money market

1/14

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

15 Terms

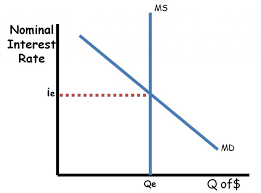

money market

nominal interest is the opportunity cost for holding money

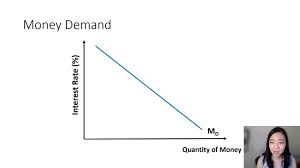

money demand

asset demand for money —> the desire to hold wealth as an money instead of other assets,

transaction demand for money—> GDP = C +Ig +G + Xn

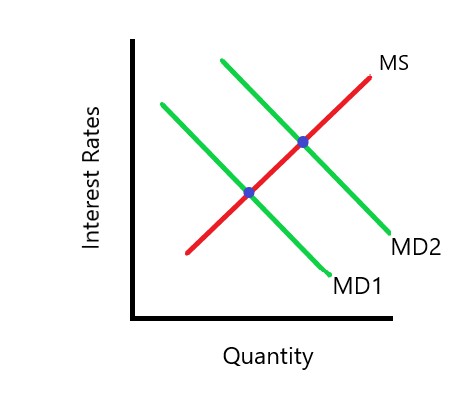

if asset demand or transaction increase/decrease

shift right/left

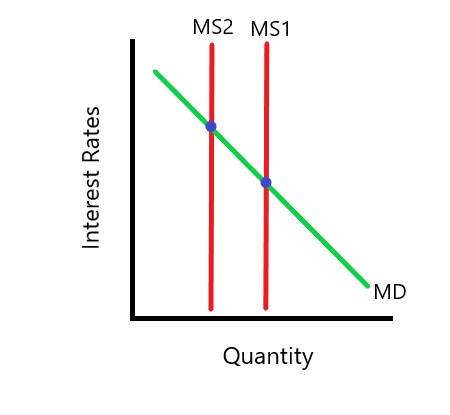

money supply

determined by actions of the central Bank and lending in the bank system

the money supply shifts to the right or shifts to the left

The Demand for Money:

Inverse relationship between interest rates and the quantity of money demanded

downwars sloping demand for money

The demand for money

Transaction demand for money: people hold money for everyday transactions

asset demand for money: poeple hold money since it is less risky than other assets.

expansionary monetary policy

increase money supply —> increases interest rate —> increases investment —> increases AD

buy bonds, lower discount rate, lower reserve requirement

Contractionary monetary policy

decrease money supply, increase interest rate, decrease investment, decrease AD

sell bonds, raise discount rate, reserve requirement

3 shifters of money supply

reserve requirement : reserve ration is the percent of deposits that banks must hold in reserve (the they can not loan out)

discount rate: the interest rate that the DEF charges commercial banks

open market operations: when the FED buys or sells government bonds (securities.)

1st money supply shifter

increased Reserve Req, —> Money supply decreased

decreased reserve req. —> increased money supply

2nd money supply shifter

increase discount rate —> money supply decreased

decreased discount rate —> money supply increased

3rd money supply shifter

FED Buys bonds —> money supply increase

FED sells bonds —> money supply decrease

federal funds rate

the interest rate that banks charge one another for one-day loans of reserves

FED influences them by setting a target and using open market operation to hit the target.

ample reserves

imply that banks have excess reserves beyond what is necessary to meet their reserve requirements and maintain liquidity.

raise administered rates or interest on reserves

contractionary policy

scarce reserves

imply that banks are operating with minimal excess reserves or even facing a deficiency of reserves relative to their obligations.

buy bonds, lower discount rate, lower reserve requirement