Monopolies

1/36

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

37 Terms

Concentrated market - definition

A market containing very few firms which have considerable market power.

Pure monopoly - definition

A single firm produces the whole of the output of a market or industry; there are no other firms to compete against

Characteristics of pure monopolies

One firm has 100% of market share

Imperfect/asymmetric information

Price makers

No substitutes

High barriers of entry and exit

Are pure monopolies likely?

No, in reality dominant firms are more likely.

Dominant firms - definition

Market dominated by a small number of firms, who can raise prices by restricting output.

What market share must a company have to be a monopoly or a dominant monopoly in the UK?

Must have a market share of 25% to be a monopoly, and 40% to be a dominant monopoly.

Monopoly power - definition

The power to act as a price maker rather than taker, allowing firms to set prices without worrying about competition from other firms.

Factors influencing monopoly power

Barriers to market entry

Number of competitors

Advertising

Product differentiation

Barrier to entry - definition

Strategies designed to block potential entrants from entering a market profitably.

They aim to protect market power of existing firms and so maintaining supernormal profits and producer surplus

How can technology both increase or decrease entry barriers in different markets?

Decrease: online platforms, cloud computers, 3D printing

Increase: Can reduce contestability in some markets, e.g. advanced tech in smartphones means new firms cannot compete with the likes of Apple.

Producer surplus - definition

The difference between the amount a producer is willing to sell for and what they actually get for it

Vertical integration - definition

When a firm owns multiple stages of production, i.e. supermarkets produce own brand food and sell it.

Natural vs man made barriers of entry

Natural (innocent) - Benefits existing companies hold due to economies of scale

Artificial - man made barriers, like patents or outpricing new firms by taking a loss - predatory prices

How do economies of scale lead to cost assymetry

Once internal economies of scale are fully exploited, firms have developed a unit cost advantage, so can afford to undercut new competitors and outprice them.

Barriers to exit - definition

The costs associated with a firm’s decision to leave a market/industry as they’re making subnormal profits

Examples of exit barriers

Lost goodwill with customers

Redundancy costs for workforce

Exit fees from rental agreements like leases on stores or equipment

Reduced value of owned equipment sold at rock-bottom prices in a fire sale.

Sunk Cost Fallacy - what is it?

A firm’s investment may be lost if it leaves the market, therefore firms are reluctant to realise their losses, which are unlikely to improve.

3 Types of advertising

Informative: promoting the product - shifts demand curve rightward

Persuasive - making products a ‘must have’ - makes demand inelastic

Saturation - Adverts everywhere - makes it hard for new firms to compete

Product differentiation - definition

Occurs when firms try to make their product different to the competition by adapting it or distinguishing it through advertising and branding

What does product differentiation provide?

A Unique Selling Point (USP) - a competitive advantage distinguishing one firm’s product from others. This ensures a degree of monopoly power

5 different ways products can be differentiated

Quality features

Function and design features

Imperfect information

Advertising

Location

How are quality/ function and design features differentitaed

Implementing features which other firms do not have

How can imperfect info contribute to product differentiation?

Makes consumers more aware of one firm’s products

How does advertising contribute to product differentiation?

Creates perceived differences between products from two different firms in the minds of consumers

How does location contribute to product differentiation?

If a product can only be bought from one product geographically.

Market power - definition

The ability of a business to set prices above a level that would exist in a highly competitive market.

How does market power allow firms to maintain high profits?

By using barriers to entry to prevent the profitable entry of new firms. Therefore making supernormal profits.

Supernormal profit - definition

The excess profit a firm makes above the minimum return necessary to keep a firm in business.

What’s the concentration ratio?

No. of biggest firms in the market : % of market share they hold.

What is the AR line equal to in monopolies?

Demand

What is the MC curve equal to in monopolies

Supply

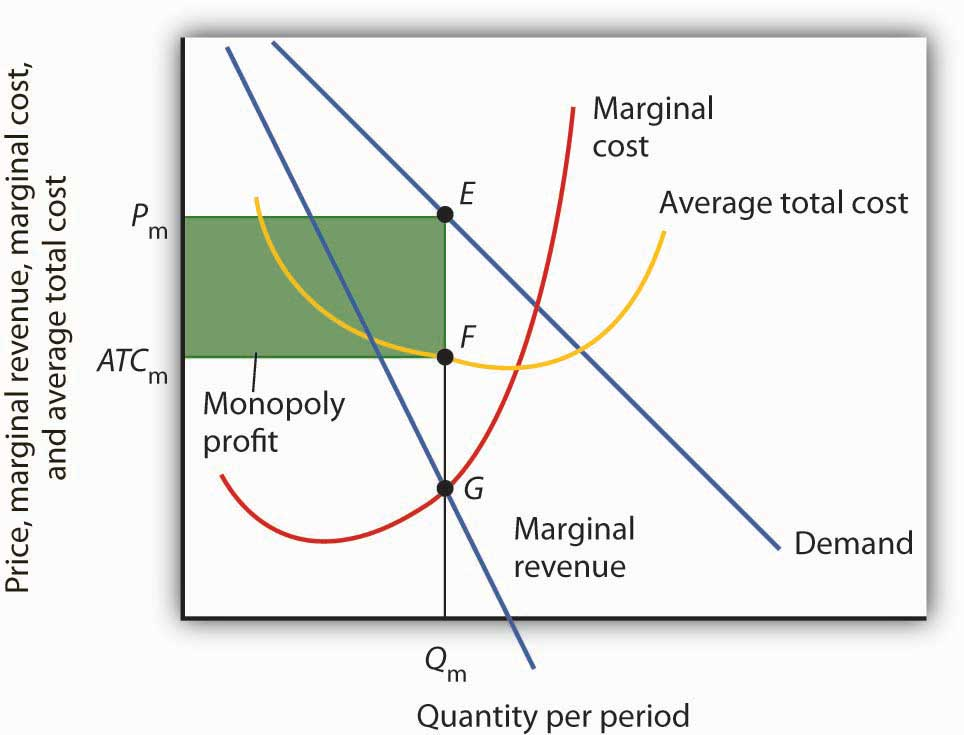

Costs, revenue and production curve in a monopoly

Profit maximisation point is MC = MR.

Allocative efficiency point is MC = AR (Supply = demand), this is at a lower price.

Productive efficiency = minimumum point of AC, also when AC = MC.

Disadvantages of monopoly power

-Prices are higher than in competition, as seen in the diagram, there’s a loss of allocative efficiency (Prices>MC).

-High prices diminish the real incomes of everyone, particularly affecting those on low incomes

-Absence of genuine competition may lead to X-inefficiencies like wasteful spending.

Arguments for monopoly power

-Profits can be used to fund extra capital investment and research projects

-Benefit from huge economy of scale, required to compete successfully globally

-Industry regulators act as proxy consumers, keeping prices down and standards high

-Price discrimination may help poorer people, as are able to provide some services for free.

4 policies to control monopoly power

Industry regulation: OFGEM sets an energy cap

Windfall tax: One off tax on supernormal profits of ,e.g. energy firms.

Trade liberalisation - free trade makes market contestable

Industry deregulation - lowers the barriers of entry

In the long run, how does a monopoly affect output and prices?

Output will decrease and prices will increase due to X-inefficiencies.

X-inefficiencies - definition

A firm’s inability to fully utilise its resources.