Consolidation-Intercompany Transactions

1/29

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

30 Terms

Intercompany profit in Inventory transfer

multiplying the inventory held by the buying affiliate by the gross profit rate based on sales of the selling affiliate

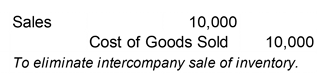

Eliminating entries in: Intercompany inventory transactions

needed to remove the revenue and expenses related to the intercompany transfers recorded by the individual companies

Elimination

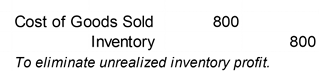

ensures that only the historical cost of the inventory still on hand is included in the consilidated Statement of Financial Position

no adjustment for consolidation

when an intercompany sale includes no profit or loss, the inventory amounts at the end of the period requires:

Inventory is resold to outsiders

the amount recognized as the cost of goods sold by the affiliate is the cost to the consolidated entity.

remove the intercompany sale, and related costs of goods sold recorded by the seller

even when the intercompany sale includes no profit or loss, the eliminating entry is needed to:

this avoids overstating the said accounts

Intercompany sale is made at Cost

the consolidated comprehensive income is not affected by eliminating entry when:

because both sales revenue and cost of goods sold are reduced by the same amount

“marked-up” by certain percentage based on cost

the sale of inventory to affiliates:

2 Goals of working paper eliminations (Intercompany sales include P/L)

Eliminations of the effects in the (SCI) - by removing the sales revenue from the intercompany sale and the related costs of goods sold recorded by the selling affiliate.

Eliminations from the Inventory on the (SPF) - of any profit or loss on the intercompany sale that has not been confirmed or realized by resale of the inventory to outsiders.

reported at a cost to the consolidated entity

inventory reported in the consolidated statement of financial position

any P/L arising from intercompany sales must be eliminated.

Downstream intercompany sales (selling inventory between affiliates)

sales made by a parent company to its subsidiaries

Profits recorded on an intercompany inventory sale - are realized in the period in which the inventory is resold to outsiders.

Until the point of resale - all intercompany profits must be deffered.

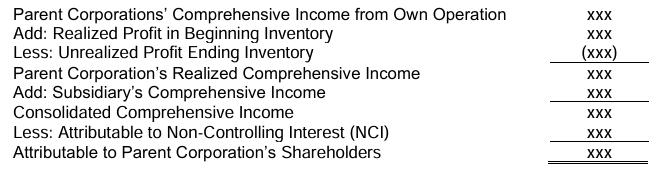

Consolidated Comprehensive Income - must be based on the realized income of the selling affiliate.

no effect on any non-contrilling interest (NCI) in the consolidated income or loss

if intercompany sales of merchandise are made by the parent company or wholly-owned subsidiary:

because the selling affiliate does not have an NCI

overstate the purchaser’s ending inventory

any merchandise purchased from an affiliated company that remains unsold on the date of preparing the Consolidated Statement of Financial Position.

the first entry eliminates Peter Corps’ intercomapny sales to Saul Company and the related cost of goods sold.

this removes the overstatement of the consolidated amounts for sales and the cost of goods sold.

the second removes the intercompany profit from Saul’s cost of goods sold, thereby reducing the consolidated inventories to the actual cost for the consolidated entity

realized trhough sales of merchandise to outsiders during the following period

assumed that on a first-in, first-out basis, the intercompany profit in the purchaser’s beginning inventories will be:

remain unrealized at the end of the period

only the intercomapny profit in the ending inventories

consolidated income involving inventories

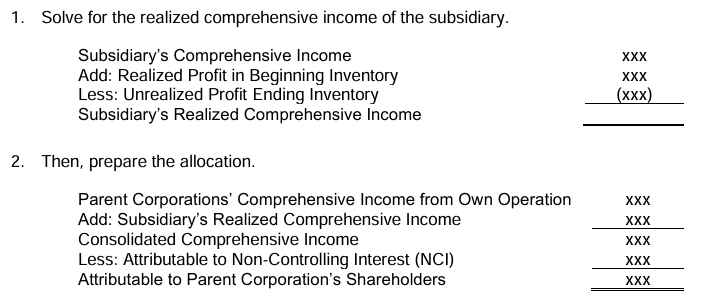

Upstream intercompany sales

sales from subsidiaries to the parent company

apportionment of unrealized intercompany profit to both the controlling and NCI

when the inventory is not resold to outsiders before the end of the period - there is now a difference in the elimination entries.

consolidated comprehensive income

differs from intercompany sales of merchandise in two (2) aspects: Intercompany sales of property, plant, and equipment (PPE)

First, intercompany sales of PPE between affiliated companies are unusual transactions.

Second, the relatively long useful lives of PPE require the passage of many accounting periods before intercompany gains or losses on sales of these assets are realized in transactions with outsiders.

Non-depreciable PPE.

eliminations are often needed in the preparation of consolidated financial statements for as long as the assets are held by the acquiring company.

When land is sold between affiliated companies at book value,

no special adjustments or eliminations are needed in preparing the consolidated financial statements.

It is because both the income and assets are stated correctly from a consolidated point of view, and thus, the seller will not record any gain or loss.

intercompany sale of land at gain

requires adjustments or eliminations in the consolidation process.

land must be reported at its original cost

in the consolidated financial statements as long as it is held within the consolidated entity, regardless of which affiliate holds the land.

Generally, gains and losses

are not considered realized by the consolidated entity until a sale is made to outsiders.

Unrealized gains and losses are eliminated in preparing consolidated financial statements

against the interests of those shareholders who recognized the gains or losses.

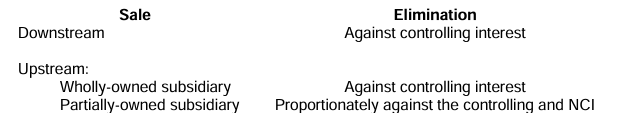

The direction of the sale determines which shareholder shall absorb the elimination of unrealized intercompany gains or losses.

when the assets are resold to outsiders

Unrealized intercompany gain on the sale of assets is viewed as being realized