Y10 Economics: Circular Flow, GDP, Inflation, and Policies

1/63

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

64 Terms

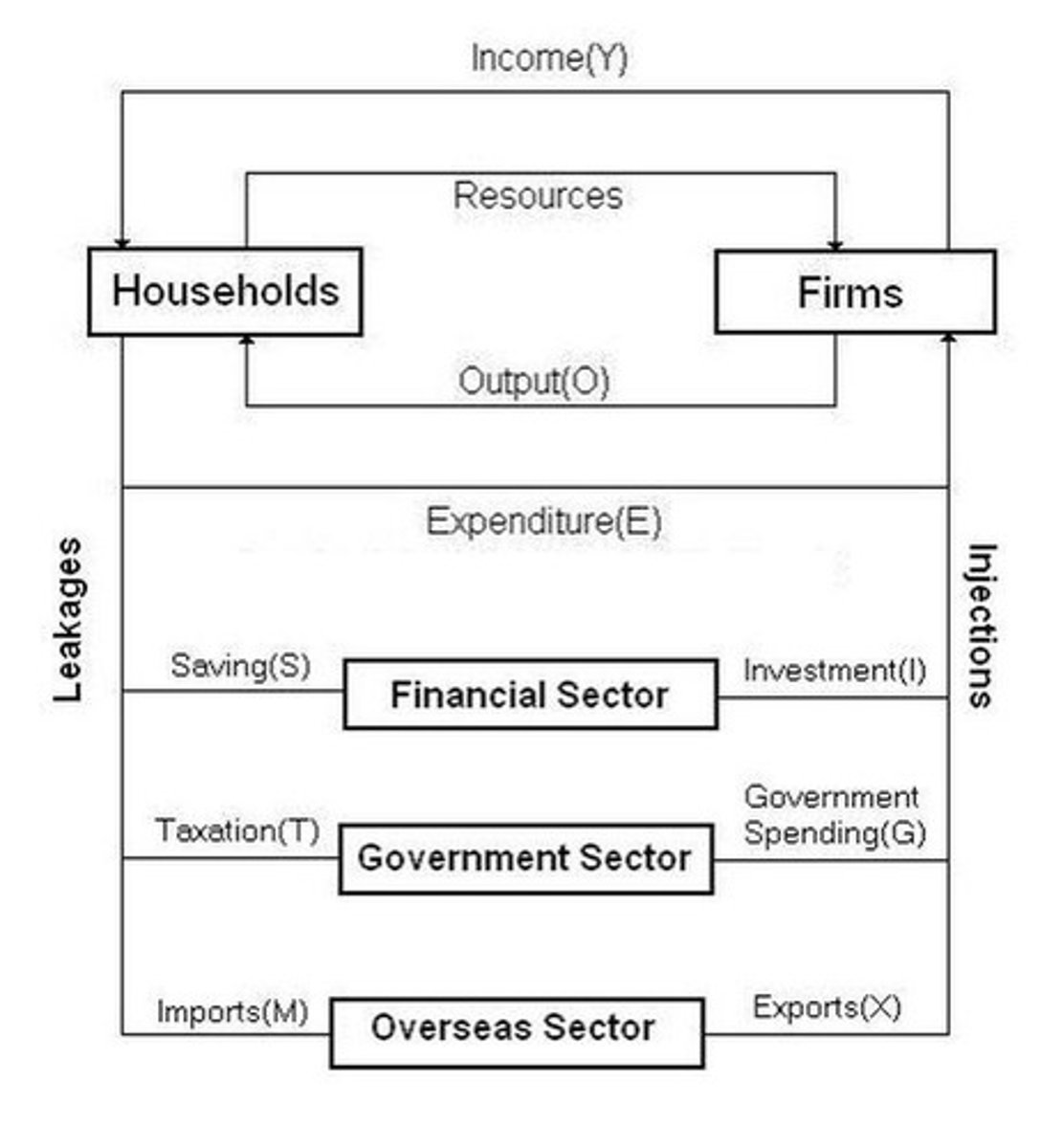

Circular Flow of Income

Flow of resources, goods, services, income, expenditure.

Household Sector

Provides production factors and purchases goods/services.

Business Sector

Supplies goods/services and pays households income.

Financial Sector

Holds savings, invests in capital, affects economy.

Government Sector

Collects taxes and spends on public services.

Overseas Sector

Imports take money out; exports bring income.

Equilibrium

Injections equal leakages; no economic change.

Disequilibrium

Injections do not equal leakages; economy fluctuates.

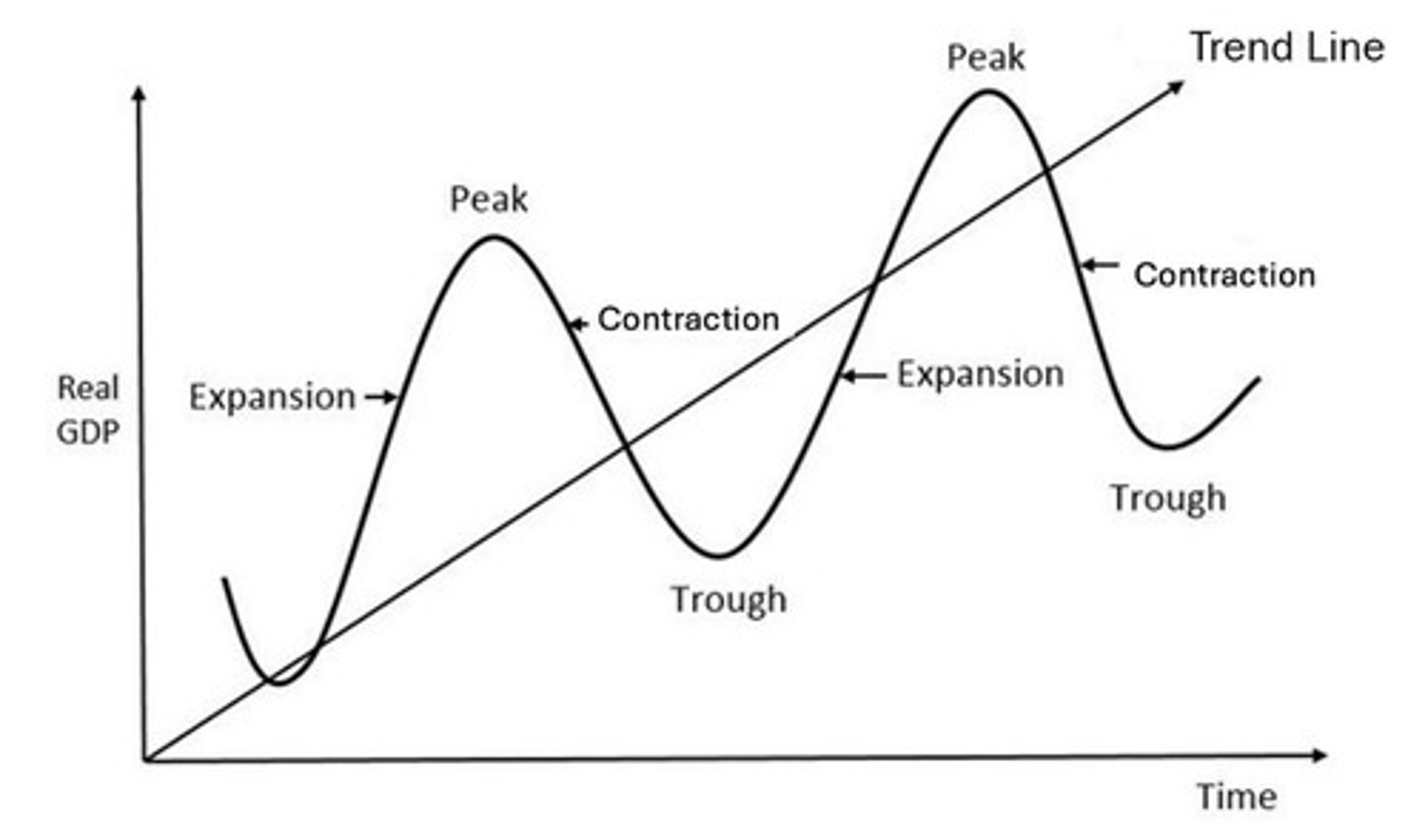

Business Cycle

Model of short-term economic activity fluctuations.

Boom/Peak Phase

High confidence, spending, low unemployment, high GDP.

Downswing Phase

Slowing economy, rising unemployment, stabilizing inflation.

Trough Phase

Low confidence, spending, high unemployment, low GDP.

Upswing Phase

Growing confidence, spending, lowering unemployment, rising GDP.

Economic Growth

Increase in productive capacity, measured over time.

Target Growth Rate

Desired economic growth range of 3-4%.

Nominal GDP

Value of output at current prices, unadjusted for inflation.

Real GDP

Inflation-adjusted measure of economic output.

Real GDP per Capita

Economic production per person in the economy.

Arguments Against GDP

GDP ignores non-market activities and quality of life.

Utility Changes

GDP does not reflect satisfaction from goods/services.

Productivity Measurement

GDP does not account for output per input.

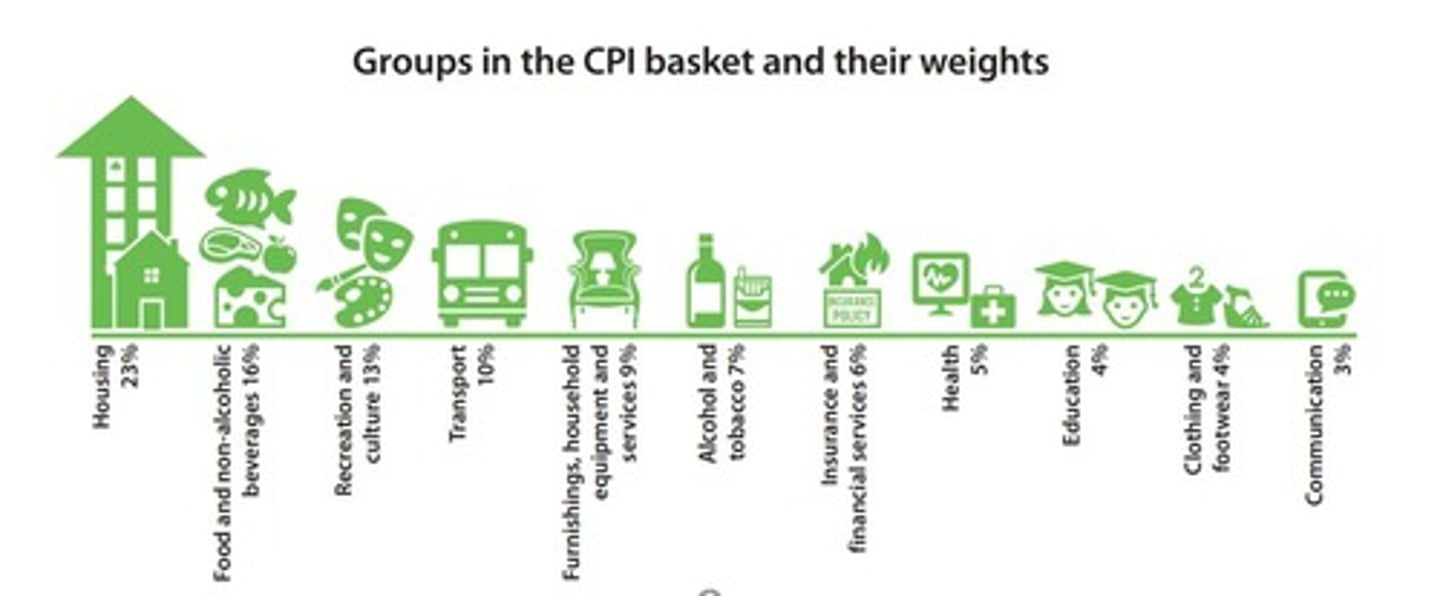

Inflation

Persistent rise in general price levels over time.

Target range

Desired inflation rate of 2-3%.

Consumer Price Index (CPI)

Measures price changes of household goods quarterly.

Headline CPI

Broad measure of inflation including all price changes.

Underlying inflation

CPI excluding short-term price influences.

Demand pull inflation

High demand causes prices to rise rapidly.

Aggregate demand

Total spending in the economy affecting inflation.

Cost push inflation

Rising input costs lead to higher consumer prices.

Input costs

Expenses incurred in producing goods and services.

Wages and productivity

Higher wages without increased output cause inflation.

Import prices

Costs of foreign goods increase with a weak dollar.

Natural disasters

Events causing shortages and rising prices in agriculture.

Unemployment

Willing and able workers unable to find jobs.

Unemployment rate

Proportion of labor force without paid work.

Target unemployment range

Desired unemployment rate of 4-5%.

Labour Force

Individuals either working or seeking employment.

Participation Rate

Proportion of working-age population in the labor force.

Underemployment Rate

Employed individuals wanting more hours.

Underutilization Rate

Sum of unemployment and underemployment rates.

Full Employment

Lowest unemployment without affecting inflation.

Cyclical unemployment

Unemployment counter-cyclical to economic cycles.

Frictional unemployment

Workers transitioning between jobs or upskilling.

Seasonal Unemployment

Job loss due to seasonal demand changes.

Structural Unemployment

Job loss from technological advancements replacing jobs.

Material Living Standards

Access to physical goods and services measured by GDP.

Non-Material Living Standards

Intangible factors affecting life enjoyment, like freedom.

OECD Index

Measures living standards based on 11 criteria.

OECD Better Life Index

Compares countries on jobs, education, income, health, environment.

Fiscal Policy

Government budget decisions affecting spending and revenue.

Expansionary Fiscal Policy

Increased spending to stimulate economic growth.

Contractionary Fiscal Policy

Decreased spending to slow economic activity.

Income Tax

Primary source of government revenue in Australia.

Social Security Spending

Major government expenditure for welfare support.

Monetary Policy

Adjustments to cash rate influencing interest rates.

Cash Rate

Interest rate charged by RBA to banks.

Contractionary Monetary Policy

Increases cash rate to slow economic activity.

Expansionary Monetary Policy

Decreases cash rate to boost economic activity.

Public Services Investment

Fiscal policy boosts living standards through infrastructure.

Progressive Taxation

Higher taxes on wealthier individuals to reduce inequality.

Inflation Control

Regulating prices to maintain purchasing power stability.

Employment Rates

Percentage of the labor force that is employed.

Quality of Life

Overall well-being and satisfaction of individuals.

Purchasing Power

Ability to buy goods and services with income.