Investment appraisal and Payback Period

1/6

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

7 Terms

What is investment appraisal?

A technique used to evaluate planned investments by a business and measure its potential value to the business

These include:

Payback period

Average rate of return (ARR)

Discount cashflow (DCF)

Payback Period Method

The time it takes for the project to pay back the initial outlay

When there are a number of different investment options for a business, the PPM will select the one that returns the initial cost of the

investment in the shortest time frame.

Step 1 to calculate PPM

Start with initial investment cost

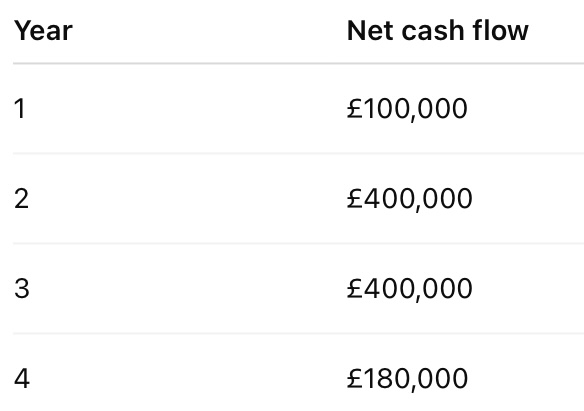

E.g. £600,00

Step 2 to calculate PPM

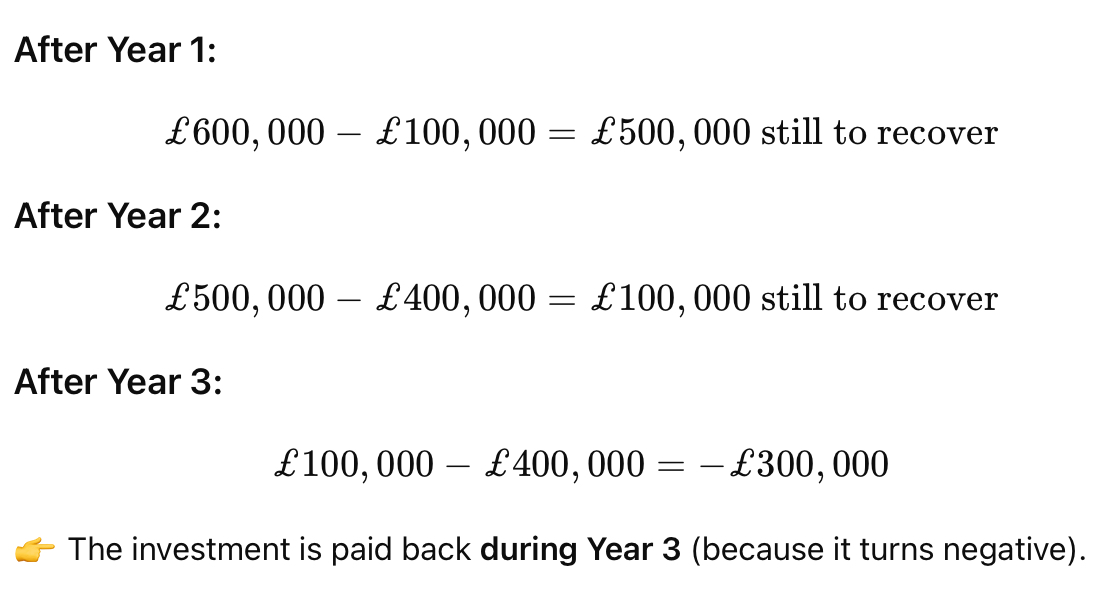

Subtract cash flows year by year

Step 3 to calculate PPM

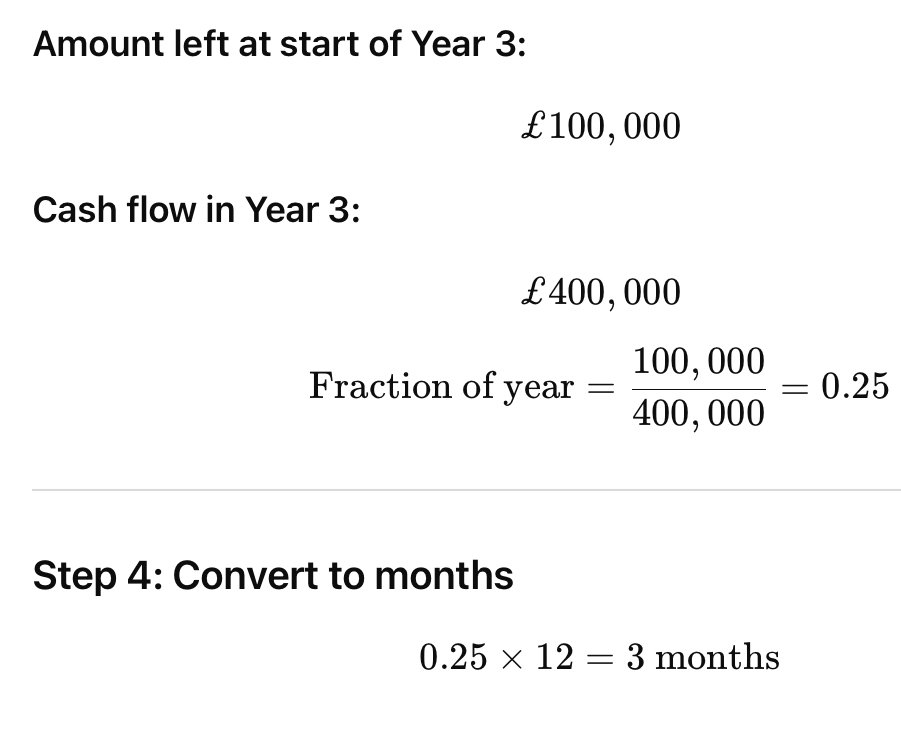

Work out the fraction of the Year needed

Using this formula:

AMOUNT TO FIND/CASH FLOW FOR NEXT YEAR X 12

Final answer is 2 years and 3 months

Advantages of PPM

• Simple to use and easy to calculate

• Effective to use when technology is

changing at a fast rate, such as high-

tech projects, to recover the cost of

investment as quickly as possible.

• Helps with managing cash flow due to

focusing on the short term

Disadvantages of PPM

Ignores flow of cash over the lifetime

of the project

• Ignores total profitability, the focus is

just on the speed at which the initial

outlay is repaid

• May encourage a short-term attitude