EXAM 5 SECTION E

1/23

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

24 Terms

uw guidelines marketing proxy

Rate Regulations

Limit on rate change

Requiring written notices to insureds receiving large rate inc

Prohibit certain rating var

Prescribe certain ratemaking techniques

Revising ratemaking assumptions (ex: trend selections)

What can insurers do in response?

Legal action → challenge regulation in court

Revise _____ _____ to limit business at inadequate rates

Revise _____ to lim business at inadequate rates

Use _____ when var is prohibited

system resource cost benefit

Operational Constraints

_____ Limitations

Cost to implement change in computer systems

_____ Constraints

Cost of additional resource needed

Ex: new rating var needs specialized staff to collect data

_____ _____ Analysis: compares inc profit vs cost of implementation

profit

Marketing Considerations:

Higher Price →

Higher profit (assuming fixed volume)

Lower volume

Expected _____ inc at first, then dec

purchasing decisions

Factors that influence _____ _____

Competitor prices

Overall cost of product

Rate changes

Insured characteristics → sensitivity to price

Customer satisfaction & brand loyalty

relative dec attract expected dramatically

New LOB investing in marketing to grow business

Should develop rate based on typical variable costs, and not the actual high marketing expenses?

A: New business → low prem → marketing costs high _____ to prem

As business grows, marketing cost ratio will _____

If full marketing costs used:

Rate too high to _____ new business

Doesn’t reflect costs _____ for future policyholders

Rates dec _____ in next few years → volatile

lifetime value analysis persistency

_____ _____ _____aka Asset Share Pricing

Looks at profitability of insured over lifetime rather than only when rates are in effect

Recognizes _____

Loss & expense diff between new & renewal business

uw cycle

Hard Market → high price/profit, slow growth

Some insuer lower rates to attract more business

All insurers lower rates to maintain competitiveness

Soft Market → low price/profit, high growth

Low / negative profit

Insurers restrict writing business

Raise prices to improve profitability → Hard Market

hard market

high prices & profits

slow growth

soft market

low prices & profits

high growth

fe fee per exposure

FE per Exposure / (1 - V -QT)

fe fee per policy

FE Fee per Exposure x Avg Exposure per Policy

add

New Base Rate (no rating factor changes)

Note: if no _____ fee → = Curr Base Rate x (1 + rate chg%)

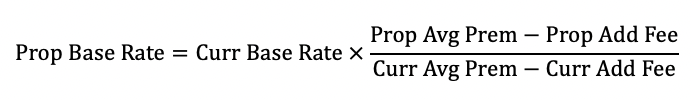

proposed avg prem

Current Avg Prem x (1 + rate chg%)

accurate correlation changing

New Base Rate (w/ rating factor chgs)

Extension of Exposures

Pro: perfectly _____ proposed base rate

Con: need detailed exposure data

Approx Avg Rate Differential

Pro: don’t need detailed exposure data

Con: not perfectly accurate → exp _____

Approx Chg in Avg Rate Differential

Pro: only need to look at _____ var

Con: not perfectly accurate → exp correlation

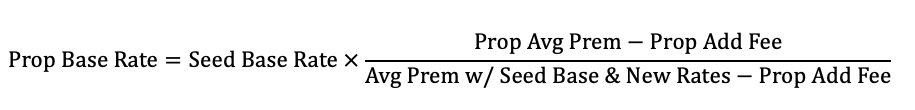

seed base new rates add

New Base Rate → Extension of Exposures

Re-rate using prop rating factors & seed base rate (ex: 1)

Denom = Avg Prem w/ _____ _____ & _____ _____ - Prop _____ Fee

exposure at base prop avg rel

New Base Rate → Approx Avg Rate Differential

For each var, calculate _____-wtd Prop Avg Rel

Prop Avg Rel = product of prop avg rel for all var

Exposure Correlation

Improve by weighing by var prem _____ _____ or adj exposure

Prop Base Rate = (Prop Avg Prem - Prop Add Fee) / _____ _____ _____

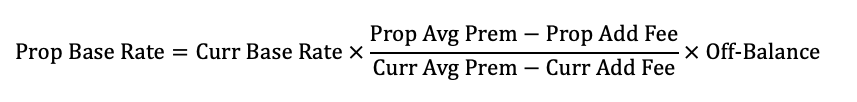

curr base rate curr avg prem - curr add fee off balance

New Base Rate → Approx Change in Avg Rate Differential

Calculate chg in exposure-wtd Avg Rel Chg Factor

Exposure Correlation

Improve by weighing by var prem at base or adj exposure

Inverse → Off Balance Factor

Prop Base Rate = _______ x (Prop Avg Prem - Prop Add Fee)/(_____) x ______

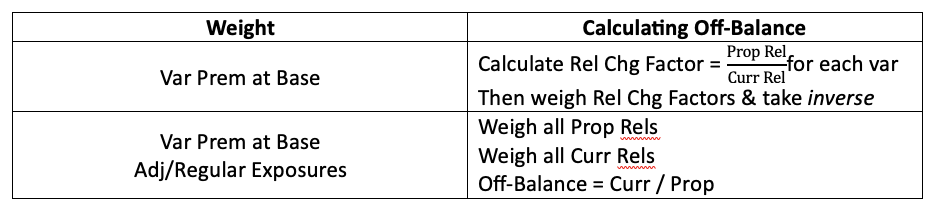

off balance

Avg rel underlying ind rates diff from curr rates → impacts total prem

Off-set this impact by modifying base rate w/ _____ _____ Factor

prop curr inverse

New Base Rate → Approx Change in Avg Rate Differential

Calculating Avg Rel Chg Factor

Var Prem (NOT at base)

For each var → Rel Chg Factor = _____ Rel / _____ Rel

Avg Rel Chg Factor = wtd-avg

Off-Balance = _____

Var Prem at Base or Exposures

Avg Rel Chg Factor = Wtd-Avg Prop Rel / Wtd-Avg Curr Rel

Weigh first BEFORE dividing!

Off-Balance = inverse = Curr / Prop Avg Rel

fe loss

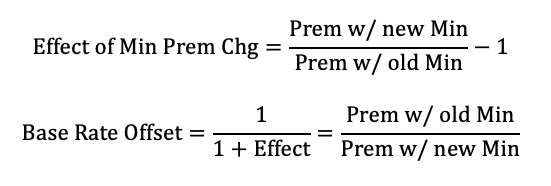

Minimum Prem: makes sure prem covers expected _____ and min expected _____

Steps:

Calculate avg prem for each level

Cap by min

Apply Offset to Base Rate

Base Rate Offset = Old min Prem / New min Prem

Multiply by base rate w/ old min

curr prem rel off balance target

Rate Capping: when you cap impact of one level, need to make up prem!

Check if any level exceeds cap:

Off-Balance = 1 / Total Rel Chg Factor wtd by _____ _____

Total Chg = _____ Chg Factor x _____ _____ x _____ Chg Factor -1

base rate chg factor x rel chg

Rate Capping → Cap Non-Base Level

Inc base rate instead of adjusting each rel!

Solve for X = _____

Total Prem inc by taget overall chg

Capped non-base level → prem change by 1+cap

Other levels → prem change by _____ AND ______ _____ factor

Final Base Rate = old base * X

Final capped non-base Rel = Curr Rel*(1+cap)/X

Other levels = same as Prop Rel

rel adj factor 1+cap prop rel x

Rate Capping → Cap Base Level

Solve for X = _____

Base rate inc by cap

Total Prem inc by target overall chg

Base level → prem change by 1+cap

Non-Base level → prem change by:

Base rate chg _____

Rel Chg Factor

Rel Adj Factor X

Final Base Rate = Curr Base * (1+cap)

Final Base Rel = 1 (bc base)

Final Non-Base Rel = _____ _____ * _____

optimized pricing price elasticity rate chg close retention

_____ _____: uses multivariate techniques to est _____ _____ of new & renewal customers

used to predict impact of _____ _____ on _____ & _____ ratios

can test diff scenarios of rate change and how they’ll impact total profit & growth