CPCU 500

0.0(0)

Card Sorting

1/98

Earn XP

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

99 Terms

1

New cards

Sets of data that are too large to be gathered and analyzed by traditional methods

big data

2

New cards

An innovative item that uses sensors; wireless sensor networks; and data collection, transmission, and analysis to further enable the item to be faster, more useful, or otherwise improved.

smart product

3

New cards

A network of objects that transmit data to and from each other without human interaction.

Internet of Things (IoT)

4

New cards

Information, technology, and storage services contractually provided from remote locations, through the internet or another network, without a direct server connection.

cloud computing

5

New cards

A distributed digital ledger that facilitates secure transactions without the need for a third party.

blockchain

6

New cards

The use of technological devices in vehicles with wireless communication and GPS tracking that transmit data to businesses or government agencies; some return information for the driver.

telematics

7

New cards

Obtaining information through language recognition.

text mining

8

New cards

The use of emerging technologies in the insurance industry.

insurtech

9

New cards

A device that detects and measures stimuli in its environment.

sensor

10

New cards

Statistical and analytical techniques used to influence or prevent future events or behaviors.

preventive analytics

11

New cards

A device that converts one form of energy into another.

transducer

12

New cards

A mechanical device that turns energy into motion or otherwise effectuates a change in position or rotation using a signal and an energy source.

actuator

13

New cards

A device that measures acceleration, motion, and tilt.

accelerometer

14

New cards

A foundation for applying the risk management process throughout the organization.

risk management framework

15

New cards

Information used as a basis for measuring the significance of a risk.

risk criteria

16

New cards

The most experienced risk professionals understand how to exploit pure risk for upside.

false (Although risk professionals ultimately try to manage threats and opportunities holistically, not all individual risks have upsides. In fact, the defining feature of pure risk, which constitutes a significant portion of the risks that organizations confront, is that there is no associated chance of gain—only loss or no loss.)

17

New cards

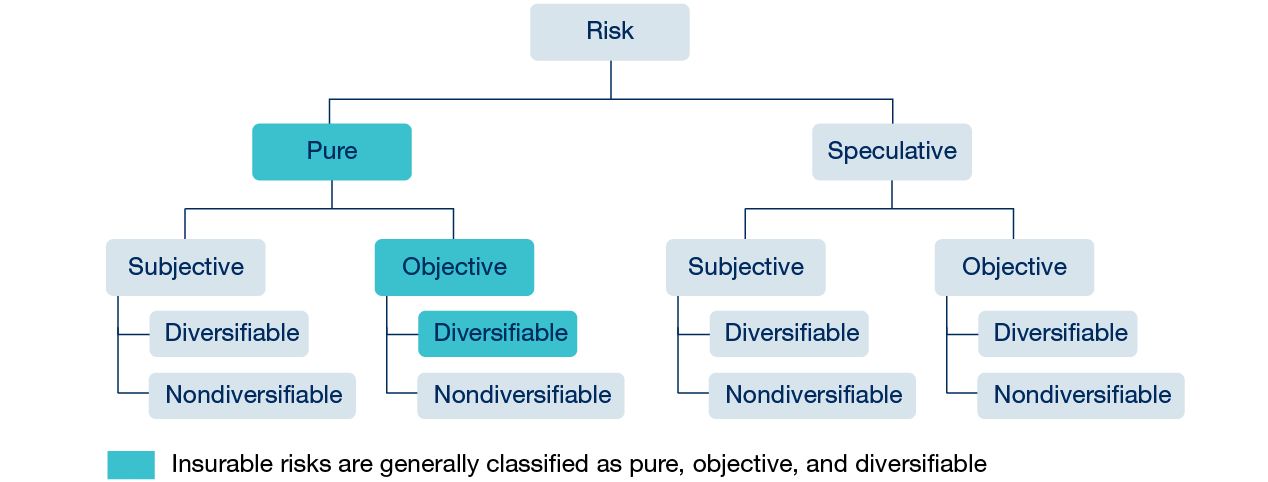

just study this graph

\

18

New cards

Arise from property, liability, or personnel loss exposures and are generally the subject of insurance

hazard risks

19

New cards

Arise from people or a failure in processes, systems, or controls, including those involving information technology

operational risks

20

New cards

Arise from the effect of market forces on financial assets or liabilities and include market risk, credit risk, liquidity risk, and price risk

financial risks

21

New cards

Arise from trends in the economy and society, including changes in the economic, political, and competitive environments, as well as from demographic shifts

strategic risks

22

New cards

Both of these are classified as pure risks

hazard and operational risks

23

New cards

Both of these are classified as speculative risks

financial and strategic risks

24

New cards

property risk, legal risk, personnel risk, and consequential loss are examples of

hazard risk

25

New cards

people risk, IT risk, management oversight, and business processes are examples of

operational risk

26

New cards

market risk, credit risk, price risk, and liquidity risk are examples of

financial risk

27

New cards

economic environment, political environment, demographics, and competition are examples of

strategic risk

28

New cards

a chance of loss or no loss, but no chance of gain

pure risk

29

New cards

a chance of loss, no loss, or gain

speculative risk

30

New cards

the risk that customers or other creditors will fail to make promised payments as they come due

credit risk

31

New cards

the perceived amount of risk based on an individual’s or organization’s opinion

subjective risk

32

New cards

the measurable variation in uncertain outcomes based on facts and data

objective risk

33

New cards

a risk that affects only some individuals, businesses, or small groups

diversifiable risk

34

New cards

the potential for a major disruption in the function of an entire market or financial system

systemic risk

35

New cards

uncertainty about an investment’s future value because of potential changes in the market for that type of investment

market risk

36

New cards

the risk that an asset cannot be sold on short notice without incurring a loss

liquidity risk

37

New cards

Most organizations’ sole risk management objective is to mitigate the effects of accidents.

false (A holistic risk management approach entails the pursuit of a variety of objectives besides mitigating the effects of accidents.)

38

New cards

It’s important for an organization to insure against common hazard risks, and this approach to risk management should be conducted separately from holistic risk management.

false (Traditional risk management practices that focus on common hazard risks are a part of holistic risk management; the two should not be separated. Holistic risk management examines all areas of the business, including hazard risks.)

39

New cards

to provide the structure to organize and analyze the data gathered during the investigation. It also helps to identify gaps and deficiencies in knowledge as the investigation progresses.

the purpose of causal factors charting

40

New cards

The agents that directly result in one event causing another.

causal factors

41

New cards

An approach to accident causation that views accidents as energy that is released and that affects objects, including living things, in amounts or at rates that the objects cannot tolerate.

energy transfer theory

42

New cards

An approach to accident causation that views the cause of accidents to be a result of management’s shortcomings.

technique of operations review (TOR)

43

New cards

An analysis that projects the effects a given system change is likely to have on an existing system.

change analysis

44

New cards

An analysis that dissects a repetitive task, whether performed by a person or machine, to determine potential hazards if each action is not performed.

job safety analysis (JSA)

45

New cards

A conscious act or decision not to act that reduces the frequency and/or severity of losses or makes losses more predictable.

risk control

46

New cards

The selection and implementation of actions to help manage or mitigate a risk.

risk treatment

47

New cards

The level of risk remaining after actions are taken to alter the level of risk.

residual risk

48

New cards

A risk control technique that involves ceasing or never undertaking an activity so that the possibility of a future loss occurring from that activity is eliminated.

avoidance

49

New cards

A risk control technique that reduces the frequency of a particular loss.

loss prevention

50

New cards

A risk control technique that reduces the severity of a particular loss.

loss reduction

51

New cards

The shifting of risk from one individual or organization to another.

risk transfer

52

New cards

A risk financing technique that involves assumption of risk in which gains and losses are retained within the organization.

retention

53

New cards

A risk management technique that includes steps to pay for or transfer the cost of losses.

risk financing

54

New cards

Artificial intelligence in which computers continually teach themselves to make better decisions based on previous results and new data.

machine learning

55

New cards

Loss ______reduces the frequency of a particular loss without affecting loss severity

prevention

56

New cards

Loss ______reduces the severity without affecting frequency.

reduction

57

New cards

A financial transaction in which one asset is held to offset the risk associated with another asset.

hedging

58

New cards

A financial instrument whose value is derived from the value of an underlying asset, which can be an index, an asset, yield on an asset, weather conditions, inflation, loans, bonds, an insurance risk, or other items.

derivative

59

New cards

A risk control technique that spreads loss exposures over numerous projects, products, markets, or regions.

diversification

60

New cards

A risk management technique that transfers the potential financial consequences of certain specified loss exposures from the insured to the insurer.

insurance

61

New cards

In many jurisdictions, anti-indemnity statutes forbid broad form hold-harmless agreements in construction contracts.

True. (In jurisdictions having such laws, a broad form hold-harmless agreement in a construction contract is void.)

62

New cards

The intentional relinquishment of a known right.

waiver

63

New cards

A contractual provision purporting to excuse a party from liability resulting from negligence or an otherwise wrongful act.

exculpatory clause/agreement

64

New cards

A contractual provision that obligates one of the parties to assume the legal liability of another party.

hold harmless agreement (indemnity)

65

New cards

A large deductible operates in the same way as a self-insured retention (SIR).

False. Large deductibles and SIRs both require insureds to retain covered losses up to a specified amount. However, there’s a key difference in how they apply. With large deductibles, the insurer adjusts and pays the entire loss and then bills the insured for the deductible amount. With SIRs, the insured is responsible for adjusting and paying its own losses up to the SIR amount.

66

New cards

For example, for a piece of real estate, the historical cost includes the building’s total original purchase price, including the value of the land it occupies, plus real estate commissions, closing costs, and any other legitimate business expenses attributable to that purchase.

true

67

New cards

Which one of the following best describes the management of process risk?

a. Process risk is best managed through training and development and performance management.

b. Process risk is best managed through a framework of procedures and a mechanism to identify nonconforming practices.

c. Process risk is best managed by developing procedures to manage market and credit risk.

d. Process risk is best managed by using best practices acquired from competitors without their knowledge.

a. Process risk is best managed through training and development and performance management.

b. Process risk is best managed through a framework of procedures and a mechanism to identify nonconforming practices.

c. Process risk is best managed by developing procedures to manage market and credit risk.

d. Process risk is best managed by using best practices acquired from competitors without their knowledge.

b. Process risk is best managed through a framework of procedures and a mechanism to identify nonconforming practices.

68

New cards

To be effective, a key risk indicator should be a

a. Lagging indicator.

b. Leading indicator.

c. Loss ratio.

a. Lagging indicator.

b. Leading indicator.

c. Loss ratio.

b. Leading indicator

69

New cards

Risk assurance is developed through internal resources because external resources could provide biased information and opinions that don’t reflect the strength of an organization’s financial status.

false (Internal and external resources both have a role to play as an organization builds risk assurance.)

70

New cards

When the United States dollar appreciates against the euro,

a. One dollar buys more euros than it had previously.

b. Swiss banks are forced to hedge currencies to make up the difference.

c. Imports rise because of demand for U.S. dollars.

d. There is no effect on importing companies who use U.S. banks.

a. One dollar buys more euros than it had previously.

b. Swiss banks are forced to hedge currencies to make up the difference.

c. Imports rise because of demand for U.S. dollars.

d. There is no effect on importing companies who use U.S. banks.

a. One dollar buys more euros than it had previously.

71

New cards

On a balance sheet, what is a term for the value calculated by subtracting liabilities from assets?

a. Owners' equity

b. Book value

c. Surplus

d. All of the above

e. None of the above

a. Owners' equity

b. Book value

c. Surplus

d. All of the above

e. None of the above

d. All of the above (Owners' equity, shareholder’s equity, book value, net worth, and surplus are all terms for the value calculated by subtracting liabilities from assets.)

72

New cards

What kinds of assets: cash, marketable securities, receivables (accounts and notes), inventories, and prepaid expenses.

current assets

73

New cards

What kinds of assets: assets that will be used over a period greater than one year; they are grouped into tangible assets (such as land, buildings, and equipment) and intangible assets (such as patents, copyrights, trademarks- intellectual property)

noncurrent assets

74

New cards

working capital =

current assets - current liabilities

75

New cards

current ratio =

current assets / current liabilities

76

New cards

quick ratio (acid-test) =

(cash + marketable securities + accounts receivable)/ current liabilities

77

New cards

debt-to-equity ratio = (how are you doing vs other companies)

long term debt / shareholder’s equity

78

New cards

debt-to-assets ratio = (how many assets have you financed by debt. DONT want over 0.5 typically)

total liabilities / total assets

79

New cards

The activity of buying a bundle of mortgage loans and then selling to investors an interest in those income-producing assets is

a. Prohibited if subprime home loans are involved.

b. Transacted with a commercial mortgage broker.

c. Required under statutory accounting as a means to mitigate financial risk.

d. Performed by an intermediary known as a special purpose vehicle.

a. Prohibited if subprime home loans are involved.

b. Transacted with a commercial mortgage broker.

c. Required under statutory accounting as a means to mitigate financial risk.

d. Performed by an intermediary known as a special purpose vehicle.

d. Performed by an intermediary known as a special purpose vehicle.

80

New cards

a facility established for the purpose of purchasing income-producing assets from an organization, holding title to them, and then using those assets to **collateralize** securities that will be sold to investors.

special purpose vehicle

81

New cards

Which one of the following is a tool that can be used by fraud investigators to compare documents and analyze notes?

a. text mining

b. blockchain

c. root cause analysis

d. telematics

a. text mining

b. blockchain

c. root cause analysis

d. telematics

a. text mining

82

New cards

Which one of the following is an example of a wearable?

a. heart monitors

b. robots

c. unmanned aircraft

d. helmets that monitor fatigue

a. heart monitors

b. robots

c. unmanned aircraft

d. helmets that monitor fatigue

d. helmets that monitor fatigue

83

New cards

The emerging technologies applied to risk assessment and control link the physical domain to the virtual domain. Together, these domains linked by the emerging technologies create a

a. smart system

b. risk management matrix

c. connected ecosystem

d. risk management information system

a. smart system

b. risk management matrix

c. connected ecosystem

d. risk management information system

c. connected ecosystem

84

New cards

Risk managers today differ from traditional risk managers in which one of the following ways?

a. They attempt to minimize threats and optimize opportunities.

b. They generally look backward for risk factors.

c. They struggle with data that is too large to capture, store, and analyze.

d. They attempt to identify a loss's predominant cause.

a. They attempt to minimize threats and optimize opportunities.

b. They generally look backward for risk factors.

c. They struggle with data that is too large to capture, store, and analyze.

d. They attempt to identify a loss's predominant cause.

a. They attempt to minimize threats and optimize opportunities.

85

New cards

Which one of the following statements is true with regard to preventive analytics?

a. Preventive analytics uses smart products and data analytics to identify root loss causes and their implications.

b. Preventive analytics involves data collection at discrete points in time, such as 10 AM or 4 PM each day, and comparison of these values at discrete points in time.

c. Preventive analytics is backward-looking, basing corrective prescriptions on the organization's past loss history.

d. Preventive analytics uses human assets to analyze data collected by smart products.

a. Preventive analytics uses smart products and data analytics to identify root loss causes and their implications.

b. Preventive analytics involves data collection at discrete points in time, such as 10 AM or 4 PM each day, and comparison of these values at discrete points in time.

c. Preventive analytics is backward-looking, basing corrective prescriptions on the organization's past loss history.

d. Preventive analytics uses human assets to analyze data collected by smart products.

a. Preventive analytics uses smart products and data analytics to identify root loss causes and their implications.

86

New cards

Which one of the following risk management objectives is critical for a manufacturer seeking new capital from investors, stockholders, and creditors?

a. social responsibility

b. reduce the deterrent effects of hazard risks

c. eliminate downside risk

d. anticipate and recognize emerging risks

a. social responsibility

b. reduce the deterrent effects of hazard risks

c. eliminate downside risk

d. anticipate and recognize emerging risks

b. reduce the deterrent effects of hazard risks

87

New cards

The focus of risk quadrants is different from the focus of risk classifications in general. While the classifications of risk focus on some aspect of the risk itself, the four quadrants of risk focus on

a. the source of risk and who has traditionally managed it

b. subjective and objective risks

c. pure and speculative risks

d. the determination of whether the risk is diversifiable

a. the source of risk and who has traditionally managed it

b. subjective and objective risks

c. pure and speculative risks

d. the determination of whether the risk is diversifiable

a. the source of risk and who has traditionally managed it

88

New cards

Delmond Manufacturing is opening a new manufacturing facility in a building that it purchased from a competitor. Using Information below, which one of the following represents the cost of risk of opening the new facility? New building cost: $60.0 Million. Safety system upgrades: $6.0 Million. Insurance Premiums: $1.5 Million. Retained losses: $3.0 Million. Risk management department budget at the site: $1.0 Million.

a. $7.0 Million

b. $10.0 Million

c. $11.5 Million

d. $71.5 Million

a. $7.0 Million

b. $10.0 Million

c. $11.5 Million

d. $71.5 Million

c. $11.5 Million

89

New cards

During the past year, International Toys has undertaken four capital projects. The company has renovated and refurbished one of its aging warehouse buildings. It has purchased the most recent version of its current order processing computer software. It has added two trucks to its fleet of delivery vehicles. Lastly, it has purchased a new production machine that will allow it to launch a new product line. Which one of the following company projects is the most speculative risk?

a. the warehouse refurbishment

b. the software upgrade

c. the two new trucks

d. the new production machine

a. the warehouse refurbishment

b. the software upgrade

c. the two new trucks

d. the new production machine

d. the new production machine

90

New cards

Concerning fundamental guidelines of contractual risk transfer management, it is wise to:

a. Be aggressive in negotiations - the more ruthless the better.

b. Try to be as general and nonspecific as possible.

c. Avoid being named as an additional insured on the transferee's policy.

d. Require a certificate of insurance for contractual liability before contract operations begin.

a. Be aggressive in negotiations - the more ruthless the better.

b. Try to be as general and nonspecific as possible.

c. Avoid being named as an additional insured on the transferee's policy.

d. Require a certificate of insurance for contractual liability before contract operations begin.

d. Require a certificate of insurance for contractual liability before contract operations begin.

91

New cards

In transferring risk to a transferee's insurer, which one of the following is an advantage for the transferor of using a named insured endorsement?

a. The transferee's insurer may have a right to inspect the transferor's business and financial records.

b. The transferee or its insurer does not have to pay for the cost to defend the transferor for liability losses.

c. The transferor may agree to provide periodic reports to the insurer.

d. The transferor's agents, employees, officers, and directors are considered insureds.

a. The transferee's insurer may have a right to inspect the transferor's business and financial records.

b. The transferee or its insurer does not have to pay for the cost to defend the transferor for liability losses.

c. The transferor may agree to provide periodic reports to the insurer.

d. The transferor's agents, employees, officers, and directors are considered insureds.

d. The transferor's agents, employees, officers, and directors are considered insureds.

92

New cards

Which one of the following is a major benefit that smart insurance contracts can provide to insurance customers?

A. Smart contracts can significantly increase the speed of premium payments.

B. Smart contracts can dramatically increase the speed of loss payments.

C. Smart contracts can render a risk completely preventable.

D. Smart contracts can provide broader coverage at a lower cost.

A. Smart contracts can significantly increase the speed of premium payments.

B. Smart contracts can dramatically increase the speed of loss payments.

C. Smart contracts can render a risk completely preventable.

D. Smart contracts can provide broader coverage at a lower cost.

B. Smart contracts can dramatically increase the speed of loss payments.

93

New cards

Which one of the following statements is correct regarding characteristics of ideally insurable loss exposures?

A. A common function that insurance provides is a spreading of risk across a large number of similar exposure units within the same period.

B. Intertemporal risk transfer, the spreading of risk through time, requires a large number of similar exposure units.

C. One requirement of the law of large numbers is that past events occur under different circumstances in the future.

D. Loss exposures such as homes and automobiles generally will not meet the ideally insurable requirement that the exposure be of a large number of similar exposure units.

A. A common function that insurance provides is a spreading of risk across a large number of similar exposure units within the same period.

B. Intertemporal risk transfer, the spreading of risk through time, requires a large number of similar exposure units.

C. One requirement of the law of large numbers is that past events occur under different circumstances in the future.

D. Loss exposures such as homes and automobiles generally will not meet the ideally insurable requirement that the exposure be of a large number of similar exposure units.

A. A common function that insurance provides is a spreading of risk across a large number of similar exposure units within the same period.

94

New cards

Location is a key pre-loss activity to control earthquake damage because

A. The availability of other temporary facilities helps an organization return to operations more quickly.

B. The availability of construction operations in a location is crucial.

C. Structures situated on stable earth can absorb most earthquake shock waves.

D. Designs for earthquake-resistant buildings are ineffective.

A. The availability of other temporary facilities helps an organization return to operations more quickly.

B. The availability of construction operations in a location is crucial.

C. Structures situated on stable earth can absorb most earthquake shock waves.

D. Designs for earthquake-resistant buildings are ineffective.

C. Structures situated on stable earth can absorb most earthquake shock waves.

95

New cards

Insurance claim manager Andy wants to know how many new claim representatives to hire. Based on the marketing department’s estimate and industry data, Andy has determined the mean number of new claims to be 2,000, with a standard deviation of 1,000 in a normal distribution. If a claim representative can adjust 600 claims per year and Andy wants at least 66% certainty, he has enough representatives, how many representatives will Andy need to hire?

a. 2

b. 3

c. 5

d. 10

a. 2

b. 3

c. 5

d. 10

c. 5

96

New cards

Which one of the following describes the law of large numbers?

a. it states that the more times a particular event has occurred in the past, the greater likelihood of that same event occurring in the future

b. it states that events that have occurred in the past under identical conditions and resulting from unchanging causal forces will increase at a predictable rate into the future

c. it states that as the number of similar but independent exposure units increases, the relative accuracy of predictions about future outcomes also increases

d. it states that, in order to be able to predict the relative probability of future events, those events must both be frequent, and independent of one another

a. it states that the more times a particular event has occurred in the past, the greater likelihood of that same event occurring in the future

b. it states that events that have occurred in the past under identical conditions and resulting from unchanging causal forces will increase at a predictable rate into the future

c. it states that as the number of similar but independent exposure units increases, the relative accuracy of predictions about future outcomes also increases

d. it states that, in order to be able to predict the relative probability of future events, those events must both be frequent, and independent of one another

c. it states that as the number of similar but independent exposure units increases, the relative accuracy of predictions about future outcomes also increases

97

New cards

An insurance or risk management professional may use dispersion to compare the characteristics of probability distributions. Which one of the following statements is true in this regard?

a. when two or more distributions are plotted on a graph, the one with the most sharply peaked curve has the smallest standard deviation

b. the greater the dispersion around a distribution’s expected value, the greater the likelihood that actual results will fall within a given range of that expected value

c. when a distribution is plotted on a graph, the more dispersed the distribution is, the more sharply peaked the curve is

d. in general, the less dispersion around the central tendency, the more risk is involved in the exposure

a. when two or more distributions are plotted on a graph, the one with the most sharply peaked curve has the smallest standard deviation

b. the greater the dispersion around a distribution’s expected value, the greater the likelihood that actual results will fall within a given range of that expected value

c. when a distribution is plotted on a graph, the more dispersed the distribution is, the more sharply peaked the curve is

d. in general, the less dispersion around the central tendency, the more risk is involved in the exposure

a. when two or more distributions are plotted on a graph, the one with the most sharply peaked curve has the smallest standard deviation

98

New cards

Determining earnings-at-risk (EaR) entails modeling the influence of factors such as

a. differences in the prices of products from competitors’ prices

b. changes in the prices of products and production costs on an organization’s earnings

c. employee satisfaction and other subjective variables that can be used for financial organizations but not nonfinancial organizations

d. the potential for both positive and negative credit risk for the organization

a. differences in the prices of products from competitors’ prices

b. changes in the prices of products and production costs on an organization’s earnings

c. employee satisfaction and other subjective variables that can be used for financial organizations but not nonfinancial organizations

d. the potential for both positive and negative credit risk for the organization

b. changes in the prices of products and production costs on an organization’s earnings

99

New cards

When it comes to finding a data-driven solution to these situations, which would be best suited for a descriptive approach and which would be best suited for a predictive approach:

a. A construction company is looking to lower accident frequency when equipment is being driven to work sites.

b. A retailer is concerned about rising theft losses.

c. An automotive retailer is looking for a more reliable supplier for a particular product.

d. A bank is considering offering a new small business loan program.

a. A construction company is looking to lower accident frequency when equipment is being driven to work sites.

b. A retailer is concerned about rising theft losses.

c. An automotive retailer is looking for a more reliable supplier for a particular product.

d. A bank is considering offering a new small business loan program.

b and c are descriptive (one time) and a and d are predictive (multi-need)