Ch 11 - Market power: Perfect competition and monopolistic competition

Perfect competition: firms organise inputs/factors of production in order to produce outputs which they can sell

- A firm which is perfectly competitive is called a price taker, meaning that in order to sell goods, it has to accept the price it is set at due to its equilibrium.

- This is the case because if a firm raises its prices more than its competitors, they will lose competitive advantage and be substituted with another firm, regardless of the quality of the product. This is opportunity cost, as they lose the consumer’s attention in order to increase prices.

- Firms will not sell above or below the equilibrium price.

- Perfect competition occurs when firms sell products which are identical to each other, and there is easy access and exit of firms

- A market structure is known as the state of the market depending on the products being sold, and the amount of sellers of the products in the market

Perfect competition includes:

- Many buyers and sellers

- Homogeneous products: not possible to distinguish between products of different firms

- Freedom of entry and exist: firms can enter and exit the market at any point

- Perfect information: all producers and consumers have access to all information regarding methods of production

- Perfect resource mobility: all resources used for production can be moved from one firm to another at zero cost

- Each firm only sells very small amounts of goods and is not able to influence the price of the good

- Demand and average revenue is determined by market price

- Demand for individual firm's output is perfectly elastic and implies marginal revenue gained from producing additional units of the good is constant and equal to the price of the good

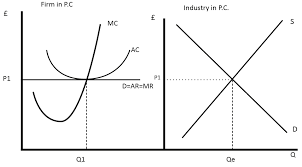

Perfect competition in the Long Run:

- Firms in perfect competition tend to increase production as they observe an increase in profits.

- If the firm observes a loss in profits, they will either reduce production or exit the market completely.

Profit maximisation in short run:

- In the short run there is a lack of firms in the industry as the market is still new. Low supply of firms means the market equilibrium price if competitively higher

- A firm can determine their profits or losses by producing at the quantity where MR=MC. When this is the case, they make sure that social benefits generated from producing a good is equal to the social costs of production

- Since firms are expected to have the same prices in a perfectly competitive market, they can make a profit by selling a larger quantity of goods. The price is predetermined, so as product increases for every unit sold, total revenue increases.

\n

Abnormal / supernormal profit:

- When a firm in a perfectly competitive market is selling its output for price that is greater than its average total cost, then the firm earning is making a supernormal profit in the short run

- Market demand is high

- Firm’s economic profit are maximised

- Due to lack of barrier to market, these profits will not be sustainable in the long run

Subnormal profits:

- When market demand is relatively low, presenting firms with a price lower than its ATC

Natural monopoly:

- When an industry in which one single firm produces all the output due to economies of scale as its average total cost is falling over a very large scale or output

- The firm is able to make profits at every point in the market because of average revenue exceeds the average cost

A monopoly has the following characteristics:

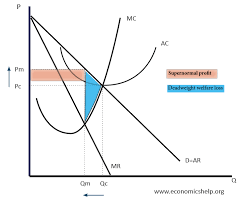

- Firms can make long run supernormal profits

- Non availability of close substitutes of the good on the market

- High level of inefficiency

- Singular firm that supplies the product

Monopolists can maintain their position in the economy due to the fact that there are barriers to market entry

- This keeps established firms on top

Entry barriers:

- Legal barriers

- Brand loyalty

- Resource ownership

Formula:

- Profit = (AR-AC) * q

- Maximum profit is achieved at a point where MC=MR

- No productive efficiency due to the fact that production of the profit maximising output

- The profit formula can tell the firm if it is profiting or not. Profits will be at its highest in a perfectly competitive firm if total revenues exceed total costs by a decent amount.

Productive efficiency: ability of the firm to produce at the lowest point of the ATC

- The productive efficiency refers to the production of goods and services with no waste. This means that goods are produced at the lowest average cost, leading to increased profits and no waste.

Allocative efficiency: Property of an efficient market where all goods and services are distributed equally among buyers in an economy

- price is equal to the marginal cost of production

- This measures the willingness of consumers to purchase a product and also takes into consideration the social benefits of purchasing the goods.