Macroeconomics 1

1/29

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

30 Terms

Production Method

Expenditure Method

Income Method

Production Method = VA = Output - intermediate

Expenditure Method = C+I+G

Income Method = labor + returns=profit from caputal to owners, after paying everyone if included

GDP Deflator use and equation

Compares PL & thus inflation at different times

GDP Deflator = Nominal GDP / Real GDP

CPI equation

P1 X Basket / P2 x basket

Unemployment notation P,N,NLF,L,U

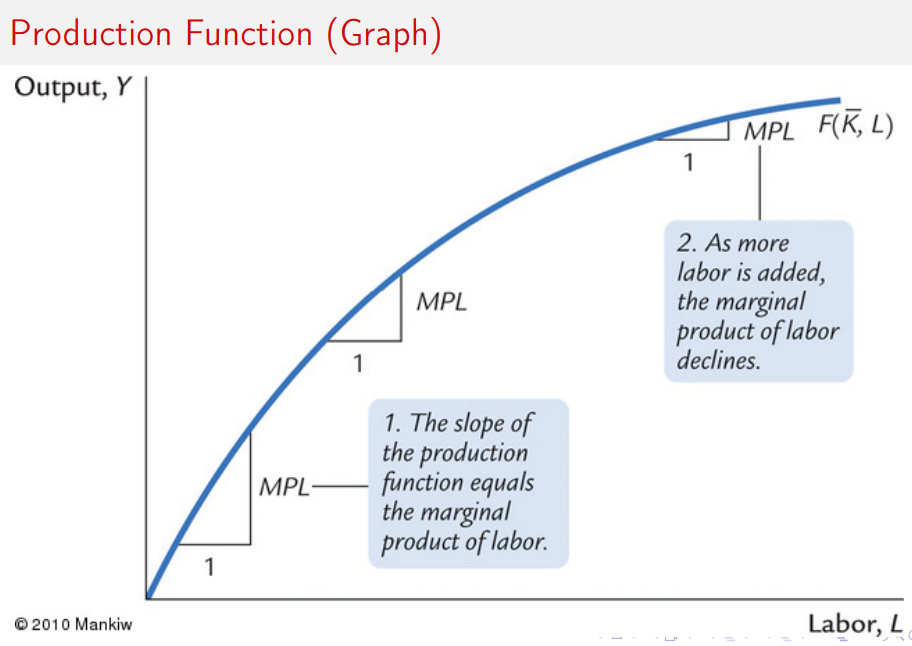

Production Function graph

MPL(Ld) equation

Firms hire labour until the marginal product of labour equals the real wage.MPL = W/ P

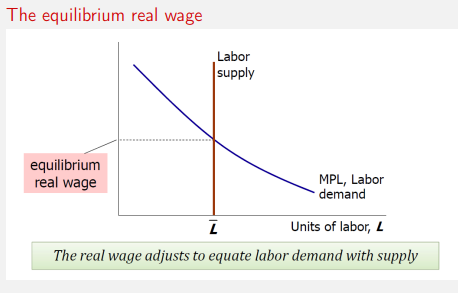

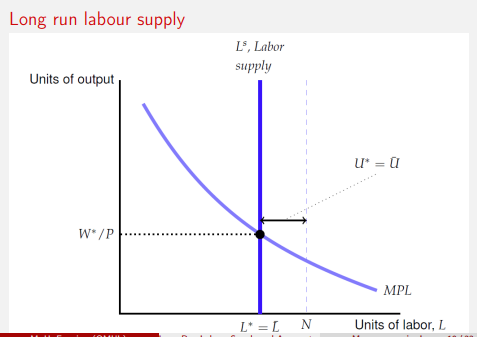

Labour Market equillibrium Graph

Natural rate of unemplyment in the long run equation

Long run laboiur supply graph

U* to L* is NRU*

U* = NRU

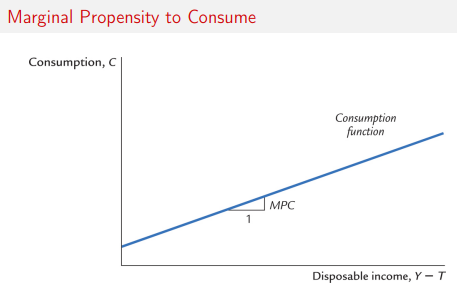

Gneeric Consumption equatio

C = C(Y-T)

remember the factor disp in is MPC

MPC Graph

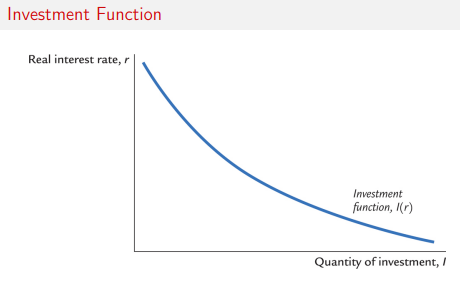

Investment graph

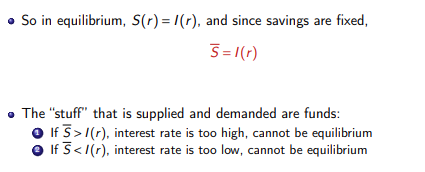

National savings

Private savings = Y -T - C

Public savings = T - G

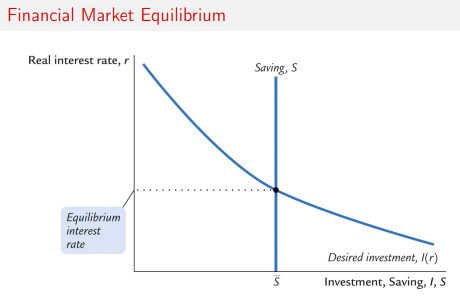

Financial Market equillibroium

Financial Market eq graph

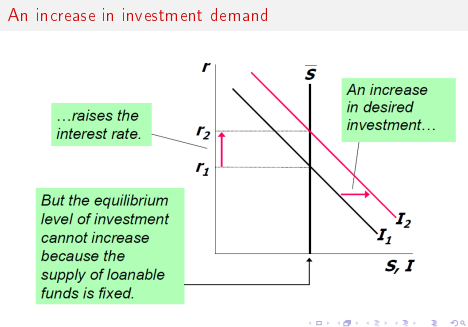

Increase in investment demand (graph)

reserve requirements equation

rr = R/D

Definition of Money supply and Moentary Base

Money Supply (Ms)=Currency held by public (C)+Deposits in banks (D)

Monetary Base = B = C+R

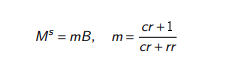

Money supply equations

Ms = m x B

m = (1+cr) / (cr+rr)

cr = C/D

rr = R/D

B = C + R

CB can only affect rr or B not cr which is determined by consumers

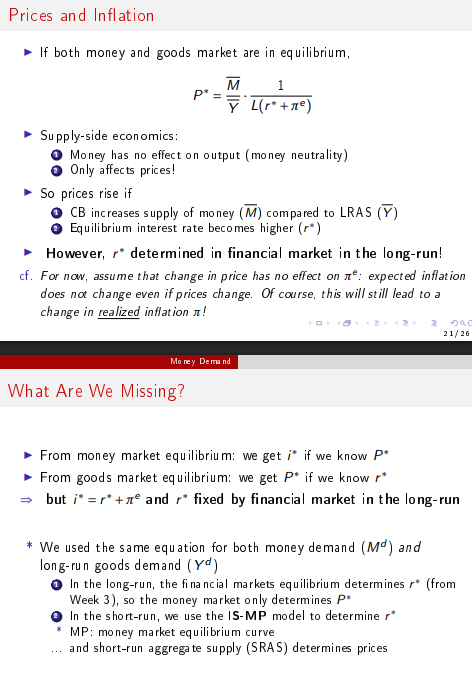

Money Demand equations

Md=P x Yd x L(i)

Money demand equals the price level times real income times liquidity preference,

where liquidity preference decreases when the interest rate increases.

Money Marjet equillibrium (Graph)

Long-run equilibrium price level equation(P*)

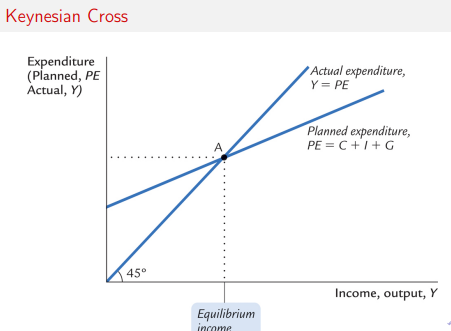

Keynesians cross

The Keynesian Cross shows that the economy reaches equilibrium when planned expenditure equals actual output (Y=PE)(Y = PE)(Y=PE), which determines the level of income/output in the short run. It highlights how changes in spending (like government spending) shift planned expenditure and lead to multiplied changes in output, explaining demand-driven fluctuations.

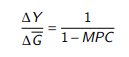

Fiscal multipler

multiplier is 1 / 1-MPC

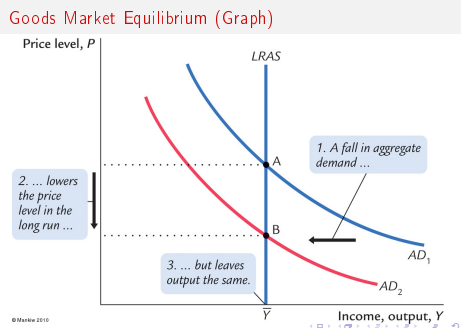

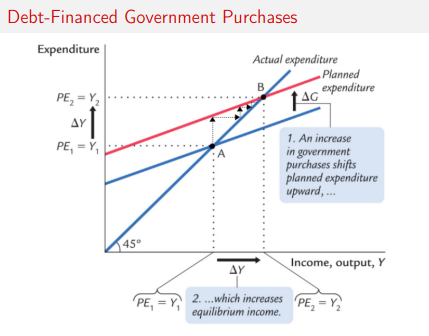

debt financed government purchases (graphs)

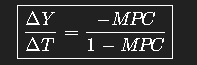

Tax multiplier equaion

u times the change in to get the change in Y

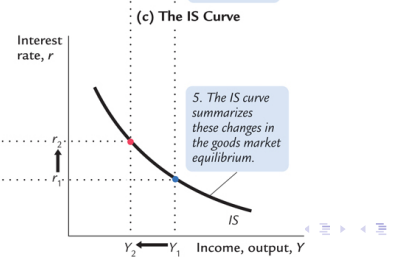

IS curve(graph)

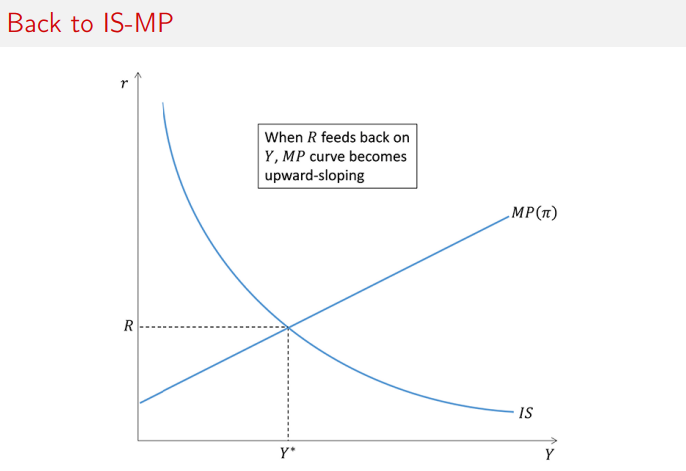

IS-MP Graph

long run equillibrium interest rate (R)

r+inflation

SRAS equation