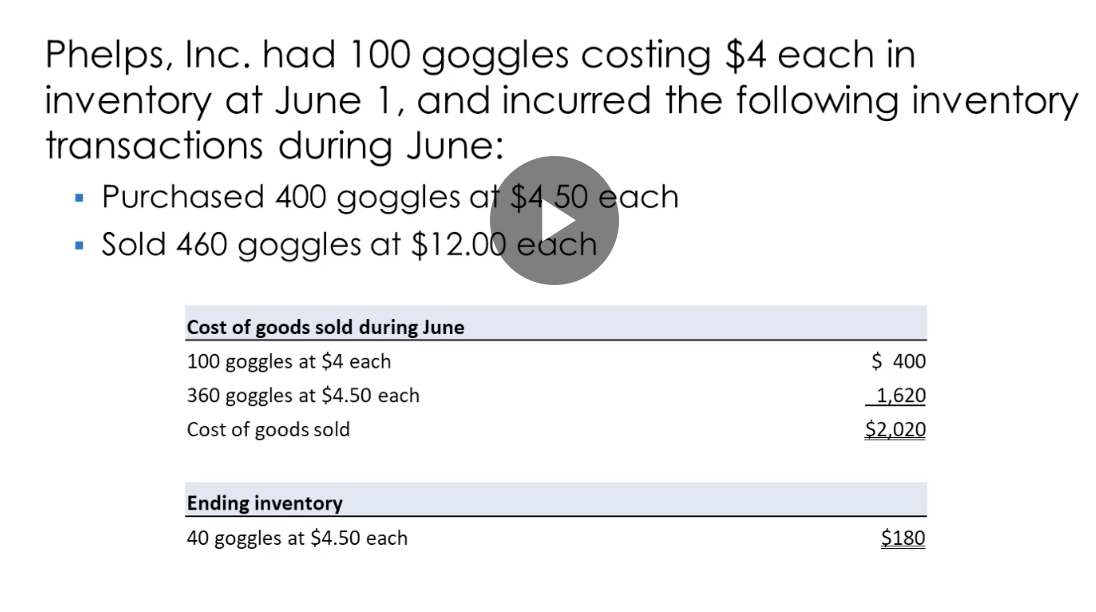

What’s the formula for COGAFS, Cost of Goods Available For Service?

Beg Inv + Purchase = COGAFS

What’s COGS?

Cost of Goods Sold

Which statements do COGS and Ending inventory end up on

COGS = Income Statement

Ending Inventory = Balance Sheet Assets

What’s COGS formula?

COGS = Beginning Inventory + Purchases − Ending Inventory

COGS = Beginning Inventory (on original) + (cost of goods purchased) Purchases - Ending Inventory (on balance sheet for next period)

What’s inventory ending formula?

Inventory ending balance = Inventory Beginning + Purchases - COGS

What are the 3 main inventory costing methods?

FIFO

LIFO

Weighted Average Cost

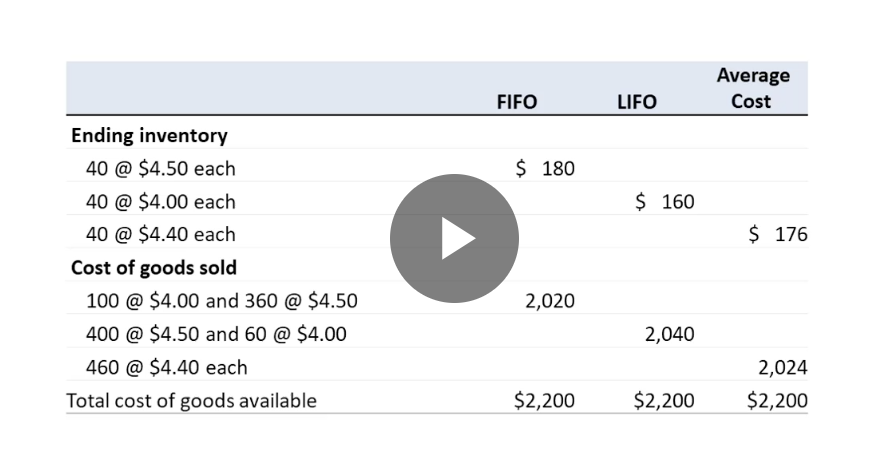

What’s FIFO?

First in, First out

First costs recorded are the first to be transfered from balance sheet assets (inventory) to income statement (costs of goods sold)

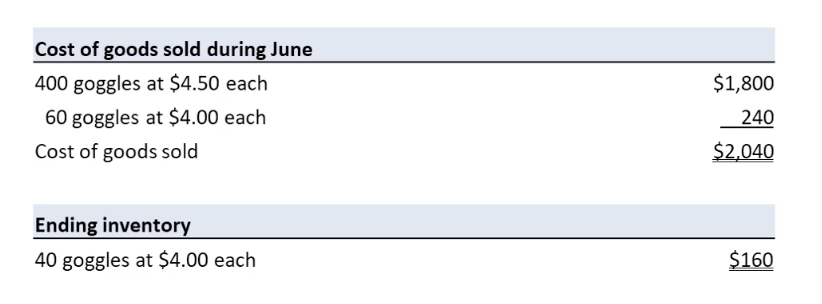

What’s LIFO?

Last in, First Out: Last costs recorded are first to be moved from balance sheet (as inventory) to income statement (as COG)

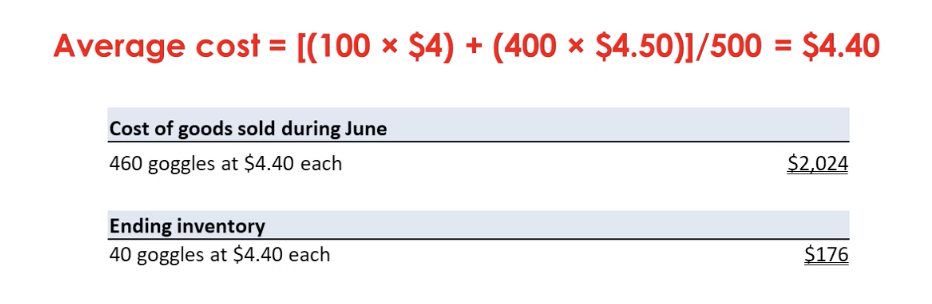

What’s AC?

Average Cost: An average of all cost of goods sold is transferred from inventory to COGS

w/ FIFO method First Inventory in, First Out

With LIFO method, Last Inventory In, First Out

Which one produces a higher COGS?

LIFO

Which one producers a lower COGS?

FIFO

use Average Cost Method

Comparing Costing Methods

Who has to report the LIFO reserve?

The difference between LIFO and FIFO costs & current value of inventory

It is required to be reported by companies that use the LIFO method

What is the LIFO reserve formula?

LIFO reserve = FIFO ending inventory cost - LIFO ending inventory cost

What’s Estimating FIFo cost of goods sold formula?

FIFO cost of goods sold = LIFO cost of goods sold - Change in LIFO reserve

When is LIFO reserves used?

comparing gross profits of a company using FIFo with another company using LIFO

Why doesn’t LIFO not completely accurate?

LIFO doesn’t accurately represent the cost that a company would incur, it is older (cheaper), which may not reflects todays actual costs

FIFO reflects current market conditions , because it uses newer inventory costs for ending inventory

What’s the balance sheet effects of FIFO?

FIFo uses current value on balance sheet, if prices fall, that means the cost and market adjustments will lower

What’s the balance sheet effects of LIFO?

When prices are rising, LIFO ending inventory is undervalued compared to FIFO (as it doesn’t represent the current cost a company would have to pay today if they repurchased the same inventory items)

Why is LIFO reserve viewed as an “unrealized holding gain”

a gain that comes from holding inventory as prices are rising

How does FIFO affect cash flow in rising prices?

higher pretax income → higher income taxes → less cash available

How does LIFO affect cash flow in rising prices?

Lower income → lower taxes → more cash available.

Why does management adopt LIFO?

save more from taxes

So what happens when you use LIFO?

it increases gross profit, results in higher pretax income, leads to higher taxes

So what happens when you use FIFO?

gross profits look less, less tax, more cash flow

How do you adjust LIFO to FIFO on balance sheet?

LIFO reserve + LIFO inventory - FIFO inventory

How do you adjust LIFO to FIFO on income statement?

LIFO cogs - Change in LIFO reserve = FIFO cogs

How does the IFRS allow reporting to be done?

NOT with LIFO, only with FIFO or AC

Reminder, how do you calculate Gross Profit Margins?

GPM = Sales revenue - cogs/ sales revenue

What’s inventory turnover?

says how quickly inventory is being sold

Whats inventory turnover formula?

INVT = cogs / average inventory

What’s average inventory days outstanding?

how long inventories are held/on the shelf b4 being sold

What’s Average inventory days outstanding formula?

AIDO: average inventory / average daly cost of goods sold = sold entire inventory x times in that year

What does higher inventory turnover imply?

favorable, strong sales, efficient inventory management, selling inventory quickly

improvement in manufacturing efficient

higher profit margins

excessive purchases

What does lower inventory turnover imply?

excessive production

lower margins

missed trends/tech advances

increased competition

Changes in promotion policies

Why is it important to optimize inventory

too much inventory is expensive

too little inventory leads to lost sales

what are some operational strategies to reduce inventory levels?

improve manufacturing process, eliminate bottle necks and work in process build up, less inventory pilling

Just in time JIT delivers, suppliers deliver materials only when needed, to reduce the storage of raw materials

demand pull production: raw materials are used only when theres customer demand to prevent overproduction and excess inventory

What’s adjusting turnover ratios?

a different version of inventory turnover that helps provide a more accurate measure, when a company uses LIFO

What’s adjusting turnover formula?

LIFO cogs / Average FIFO inventory ( FIFo - based) = Adjusted inventory turnover

Why do we adjust?

LIFO inflates COGS, and udnerstates the inventory, this makes the incorrect turnover ratio, so this adjustment makes it more accurte

How do we fix this issue?

change the beg and ending inventory values to use LIFO reserve information

What’s the Net realizable value rule?

rule to make sure inventory is not overstated

What’s the Net realizable value formula?

NRV = Selling Price − Costs of Completion − Selling Costs

What’s the Lower of Cost

Prevents overstating inventory value on financial statements

What’s the Lower of Cost formula?

LCNRV Inventory Value=min(Cost,NRV)

What’s the formula for FIFO gross profit when given LIFO info

FIFO cogs = LIFO cogs - change in reserve LIFO

FIFO gross profit = revenue - FIFO cogs