5.2 - Marshallian externalities & multiple equilibria

1/15

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

16 Terms

Marshallian externalities

Local positive externalities that increase with size of industry

Lead to geographical agglomeration

Local knowledge spillovers

Input-output linkages

L market pooling etc

Static model - can switch equilibria with out any fundamental changes

Dynamic CA changes fundamentals

Marshallian externalities (ME) model - Harrison & Rodriguez-clare (2010) - Assumptions

Small open economy

2 sectors & 1 FofP (L)

Sector 1 has constant RtS (& no externalities)

Sector 2 has ME (constant RtS at firm level but L can have increasing productivity)

Marshallian externalities (ME) model - Harrison & Rodriguez-clare (2010) - Results

Under certain conditions, multiple equilibria arise

Equilibria in complete specialisation in 2 superior to 1

Economy has latent advantage in 2 but due to coordination failures it fails to exploit it (specialises in 1)

As externalities take time to realise, countries may have dynamic CA in sector not currently specialised in

may justify protection / IIP - policy can swap it to new CA without any fundamental changes

Marshallian externalities (ME) model - Harrison & Rodriguez-clare (2010) - maths

1: L produces λ1 units of 1

2: L produces λ2(1+αMin(Lbar,L2)

externalities increasing with employment but exhausted when L in sector teaches Lbar

θ ≡ 1 + αLbar > 1 = max benefits from clustering in 2 1 + α = max benefits

If L2 > Lbar the max level of productivity = θλ2

p* is world price of good 2 p*=p*2 / p*1

Marshallian externalities (ME) model - Harrison & Rodriguez-clare (2010) - specialisation in good 1

wage = λ1p*1 if specialised in good 1

unit cost of producing 2 (with no cluster benefits) = w/λ2 = p*

Hence, complete specialisation in good 1 is an equilibrium if and only if p* <= λ1/ λ2

p*=p*2 / p*1 = (w/λ2) / (w/λ1) = λ1/ λ2

Marshallian externalities (ME) model - Harrison & Rodriguez-clare (2010) - specialisation in good 2

wage = λ2p*2θ

Hence, complete specialisation in good 2 is an equilibrium if and only if θp* >= λ1/ λ2

p*=p*2 / p*1 = (w/θλ2) / (w/λ1) = λ1/θλ2

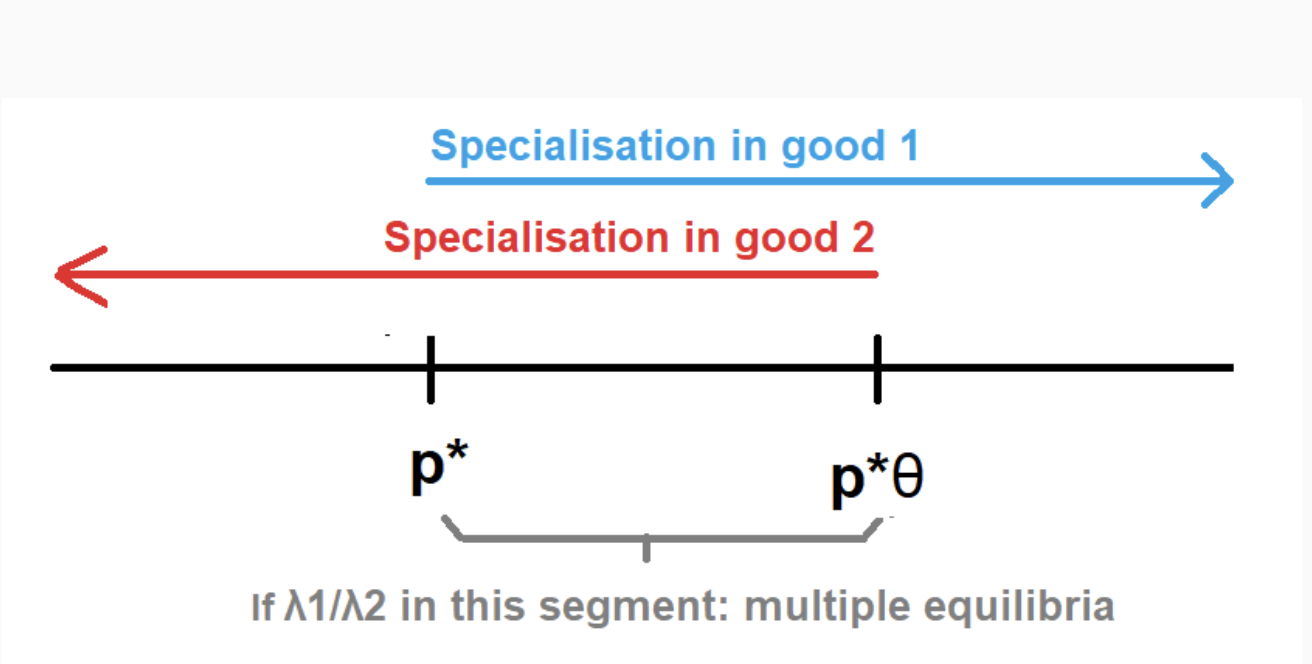

Marshallian externalities (ME) model - Harrison & Rodriguez-clare (2010) - multiple equilibria

There is multiple equilibria if and only if:

p* <= λ1/ λ2 <= θp* CONDITION 1

θ > 1 as α > 0 & θ = 1 + α

If no externalities then p* only equilibrium

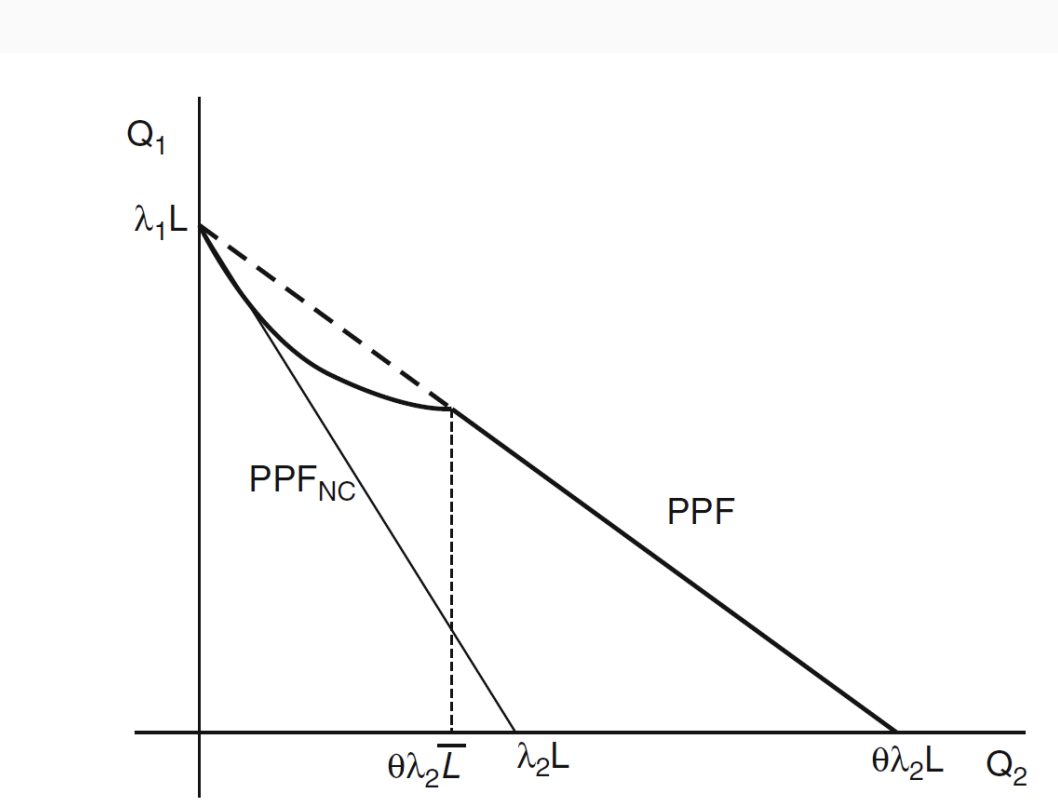

Marshallian externalities (ME) model - Harrison & Rodriguez-clare (2010) - multiple equilibria graph

θ = λL (determined by L assigned to each sector)

Externality causes line to turn as L increase = externality UP = Productivity UP

Turns until limit of Lbar then back to linear PPF with 1 factor

Marshallian externalities (ME) model - Harrison & Rodriguez-clare (2010) - wages in multiple equilibria

If complete specialisation in 1: w = λ1p*1

2: w = λ2p*2θ

Therefore if condition 1 satisfied then w2 > w1

Marshallian externalities (ME) model - Harrison & Rodriguez-clare (2010) - latent CA (LCA)

LCA in good i if: OC of this good when ME realised < pw

For good 1: λ2θ/ λ1 <= 1/p*

For good 2: λ1/ λ2θ <= p*

Specialisation may still occur in 1 as nation has static CA in it and so isnt realising all ME

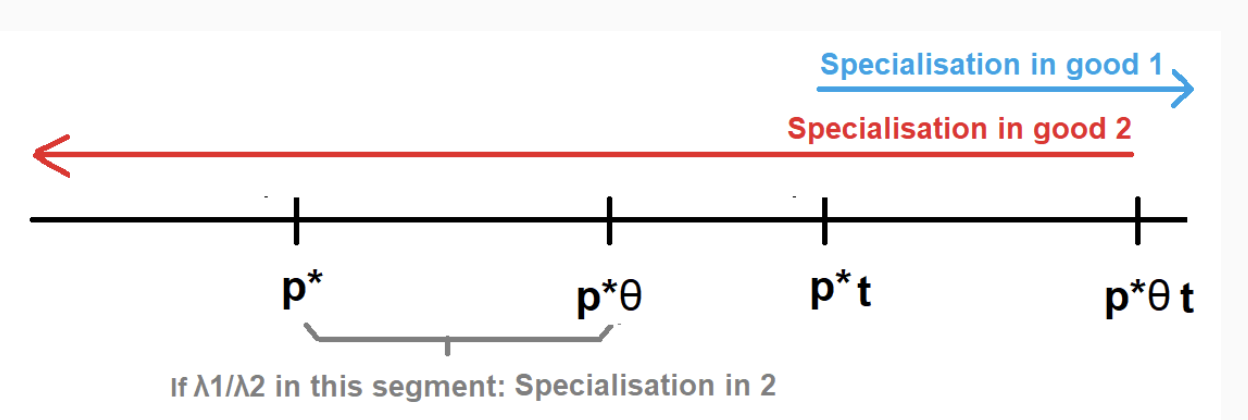

Marshallian externalities (ME) model - Harrison & Rodriguez-clare (2010) - Using a tariff

By using a tariff, consumers only see modified p - may cause switch to better equilibrium → Welfare rises

If p2 price increased enough by t → OC of producing 1 high enough to switch specialisation to 2

p = p*t2 = p*2t2 / p*1 > p*

Once economy has switched specialisation then tariff can be removed

Marshallian externalities (ME) model - Harrison & Rodriguez-clare (2010) - Endogenous prices

Previously we have assumed p* is exogenous - in reality p* is determined by RoW productivity

Rich nations already enjoy lower costs of cluster in 2

lower costs shown by p*

For developing nation to have LCA in 2 it must have deep parameters to sustain advantage

α & Lbar need to be higher than in developed

Large developing can realise more ME as shift moreL

Technology affects α but unlikely to only affect developing

Marshallian externalities (ME) model - Harrison & Rodriguez-clare (2010) - Endogenous prices implications on model

Assume 2 is K & H intensive relative to 1

Specialising in 1 = low levels of K&H + lower TFP

By shifting specialisation to 2 through policy, endogenous accumulation of K&H

Low K stock & TFP in developing caused by not exploiting LCA

Either cant exploit or not enough access to K market to exploit

Marshallian externalities (ME) model - Harrison & Rodriguez-clare (2010) - Dynamic externalities problem

Model is static not dynamic

With international knowledge spillovers we have to add conditions for specialisation transition from 1 → 2

took China 20-30yrs to realise gains

2 needs large externalities + improvement in productivity at fast pace

Faster change = more benefits & shorter protection

Protection losses < discounted gains

Marshallian externalities (ME) model - Harrison & Rodriguez-clare (2010) - Dynamic externalities problem & policy

Policy needs to shift resources quickly

OR a large enough externality underlying to get to new equilibrium quickly naturally

Marshallian externalities (ME) model - Harrison & Rodriguez-clare (2010) - Exceptionality

Does a policy to achieve LCA pass Mill test

if all economies protect some industry to achieve LCA then not optimal - even with productivity gains

Never reach frontier as efficient for producers to stop producing before CA level (p < p*)

Protection only passes Mill test only if nation has LCA in protected sector

China has LCA as largest economy of L in Manu

Realised the gains so other similar nation (india) cant overturn its realisation

India may have own LCA in tech but needs exceptionality to force switch in specialisation