Economics Final Pearson Flashcards

1/68

Earn XP

Description and Tags

HW10 (Ch.20), HW9,WU 9, WU 8, HW 8

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

69 Terms

Which of the following are financial securities that represent promises to repay a fixed amount of funds

bonds

Which of the following is not a service that the financial system provides for savers and borrowers

guaranteeing savers high rates of return

Which of the following equals the amount of public saving

Government tax revenue minus the sum of government purchases and transfer payments to households

A government that collects more in taxes than it spends experiences

a budget surplus

Which one of the following statements regarding real and potential GDP is true

Potential GDP increases every year

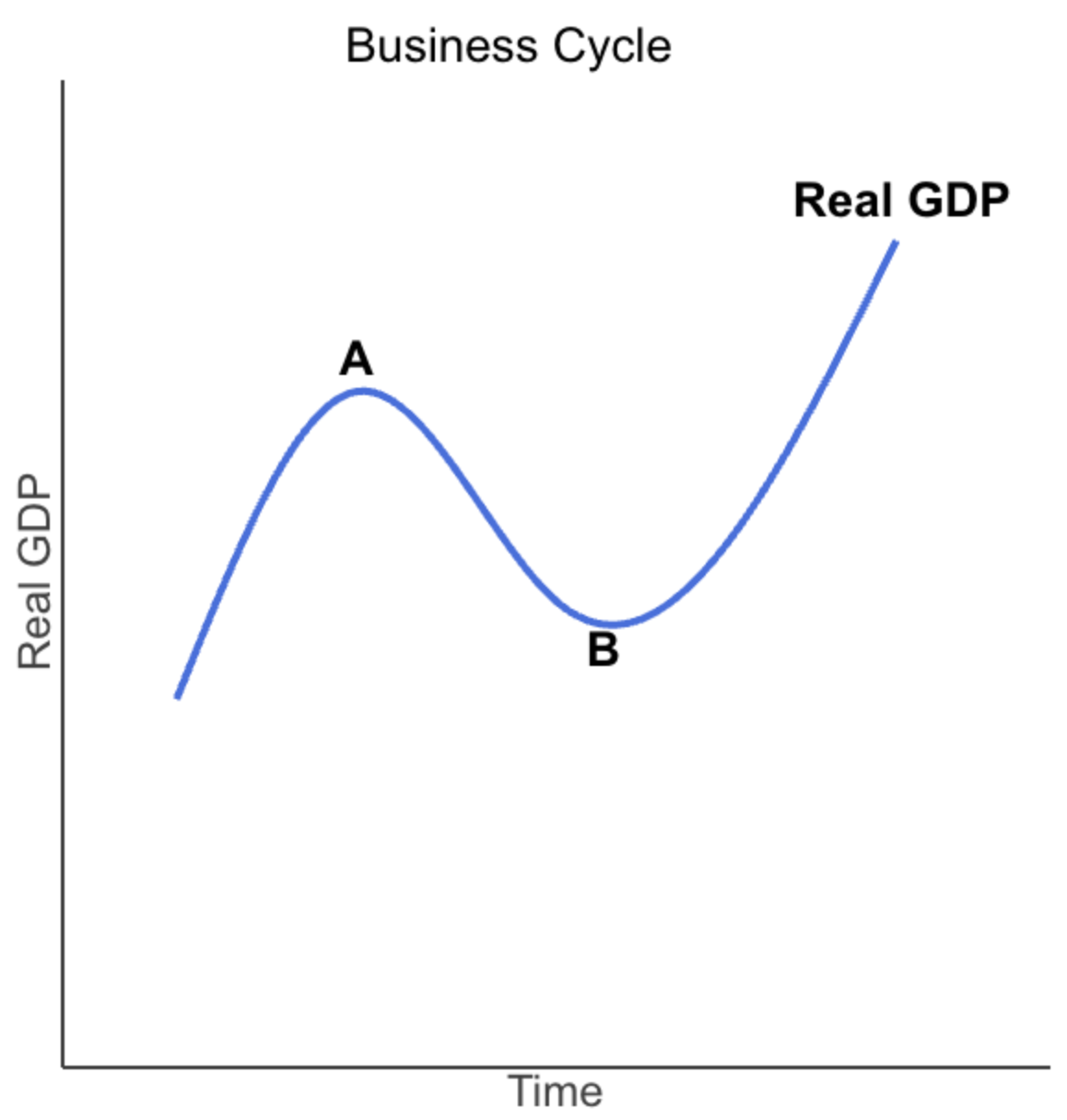

Identify the following parts of the business cycle using the figure

(a) The section of the curve to the left of point A is ____

(b) Point A is _____

© The section of the curve between point A and B is ____

(d) The section of the curve to the right of point B is ____

expansion, the peak, a recession, the trough, an expansion

Business cycles are

alternating periods of expanding and contracting economic activity, which are usually illustrated using movements in real GDP

Long- run economic growth in the United States is best measured using

real GDP per capita, which has been trending strongly upwards over the past century

Capital can be differentiated between physical capital and human capital. Human capital is

the knowledge and skills workers acquire from education and training or from their life experiences

Which of the following is the best example of human capital?

a workers gets a college degree

The ease with which a financial security can be exchanged for money is referred to as

liquidity

Even though individuals earn interest on financial investments such as bonds, mutual funds, and certificates of deposits, they may still hold wealth in checking accounts because

individuals need money that is available to be spent on goods and services

Long- run growth in GDP is determined by

capital, labor productivity, and technology

Technological progress is affected by

entrepreneurship, private property rights, investment in capital, new software developments

An article in the Economist notes, "For 60 years, from 1770 to 1830, growth in British wages, adjusted for inflation, was imperceptible because productivity growth was restricted to a few industries." Not until the late nineteenth century, when productivity "gains had spread across the whole economy," did a sustained increase in real wages begin.

Source: "The Onrushing Wave,"

Economist,

January 18, 2014.

You can expect there to be a close relationship between productivity gains and increases in real wages because

unit costs fall when more goods are produced per worker, so prices can fall, thereby increasing the value of real wages.

What measure do economists use for the productive capacity of the economy?

Potential GDP

The financial system of a country is important for long-run economic growth because

firms need the financial system to acquire funds from households.

The financial system— either financial markets or financial intermediaries—provides savers and borrowers with all of the following except

The financial system provides security to savers by warranting that their funds are fully insured against loss

Briefly explain how the financial system channels savings into investment

Savers provide funds to firms by buying the firms’ stocks and binds and by depositing funds in banks

How does channeling savings into investment support economic growth?

Firms can acquire funds to invest in new capital and new technologies, which increases worker productivity and thus economic growth.

Which of the following describes the effect of the business cycle on the inflation rate and the unemployment rate?

The unemployment rate increases and the inflation rate falls during recession

What is the labor force participation rate

the percentage of the working-age population that is in the labor force.

To avoid the cost of the purchasing power of paper money decreasing with inflation, workers and firms will try to hold as much paper money as possible.(True/False)

False

Your father earned $34,000 per year in 1984. To the nearest dollar, what is that equivalent to in 2014 if the CPI in 2014 is 215 and the CPI in 1984 is 104?

70,288

Which of the following is not a cost created by high inflation?

Inflation causes the real wage to fall which means that firms have to pay more for workers.

For a given positive inflation rate

the nominal interest rate is always higher than the real interest rate, and the real interest rate may be positive or

negative.

Which of the following can give an early warning of future increases in the price level

Producer price index

If a 3-month Treasury bill pays 5.5% and the change in the consumer price index (CPI) is 4.7%, what is the real interest rate (the true return to lending)?

0.8%

Suppose the fixed interest rate on a loan is 5.75% and the rate of inflation is expected to be 4.25%. The real interest rate is 1.5%.

Suppose now that instead of 4.25%, the inflation rate unexpectedly reaches 5.5%. Who gains and who loses from this unanticipated inflation? (In terms of borrowers and lenders)

Borrowers gain from a lower real interest rate.

Lenders lose from a lower real interest rate.

Which one of the following is not a measure of the price level?

Government Price Index

The price index which is used to measure changes in the cost of living is the

Consumer Price Index

During a period of deflation what happens to real average hourly earnings vs nominal average hourly earnings

Real average hourly earnings are likely to increase faster than nominal average hourly earnings during a period of deflation.

The difference between the nominal interest rate and the real interest rate is

the nominal interest rate is the stated interest rate whereas the real interest rate is the nominal interest rate minus the inflation rate.

What are menu costs

the costs to firms of changing prices

A good measure of the standard of living is

real GDP per capita

The quantity of goods and services that can be produced by one worker or by one hour of work is referred to as

labor productivity

The total amount of physical capital available in a country is known as the country’s

capital stock

What two factors are the keys to determining labor productivity

the level of technology and the quantity of capital per hour worked

If the labor productivity growth slows down in a country, this will

slow down the increase in real GDP per capita

How can you define human capital

The accumulated knowledge and skills workers acquire from education and training or from their life experiences.

Liquidity refers to

the ease with which a financial security can be traded for cash

Financial securities that represent promises to repay a fixed amount of funds are known as

bonds

Given the following economic data, what is the value of investment in a closed economy?

Y = $10 trillion

C = $5 trillion

TR = $2 trillion

G = $2 trillion

3 trillion

In what phase of the business cycle are interest rates usually falling

recession phase

Inflation tends to ________ during the expansion phase of the business cycle and ________ during the recession phase of the business cycle.

increase;decrease

The average price of goods and services in the economy is generally also known as

the price level

If the price level rose in three consecutive years from 100 to 120 to 140, then the annual inflation rate over those years would

decrease

What price indicies comes closest to measuring the cost of living of the typical household

consumer price index

If we want to use a measure of inflation that foreshadows price changes before they affect prices at the retail level, we would base our measure of inflation on

the producer price index

The broadest measure of the price level that includes all final goods and services is

the GDP deflator

If the CPI changes from 125 to 120 between 2023 and 2024, what was the price change between 2023 and 2024?

prices decreased by 4%

If your nominal wage rises faster than the price level, we can say your real wage has ________ and the purchasing power of your income has ________.

risen, risen

the nominal interest rate equals the real interest rate plus

the inflation rate

the stated interest rate on a loan is the

nominal interest rate

when deflation occurs what happens to the real interst rate

it becomes greater than the nominal interest rate

When does deflation occur

when there is a decline in the price level

If inflation expectations are increasing, we would expect that the nominal interest rate would also be increasing, holding all else constant. (True or False)

True

Workers who lose their jobs because of a recession are experiencing what type of unemployment

cyclical unemployment

When the economy is at full employment, which types of unemployment remain?

frictional and structural

Most economists agree that the above-market wage paid in unionized industries significantly increases the unemployment rate in the United States. True or False

False

What type of unemployment is caused by a recession

cyclical unemployment

The unemployment rate is calculated as follows

(number of unemployed/labor force)*100

the labour force participation rate is calculated by

(labor force/working -age population)*100

what are the three types of unemployment

frictional, structural, and cyclical unemploment.

The type of unemployment most likely to result in hardship for the people who are unemployed is

structural because this type of unemployment requires retraining to acquire new job skills.

The natural rate of unemployment is

the sum of structural unemployment and frictional unemloyment

When the economy is at full employment, unemployment is equal to

the natural rate of unemployment

Would a decline in frictional unemployment would increase U.S. economic growth?

Yes, a decline in frictional unemployment would increase the number of workers employed, increasing production and economic growth

An efficiency wage

increases the unemployment rate since firms pay a higher-than-market wage that increases the quantity of labor supplied.