IMC Unit 2: Derivatives

1/62

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

63 Terms

What is a forward contract

A contract between a buyer and a seller to exchange an underlying asset on a future date, at a price agreed today

• Traded OTC

What is a futures contract

Exchange-traded forward, with standardised contract specifications

What is specified in a futures contract

a specific quantity and quality of a specified asset;

on a fixed future date;

at a price agreed today

What terminology is used for futures contracts

Buyer/Long

Seller/Short

Underlying

Futures price

Delivery

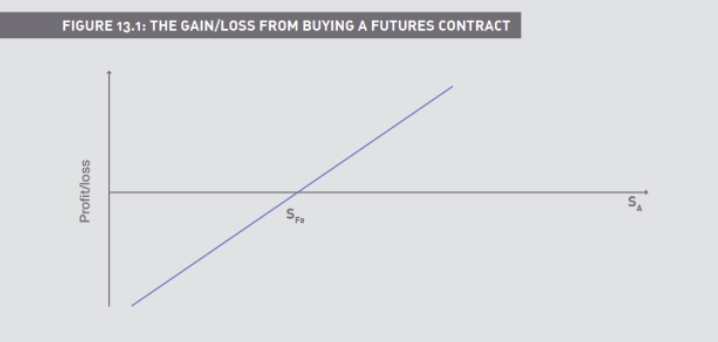

Who in a futures contract benefits when prices rise and fall

Buyers (‘longs’) gain if prices RISE

Sellers (‘shorts’) gain as prices FALL

Futures price vs. cash price (and the concept of ‘arbitrage’

Exploiting price differences between futures and cash markets to make risk-free profit.

xyz

What are the Uses of futures

Hedging

Speculation

Examples of futures contracts

Short-term interest rate futures (‘short sterling’ futures)

• Fix an interest rate on a (notional) deposit of £500,000 for three

months (3mth SONIA)

• Cash settled

• Priced at 100 minus the rate

• Long profits if rates fall, so use to hedge a DEPOSIT

• Short profits if rates rise, so use to hedge a LOAN

• Long bond futures

• Take or make delivery of £100,000 nominal of a UK gilt

• Physically delivered

• Actual gilt delivered: ‘cheapest to deliver’ (CTD) gil

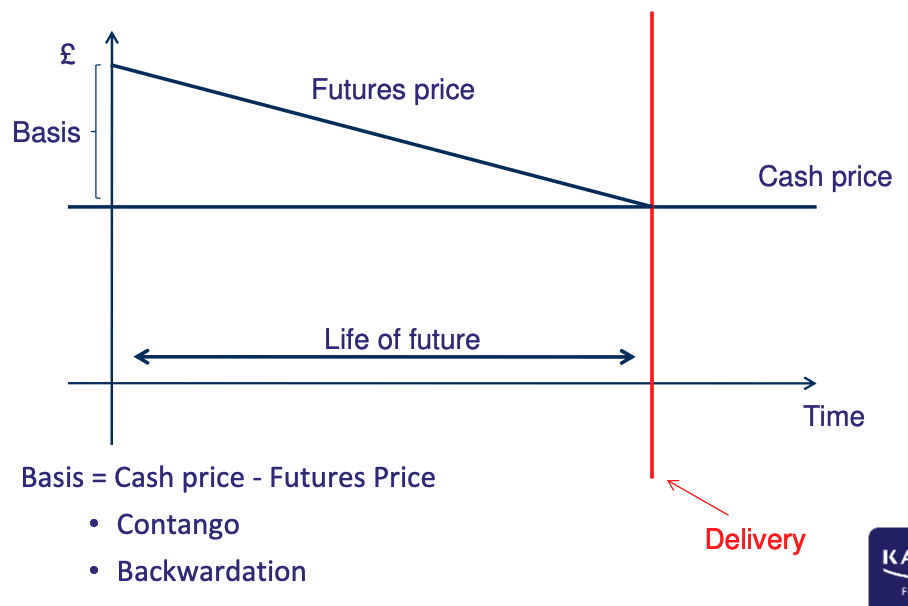

How is Basis calculated

Basis = Cash Price – Futures Price.

It indicates the difference between spot and futures market prices.

What is Contango

When futures price is higher than cash price—often due to storage costs or expectations of rising prices.

What is Backwardation

When futures price is lower than the current cash price—common when there's immediate high demand or scarcity.

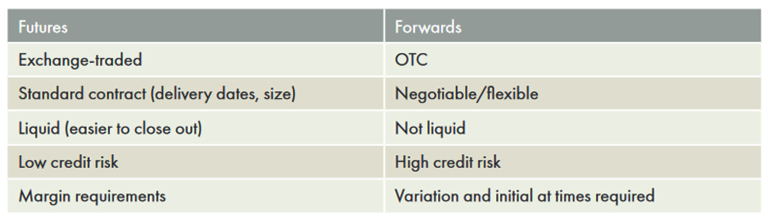

What are the differences between Forwards and Futures

What is a swap (contract for difference)

Agreement to exchange a series of cash flows

Traded OTC

What is an Option

A contract between a buyer and a seller giving the RIGHT to exchange an underlying asset for a pre-agreed price

Exchange-traded or OTC

What is specified in a Options contract

a particular asset;

at a particular price;

on or before a specified date

What terminology is used in options contracts

Put/Call

Buyer/Long/Holder

Seller/Short/Writer

Underlying

Premium

Expiry

• European-style: exercise AT expiry

• American-style: exercise ON OR BEFORE expiry

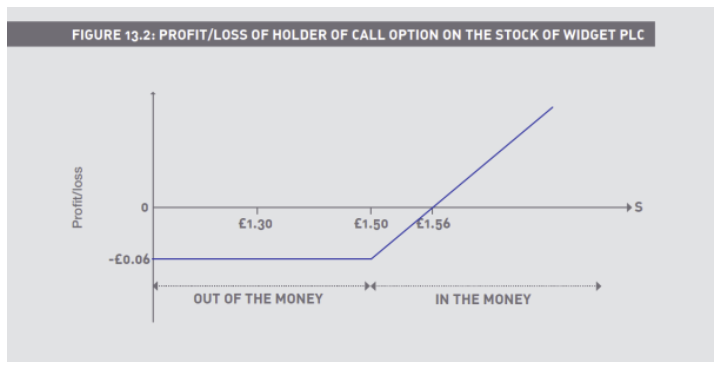

Long a 150p call, premium 6p

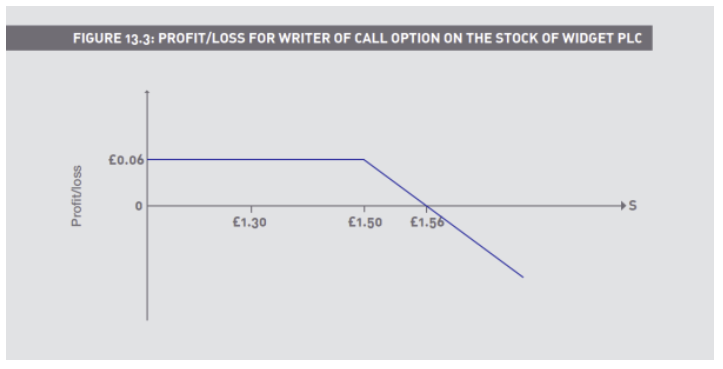

Short a 150p call, premium 6p

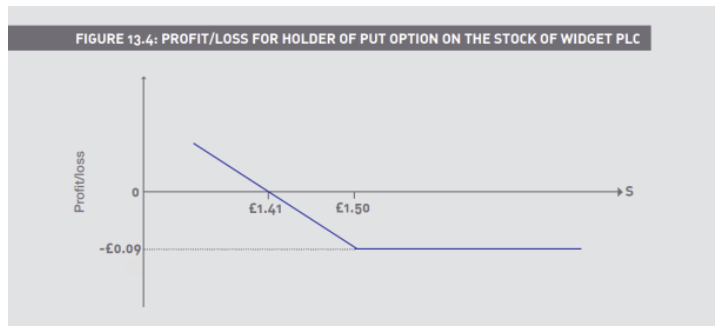

Long a 150p put, premium 9p

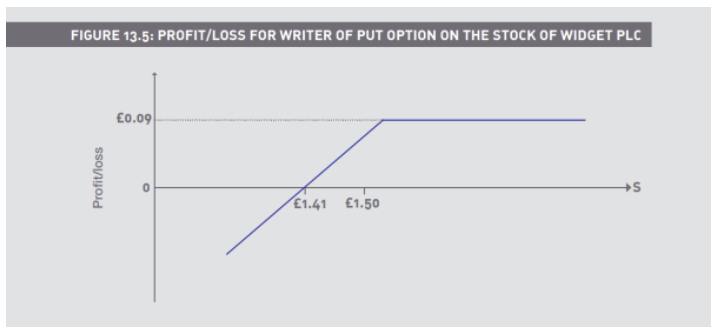

Short a 150p put, premium 9p

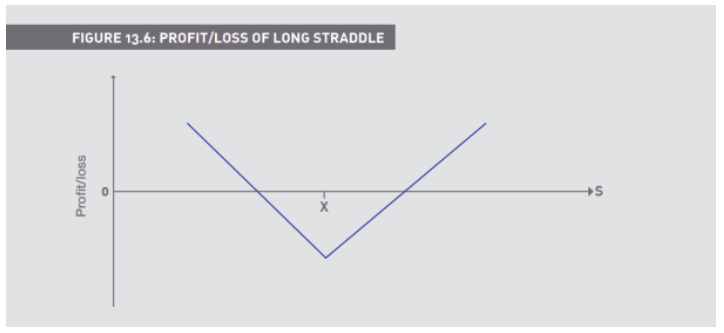

How does a Straddle work

Combines a put and a call on the same underlying, with the same expiries and the SAME strikes

(Straddle) Long a 550 call for 37, and a 550 put for 3

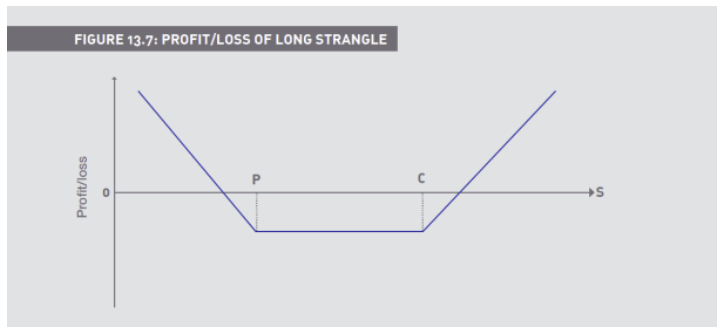

How does a strangle work

Combines a put and a call on the same underlying, with the same expiries and the DIFFERENT strikes

(Strangle) Long a 500 put for 18, and a 600 call for 1

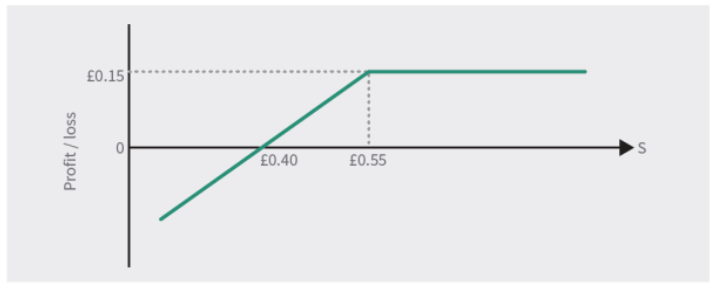

How does a covered call work

Sell a call (short call) against an existing, or simultaneously purchased holding of the underlying (long the underlying

(Covered Call) Long a share at 50p, and sells a 55 call for 10

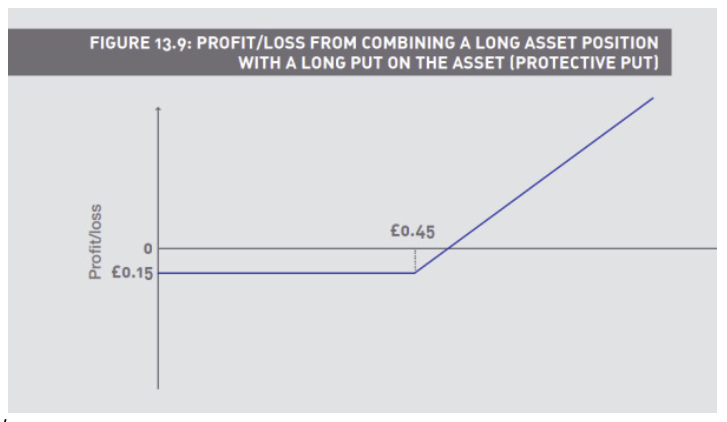

What is Protective Put

Buy a put (long put) against an existing, or simultaneously purchased holding of the underlying (long the underlying

(Protective Put) Long a share at 50p, and buys a 45 put for 10

What is the role of clearing houses for derivatives

Act as CENTRAL COUNTERPARTIES and guarantee the performance of contracts

What is Initial Margin

Goodwill Deposit

What is Variation Margin

Daily marking-to-market of contract

What model do Uncleared Transactions for derivatives use

ISDA Standard Initial Margin Model (ISDA SIMM®)

What is Aggregate Average Notional Amount (AANA)

A firm must calculate the average notional value of its non-cleared derivatives over a set period.

What happens If AANA exceeds €8 billion,

The firm becomes subject to margin requirements.

Intial Margin

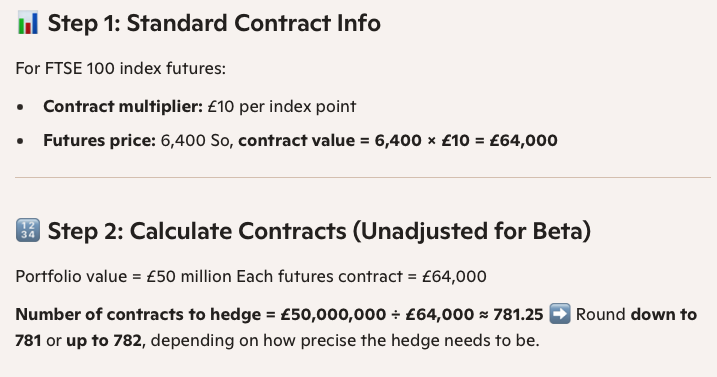

How much is each FTSE 100 futures contract valued at

£10 per index point

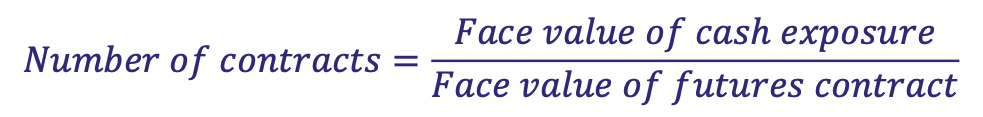

What is the formula for hedging with futures

A fund manager has a well diversified portfolio of UK equities valued at £50m. The FTSE 100 index is currently standing at 6,350, and the FTSE100 future is trading at 6,400.

How many contracts does the fund manager need to sell to hedge the

portfolio?

A fund manager has a well diversified portfolio of UK equities valued at £50m. The FTSE 100 index is currently standing at 6,350, and the FTSE100 future is trading at 6,400.

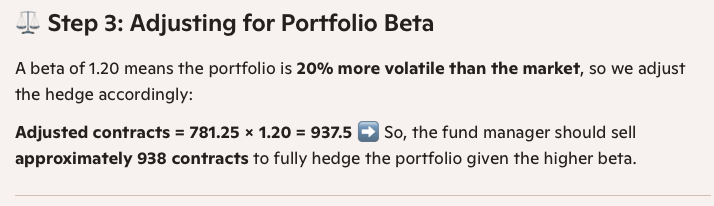

How would the answer change if the portfolio has a beta (ß) of 1.20

What is the formula for hedging with futures

A fund manager has a well diversified portfolio of UK equities valued at £50m. The FTSE 100 index is currently standing at 6,350, and the FTSE100

6,100 puts are quoted at 40.

How many long puts does the fund manager need to hedge the portfolio?

A fund manager has a well diversified portfolio of UK equities valued at £50m. The FTSE 100 index is currently standing at 6,350, and the FTSE100

6,100 puts are quoted at 40.

How would the answer change if the portfolio has a beta (ß) of 1.20

What is the formula for Option Premium

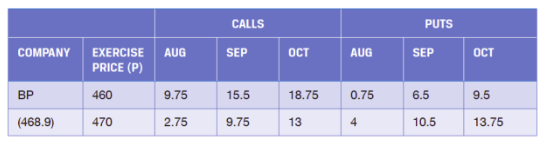

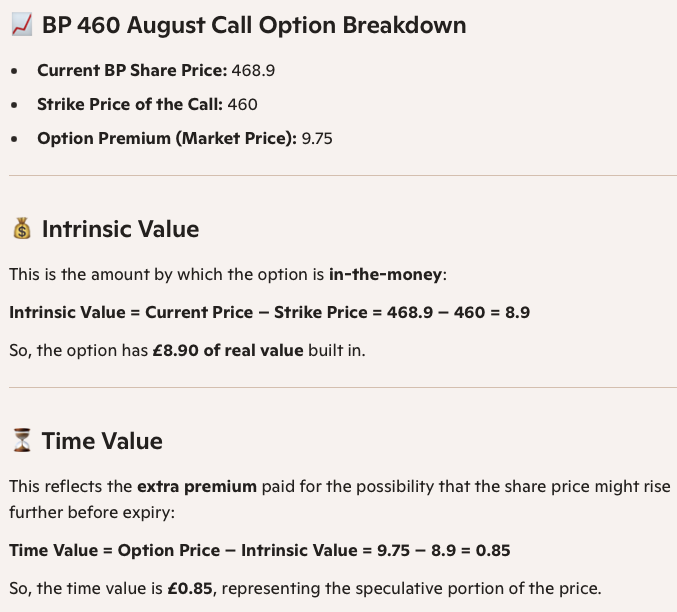

What is the intrinsic value and time value in the BP 460 Aug call? Question

What is the intrinsic value and time value in the BP 460 Aug call?

What factors affect option premiums (and associated measures of how ‘sensitive’ option premiums are to changes in these factors

Cash price (Delta)

Time to expiry (Theta)

Volatility of share price (Vega)

Discount rate (Rho)

What is stock lending

Securities temporarily transferred from a lender to a borrower for a fee

Borrowers provide lenders with collateral

Who does the legal title transfer to in a stock lending arrangement

Borrower

‘Manufactured dividends’

What is Short Selling

Borrowing securities and selling them, in the hope that prices will fa

What are the types of contracts for differences

Interest rate swaps

Equity swaps

Inflation swaps

Currency swaps

What is an Interest rate swaps

The exchange of a fixed rate of interest and a variable rate (usually SONIA)

What is an example of an Intereset rate swaps

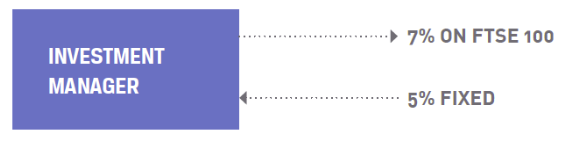

A fund manager wanting to remove exposure to a rise in SONIA buys a swap (becomes the ‘fixed rate payer’

What is an equity swap

One party pays another the return on equities (or an equity index) in exchange for a fixed return

Why would a fund manager do a equity swap

To remove equity exposure

What is an inflation swap

Transfer inflation risk

Variable rate reset by reference to an inflation index

What is a currency swap

Two parties swap fixed (or floating) interest in one currency for fixed (or floating) interest in another, to hedge underlying liabilities in the respective currencies

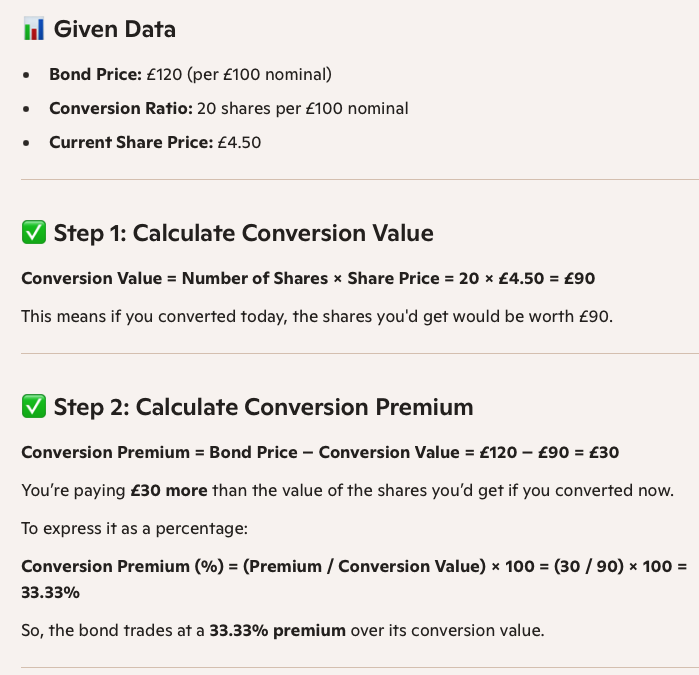

What is a Convertible Bond / Preference Share

Allow investors to convert their holding into a pre-specified amount of equity

Generally trade at a higher price than equivalent non-convertible bonds (and hence lower yield)

What is the formula for conversion value

A convertible bond is trading at £120 (per £100 nominal), and offers the holder the right to convert into 20 ordinary shares (per £100 nominal). The current share price is £4.50.

What is the conversion value and the conversion premium

What is a Warrant

Give the holder the right to buy a certain number of NEW SHARES in the issuer at a fixed exercise price

(so INCREASE the number of issued shares on exercise)

What is a Traded Option

Give the holder the right to buy a certain number of EXISTING shares in the issuer at a fixed exercise price (so DO NOT increase the number of issued shares on exercise)

Generally shorter lives than warrants

What is a Covered Warrant

Issued by investment banks

Call (buy) and put (sell) covered warrants availabl

What is a Credit Default Swap

A buyer pays a premium to a seller for protection against bond default

What happens if a default occurs

The seller receives the bond and pays the face value to the buyer (physical settlement); or

The seller pays agreed notional principle to the buyer (cash settlement)