Financial Statements in More Details

1/24

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

25 Terms

Statement of Profit or Loss (SPL)

The statement of profit or loss (income statement) is a financial statement that reports the revenue, revenue expenditure and the overall performance of the firm in terms of profit (or loss) resulting from its operations over a period.

Importance of the SPL

The statement of profit or loss helps decision makers in many ways:

To answer the question of whether the company is making profit or not and how much it is making.

To reasonably forecast the future using past performance

To assess the performance of the company against other companies in the same industry using industry benchmarks and over time.

To detect problems with sales, margins and expenses in time so that timely corrective actions could be taken to reduce expenses and losses

Accounting profit (Loss)

Accounting profit is determined as:

Revenue (or Income) – Expenses = Profit (Loss)

If income is greater than expenses, there is profit. On the other hand, if income is less than expenses, loss is made.

Revenue

If the only source of income to a company is the sale of products, then, revenue will be calculated as the selling price multiplied by the quantity sold.

Note that what is reported in the income statement is not gross sales but net sales.

Net sales refer to the total revenue generated by a company, excluding any sales returns, discounts, sales tax, VAT (and other taxes collected on behalf of third parties (e.g., excise duties, customs duties, other government levies – see IFRS 15

Costs and Expenses: Product cost and Period cost

Costs and expenses are costs resulting from the costs of producing or acquiring goods, selling goods, rendering services, or performing other business activities.

in income statement , we could classify costs and expenses into the following:

Product cost

Period cost

Product cost and Cost of goods sold

Product cost is the cost of making or acquiring a product.

For manufactured goods, they include:

Direct material cost

Direct labor cost

Manufacturing overhead.

Product cost are called inventoriable costs and attaches to a product wherever it goes.

When the product is not sold, these costs go into the balance sheet as inventory. When the product is sold, they are brought into the income statement as cost of goods sold (COGS)

Cost of Goods Sold (COGS)

The COGS or cost of sales is deducted from the net sales to give the gross profit (GP).

The COGS is deducted from the revenue in line with the matching concept of accounting

COGS = Beginning inventory + Inventory purchased/manufactured during the period - Ending inventory.

Period costs (Operating expenses)

All costs that are not product cost are classified as period costs (operating expenses)

They are expensed on the income statement in the period in which they are incurred, irrespective of when cash outflow on them takes place.

Examples are selling expenses, telephone, electricity, rent, salaries, etc.

Period costs are deducted from the gross profit to arrive at the profit (earnings) before interest and taxes

The structure of the Income Statement for a Service Business

Service businesses (such as those involved in consulting, accounting and financial planning, and insurance, etc.) do not sell tangible goods to produce income

Rather, they provide services to customers or clients through specific expertise that are charged based on a fixed fee or hourly rate

Therefore, their income statement will be a basic breakdown of income and operating expenses that usually do not have cost of goods sold.

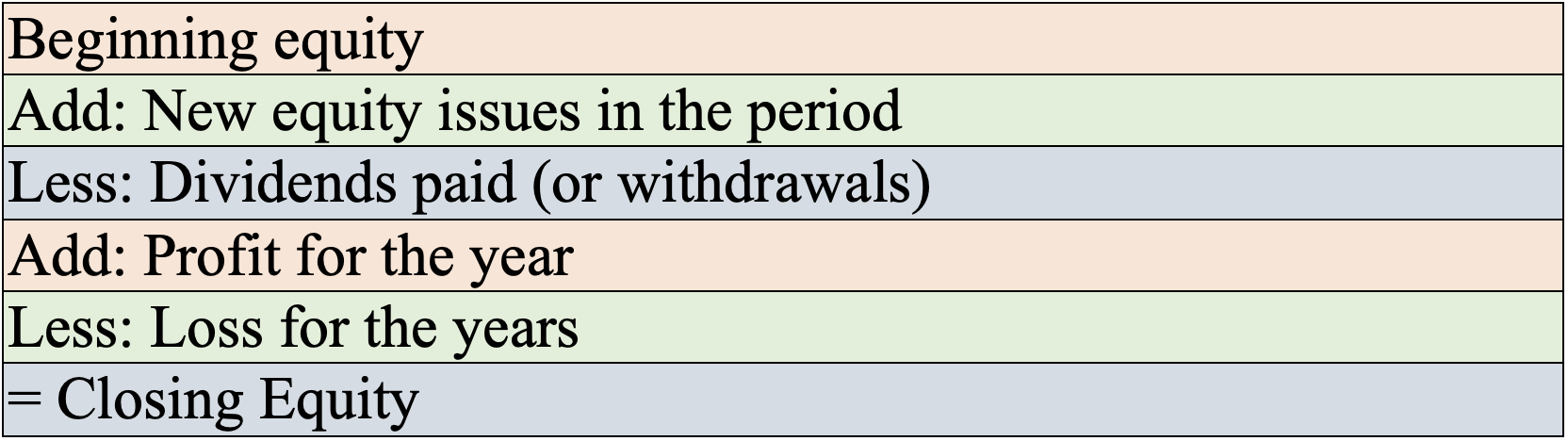

Statement of Shareholders Equity

It indicates the changes that have occurred on shareholders’ equity resulting from sale of new shares, payment of dividend, and retention of profit

This statement shows the shareholders’ equity at the beginning of the period, plus any new share issues, minus any dividends paid during the period (or withdrawals) plus any profit for the year minus any losses for the year.

Beginning equity |

Add: New equity issues in the period |

Less: Dividends paid (or withdrawals) |

Add: Profit for the year |

Less: Loss for the years |

= Closing Equity |

Statement of Financial Position (Balance sheet)

The statement of financial position shows as at a particular date, the financial position of the firm, listing its assets, liabilities and the stockholders’ equity.

It groups the assets of the company on one side, and the way they have been financed (liabilities and equity) on the other side.

As a result, both sides of the balance sheet must be equal since all the assets the firm owns, or controls could only have been financed by either some form of borrowing or the other (liability), or ownership funds.

Assets

Assets are resources that a business uses to operate its business and produce revenue/benefits.

These assets are usually grouped into two:

Non-current (Long-term) assets

Current (short-term) assets.

Non-current assets

Assets held for periods that exceeds the accounting year (usually one year) and are not intended for immediate sale and are crucial for long-term business operations. These include:

Property, plant, and equipment (PPE) – Tangible assets used in production or operations (fixed assets).

Intangible assets – Patents, trademarks, goodwill, and other non-physical assets.

Investment property – Real estate held for rental income or capital appreciation.

Long-term financial assets – Investments in stocks, bonds, or subsidiaries.

Deferred tax assets – Future tax benefits from deductible temporary differences.

Current assets

Current assets are those assets held in the form of cash or are expected to be realized, sold, or consumed within the accounting period or the normal operating cycle of the business, usually one year.

These assets are essential for short-term liquidity and operational needs.

Examples of current assets include:

Cash and cash equivalents – Readily available funds.

Short-term investments – Marketable securities expected to be converted into cash soon.

Accounts receivable – Amounts owed by customers.

Inventories – Raw materials, work-in-progress, and finished goods.

Prepaid expenses – Payments made in advance for future services.

Current tax assets – Recoverable tax amounts.

Assets held for sale – Non-current assets reclassified for imminent sale.

Liabilities

debts or obligations that a business has as a result of past economic transactions

Liabilities arise from activities such as borrowing funds, acquiring inventory on credit or incurring other expenses without yet paying for them.

Liabilities are classified into two:

Current liabilities

Non-current liabilities

Current Liabilities (CL)

obligations that a company expects to settle within a year or within its normal operating cycle.

These liabilities are typically paid using current assets or by creating new short-term obligations

Current liabilities are reported separately so the users of the financial statements can assess the liquidity (or short-term debt-paying ability) of the reporting entity

Common types of current liabilities:

Short-term loans – Borrowings due within a year (e.g., overdrafts)

Accounts payable (amounts owed to suppliers for goods or services for which invoice has been issued) and accrued expenses (amounts owed to suppliers for goods or services for which invoice has not) been issued)

Dividends payable – Declared dividends awaiting distribution.

Refund liabilities

Tax payable. Liabilities relating to income tax, sales, and property taxes;

Salaries

Interest payable – Interest due on outstanding loans.

Deferred revenue (unearned revenue) – Payments received in advance for goods or services yet to be delivered.

Current portion of bank loans and mortgages.

Non-current liabilities

obligations that a company expects to settle beyond 12 months or outside its normal operating cycle.

These liabilities are crucial for long-term financing and strategic planning.

Common examples of Non-Current Liabilities:

Long-term debt – Loans or bonds payable beyond one year.

Deferred tax liabilities – Taxes owed but deferred to future periods.

Lease liabilities – Obligations under long-term lease agreements.

Pension obligations – Commitments to employee retirement benefits.

Provisions for contingencies – Legal claims or warranties expected to be settled in the future.

Equity (Shareholders’ Funds)

Equity is the residual interest in the assets of the entity after deducting all its liabilities (i.e., the difference between assets and liabilities)

It represents the amount belonging to the owner of the firm once all financial obligations have been met.

Equity is also known as the net assets or the net worth or capital of the company.

Components of equity

issued and paid-up share capital - Funds raised from issuing shares (number of shares issued multiplied by the nominal value of the shares)

Share premium – Difference between issue price and the nominal value of the shares, multiplied by the number of shares issued

Reserves - Funds set aside for specific purposes.

Retained earnings (Accumulated profits reinvested in the business)

The Statement of Cash Flows

Shows the amount of cash the firm has generated during a period and how those cash has been used during the same period, that is, flow of cash in and out of the business.

Net profit is usually different from cash because of the accrual system of accounting in which:

Non-cash expenses such as depreciation and amortization are treated as deductible expenses to arrive at net profit and are not deducted in determining cash flow.

in income statement depreciation & amortisation are seen expenses that reduce net profit. but in cashflow statement they are added back into net profit as they do not involve any real cash being spent

Sales and expenses are recorded when they occur and not when cash is received or paid.

Accounting distinguishes between capital expenditure and revenue expenditure. While capital expenditure is not deducted for the purposes of determining net profit, it is deducted for the purpose of cash flow determination.

add up all inflows and all outflows then do total inflows- total outflows for each of the 3 sections

Summary of operating activities section of the cash flow statement (Indirect method)

start from net profit

add non cash expenses(depreciation & amortisation)

subtract non operating gains

subtract if account receivables increases

add if account receivables decrease

subtract if account payables decrease

add if account payables increase

subtract if inventory increase

add if inventory decreases

Investment activities

In this section, the cash used for investment are listed. Purchases of new property, plant and equipment and intangible assets are called capital expenditures, and this involves the outflow of cash that reduces cash available to the firm.

Since capital expenditure involves the outflow of cash, it must be deducted to determine the cash flow.

The company may also sell some assets. These represent cash inflows and that need to be added.

Summary of investment activities section of the cash flow statement (Indirect method)

Deduct:

Purchase of property, plant, and equipment (PP&E) (e.g., buying machinery, buildings, or land);

Acquisition of other businesses (e.g., mergers or buying controlling stakes in companies);

Purchase of marketable securities (e.g., stocks, bonds, or other financial instruments);

Loans made to other entities (e.g., lending money to subsidiaries or external businesses);

Purchase of intangible assets (e.g., patents, trademarks, or copyrights).

Add:

Proceeds from the sale of PP&E (e.g., selling equipment or real estate).

Proceeds from the sale of investments (e.g., selling stocks or bonds).

Cash received from loan repayments (e.g., money collected from loans previously issued).

Proceeds from the sale of intangible assets (e.g., selling patents or trademarks).

Financing activities

This section shows the flow of cash between the firm and its investors and providers of funds.

These transactions reflect how a company funds its operations and returns capital to investors.

Summary of Financing activities section of the cash flow statement (Indirect method)

Add:

Proceeds from issuance of common and preference shares

Sale of treasury stock (selling previously repurchased shares).

Proceeds from issuance of bonds or long-term debt

Proceeds from other forms of loans or credit facilities (from financial institutions).

Deduct:

Repayment of long-term and short-term debt (paying off loans or bonds).

Repurchase of treasury stock (buying back shares from investors).

Payment of dividends (distributing earnings to shareholders).

Redemption of preferred stock or bonds (retiring financial obligations).