Chapter 7 - Liabilities

1/67

Earn XP

Description and Tags

Current assets and long-term assests combined

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

68 Terms

Liabilities

Sources of funding

Assets

Uses of funding

Can be financed by:

Debt

Liabilites

Equity

Common shares

Retained Earnings

Capital structure

Mix of debt and equity

Which is risker: Debt financing or equity financing

Debt financing is risker than equity financing

Why is debt financing riskier?

Interest payments on debt are legal obligations

Creditors can force bankruptcy if a business fails to meet these obligations

Why use debt financing even if it is riskier?

Businesses that use debt financing are leveraged

Financial leverage

Borrowing money (debt) to increase potential returns on equity (investment)

Still is a financial risk as the company must pay back the debt + interest

How is financial leverage measured

Using financial ratios such as:

Debt-to-equity

Debt-to-total-assets

How does leverage affect Return on Equity (ROE)

It magnifies gains and losses.

Interest Rate includes:

Contractual interest rate

Market (effective) interest rate

Contractual interest rate

Used to calculate interest payments

Also called:

Coupon rate (≠ market rate)

Nominal rate

Face rate

Market (effective) interest rate

Demanded by investors

Also called the yield

Value includes:

Face value

Makret value (or issues price)

Face value

Principal due at maturity

Market value (issues price)

Price for a bond on the bond market

What is a bond?

Fixed income security that allows investors to receive interest payments for loaning their money to a government or corporation for a set period of time.

Why do companies issue bonds?

To borrow large amounts of money from many lenders at once.

What is a bondholder?

An investor who lends money to the company by buying a bond.

How often is bond interest usually paid?

Twice a year

What are term bonds?

Bonds that all mature at the same time.

What are serial bonds?

Bonds that mature in installments.

What are secured bonds?

Bonds backed by specific assets.

What are unsecured bonds (debentures)?

Bonds backed only by the issuer’s reputation.

Bond price

% of the face value (maturity) of the bond

Bonds are taded at:

Face value

Discount

Premium

Bond pricing - Face value

market value = face value

Traded when the coupon rate = the market value

Bond pricing - Discount

Market value < face value

Traded when coupon rate < the market value

Bond pricing - Premium

Market value > face value

Traded when the coupon rate > the market value

Bonds Interest Payment

Regardless of face, discount and premium value

Interest payment = face value x coupon rate

Bonds Interest Expense

Interest expense is based on the market rate

Bonds Interest Expense - Face value

Interest expense = interest payment

Bonds Interest Expense - Discount

Interest expense > Interest payment

Bonds Interest Expense - Premium

Interest expense < Interest payment

Amortization

Gradually write down the cost of an intangible asset over its useful life

Journal Entry for bonds issues at Discount

(DR) Interest Expense

(CR) Cash

(CR) Discount on bonds payable

Journal Entry for bonds issues at Premium

(DR) Interest Expense

(DR) Premium on bonds payable

(CR) Cash

Methods to Amortize Bonds Discount and bonds premium

Effective Straight Line Method

Straight line method

Why issue shares instead of debt?

No interest payments + no mandatory repayment.

Why issue debt instead of shares?

No dilution of ownership + potentially higher Earnings per share (EPS).

The payment of the face amount of a bond on its maturity date is regarded as what?

A financing activity

Amortizing the discount on bonds payable does what?

Increases the recorded amount of interest expense

Bond carrying value equals Bonds Payable

Plus Premium on Bonds Payable.

Minus Discount on Bonds Payable.

Liabilities (according to IFRS)

Something your business already owes

Can be paid by:

Cash

Give another asset

Deliver goods or services you own (i.e unearned revenue)

Converted to shares (creditor accepts equity instead of cash)

Current liabilities

Obligation due within one year or within a company's operating cycle

Operating cycle

The time it takes for a company to convert its investments in inventory into cash flows from sales

Typically is one year

Types of current liabilities

Known amounts

Provisions (less certainty about timing or amount)

Types of known current liabilities

Accounts Payable

Accrued liabilities

Income tax payable

Unearned revenue

Current portion of long-term debt

Payroll liabilities

Sales tax payable

Short-term notes payable

Dividend Payable

Accounts Payable

Amounts owed to suppliers

Accrued liabilities

Expenses incurred (used), but not paid

insurance payable

Rent

payable

Interest payable

Unearned revenue / Deferred revenue

Cash advances from customers for services that have not been delivered yet

Current portion of long-term debt

Business has a debt that is due after 1 year

Long-term liability on the balance sheet

As time passes, the business must reclassify the portion of debt into a current liability

Payroll liabiliites includes;

Payroll deductions

Payroll expenses

Payroll deductions

Paid by employers to the government on behalf of employees

Income taxes

Canada Pension Plan (CPP)

Retirement fund

Employment Insurance (EI)

Security in case they lose their job at some future date

Payroll expenses

Salary expenses

Canada Pension Plan (CPP)

Employer's CPP contribution = Employee CPP contribution

Employment Insurance (EI)

Employee EI contribution x 1.4

Why are Income taxes, CPP and EI considered a liability?

The liabilities will remain in the books until the company pays the money to the government

Hence why they owe this, making it a liability

Sales tax payable

The tax added to purchases when shopping

3 Types of Sales Tax Payable

Goods and services tax (GST)

Provincial/regional sales tax (PST)

Harmonized sales tax (HST)

Harmoinized sales tax (HST)

Ontario only has HST

HST combines GST and PST = 13% in Ontario

Value-added sales tax

Businesses that buy a product and resell it for a profit will receive an input tax credit (ITC) for the HST they paid

Input tax (or Tax recoverable)

Tax paid when purchasing goods

Output Tax (or Tax payable)

Tax collected when selling goods or services

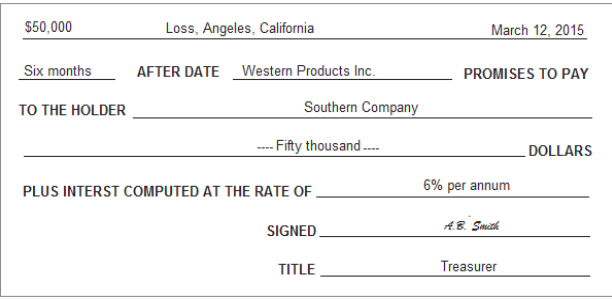

Notes Payable and Notes Receivable (OR promissory notes)

Written promise to pay a sum at the maturity date

Plus interest

Why are notes payable and notes receivable issued?

Gives the lender stronger legal protection

The borrower signs it, the lender keeps it as proof

Example of issues N/R/NP

Dates in which journal entries should be made for notes payable/receivable

Initial transaction

End of accounting period

First interest payment date

Final payment

Interest

The cost of borrowing money

Stated as an annual percentage date

Maturity date

The date at which the debtor must pay the note

Principal

The amount of money borrowe dby the debtor

Term

The length of time the debtor must repay the note