AP Micro Test Based on Notes

1/203

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

204 Terms

rent

payment for land

interest

payment for capital

profit

payment for entrepreneurship

wages

payment for labor

command economy

government is in charge of aloocation of resources

pure market economy

all resource allocation is decided by individuals

mixed economy

resource allocation is somewhat made by economy and somewhat made by individuals

market economy characteristics

private ownership of resources, market prices direct resource use, income depends on individual resources, consumer demand is driving force behind production decisions

invisible hand

interactions of individual consumers and producers, each acting in their own self-interect

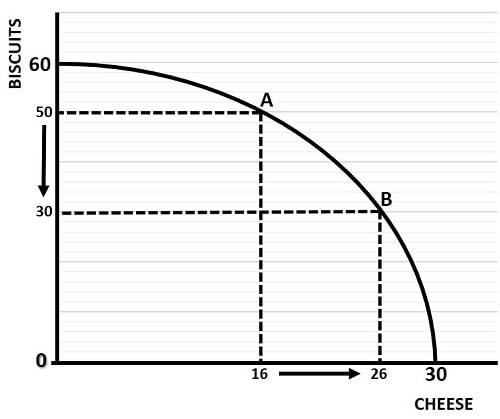

PPC Curve

PPC Curve

a graph based on the production of 2 goods used to calculate opportunity costs

Opportunity cost formula

what is given up divided by what is gained

effect of more resources on PPC

outward shift indicates increased production capacity

assumptions of PPC

fixed resources, productive efficiency, full employment, two goods

what do capital goods lead to

future consumption

what do consumer goods lead to

current consumption

absolute advantage

the ability to produce more of a good/service than someone else in the same amount of time

comparative advantage

the ability to produce something at a lower opportunity cost than someone else, given the same resources

what is trade based on

comparative advantage

output opportunity cost

involves how much output can be produced

output opportunity cost formula

possibility divided by self

input opportunity cost

shows how many resources are required

input opportunity cost formula

self divided by possibility

terms of trade

for both to benefit, the change in price must fall between the opportunity costs of the two parties

how do you consume outside of PPC

when individuals specialize according to comparative advantage and the trade ratio is better than each’s opportunity costs

explicit costs

costs involving monetary payment

implicit costs

non-monetary costs

opportunity cost

explicit cost and implicit cost together

formula to find utility maximization

MUx divided by Px = MUy divided by Py

law of demand

a decrease in the price of the good causes an increase in the quantity demanded and vise versa

income effect

when the price of a good falls, consumers experience an increase in purchasing power

substitution effect

when a price of a good increases, people will substitute less expensive goods

market demand

adding together the quantities that all consumers in the market place are willing to buy at each price

price effect on demand and supply

none

law of supply

as prices increase, quantity supplied increases

market supply curve

horizontal summation of the quantity supplied by each firm

increase in cost of product effect on supply

decrease

increase in technological advances effect on supply

increase

increase in number of sellers effect on supply

increase

if sellers think the price of a good will increase soon what will happen to supply

decrease

Elasticity of Demand formula

Ed = % change in quantity demanded divided by % change in price

Ed < 1

inelastic demand

Ed > 1

elastic demand

Ed = 0

perfectly inelastic demand

Ed = 1

unit-elastic demand

Ed= infinity

perfectly elastic demand

elastic range of demand

below equilibrium point

inelastic range of demand

above the equilibrium point

Total revenue test

if price divided by TR moves in same direction, demand is inelastic

total revenue test formula

TR = P*Q

close substitutes effect on Ed

elastic

Larger % of budget effect on Ed

more elastic

longer time to adjust to price change effect on Ed

more elastic

necessity effect on Ed

More inelastic

Formula for Elasticity of Supply

Es = % change in quantity supplied divided by % change in price

income elasticity of demand formula

% change in quantity demanded divided by % change in income

what does a positive value for income Ed mean

normal good

what does a negative value for income Ed mean

inferior good

Cross price elasticity of demand formula

% change in quantity demanded of good x divided by % change in price of good y

what does positive cross price Ed mean

substitutes

what does negative cross-price Ed mean

compliments

what does 0 cross-price Ed mean

not related

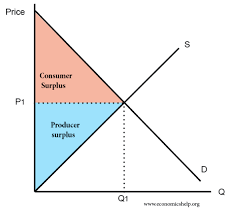

consumer surplus

difference between what buyer was willing to pay and actually paid (WTP - P)

producer surplus

difference between actual cost and what they would be willing to sell at (P - WTS)

Top is consumer, bottom is producer

economic surplus

sum of CS and PS, maxed at equilibrium

Surplus

Quantity supplied > Quantity demanded

shortage

Quantity supplied < Quantity demanded

shift left on graph indicates

decrease

shift right on graph indicates

increase

quota

restriction on the quantity that can be sold in a market

deadweight loss

loss in economic efficiency, occurs when not at equilibrium

excise tax

per-unit tax

import quota

restriction on the quantity of a good that can be imported

free trade quantity imported formula

Quantity demanded - quantity supplied

production function

the way a firm combines inputs to produce an output

variable inputs

inputs that can be changed in the short run to change production

fixed inputs

inputs that cannot be changed in the short run to change production

short run

the period of time during which there are fixed inputs; a period of time too short for a firm to alter its plant capacity

plant capacity

a firm’s maximum potential level of production

what happens to marginal product at first

increases at first due to specialization and then decreases due to diminishing returns

marginal product formula

change in total product divided by change in labor

average product formula

total product divided by labor

fixed cost

a cost that must be paid even when a firm’s output is 0; a cost that is the same at all output levels

variable cost

a cost that changes as output changes

total cost

fixed costs + variable costs

marginal cost formula

change in total cost divided by change in quantity

average fixed cost formula

fixed costs divided by quantity

average variable cost formula

variable costs divided by quantity

average total cost formula

total cost divided by quantity

Shape of AVC and ATC curves

U shaped

ATC curve

falls as fixed costs are spread over more units, then rises as diminishing returns outweigh the spreading effect

MC curve

crosses through the minimum of ATC and AVC

what happens if the MC curve is below ATC

ATC is falling

what happens if MC is below ABC

AVC is falling

what happens if MC is above ATC

ATC is rising

what happens if MC is above AVC

AVC is rising

increasing returns to scale

output is increasing at a faster rate than all inputs

decreasing returns to scale

output is increasing at a slower rate than all inputs

constant returns to scale

output is increasing at the same rate than all inputs