FINC 4660 ETFs

1/22

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

23 Terms

Traditional ETFs strategy

Passive investment strategy tracking an index

Ex.

SPY, MDY, Dow Diamonds, Nasdaq QQQQ

Other types of ETFs

Leveraged (LETFS)

Actively managed ETFs

ANTs (active non transparent ETFs)

What ETFs offer

-Diversification

-Low cost

-Tax Efficiency

-Transparency

-Stock like trading features

Net asset value

Assets - liabilities divided by shares outstanding of an investment fund

Intraday indicative value

Estimated value of an ETFs NAV updated every 15 seconds

Sponsor of ETF

Entity that creates the ETF

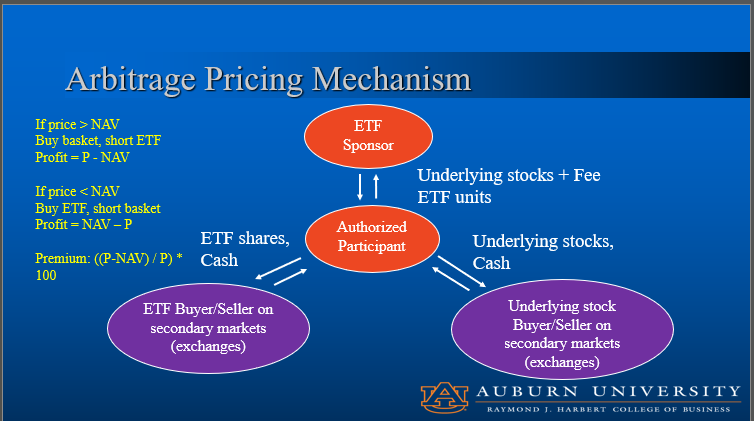

Authorized participant (arbitrageur)

Acquires the securities the ETF wants to hold, obtain and create the underlying shares

Creation unit

Block of new shares issued by an etf ranging from 25000 - 600000

In kind transactions vs cash transactions

Shares of underlying basket for ETF shares vs redeeming cash for ETF shares

If the price of an etf is greater than the ETF

Buy the basket and short the ETF

Profit = P - NAV

If the price of the ETF is less than the NAV

Buy the etf and short the basket

Profit = NAV - P

Premium on ETF

((P - NAV) / P )* 100

Study this

Graph

Barriers to ETF arbitrage

-Decreased transparency of ETF holding

-Low liquidity of underlying securities

-Time differences in trading ETF and underlying securities

-Restrictions on in kind transactions

Actively managed ETF characteristics

New and fast growing

Concerns about price efficiency

Mainly operate in bond category

ANTs

Disclose holdings quarterly, not daily

More meaningfully pursue active strategy with lack of transparency

Limited to investments that trade simultaneously as the fund itself

Sponsors required to provide additional info on the creation and redemption baskets

Leveraged ETFs

Promise to pay shareholders a multiple of the daily change of the underlying assets

Uses derivatives rolled quarterly

Frequent rebalancing

Used for short term trading strategies

LT returns differ substantially from promised return

ETF passive investment concern

No fundamental analysis

No corporate governance

ETF increase volatility in underlying securities concern

Brought by arbitrage pricing mechanism and rebalancing of LETFs

ETF liquidity concerns

Increased trading in illiquid markets may lead to increased volatility

ETF exogeneous negative price shock risks

Lead to panic selling by institutions that face redemption from investors

ETF leverage concern

Rebalancing adds upward price pressure in good times and downward pressure in bad times

ETF Counterparty risk concern

LETFs, ETFs using synthetic replication