Economics Concepts and Multiple Choice Questions

1/103

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

104 Terms

Utility

For economists, the word 'utility' means pleasure or satisfaction.

apples prices

The best example of a microeconomic topic is ___.

Microeconomics vs Macroeconomics

Microeconomics focuses on specific decision making units of the economy; macroeconomics examines the economy as a whole.

Laissez-faire Capitalism

A distinguishing feature of laissez-faire capitalism is minimal government intervention.

Circular Flow Model

The simple circular flow model shows that households are on the selling side of the resource market and on the buying side of the product market.

Price Increase Effect on Demand

An increase in the price of a product will reduce the amount of it purchased because consumers will substitute other products for the one whose price has risen.

Demand and Supply Curves

The construction of demand and supply curves assumes that the primary variable influencing decisions to produce and purchase goods is price.

Substitution Effect

Steve's response to the decrease in the price of hamburgers is best explained by the substitution effect.

Income Effect

The income effect refers to the change in consumption resulting from a change in real income.

Price Effect

The price effect describes how changes in price impact consumer purchasing behavior.

Demand Curve Shift

A rightward shift in the demand curve for hamburgers indicates an increase in demand.

Rationing Function of Prices

The rationing function of prices refers to the ability of a competitive market to equalize quantity demanded and quantity supplied.

Business Cycle

The business cycle depicts short-run fluctuations in output and employment.

Real GDP

Real GDP is preferred to nominal GDP as a measure of economic performance because nominal GDP uses current prices and thus may over or understate true changes in output.

Nominal GDP

Nominal GDP is not adjusted for population changes.

Final Goods and Services

A final good or service is a product that is purchased for consumption and not for resale or further processing.

GDP Calculation

GDP that year is $500 billion if the total monetary value of all final goods and services produced in a particular country in a year is $500 billion.

NDP Calculation

NDP is $450 billion if the total monetary value of final goods and services sold is $450 billion.

Haircut as Final Good

A haircut purchased by a father for his 12-year-old son is considered a final good.

Fertilizer as Final Good

Fertilizer purchased by a farm supplier is not considered a final good.

Diesel Fuel as Final Good

Diesel fuel bought for a delivery truck is not considered a final good.

Chevrolet Windows as Final Good

Chevrolet windows purchased by a General Motors assembly plant are not considered a final good.

Gross Domestic Product (GDP)

A measure of the economic performance of a country, defined as the total value of all goods and services produced over a specific time period.

Value Added

The difference between the sales price of a product and the cost of the inputs used to produce it.

Expansion Phase

The phase of the business cycle in which the economy experiences rising real GDP and employment.

Aggregate Demand Curve

A curve that shows the amount of real output that will be purchased at each possible price level.

Real Balances Effect

The effect that changes in the price level have on the purchasing power of money balances, influencing consumer demand.

Recession

A period of economic decline characterized by falling GDP and rising unemployment.

Peak

The highest point in the business cycle, where economic activity is at its maximum.

Trough

The lowest point in the business cycle, where economic activity is at its minimum.

Capital Goods

Goods that are used in the production of other goods or services.

Durable Consumer Goods

Goods that have a long life span and are used by consumers over time.

Nondurable Consumer Goods

Goods that are consumed quickly and have a short life span.

Services

Intangible products that provide value to consumers, such as healthcare or education.

Military Goods

Products specifically manufactured for military use.

Components for Drones

Parts purchased by a manufacturer to assemble drones, costing $40 each.

Completed Drone Sale Price

The selling price of a completed drone, which is $70.

Purchasing Power

The amount of goods and services that can be bought with a unit of currency.

Price Level

The average of current prices across the entire spectrum of goods and services produced in the economy.

Consumer Spending

The total amount of money spent by households on goods and services.

Output Yo-Yos

A colloquial term for fluctuations in production levels.

Total Product Oscillations

Variations in the total output of goods and services in an economy.

Expenditures Required

The total amount of money needed to induce the production of a certain level of real output.

Aggregate Demand (AD)

The total demand for goods and services within a particular market.

Real-Balances Effect

The effect that shows how a change in the price level affects the purchasing power of money and thus the quantity of goods demanded.

Interest-Rate Effect

The effect that describes how changes in the price level influence interest rates and subsequently affect the quantity of goods demanded.

Foreign Purchases Effect

The effect that explains how a change in the domestic price level affects the quantity of goods demanded from foreign markets.

Downward Slope of Aggregate Demand Curve

The result of the real-balances effect, the interest-rate effect, and the foreign purchases effect.

Shift in Aggregate Demand Curve

A change in the overall demand for goods and services that can be caused by factors such as investment changes.

Investment Decline

A decline in investment will shift the AD curve to the left by a multiple of the change in investment.

Tax Rebate Program

A government initiative that cuts taxes for households to stimulate aggregate demand.

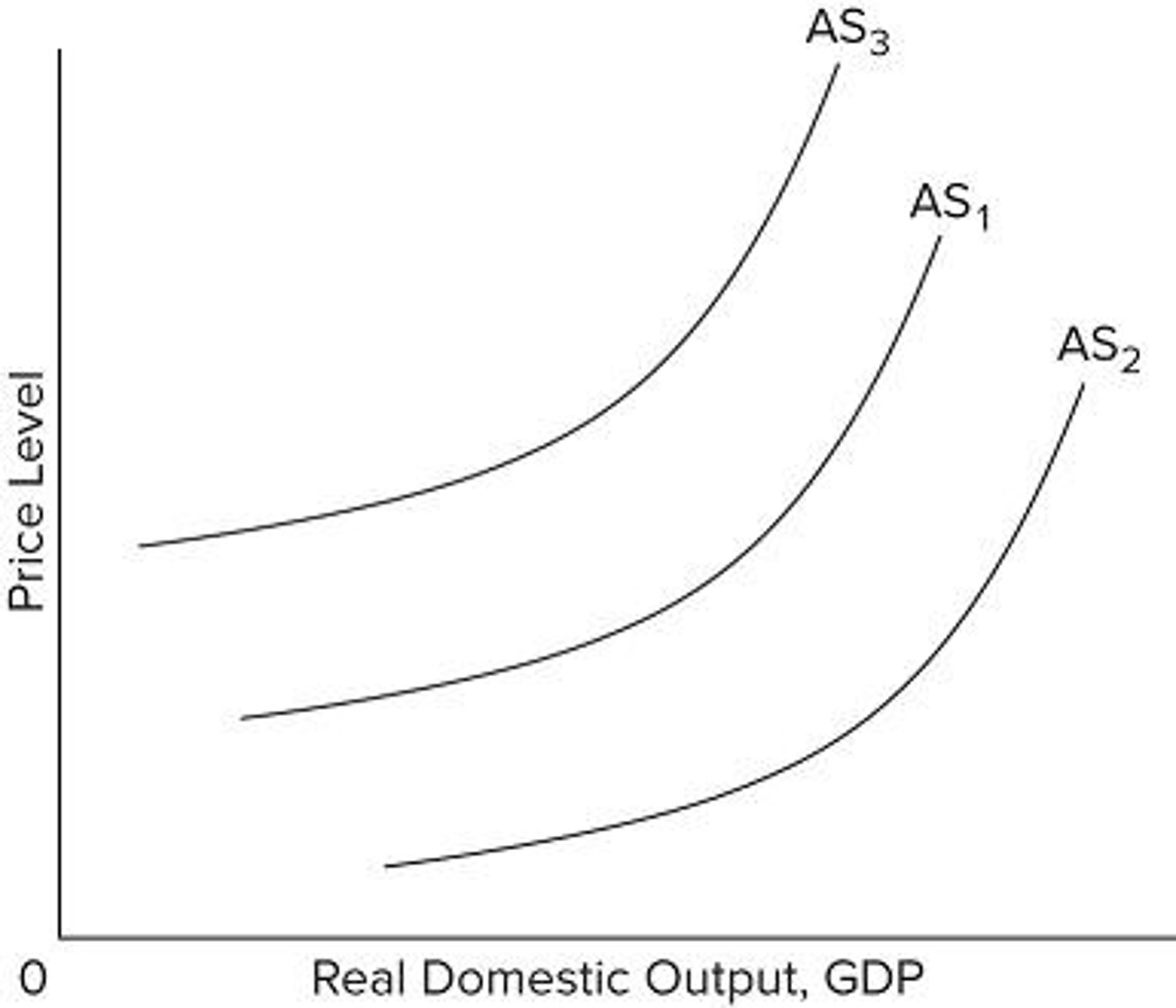

Aggregate Supply Curve (Short-Run)

The curve that slopes upward and to the right, indicating a positive relationship between the price level and the quantity of goods supplied.

Wages and Resource Prices

In the short-run, wages and other resource prices match changes in the price level.

Per-Unit Production Costs

Costs that rise as the economy moves toward and beyond its full-employment real output.

Factors that Shift Aggregate Supply

Determinants such as consumption, investment, government spending, and net export spending.

Stricter Government Regulations

A potential cause for a shift in the aggregate supply curve.

Prices of Imported Resources

An increase in these prices can lead to a shift in the aggregate supply curve.

Prices of Domestic Resources

A decrease in these prices can cause a shift in the aggregate supply curve.

Business Taxes

An increase in these taxes can shift the aggregate supply curve.

Determinants of Aggregate Supply

Factors that influence the total supply of goods and services in an economy.

Real Domestic Output and Price Level

They are directly related.

Three Distinct Ranges of Aggregate Supply Curve

Explain the three distinct ranges.

Resource Prices and Productivity

Include resource prices and changes in productivity.

Functions of Money

Includes unit of account, standard of deferred payments, store of value, and medium of exchange.

Unit of Account

A $80 price tag on a sweater in a department store window is an example.

Difference between M1 and M2

The former includes time deposits.

M2 Components

The latter includes small-denominated time deposits and money market mutual fund balances.

Negotiable Government Bonds in M2

The latter includes negotiable government bonds.

Cash in M2

The latter includes cash held by commercial banks and the U.S. Treasury.

Transactions Balances

Funds that commercial banks and thrift institutions hold on deposit at the central bank.

Central Bank Balances

Funds that commercial banks and thrift institutions hold on deposit at the central bank.

M1 Balances

Funds that commercial banks and thrift institutions hold on deposit at the central bank.

Reserve Balances

Funds that commercial banks and thrift institutions hold on deposit at the central bank.

Tool of Monetary Policy

Open-market operations.

Federal Reserve System's Administered Rates

The interest on reserve balances rate, overnight reverse repo rate, and policy rate.

Federal Funds Rate

One of the three administered rates of the Federal Reserve System.

Discount Rate

One of the three administered rates of the Federal Reserve System.

Sale of Government Securities by the Fed

Will cause the money supply to decrease.

Bank Reserves Increase

The sale of government securities by the Fed will cause bank reserves to increase.

Demand Deposits Increase

The sale of government securities by the Fed will cause demand deposits to increase.

Interest Rate Decrease

The sale of government securities by the Fed will cause the interest rate to decrease.

raising the overnight reverse repo rate

A monetary policy tool used by the Federal Reserve to control liquidity in the financial system.

optimistic forward guidance

A communication strategy used by central banks to influence market expectations about future monetary policy.

open-market purchases of bonds

A monetary policy action where the central bank buys government securities to increase the money supply.

raising taxes

A fiscal policy action that increases government revenue by increasing the tax rate.

interest paid on reserve balances

The amount of interest that the Federal Reserve pays to banks on their reserves held at the Fed.

GDP

Gross Domestic Product, the total value of all final goods and services produced within a country in a given period.

Government Purchases

Total spending by the government on goods and services.

Personal Consumption Expenditures

Total spending by households on goods and services for consumption.

Gross Private Domestic Investment

Total spending on capital goods that will be used for future production.

Consumption of Fixed Capital

The depreciation of capital goods over time.

Exports

Goods and services produced domestically and sold to foreign markets.

Imports

Goods and services produced abroad and purchased by domestic consumers.

labor force

The total number of people who are available for work, including both the employed and the unemployed.

frictional unemployment

Unemployment that occurs when people are temporarily between jobs or entering the labor market.

structural unemployment

Unemployment resulting from industrial reorganization, typically due to technological change.

cyclical unemployment

Unemployment that results from economic recessions or downturns.

seasonal unemployment

Unemployment that occurs at certain times of the year when demand for labor is lower.

comparative advantage

The ability of a country to produce a good at a lower opportunity cost than another country.

mutually beneficial trade

Trade that occurs when two nations can gain from exchanging goods and services.