2.6.3 supply-side policies

1/24

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

25 Terms

Supply-side policies

Focus on improving the structural long-term performance of an economy

Policies that increase productive potential (LRAS) of economy

*Focus is on LRAS, but can affect SRAS

Why can supply-side policies be good?

Lead to more possible production whilst also lowering PL IF productivity improves

May also improve some of the other macro objectives

What are the 2 different approaches to supply-side policies?

Market-based

Interventionist

Interventionist supply-side policies

Gov actively intervenes to correct market failure + improve economic efficiency

→ more spending, more tax, more control

e.g. investment in education + training, infrastructure spending

Market-based supply-side policies

Policies that aim to increase efficiency by removing barriers + letting free-market forces work better

→ less spending, less tax, less control

e.g. tax cuts, removing unemployment benefits, deregulation

Key difference between market-based + interventionist policies?

Market-based policies reduce government involvement and rely on competition

Interventionist policies involve active government spending + planning to boost supply

5 SSPs that I need to know

Change visa rules to encourage more skilled overseas workers

Cut corporation tax

Cut unemployment benefits

Increase spending on railway network

More relaxed rules for smaller firms on meeting health + safety requirements

Supply-side policies can either be fiscal/regulatory

→ What does this mean?

Fiscal: Gov is spending more or spending less OR increasing tax or reducing tax

Regulatory: Adding to/taking away gov laws + rules

Is ‘change visa rules to encourage more skilled overseas workers’ interventionist or market-based?

Fiscal or regulatory?

Interventionist

→ Gov is doing more to encourage number of potential workers in economy

Regulatory

→ Adding gov laws + rules on immigration

Is ‘cut corporation tax’ interventionist or market-based?

Fiscal or regulatory?

Market-based

→ Less gov taxation compared to before

Fiscal

→ Reduction of a tax

Is ‘cut unemployment benefits’ interventionist or market-based?

Fiscal or regulatory?

Market-based

→ Gov is intervening less in income payments

Fiscal

→ Decrease in gov spending

Is ‘increase spending on railway network’ interventionist or market-based?

Fiscal or regulatory?

Interventionist

→ More spending + more control

Fiscal

→ Increase in gov spending

Is ‘more relaxed rules for smaller firms on meeting health + safety requirements’ interventionist or market-based?

Fiscal or regulatory?

Market-based

→ Less control of firms

Regulatory

→ Change of a gov law

What is the economic effect of changing visa rules to allow more skilled overseas workers?

→ Improves labour force skills

→ By bringing in new, better quality resources

How does cutting corporation tax improve economic performance?

→ Increases incentives

→ Firms have more profit to invest in capital goods

Why might cutting unemployment benefit help the labour market?

→ Reforms the labour market

→ Encourages unemployed workers to search harder for work

What’s the benefit of increasing spending on the railway network?

→ Improves infrastructure

→ Helps firms transport raw materials + finished goods

What’s the impact of relaxing health & safety rules for small firms?

→ Promotes competition

→ Reduces costly regulations, helping smaller firms compete

All SSPs aim to? (3 things)

→ Increase productive potential: This is because the policy will lead to either more resources of a certain type (FoP)/better resources of a certain type

→ Lower the price level: If resources are also more productive, firms see lower costs, which they pass on in the form of lower prices

→ Maybe improve other macro objectives: E.g. there might be an increase in GDP growth/lower unemployment/lower inequality

Why does higher productivity lead to lower prices?

→ Firms can produce more with the same resources, their cost per unit falls

→ This allows them to cut prices while still earning profits, which reduces the overall price level in the economy

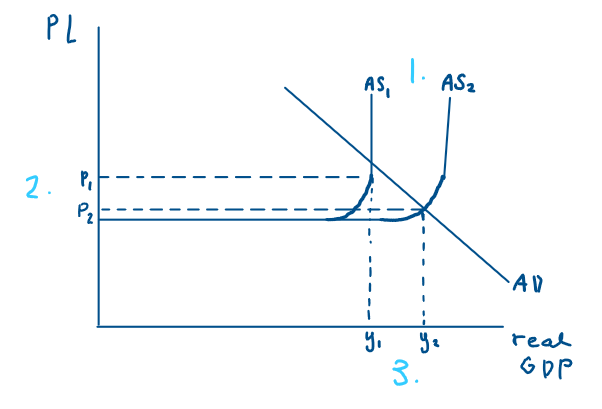

Which diagram links well to SSPs?

Draw it

→ Keynesian diagram

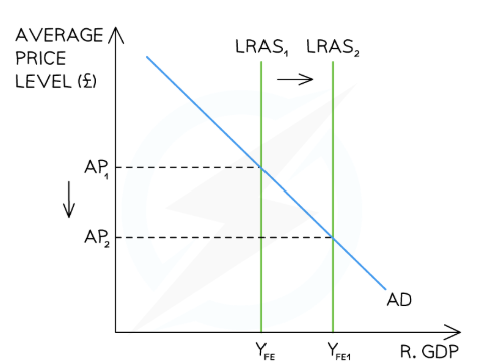

Increase productive potential

Lower PL

Maybe improve other macro objectives

SSPs classical diagram

Draw it

Evaluation points for the 5 SSPs

Negatively affects gov finances - p 2, 4

Takes a long time to work - p 1, 4, 5

Overly complex - p 1, 4

Bad for workers - p 1, 3, 5

May only have a short-term effect - p 2, 5

Strengths of SSPs?

Promote long-run economic growth

Reduce unemployment (structural)

Control inflation in long term

Improve balance of payments

Encourage enterprise + investment

Weaknesses of SSPs?

Very slow to have an effect

Expensive

No guarantee of success

May increase inequality

Can’t fix demand-side issues