Market Failure in the Financial Sector

1/9

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

10 Terms

What are the types of market failure in the financial sector?

asymmetric information

speculation and market bubbles

negative externalities

moral hazard

market rigging

What is asymmetric information?

Where one party knows more then the other in the transaction.

Two examples of asymmetric information in the financial sector are:

Bankers knew much more about their subprime mortgages than the people they were selling them to.

Bankers knew far more about banking than the financial regulators who were meant to be monitoring their behaviour.

Before the 2008 financial crisis, bankers speculated that:

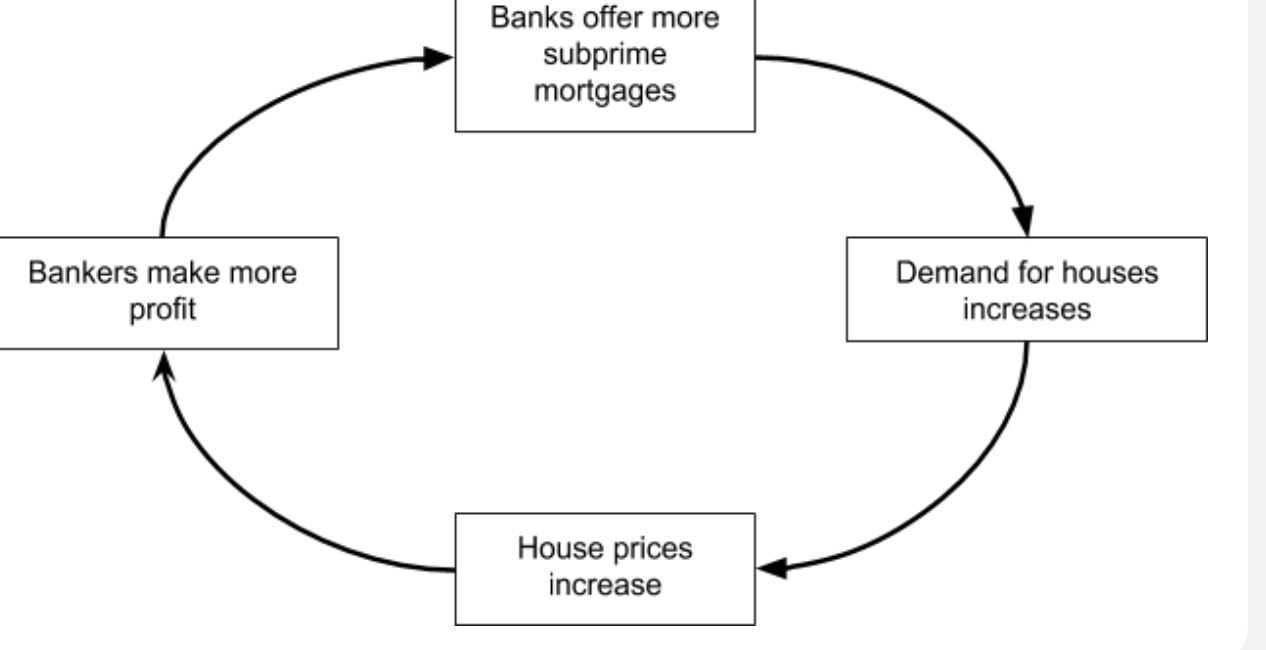

The cycle of increasing demand for housing, which increased house prices and eventually led to a housing bubble.

The chain of reasoning is:

More subprime mortgages -> Increased demand for houses -> Increases house prices -> More profit from selling houses when people default -> More subprime mortgages -> Increased demand for houses -> Increases house prices -> Housing bubble

Why might an asset bubble ‘burst’ ?

In a market bubble, the price of an asset begins to increase. As the price of an asset increases, demand for that asset increases. This increases the price of the asset further and the cycle continues until the asset become hugely overvalued. People suddenly realise that they have paid more for the asset than it is actually worth - the bubble starts to burst. They quickly start to sell the asset while the price is still high. As they sell the asset, supply increases and price falls. As the price starts to fall, more people sell and the cycle continues.

How does the 2008 financial crisis represent a negative externality?

After the financial crisis, banks stopped lending money to people or businesses. Firms couldn’t borrow money, so they had to make cutbacks, which meant that millions of people became unemployed. There was therefore a decrease in real GDP. This is a negative externality because the people who lost their jobs were outside the price mechanism in the financial sector.

What is moral hazard?

Someone else pays consequences for risky behaviour.

How is moral hazard portrayed in the 2008 financial crisis?

the US spent about $700 billion of taxpayers’ money in order to stop the banks from going bankrupt.

What explains why the manipulation of the London Interbank Offered Rate (LIBOR) was an example of financial market failure ?

The LIBOR rate is calculated by Reuters. Everyday, they ask bankers from 16 banks to submit the interest rate that they use to borrow/lend to other banks.

This should mean that the LIBOR rate is determined by supply and demand for borrowed money. However, since the bankers lied about the rate, it was manipulated and no longer correctly determined by supply and demand.

What is market rigging?

where firms unfairly try to control prices which distorts the price mechanism e.g LIBOR