3.5 demand-side policies : monetary policy

1/79

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

80 Terms

demand-side policies

Policies that attempt to change aggregate demand in order to achieve goals of price stability, full employment, and economic growth, and minimize the severity of the business cycle.

monetary policy

Monetary policy refers to the government's use of interest rates and the money supply to influence the level of aggregate demand and economic activity. This is usually done by the country's central bank.

goals of monetary policy

- low stable inflation (2% target for most developed countries, higher more LDCs)

- low unemployment

- reduce business cycle fluctuations

- promote stable economic environment

- NX balance (balance of payments)

central bank influence on interest rate/money supply

- cannot directly control the equilibrium interest rate, they can influence it by altering money supply

- can not directly & independently increase/decrease money supply but use instruments to impact it

Do central banks directly set the interest rates charged by commercial banks?

No, commercial bank rates are determined by the equilibrium between money supply and demand in the money market.

How do central banks influence the equilibrium interest rate?

By altering the money supply using monetary policy instruments.

What does the money supply consist of in an economy with a banking system?

It includes both currency in circulation and demand deposits in banks

What is the Required Reserve Ratio (RRR)?

The fraction of demand deposits that commercial banks must hold in reserve, set by the central bank

What are required reserves?

Funds that commercial banks must keep to meet withdrawal demands, including deposits at the central bank and physical vault cash.

Are bank reserves part of the money supply? Why or why not?

No, because reserves are not held by the public.

What are excess reserves?

Reserves held by banks above the required minimum, which can be used to issue new loans

How do commercial banks create new money?

By issuing loans from excess reserves, increasing demand deposits.

What is the money multiplier?

It's the total amount of money ultimately generated per $1 of additional excess reserves.

How is the money multiplier calculated under certain assumptions?

Money Multiplier (m) = 1 / RRR

What happens to the money multiplier when the RRR decreases?

The money multiplier increases, enabling more money creation.

How does lowering the RRR affect the economy?

Increases excess reserves, increases loans and money supply, lowers interest rates, raises AD — an expansionary monetary policy (EMP).How does raising the RRR affect the economy?

How does raising the RRR affect the economy?

Decreases excess reserves, reduces loans and money supply, raises interest rates, lowers AD — a contractionary monetary policy (CMP)

What is the base rate?

The interest rate at which central banks lend to commercial banks; also called the discount rate (US) or refinancing rate (eurozone).

How does lowering the base rate influence the money supply?

It makes borrowing cheaper for commercial banks, encouraging more loans, increasing the money supply and AD — an EMP.

How does raising the base rate influence the money supply?

It makes borrowing more expensive, discouraging loans, decreasing the money supply and AD — a CMP.

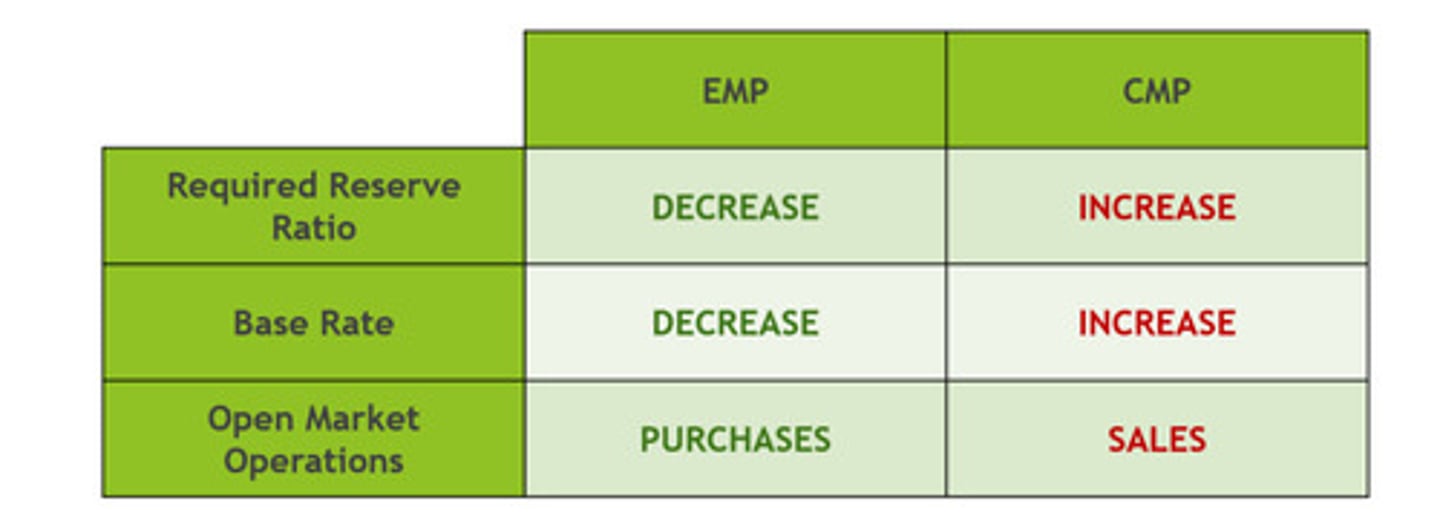

tools of monetary policy (HL)

1. open market operations

2. minimum reserve requirements

3. changes in the central bank minimum lending rate

4. quantitative easing

Open Market Operations (OMOs)

The buying and selling of government bonds by the central bank in the secondary market to influence the money supply

💡 Used to control short-term interest rates and influence economic activity.

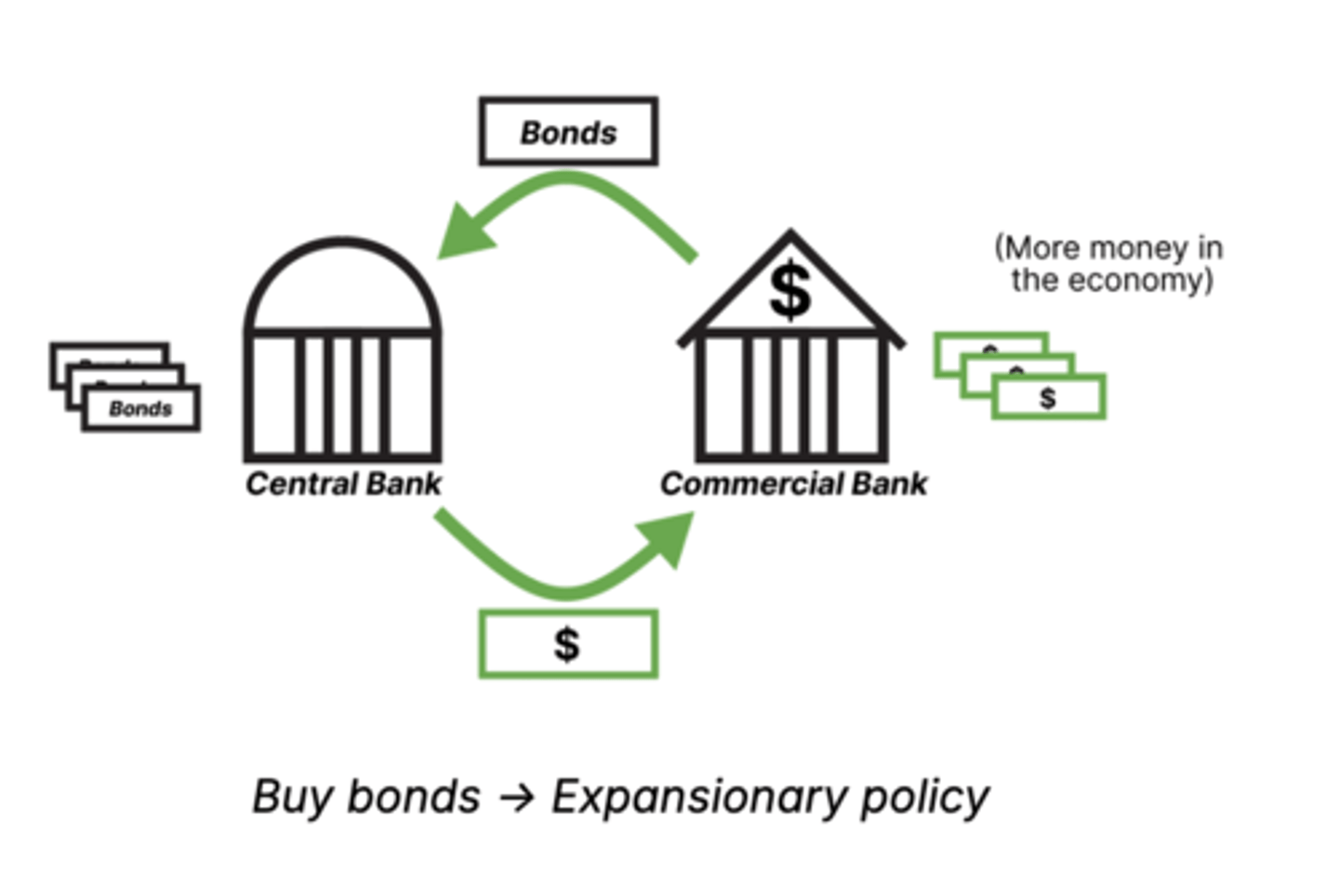

What happens during an open market purchase?

Central bank buys bonds from commercial banks, increasing their excess reserves and enabling more loans — an EMP.

bonds

A certificate issued by a government or private company which promises to pay back with interest the money borrowed from the buyer of the certificate: The city issued bonds to raise money for putting in new sewers.

bonds in super simple terms

When you buy a bond, you’re lending money to a company or a government.

In return, they promise to:

1. Pay you interest regularly (like a thank-you for lending them money).

2. Pay you back the full amount (called the “face value”) later on at a set date (called the “maturity date”).

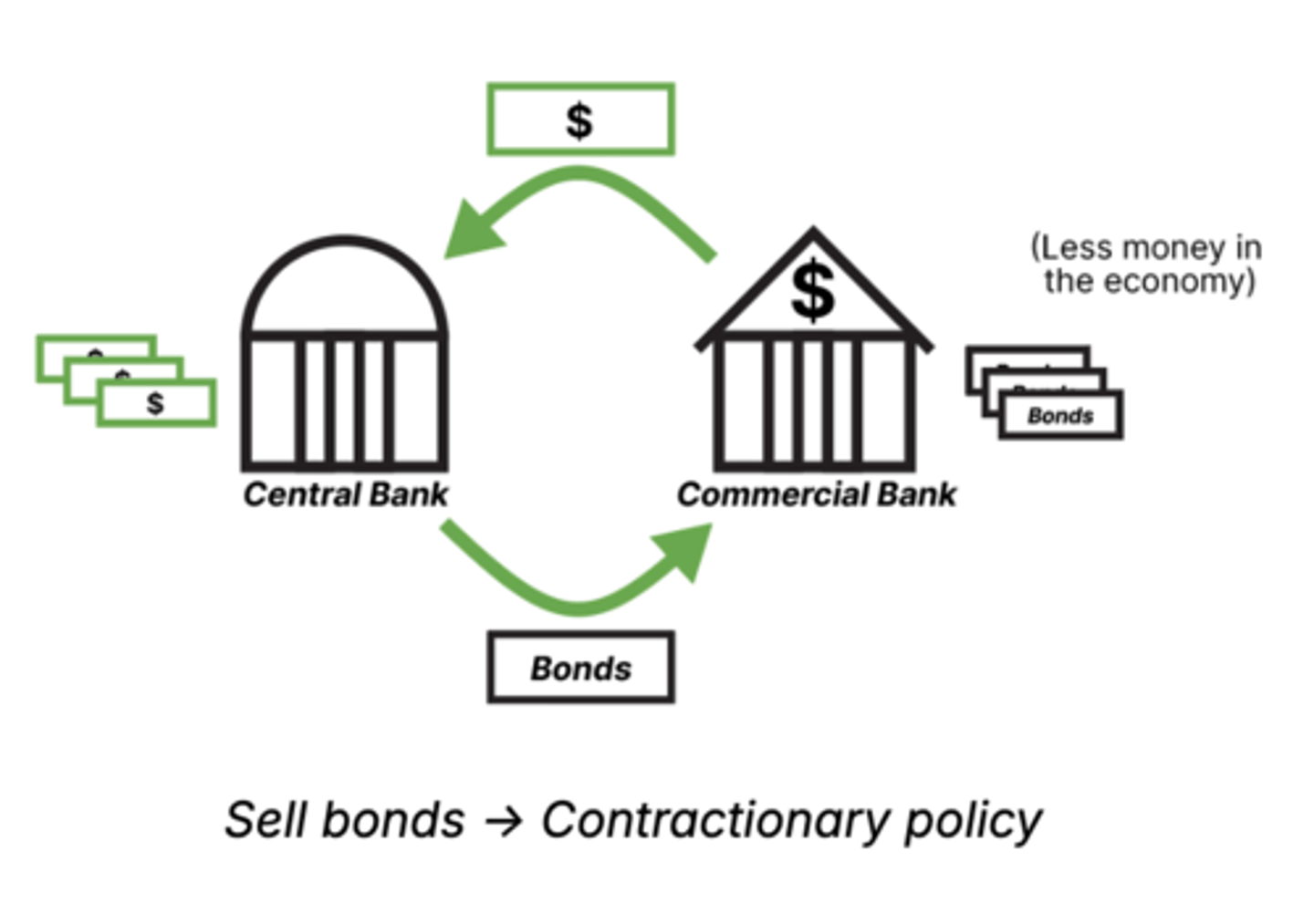

if the central bank sells bonds...

If the central bank sells bonds, it gets money while the buyer gets a bond. The central bank can lock this money up. This reduces the money supply in the economy, increasing interest rates and reducing inflation.

if the central bank buys bonds...

If the central bank buys bonds, it gets bonds while the buyer gets money. This increases the money supply in the economy, decreasing interest rates and encouraging economic growth.

minimum reserve requirements

A requirement by the central bank that sets the minimum amount of reserves that commercial banks must maintain to back their loans.

- Banks want to lend out as much money as possible, as they make more off of interest.

- The more money is lent out, the more money is invested and consumed.

🧱 Acts as a safety net and a way to control how much banks can lend.

if the central bank sets a minimum reserve requirement...

banks are obliged to keep a certain amount of customer deposits safe (not lending them out).

this decreases the amount of money lent out, indirectly decreasing investment and consumption.

If the central bank RAISES the reserve requirement:

Banks have less money to lend → less borrowing → slower economic activity.

If the central bank LOWERS the reserve requirement:

Banks can lend more → more borrowing → boosts spending and investment.

Changes in the Central Bank Minimum Lending Rate

(also called policy rate or base rate)

This is the interest rate at which the central bank lends money to commercial banks.

🔁 Directly affects interest rates in the whole economy.

if the central bank lowers this rate

It becomes cheaper for banks to borrow → they reduce their own interest rates → more loans to people and businesses → boosts the economy.

if the central bank raises the rate

Borrowing becomes more expensive → reduces inflation and slows the economy down.

how will commercial banks offset increase in this interest rate

- commercial banks have a higher cost of borrowing money

- commercial banks will offset this by raising their interest rates, making borrowing more expensive for households and firms.

- this decreases consumption and investment.

quantitative easing (QE)

A form of aggressive EMP where central banks purchase a wide range of financial assets on a large scale to inject liquidity.

QE is when the central bank creates new money (digitally) and uses it to buy financial assets (like government and corporate bonds) to inject money into the economy.

Quantitative Easing refers to the buying and selling of bonds, but on a larger scale (and more long-term) than OMOs, and involve riskier bonds (corporate instead of govt.)

QE goal

Increase money supply, encourage lending and investment, especially when interest rates are already very low.

when is QE used

QE is usually used during recessions or crises, like the 2008 financial crash or COVID-19, when normal tools aren’t enough.

What happens during an open market sale?

Central bank sells bonds to commercial banks, reducing excess reserves and restricting new loans — a CMP.

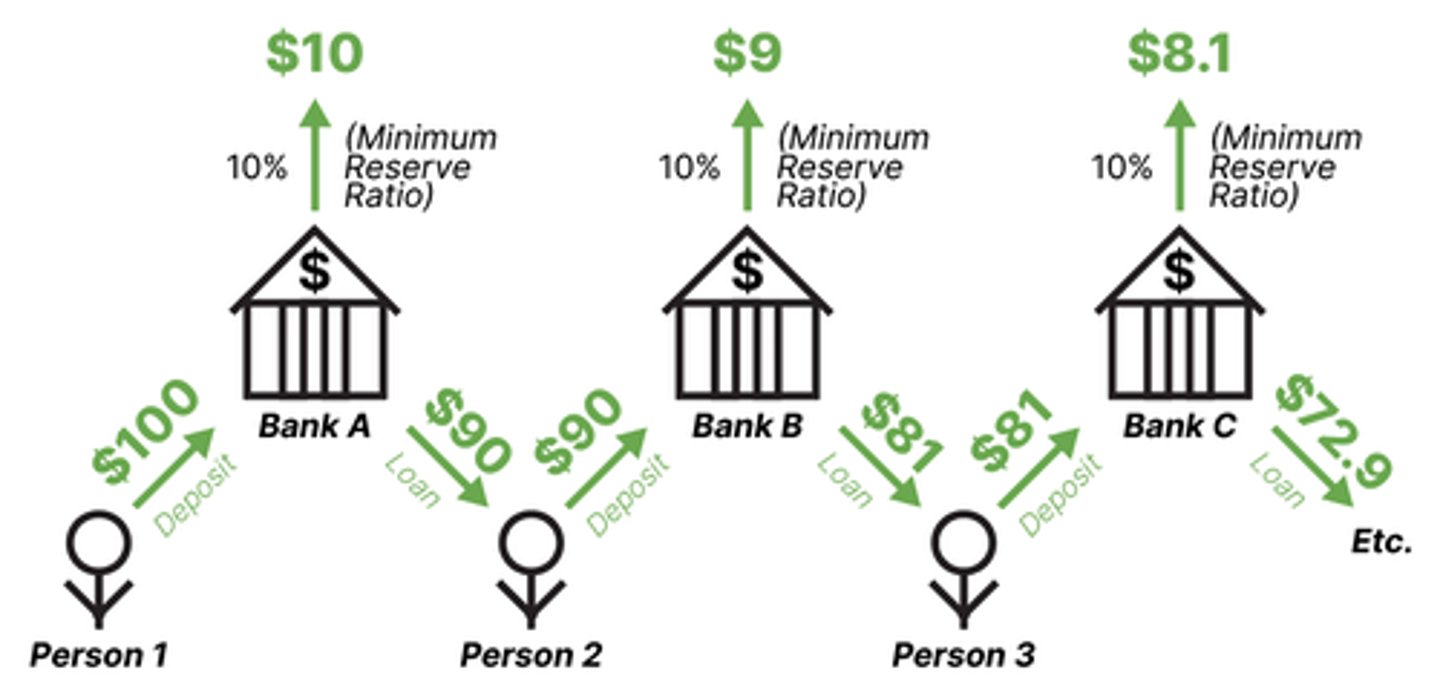

Money Creation by Commercial Banks (HL)

Commercial banks play a key role in creating credit (money) through a process called money creation.

💡 Banks don’t just store money—they create more by lending it out.

example of how money creation works

1. Person A deposits $100 in Bank A.

2. The bank keeps 10% (reserve requirement = $10) and lends out $90.

3. Person B deposits the $90 into Bank B.

4. Bank B keeps 10% ($9) and lends out $81.

5. This cycle continues, multiplying the money in the economy.

money multiplier

the amount of money the banking system generates with each dollar of reserves

= 1 ÷ reserve ratio (RRR)

money multiplier example

If reserve ratio = 10% → multiplier = 1 / 0.1 = 10

So a $100 deposit can lead to $1000 total money in the economy.

Lower reserve ratio

→ more lending → more money created

(if the ratio decreases, the banks can lend out more money, creating more)

Higher reserve ratio

→ less lending → less money created

(if the money increases the amount of money banks can create decreases)

Low MMR

= More money creation = More money = Cheaper borrowing = Cheaper investing = higher real GDP

nominal interest rate

The actual interest rate of a loan, regardless of inflation.

real interest rate

The interest rate of a loan adjusted to the inflation rate.

= Nominal Interest Rate - Inflation

in times of high inflation...

there might be a negative real interest rate:

the borrower pays interest, but it is lower than the inflation rate so the bank loses the real value of the loan.

functions of money

medium of exchange, unit of account, store of value

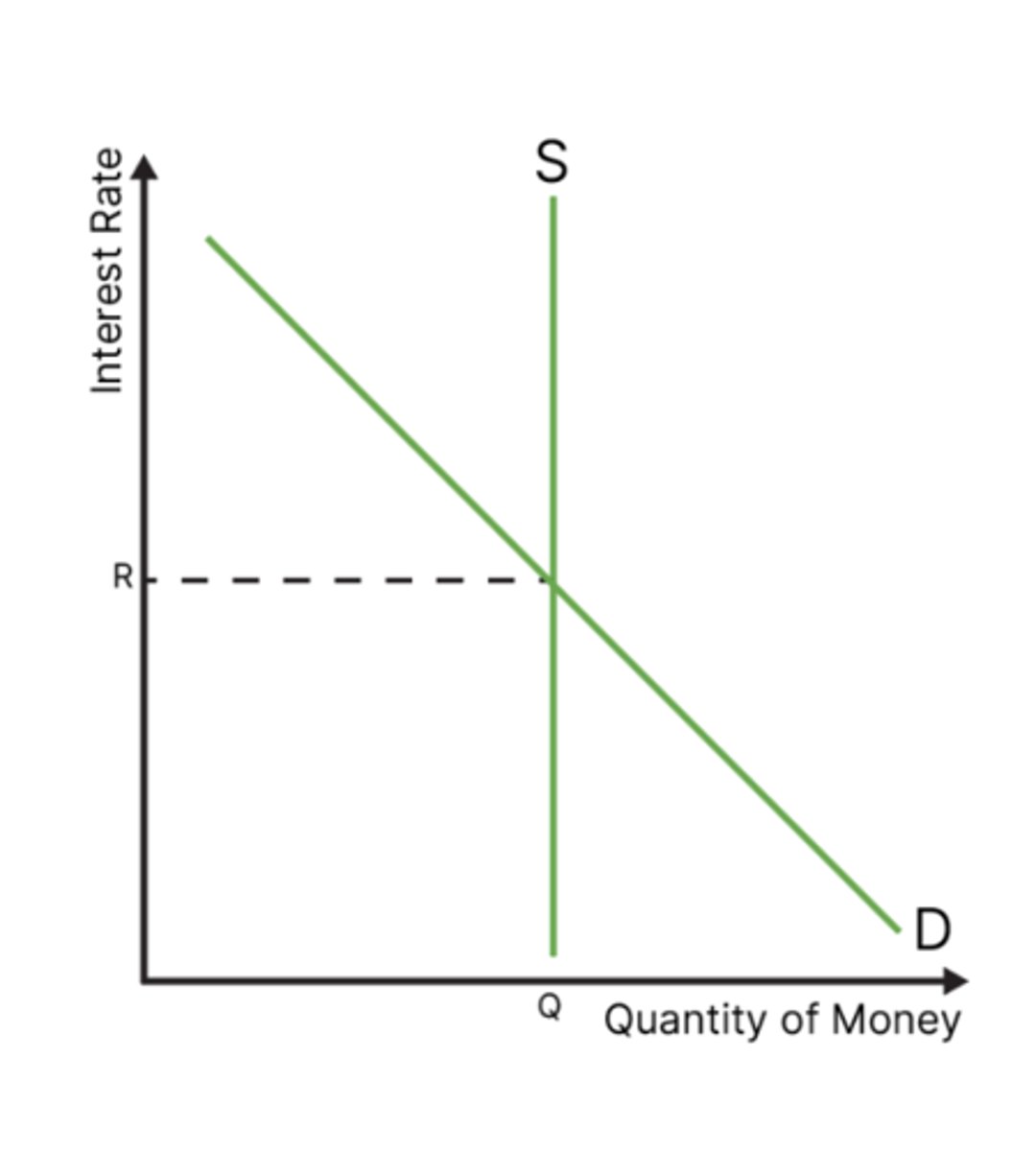

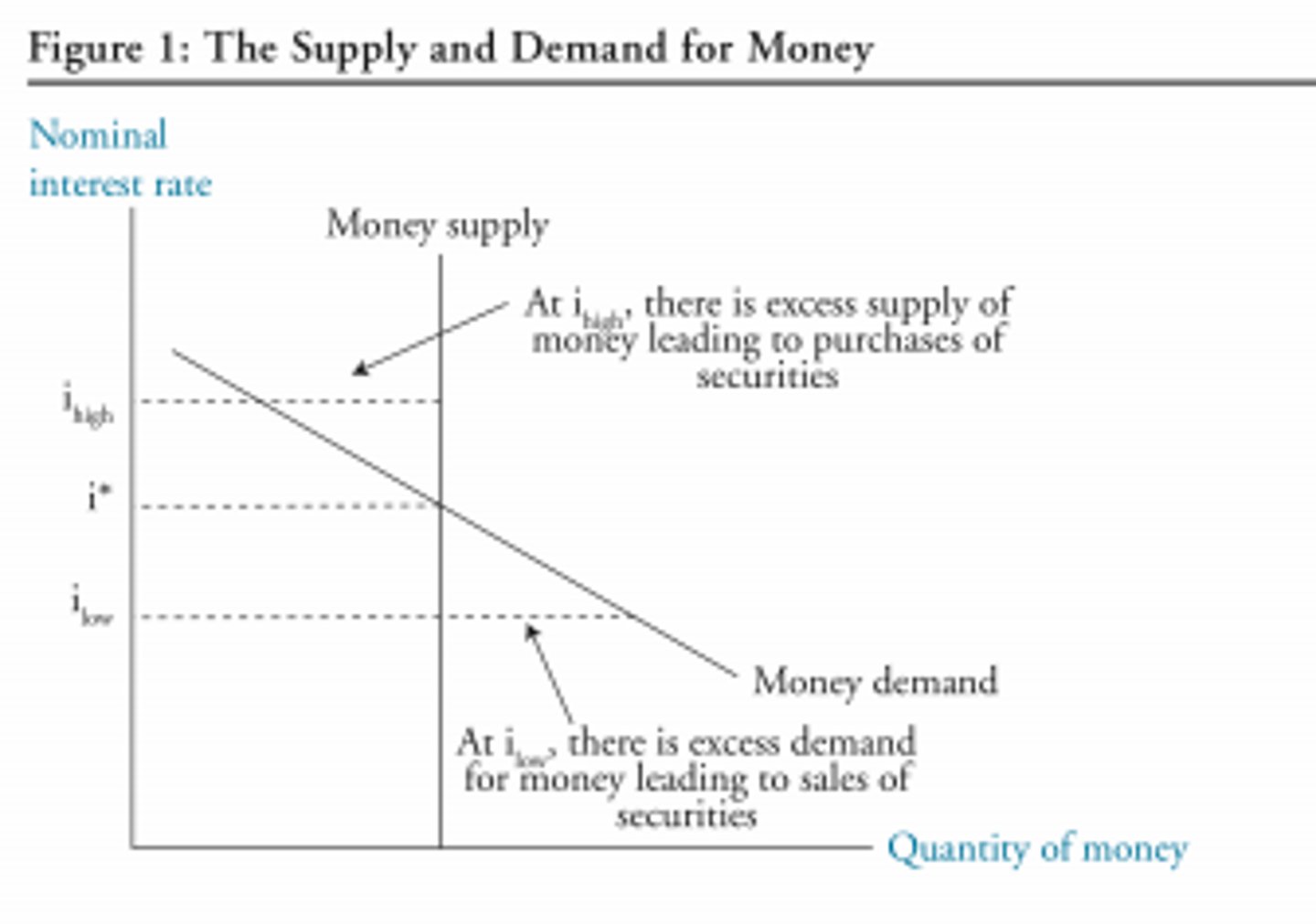

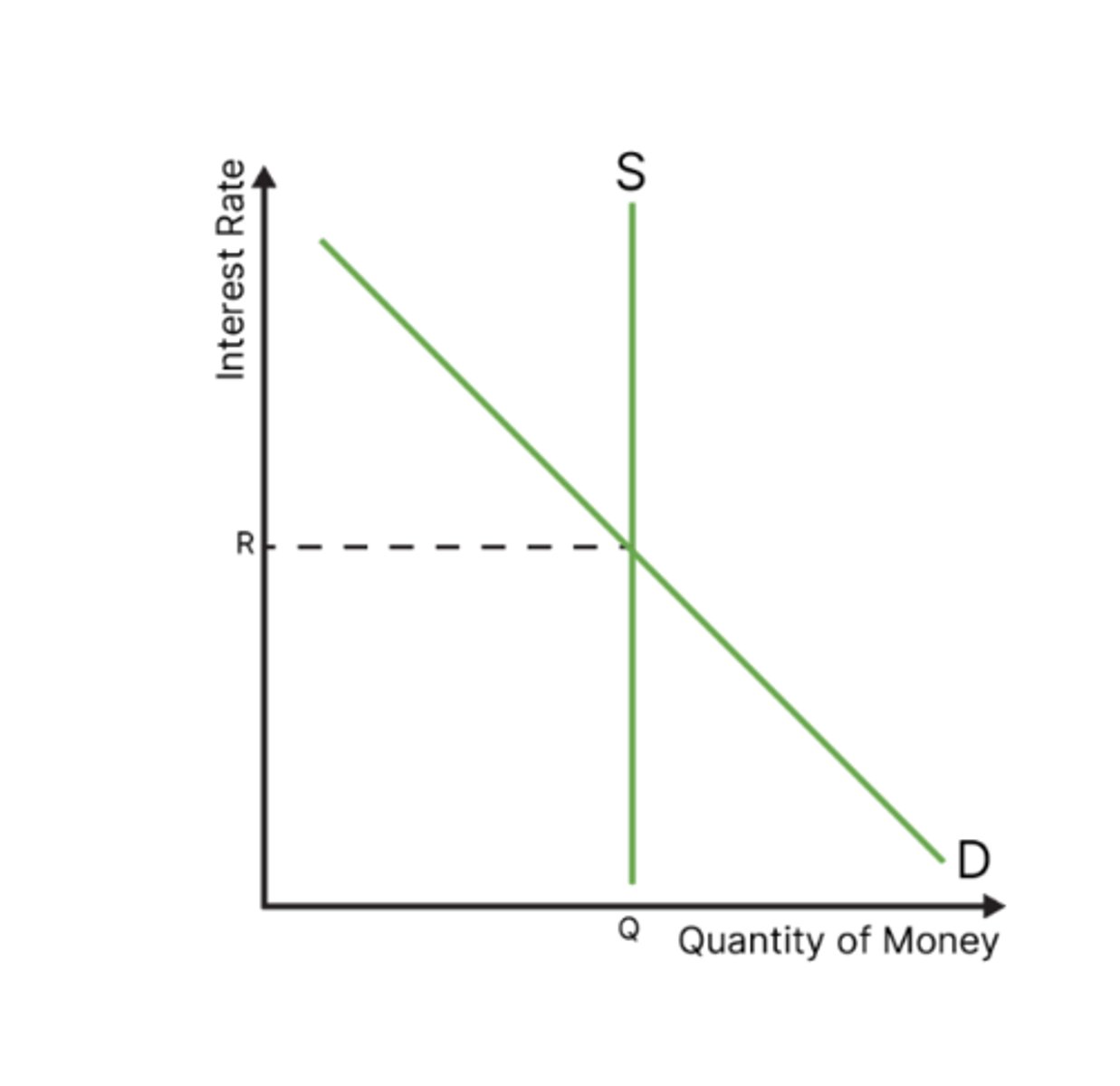

Demand and Supply of Money - Equilibrium Interest Rates (HL)

Demand of money: The total demand of money meant for spending

Supply of money: The total amount of money in circulation in an economy

Interest Rate on the y-axis

Quantity of Money on the x-axis

3 main reasons for demanding money

1. transaction motive : to facilitate everyday purchases

2. precautionary motive : to cover unexpected expenses or emergencies

3. speculative motive : to take advantage of future investment opportunities

demand for money curve

Dm illustrates the inverse relationship between Q. of money demanded and the interest rate

➜ as interest rates rise, the opportunity cost of holding money increases, leading to a reduction in Q. of money demanded

money supply

the total quantity of money circulating within an economy. this is controlled by the central bank.

vertical b/c it is a fixed policy variable (indicating that the quantity of money in circulation does not vary with changes in interest rate)

equilibrium in the money market

the equilibrium interest rate is determined by the intersection of the money supply and demand curves

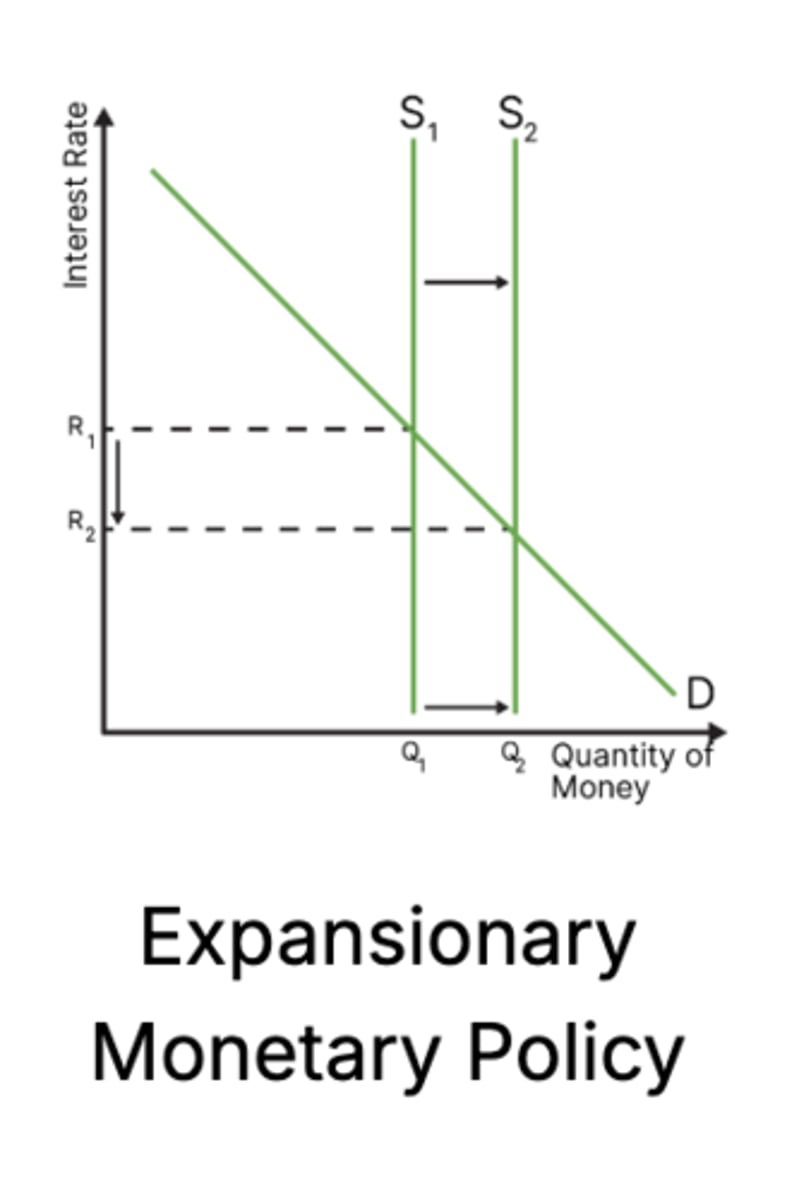

shift in supply of money (expansionary monetary policy)

an increase in the money supply will cause a fall in the equilibrium interest rate

If the central bank uses one of its tools for expanding the economy (expansionary monetary policy), the supply will shift to the right, as there will be more money in circulation. This lowers interest rates.

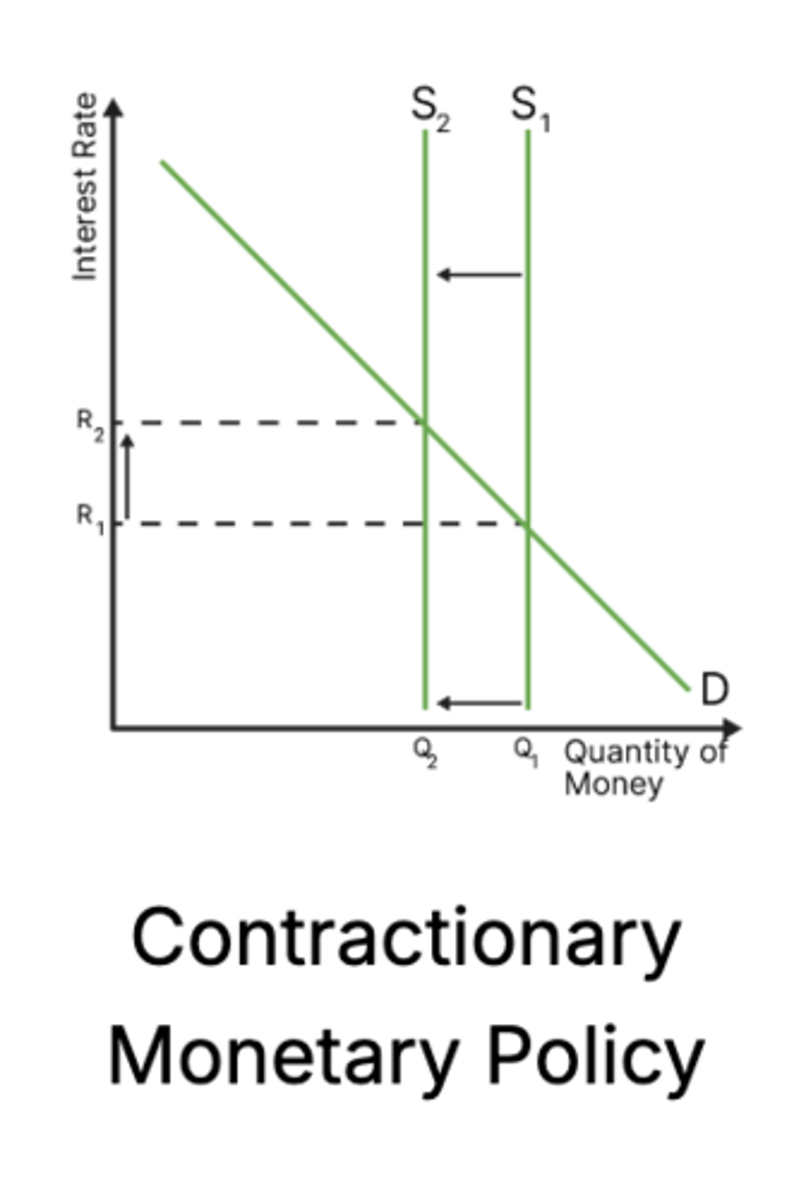

shift in supply of money (contractionary monetary policy)

a decrease in the money supply will cause a rise in the equilibrium interest rate

If the central bank uses one of its tools to slow down the economy, the money supply will shift to the left, as less money is in circulation. This leads to higher interest rates, making borrowing more expensive and reducing spending and investment.

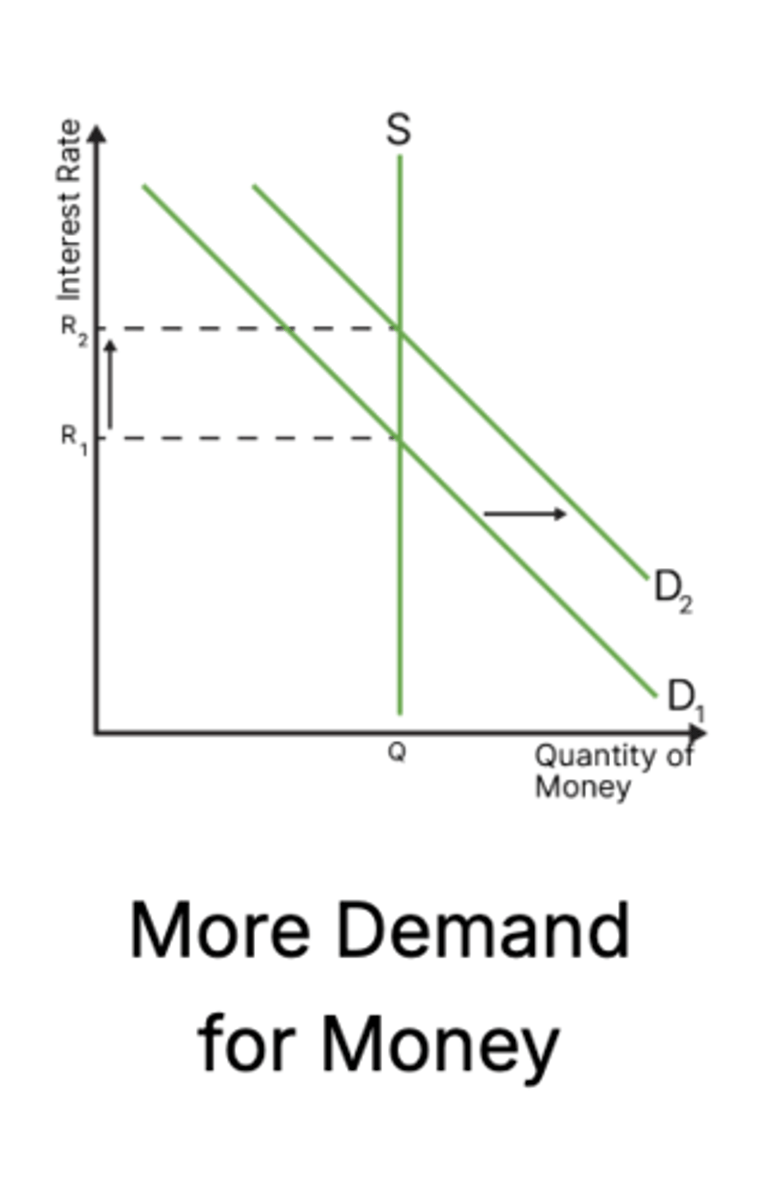

increase demand for money

If one of AD's components increases, there will be a general increase in the demand for money. This increases interest rates.

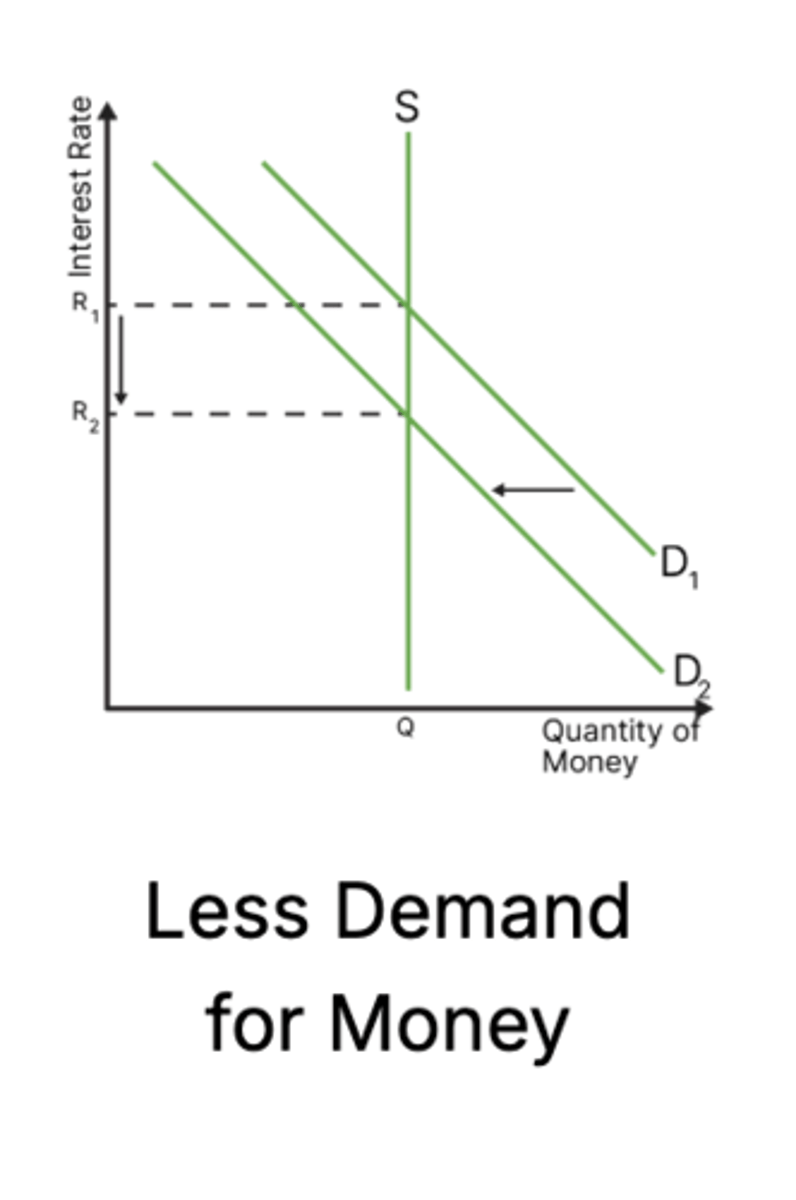

decrease demand for money

If one of the components of aggregate demand (AD) decreases (like lower consumer spending, investment, or government spending), the demand for money falls. This causes interest rates to decrease, as there is less need for borrowing in the economy.

target interest rate

when a central bank conducts monetary policy, it sets a target interest rate and adjusts the money supply to align the equilibrium interest rate in the money market with the target

→ serve as a benchmark, influencing all other interest rates in the economy, affecting overall economic activity & inflation

if target interest rate is above current equilibrium interest rate

central bank will reduce money supply until new equ. interest rate aligns with the target

if target interest rate is below current equilibrium interest rate

the central bank will increase the money supply until new equ. interest rate aligns with the target

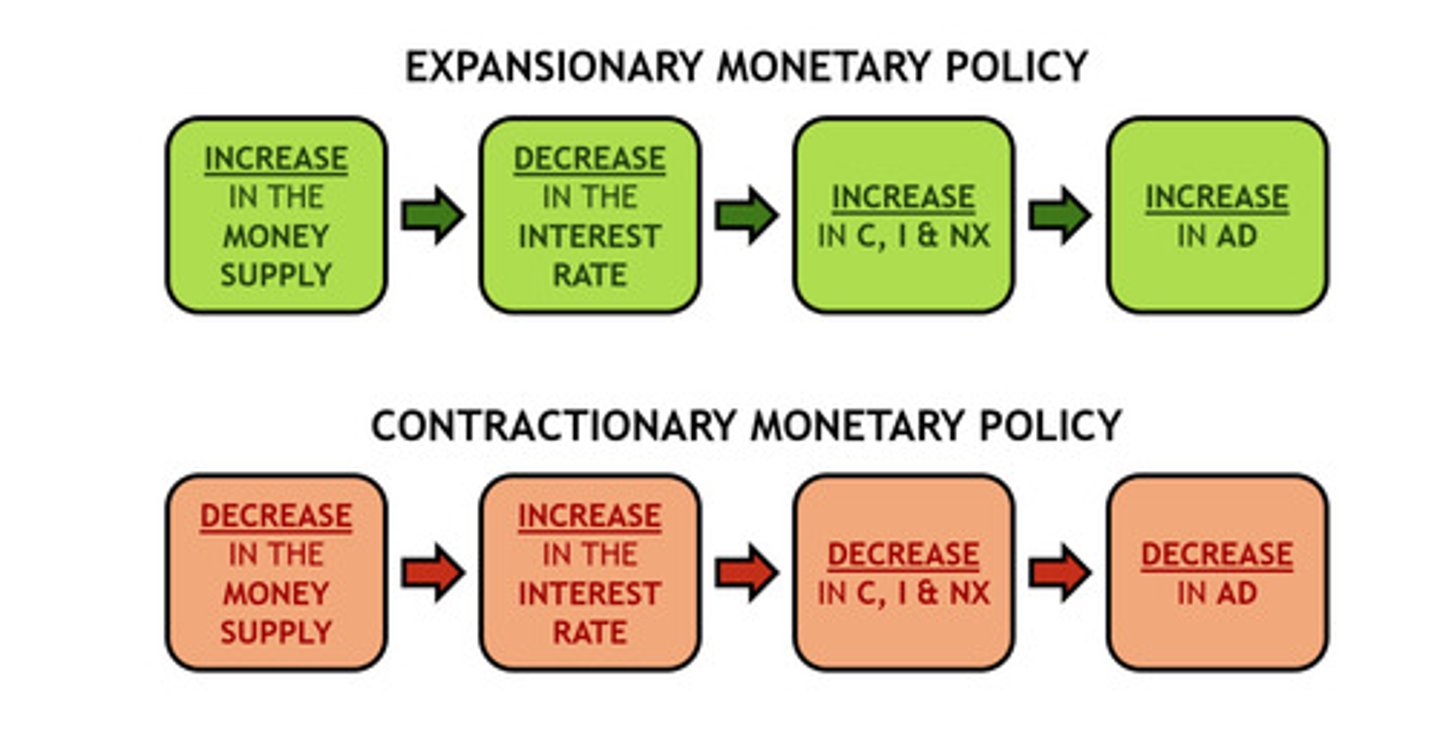

expansionary monetary policy

monetary policy that increases aggregate demand

ways to expand the economy

- Decrease minimum reserve ratio (so commercial banks can lend out more)

- Decrease the central bank interest rate (so commercial banks can take out cheaper loans, so consumers and firms hopefully also get cheaper loans).

- Buy government bonds (so there is more money in the economy)

- Buy corporate bonds (a.k.a quantitative easing, so there is more money in the economy)

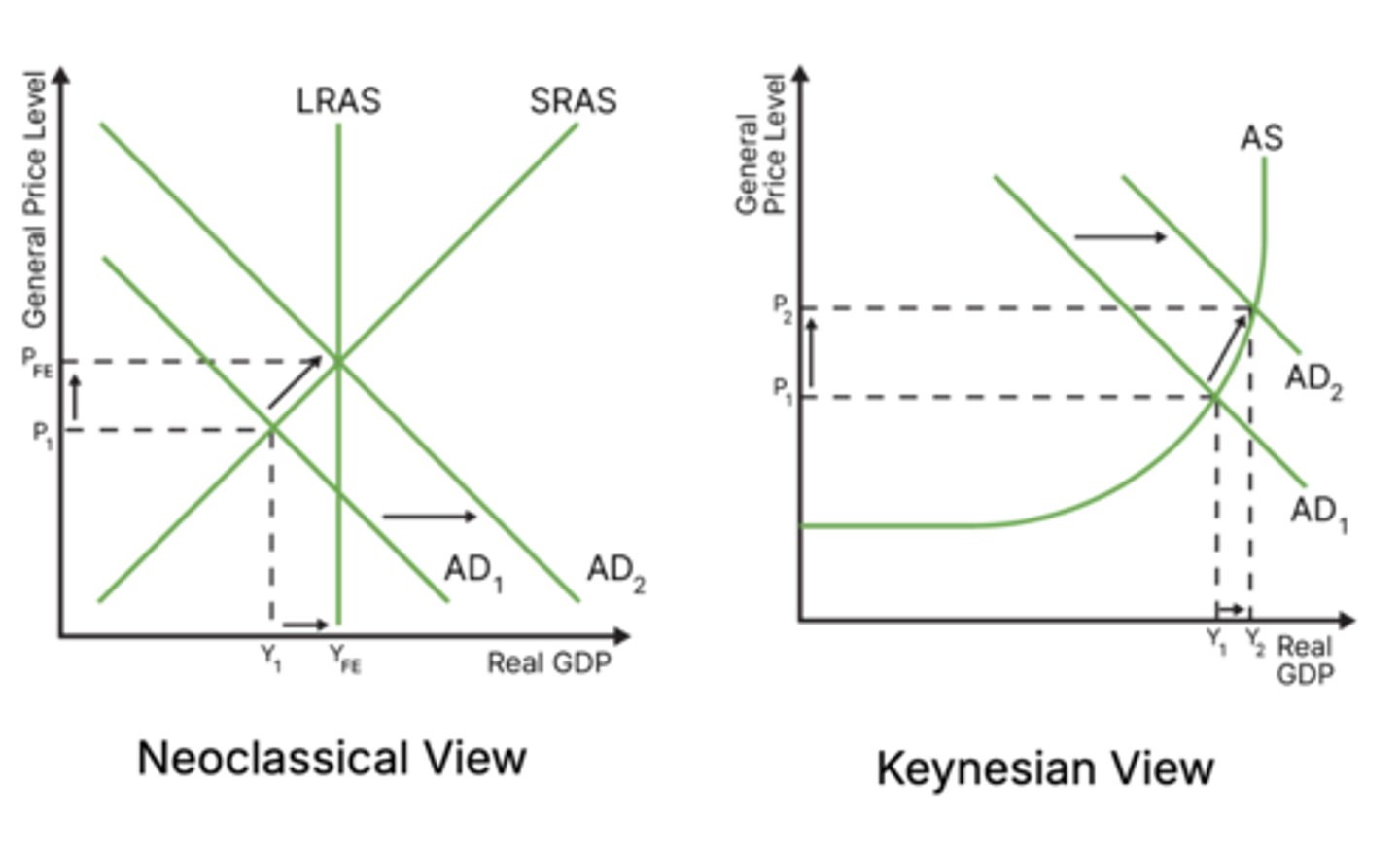

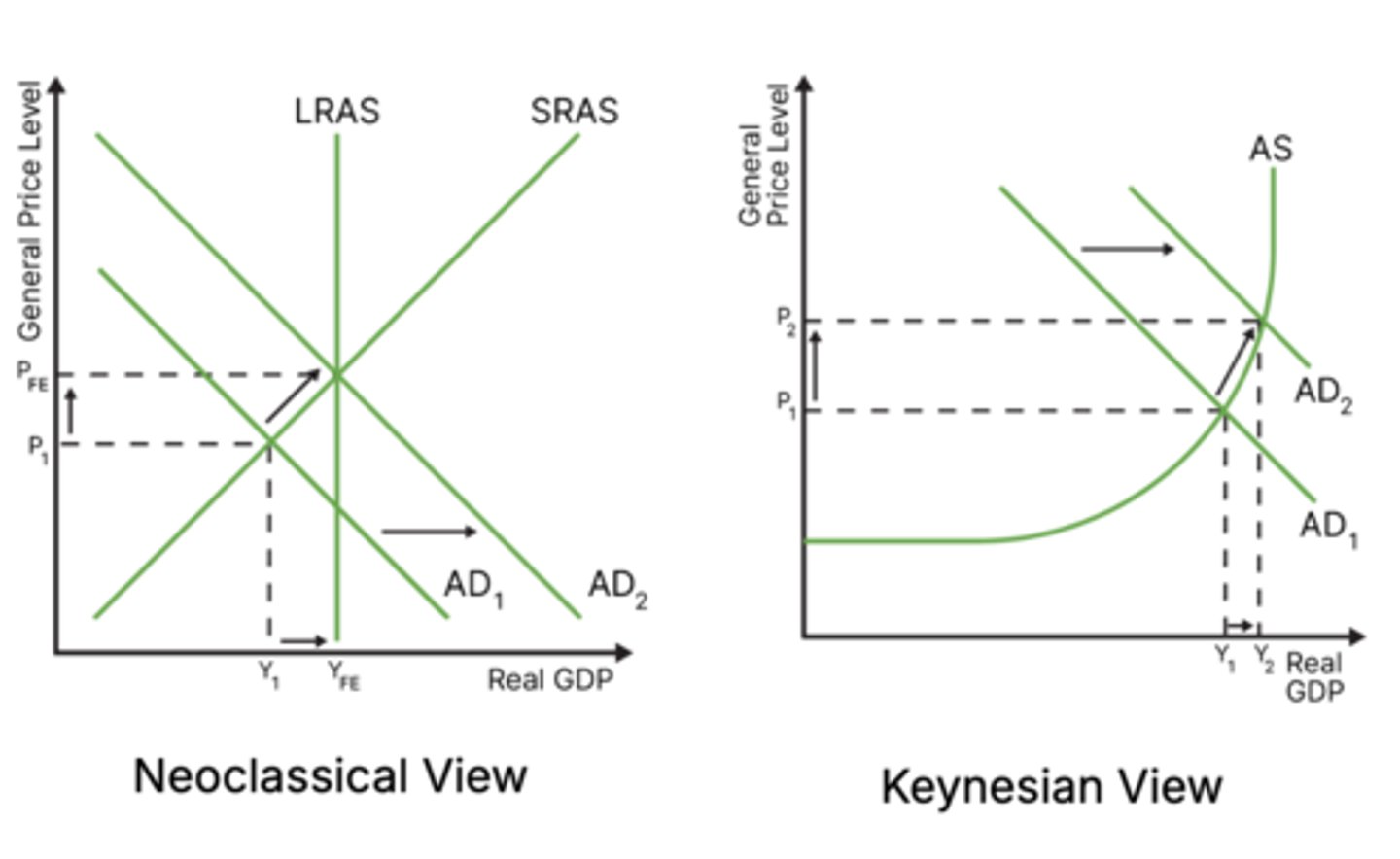

expansionary diagram explanation

- initial macro equilibrium: AP1Y1

- central bank wants to boost economic growth → lowers interest rates

- interest rates cause investment and consumption to increase (components of AD) AD increases

- new macro equilibrium: AP2Y2

- higher average price level and a greater level of national output

when is expansionary monetary policy used?

Used when the economy is weak—during recession, high unemployment, or low growth.

expansionary goals

Boost spending, increase demand, create jobs, and grow the economy.

expansionary effect on the economy

commercial banks receive cash for their bonds

→ liquidity in the market increases

→ commercial banks lower lending rates

→ consumers and firms borrow more

→ consumption and investment increase

→ AD increase

expansionary impact on macro aims

- economic growth increases and inflation rises

- unemployment may fall as output is increasing so more workers required

- net external demand worsens with higher price levels

- exports may decrease and with rising incomes, imports may increase

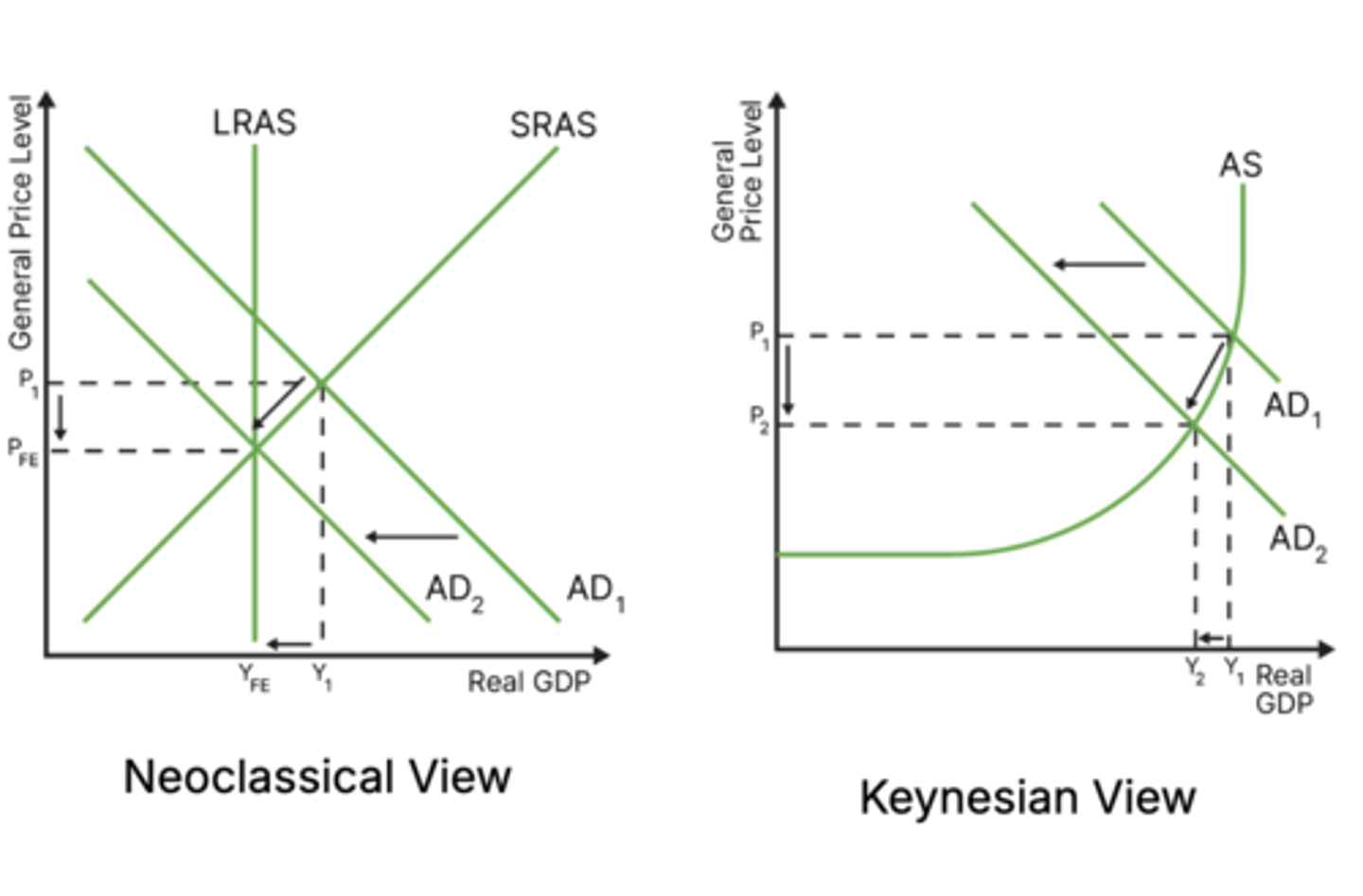

contractionary monetary policy

monetary policy that reduces aggregate demand.

This is for when you want to slow the economy down. This is usually done to lower inflation rates, but will also drag down real GDP with it.

ways to contract the economy

Increase minimum reserve ratio

Increase the central bank interest rate

Sell government bonds

Decreasing/stopping QE

Appreciating the exchange rate

when does a government use contractionary policy?

Used when the economy is overheating—with high inflation or unsustainable growth.

- Inflation is too high

-Economy is growing too fast

- Asset bubbles or demand-pull inflation is present

contractionary goals

Reduce spending, slow inflation, and stabilize the economy.

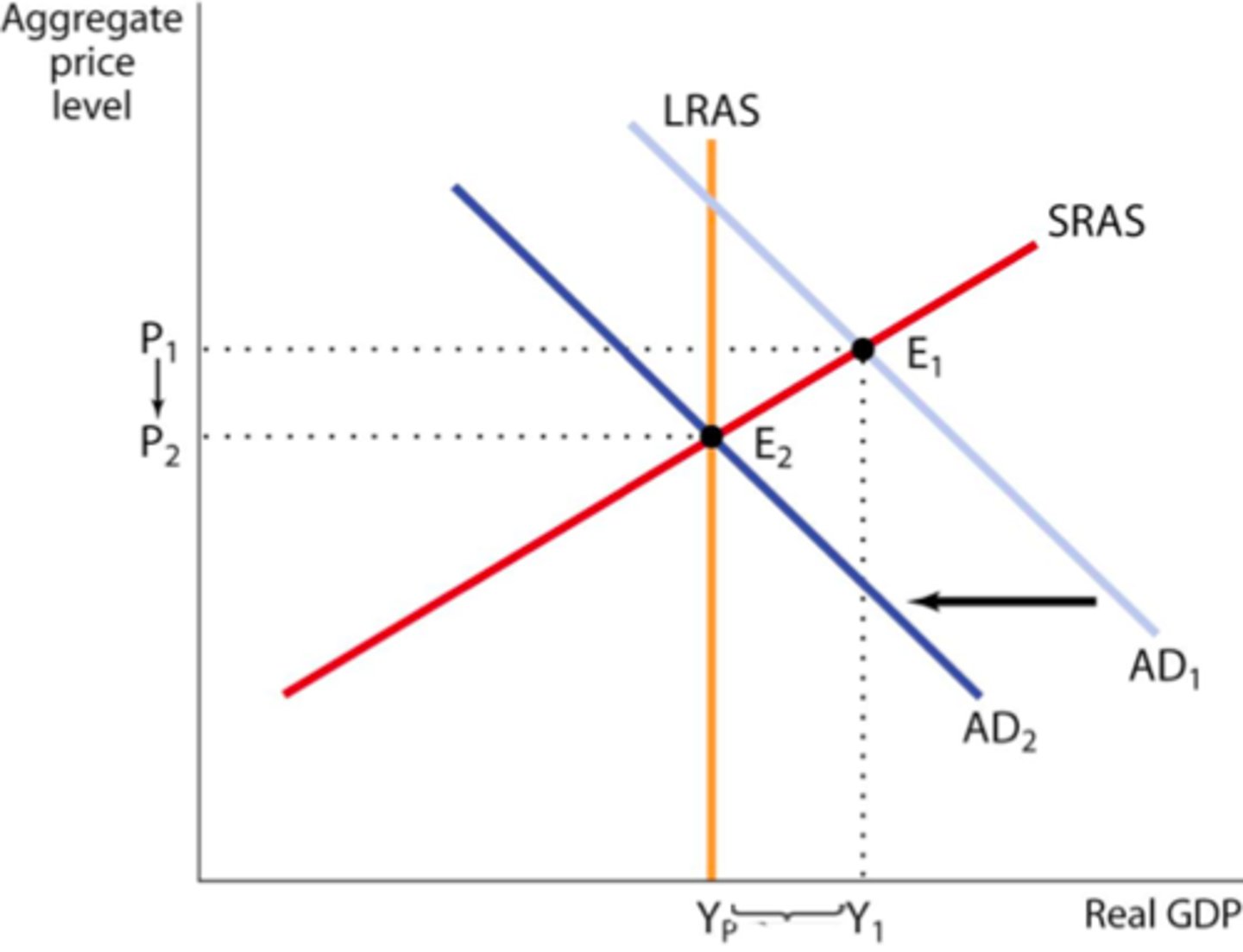

contractionary diagram analysis

- macro equilibrium: AP1Yfe

- central bank wants to lower inflation towards target of 2% → increases interest rates

- high interest rates cause investment and consumption to decrease

- AD1 → AD2 (AD decreases)

- economy reaches new equilibrium AP2Y1

- lower average price level and a smaller level of national output

contractionary effects on economy

existing loan repayments for households become more expensive

→ discretionary income reduces

→ consumption decreases

→ total demand falls

firms are less likely to borrow ⇒ less investment in capital takes place ⇒ AD falls

"hot money flows" increase ⇒ the exchange rate appreciates ⇒ exports more expensive and imports cheaper ⇒ net exports reduce ⇒ AD decrease

contractionary impact on macro aims

- economic growth slows

- inflation eases

- unemployment may increase as output is falling and fewer workers are required

- net external demand is likley to worsen

- both exports and imports reduce

- exports more expensive due to higher exchange

- imports cheaper households have less income for imports

expansionary vs contractionary monetary policy

strengths of monetary policy

Incremental, flexible, and easily reversible: Unlike other forms of policy, changing monetary policy can be quickly done by the central bank. When they raise interest rates, for example, this is often done +0.25% at a time.

Short time lags: Most central banks are independent of the government's politics. They were designed this way so policies can be implemented quickly without votes and bureaucracy.

weaknesses of monetary policy

The effectiveness of lowering interest rates decreases when close to 0: When interest rates are already very low, it is hard to lower them further. Other forms of monetary policy therefore need to be used, but they can be more expensive.

Low consumer and business confidence: Monetary policy such as interest rates can often reduce confidence in markets such as housing, reducing consumption and investment.

tools of EMP & CMP