3.5 demand side policies, monetary policy (WAIT THIS IS WITH HL DONT USE THIS) (copy)

1/25

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

26 Terms

Outline Monetary Policy

Monetary police: Carried out by central bank and involves control of money supply and interest rates to influence AD — subsequently fulfilling macro objectives.

KEY TERMS

Central Bank: Monetary authority responsible for an economy’s monetary policy/financial system regulation

Interest rates: The cost of borrowing and returns for saving of money (%)

Money supply: amount of money circulating in the economy, which includes notes and coins, loans, credits, and deposits

Demand Side policy: Goverment policy aiming to influecnce AD

Outline the goals of monetary policy

Low and stable rate of inflation:

Low unemployment:

Reduce business cycle fluctuations:

Stable environments (long term growth)

External policy (also refer to image

Outline low and stable rate of inflation (objective)

Low and stable rate of inflation:

Inflation target: using monetary policy to achieve predetermined level of inflation

Increasing transparency of the central bank and controlling inflation: creates a stable economic environment

Outline low unemployment (objective)

Low unemployment:

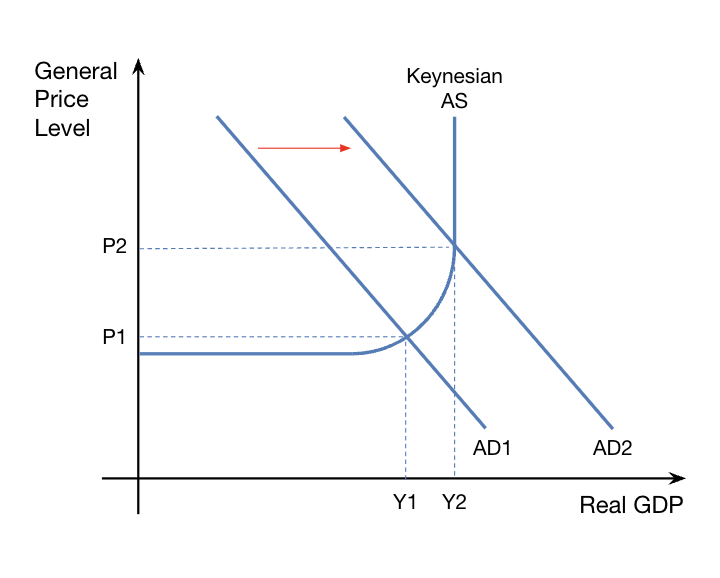

Reducing interest rates: Reduces cost of borrowing for firms and households, encouraging investment and consumption (AD)

AD increases alongside Real GDP, decreasing unemployment

AD1 → AD2 , Y1 → Y2

(Recall types of unemployent)

Structural: Mismatch bewteen skills and work

cyclical: occurs during cost push, is a result of economic downturn/upturn

seasonal: unemployed because a workplace only operates seasonally

Frictional: Occurs between jobs, searching for new jobs

Outline the reduction of business cycle fluctuatoins (objective)

Monetary policy used to influence degree of economic activity

during downturn, interest rates are lowered to stimulate economy

when economies are booming, interest is raised to reduce inflationary pressure

Outline the promotion of stable economic environments for long term growth (Objective)

Low and stable → higher economic stability

increased economic stability increasess certaintiy and confidence for housholds/firms for economic activities

Outline External Blaance (objective)

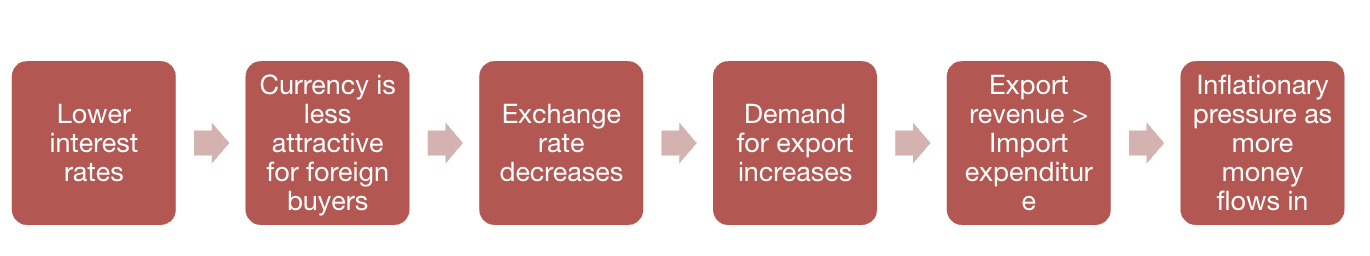

External balance: Value of economy’s export revenue being equal to import expenditure

Interest rates influence exchange rate → influence the value of exports and imports

Lower interest rates → currency is less attractive for foreign buyers → exchange rate decreases → demand for exports increase → export revenue > import expenditure → inflationary pressure due to increased money flowing

Real vs nominal interest rates

Interest rate is the cost of borrowing and reward for saving of money (%)

Nominal interest rate is the actual interest rate that is agreed between the bank and the customer, which is the rate that borrowers pay their loans or savers receive from their deposits.

Real interest rate considers the impact of inflation on the cost of borrowers and the return for savers.

Negative interest rates can occur when the nominal interest rate is less than the inflation rate as

Real interest rate = Nominal interest rate – Inflation rate

For example, if the nominal interest rate is 1% and the inflation rate is 2%, then the real interest rate is -1%. This means the purchasing power of any savings would fall by 1% by year end.

Outline Expansionary monetary policy

Expansionary Monetary policy: Aims to increase level of AD by increasing money supply/interest rates

Cost of borrowing and reward for saving reduces, increasing consumption and investment through increased borrowing and reduced savings. Expansionary policy stimulates economy by shiftingAD curve to the right

Consumption and investment increases

AD increase

Equilibrium increase in price level and output (inflationary pressures, unemployment reduces)

When is expansionary monetary policy used?

when inflation is below the target rate

when the economy is suffering from a recessionary gap where unemployment is high and economic growth is low or negative

Outline Contractionary monetary policy

Contractionary monetary policy: cost of borowing and reward and saving increases → decreasing consumption and investment through decreased borrowing and increased saving. Contractionary monetary reduces economic activity → reduces inflationary pressures

Consumption and investment decreases

AD curve shifts left

equilibirum shifts decrease in output and price level

cloess inflationary gap

unemployemtn increases

When is it used?

When inflatoin is above target rate

when economy is experiencing high levels of economic growth and low levels of unemployment

may be used as measure to slwo AD growth and prevent overheating (productive capacity is unable to keep pace with growing aggregate demand)

Outline all constraints of monetary policy:

limiting scope of reducing interest rates when close to zero

low consumer and bsiness confidence

Trade-offs with other macroeconomic objectives

Outline limiting scope of reducing interest rates when close to zero (constraint)

low interest rates do not necessarily pull economies out of a recession

Ex. During covid, interest hit 0% — ;interest cannot be further lowered to stimulate economy

Expansionary in that case is not as effective

Outline “low consumer and bsiness confidence” (constraint)

During 2008 financial crisis, rates were almost zero, however lack of consumer and business confidence led to prolonged recession. =

Changes in interest rates and money supply can be destabilising to firms and consumers

during recessions, consumers are unwilling to purchase goods or services. Firms may not borrow money to invest even with low interest

Outline Trade-offs with other macro aims

contractionary demand side: trade-off when dealing with cost push inflation — when economy experiences cost-push, price levels increase while real GDP decreases

In order to maintain stable inflation, contractionary monetary or fiscal policy may be used to reduce AD1 to AD2. While this reduces inflation back to stable rate, trade off with unemployment and growth as real GDP decreases further, resulting in greater recessionary gap.

thus, when addressing cost-push inflation in an economy, it is more suitable to implement supply side policies: They address the objectives of low and stable inflation, economic growth, and low unemployemtn

Outline Strengths of monetary policy

incremental, flexible and easily reversible (strength)

short time lags (monetary strength)

Outline incremental, flexible and easily reversible (strength)

Incremental — interest rates can be adjustd incrementally → reduce rsisks of huge disruptions

Fleixble — central bank is independent from poltical interferences → acts in best interest of economy

Reversible — The decision is reversible. Ex. if money multiplier is underestimated and causing inflation, bank can increase interest immediately

Outline short time lags (monetary strength)

Monetary policy can be implemented quickly compared to fiscal, no adminsitrateive, recognition, etc.

Outline the minimum reserve ratio and process of money creation by commercial banks (HL)

When banks lend out money (make loans) they “create” money through increasing total amount of debt owed to them

savers deposit money in banks and gain interest → banks create loans from deposits and lend money to borrowers → banks charge interest rate to borrowers → interest rate charged to borrowers exceed the interest paid to savers → bank profit

MINIMUM RESERVE RATIO: Required percentage of deposits commercial banks must keep in vaults. Excess ratio is the percentage that may be lended out.

Deposits generate loans → loans return to banks as deposits → subsequently increasing money supply. Essentially, the minimum reserve ratio determines the money supply.

Outline the money multiplier (HL)

The money multiplier can be used to calculate how mcuh of a deposit can be used to multiply money.

money multiplier = 1/reserve ratio (e.g: minimum reserve ratio is 10%, money multiplier = 1/0.1 = 10. If a 100$ deposit was put in, 90$ may be lent, thus 900$ created).

outline demand and supply of money (HL only)

Demand for money: willingness and ability of borrowers to obtain loans. Stakeholders include: household, firms, and the government.

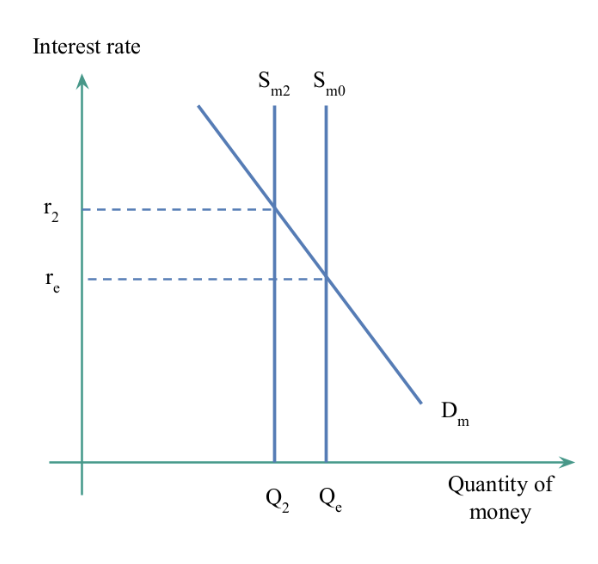

Supply of money: amount of money circulating in economy at any time. Money supply is always fixed thus always perfectly inelastic.

Demand for money has inverse relationship with interest rates — as interest increases, quantity of loans demanded decreases (more expensive to borrow money) and vice versa.

Equilibrium interest rate = intersection of demand and supply of money

central bank increases/decreases money supply, hence shifting money supply left or right, decreasing or increasing interest rate.

Outline bank considerations when setting interest rates (HL)

Exchange rate: lower interest rates decrease demand of domestic currency. exchange rates fall, discouraging sale of exports. (less foreign investors want to invest due to lower rate of returns)

Property Prices: directly impact the level of consumer confidence and potential economic growth of the economy

Rate of growth/nominal wages: higher wages imply firms will increase prices, thus increased interest reduces inflationary pressure

State of an economy: Reduction in interest rates assists in getting out of recession

Business confidence levels: Lower interest rates encourages firms to invest (to take loans and invest into company?)

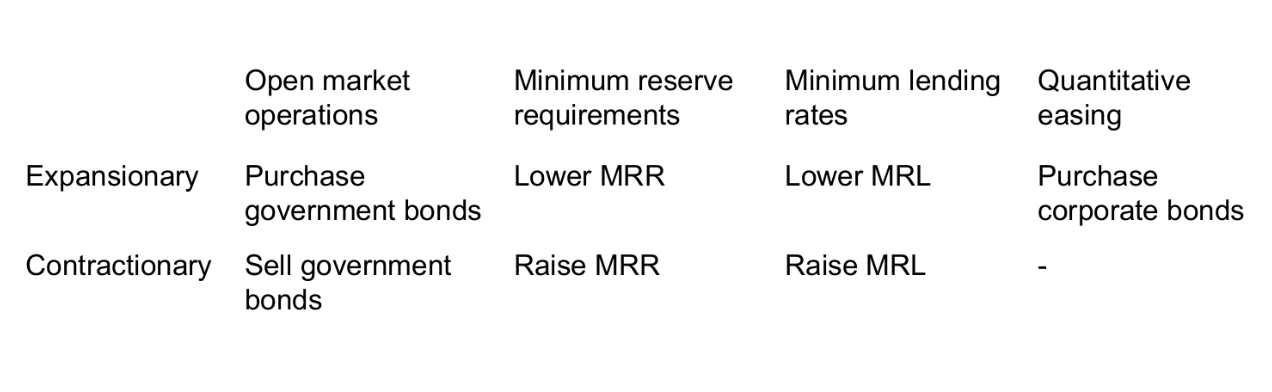

State the tools of monetary policy (HL)

Four main methods used by central bank to influence money supply and interest:

open market operations

minimum reserve requirements

changes in central bank minimum lending rate

quantitative easing

Note: bonds is essentially lending money out to governments/institutions, hence increasing government budgets

Outline open market operations as a tool of monetary policy

Open market operations: buying and selling of government bonds to control money supply and interest rates

governments may sell bonds to investors in exchange for money. A bond certificate offers interest payments and is promised to be paid later → raises finance

May occur via 2 ways: central bank buys gov bonds to increase money supply + central bank sells government bonds to decrease money supply

Outline minimum reserve requirements as a tool of monetary policy.

inverse relationship between MRR (minimum reserve req) and the money multiplier. Higher MRR → there is decreased money created.

Expansionary: Decreased MRR → increase money creation/supply

Contractionary: Increased MRR → decrease money circulation and supply

Outline minimum lending rate as a tool of monetary policy

Minimum lending rate: Interest charged by central bank on loans to commercial banks

Changes in the central bank minimum lending rate: MLR influences all interest on bank loans, credit transactions, and mortgages. Can be;

Expansionary monetary: Central bank lowers MLR → commercial banks lower interest rate paid to savers → encourages consumption and investment via borrowing → AD INCREASE

Contractionary monetary: Central bank raises MLR → commercial banks increase lending rates, encourages people to save → consumption and investment decrease → AD DECREASE

Outline Quantitative Easing (HL)

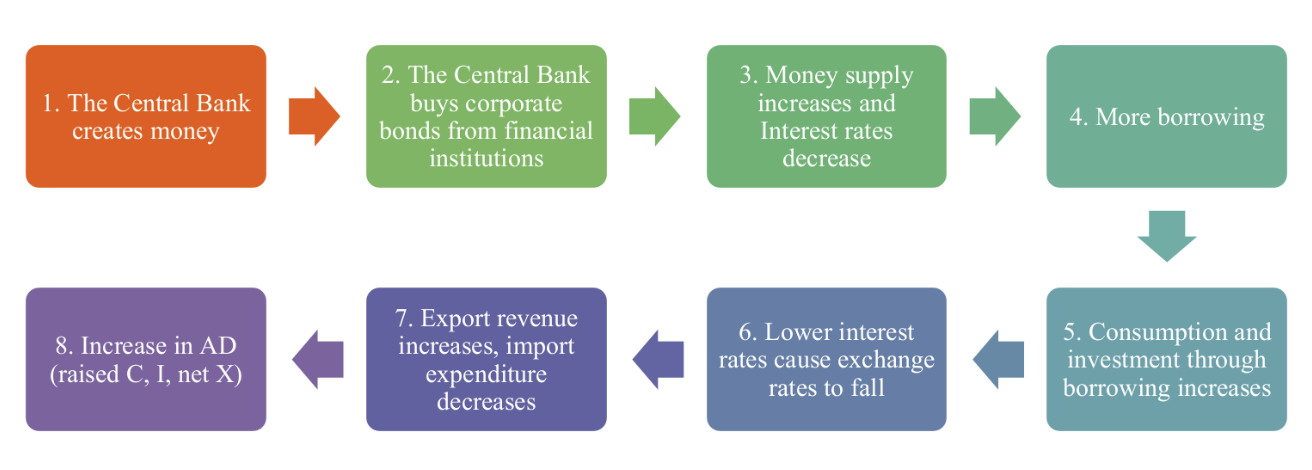

Quantitative Easing: Tool of monetary policy where central bank injects money into economy by purchasing corporate bonds (LARGE SCALE)

Bonds: Type of debt — banks selling bonds to government will receive additional money which increases liquidity. Essentially, money supply increases, encouraging lending and hence economic growth. Quantitative easing may help avoid deflation.