Chapter 9 - Savings, Interest Rates and the Market for Loanable Funds

1/17

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

18 Terms

loanable funds market

The market where savers supply funds for loans to borrowers, including institutions like stock exchanges, investment banks, mutual funds, and commercial banks.

role of loanable funds market

A bridge between savers and borrowers that helps firms invest in resources and enables economic growth by efficiently channeling funds.

interest rate

The price of loanable funds, expressed as a percentage of the original loan amount.

Interest rate as a reward for saving

higher interest rates incentivize saving by increasing the return on funds supplied

interest rate as a cost of borrowing

firms borrow only if the expected return on investment exceeds the interest rate on the loan

supply of loanable funds

Comes from households, foreign entities, and institutions that save money, which banks then lend out.

Demand for Loanable Funds

Comes from borrowers, primarily firms looking to invest in capital to produce future output.

real interest rate

The interest rate corrected for inflation, representing the actual change in purchasing power.

nominal interest rate

The stated interest rate before adjusting for inflation.

fisher equation

Real Interest Rate=Nominal Interest Rate−Inflation Rate

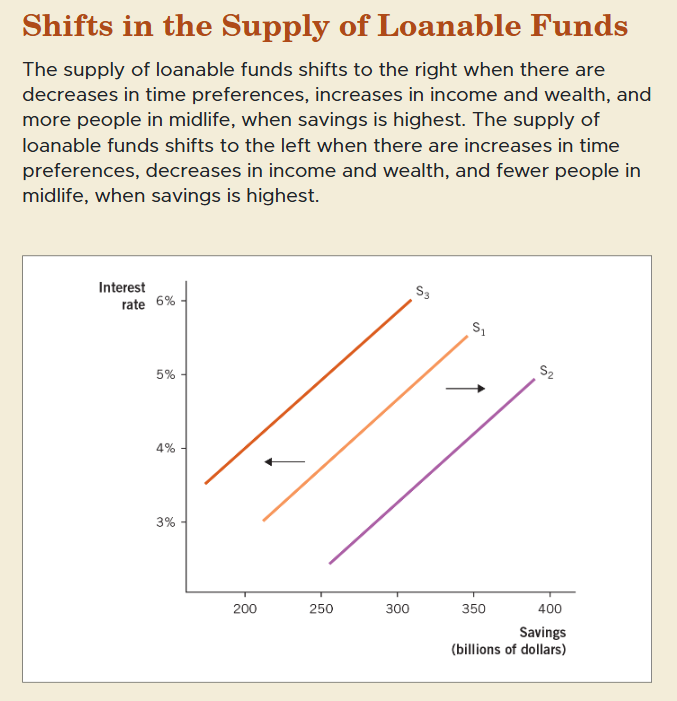

Factors Shifting Supply of Loanable Funds

Income and Wealth – Higher income and wealth lead to more savings, increasing supply.

Time Preferences – People who prefer future consumption save more, increasing supply.

Consumption Smoothing – Individuals save during working years and dissave during retirement, affecting supply.

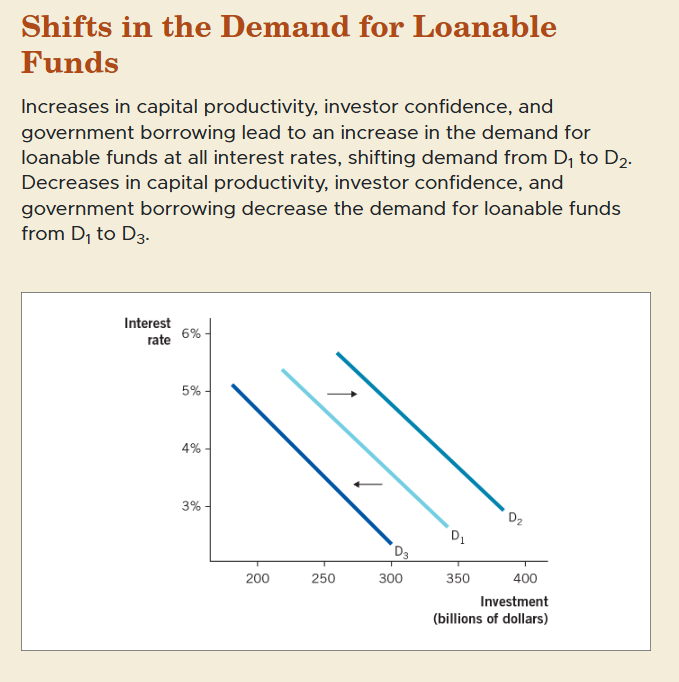

factors shifting demand for loanable funds

Productivity of Capital – More productive capital increases demand for loans.

Investor Confidence – Higher confidence leads to greater borrowing for investment.

Government Borrowing – Higher government borrowing increases demand for loanable funds.

consumption smoothing

The tendency of individuals to maintain stable consumption over time by saving during high-income years and dissaving during low-income years.

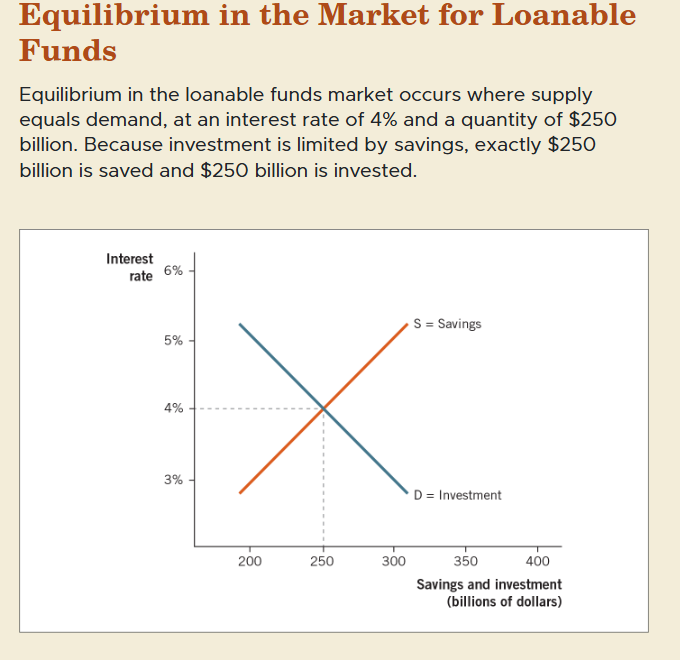

equilibrium in loanable funds market

Occurs when the quantity of savings supplied equals the quantity of funds demanded for investment.

Effect of Economic Downturn on Loanable Funds Market

Firms reduce investment due to lower expected sales, decreasing the demand for loanable funds.

shift in the supply of loanable funds

shifts in the demand for loanable funds

equilibrium in the market for loanable funds