ECO 304L UEX Final Exam

1/271

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

272 Terms

Law of Demand

other things equal, as price falls, quantity demanded RISES, and as price rises, quantity demanded FALLS

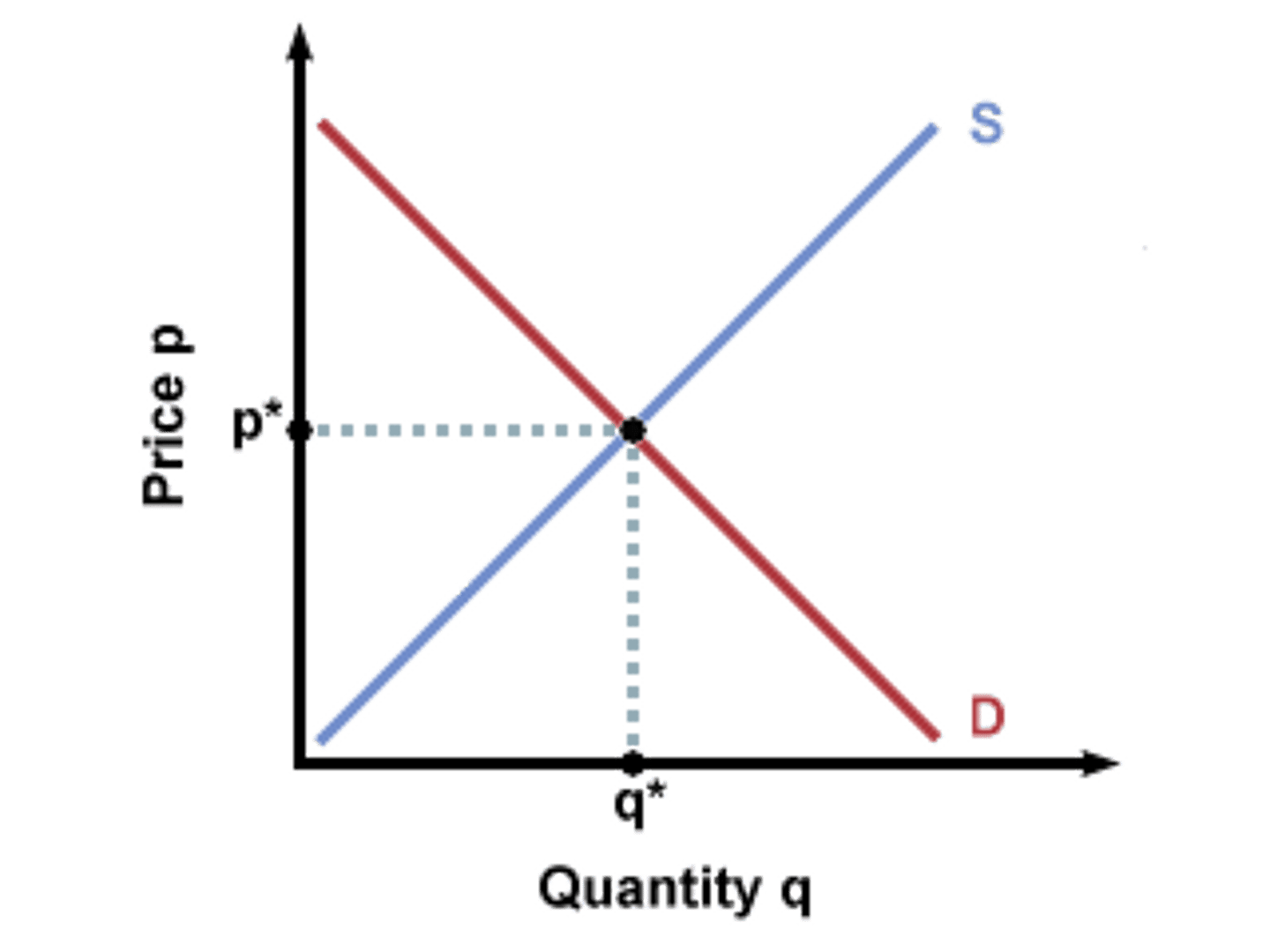

Demand Curve

-downward sloping

-inverse relationship

-shift to the right= increase

-shift to the left=decrease

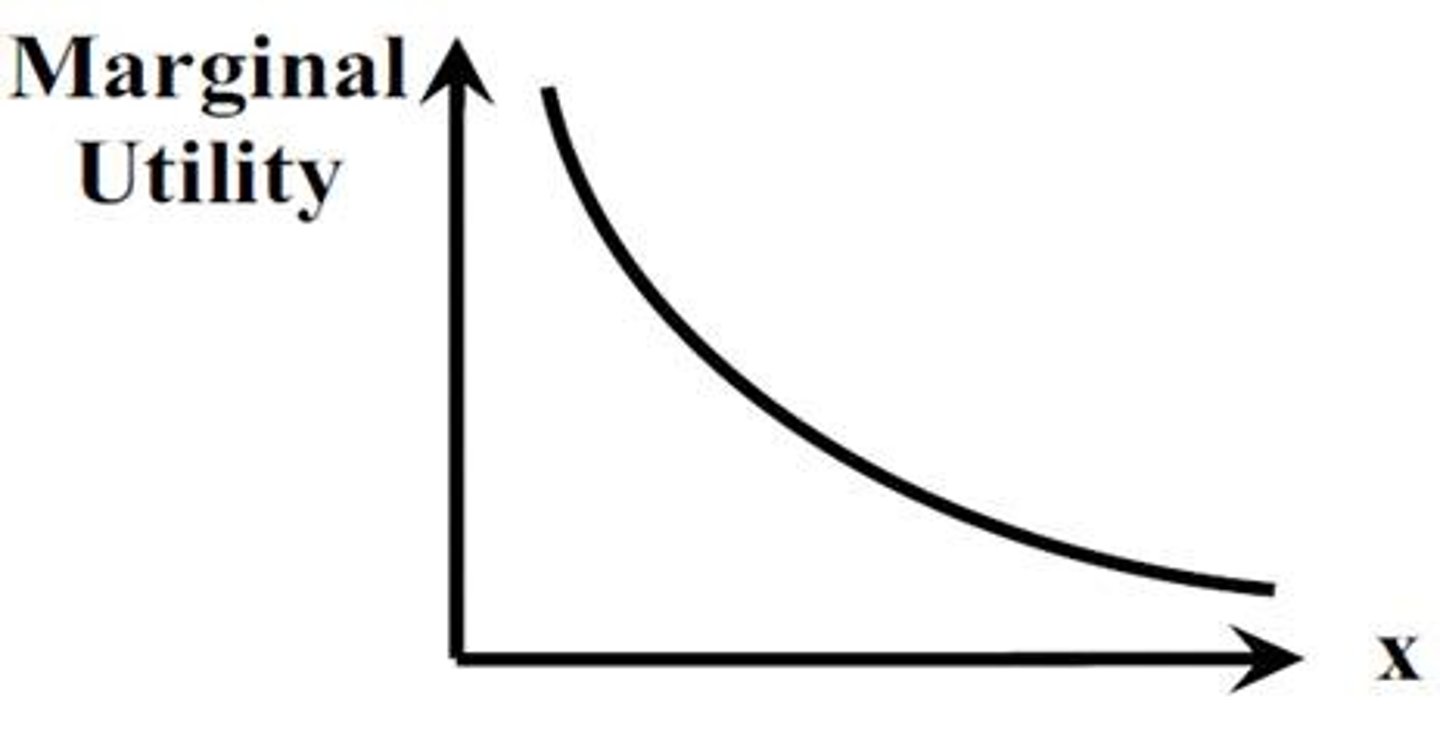

Diminishing Marginal Utility

successive units of a particular product yield less and less marginal utility, consumers will buy additional units only if price is reduced (think Costco)

Income Effect

indicates that a lower price increases the purchasing power of a buyer's money income, enabling the buyer to purchase more of the product than before

Substitution Effect

suggests that at a lower price buyers have the incentive to substitute what is now a less expensive product for other products that are now relatively more expensive

Determinants of Demand

factors that affect purchases:

-consumer preferences

-# of buyers in a market

-consumer incomes

-prices of related goods

-consumer expectations

Superior Goods (Normal Goods)

products whose demand varies DIRECTLY with money income

Inferior Goods

products whose demand varies INVERSELY with money income

Substitute Good

used in place of another good; example: two brands of ice cream

Complimentary Good

used with another good; example: tennis ball and racquet

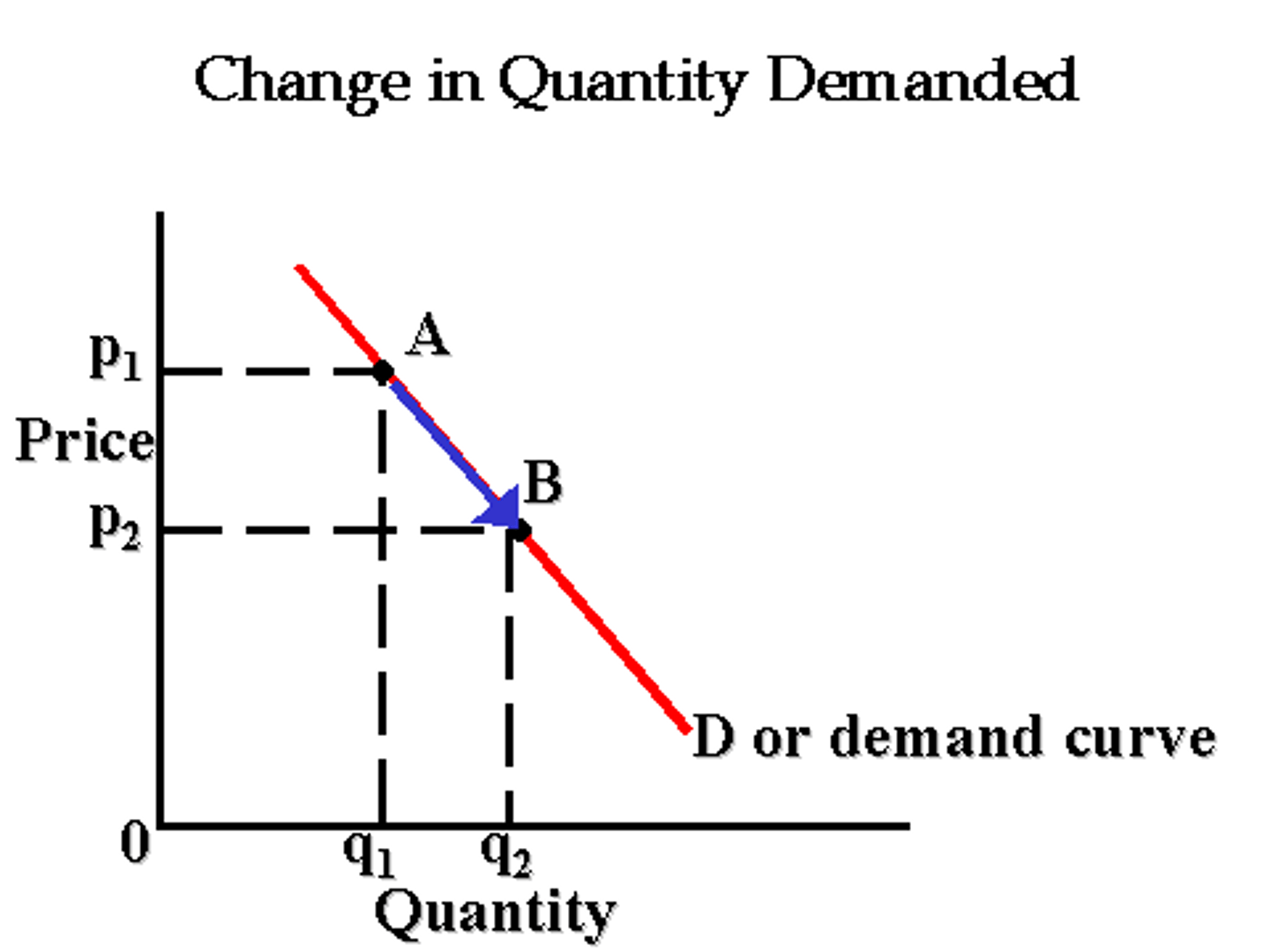

Change in Quantity Demanded

movement from one point to another point on the fixed demand curve; reflects change in price, not consumer tastes

Law of Supply

as price rises, quantity supplied RISES, and as price falls, quantity supplied FALLS

Supply Curve

-upward sloping

-direct relationship

-shift to the right= increase

-shift to the left= decrease

Determinants of Supply

factors other than price that determine the quantities supplied of a good or service:

-resource prices

-technology

-taxes/subsidies

-prices of other goods

-producer expectations

-# of sellers in a market

As firms leave an industry, the supply curve shifts to the ____?

left

Change in Quantity Supplied

a movement from one point to another on a fixed supply curve; reflects change in price

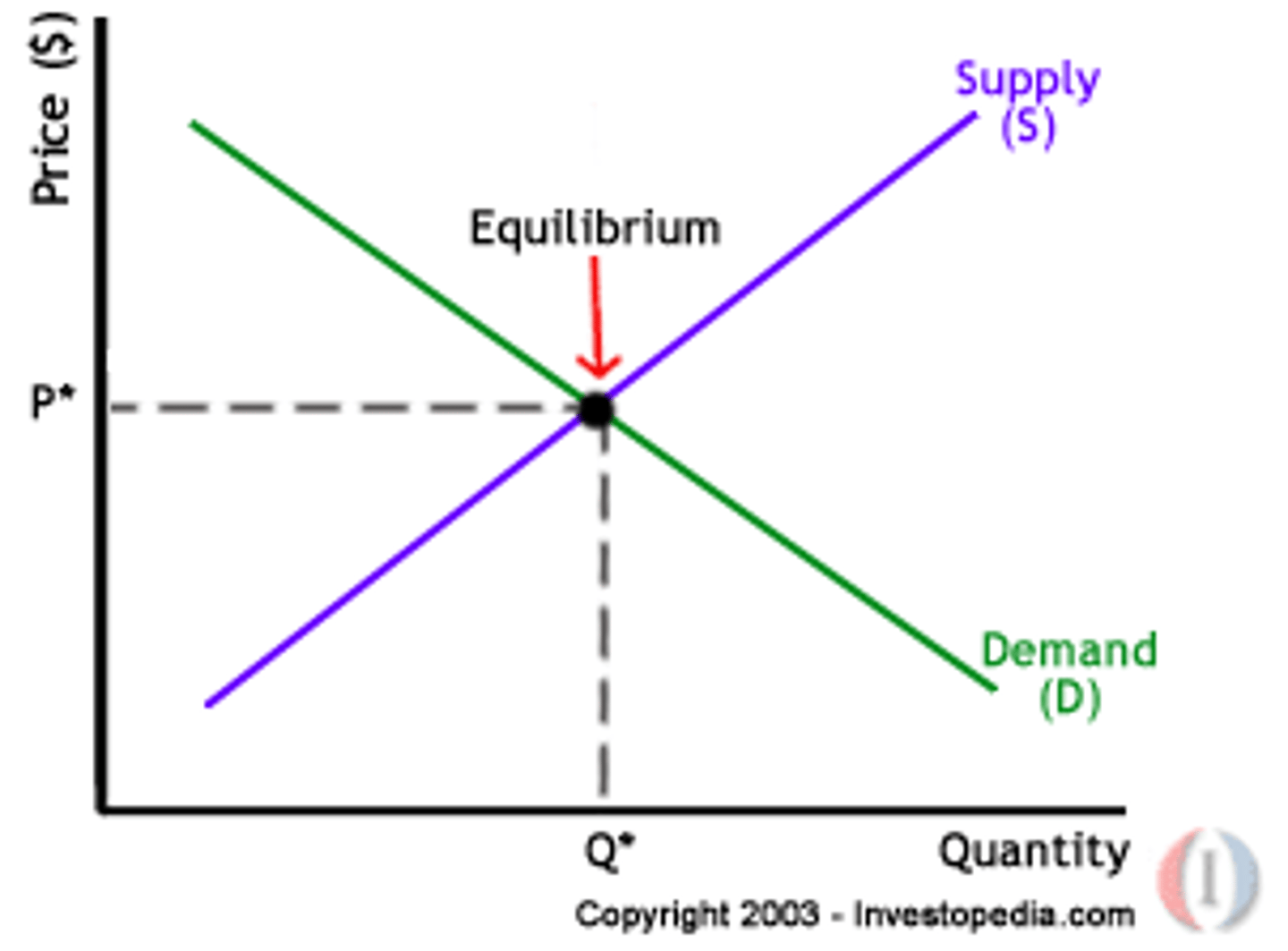

Equilibrium Quantity

the quantity at which the intentions of buyers and sellers match, so quantity demanded = quantity supplied

Equilibrium Price

the price where the intentions of buyers and sellers match

Surplus

quantity supplied is greater than quantity demanded

Shortage

quantity demanded is greater than quantity supplied

Productive Efficiency

the production of any particular good in the least costly way

Allocative Efficiency

the particular mix of goods and services most highly valued by society

Price Ceiling

sets the maximum legal price a seller may charge for a product or service; price above ceiling would be illegal

Rent Controls

maximum rents established by law (maximum rent increases for existing tenants)

Price Floor

minimum price fixed by the government; price below floor is illegal; used when society feels the free functioning of the competitive market is not providing sufficient income for certain producers

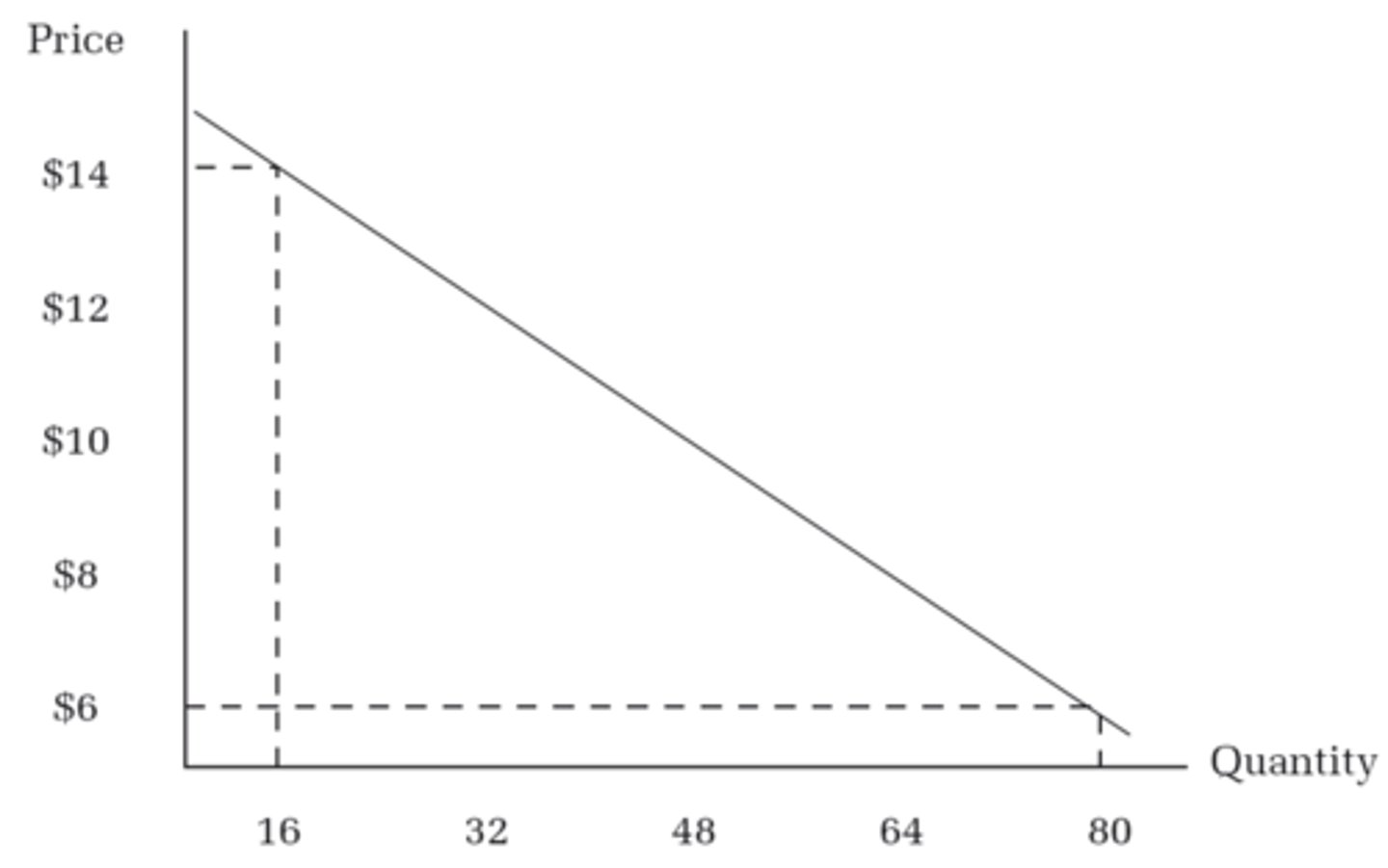

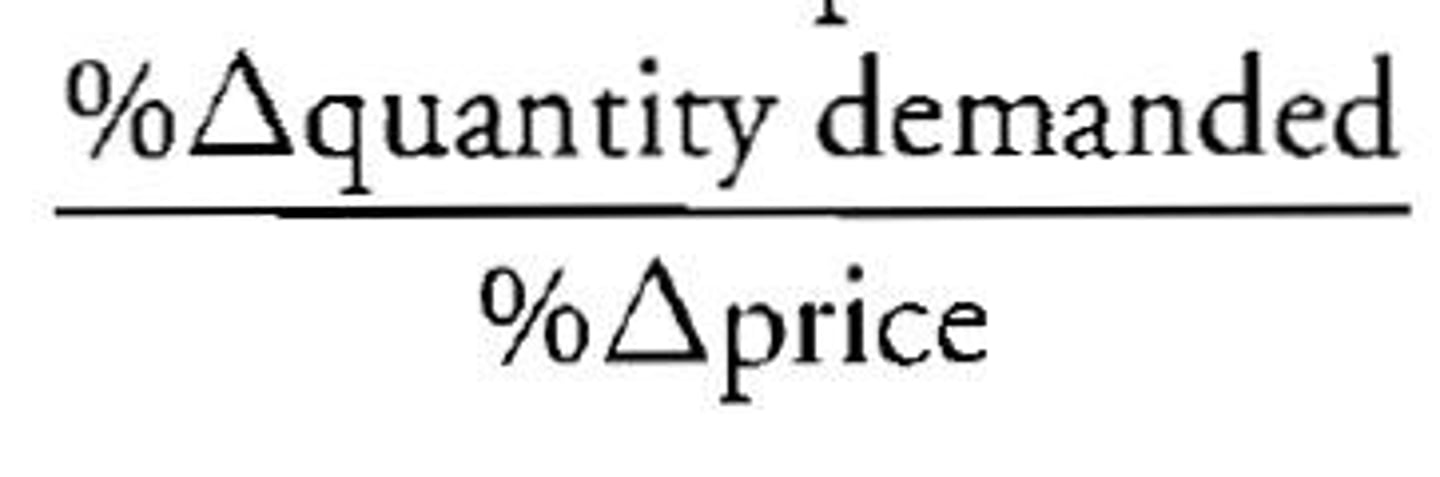

Price Elasticity of Demand

the measure of responsiveness (or sensitivity) of consumers to a price change

Price Elasticity of Demand Formula

Ed= (%change in quantity demanded of good X)/(%change in the price of good X)

Elastic Demand

a situation in which consumer demand is sensitive to changes in price

Inelastic Demand

a situation in which an increase or a decrease in price will not significantly affect demand for the product

Unit Elasticity

demand or supply for which the elasticity coefficient is equal to 1; means that the percentage change in the quantity demanded or supplied is equal to the percentage change in price.

Perfectly Inelastic Demand

when a price change results in no change whatsoever in quantity demanded; price-elasticity coefficient is zero

Perfectly Elastic Demand

situation where a small price reduction causes buyers to increase their purchases from zero to all they can obtain; price-elasticity coefficient is infinity

Total Revenue

total amount the seller receives from the sale of a product in a particular time period

Total Revenue Formula

TR= (price) x (quantity sold)

Total Revenue Test

a method of measuring whether demand is elastic or inelastic; if TR changes in opposite direction of price, demand is elastic, if TR changes in same direction of price, demand is inelastic

If demand is elastic, a decrease in price will ________ total revenue?

increase

If demand is inelastic, a price decrease will ______ total revenue?

reduce

At the top of the linear demand curve, demand is _______?

elastic

At the bottom of the linear demand curve, demand is _________?

inelastic

Determinants of Price Elasticity of Demand

-substitutability

-proportion of income

-luxuries vs necessities

-time

Luxury items tend to have ________ demand, and necessities tend to have ________ demand.

elastic; inelastic

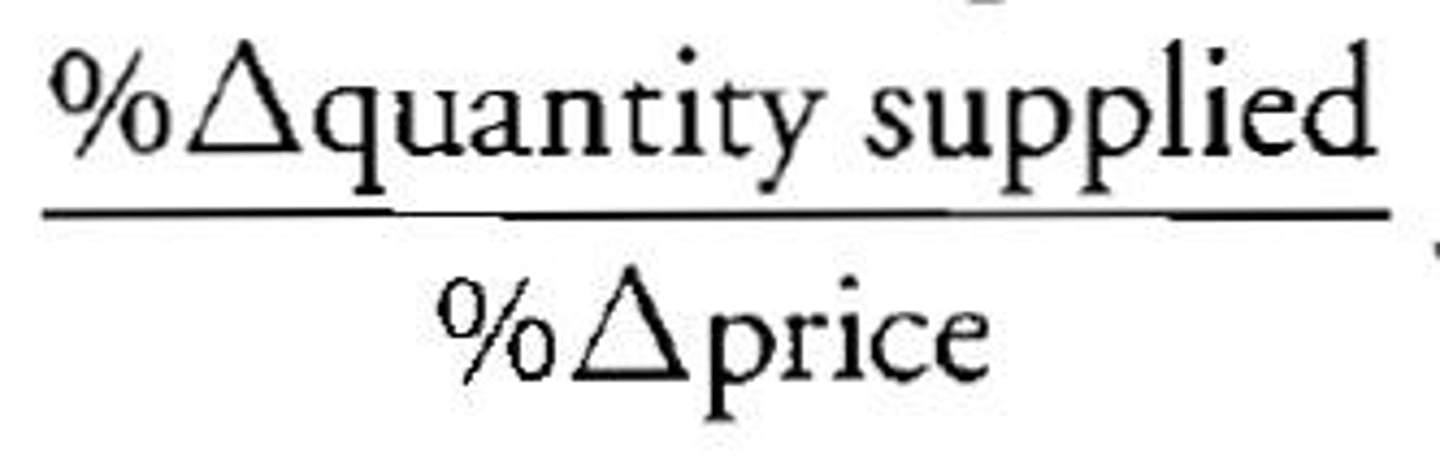

Price Elasticity of Supply

a measure of how much the quantity supplied of a good responds to a change in the price of that good

Price Elasticity of Supply Formula

Es = (%change in quantity supplied of good X) / (%change in the price of good X)

Market Period

the period that occurs when the time immediately after a change in market price is too short for producers to respond with a change in quantity supplied

Short Run

a period of time too short to change plant capacity but long enough to use the fixed-size plant more or less intensively

Long Run

a period of time long enough for firms to adjust their plant sizes and fore new firms to enter or exit

Cross Elasticity of Demand

measures how sensitive consumer purchases of one product are to a change in the price of some other product

Coefficient of Cross Elasticity of Demand Formula

Exy= (%change in quantity demanded of good X)/(%change in price of good Y)

If the cross elasticity of demand is positive for two goods, this means the two goods are ___________?

substitutes

If the cross elasticity of demand is negative for two goods, this means the two goods are ___________?

complements

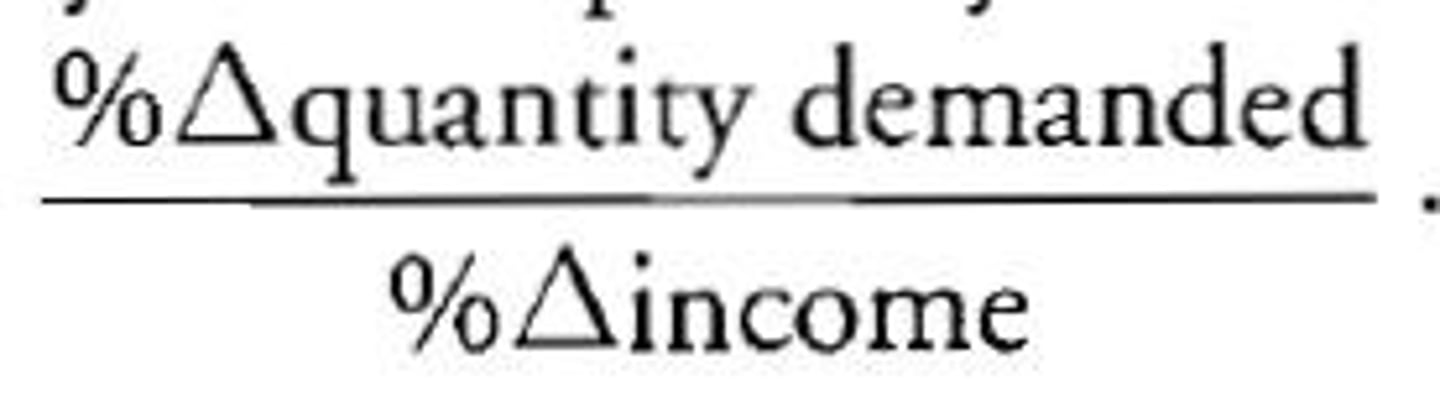

Income Elasticity of Demand

measures the degree to which consumers respond to a change in their incomes by buying more or less of a particular good

Income Elasticity of Demand Formula

Ei= (%change in Qd) / (%change in Income)

Demand-side Market Failures

happen when demand curves do not reflect consumers' full willingness to pay for a good or service; example: fire work displays; people can watch them without paying for them since they are outside

Supply-side Market Failures

occur when supply curves do not reflect the full cost of producing a good or service

Consumer Surplus

difference between the maximum price a consumer is willing to pay for a product and the actual price they end up paying

Consumer surplus and price are _________ related?

inversely

Producer Surplus

difference between the actual price a producer receives & the minimum acceptable price that a consumer would have to pay the producer to make a particular unit of output available

Producer surplus and price are ________ related?

directly

Public Good

a shared good or service for which it would be impractical to make consumers pay individually and to exclude non-payers

Private Good

goods offered for sale in stores, shops, and on the Internet

Rivalry

when one person buys and consumes a product, it is not available for another person to buy and consume

Excludability

sellers can keep people who do not pay for a product from obtaining its benefits

Efficiency Losses (Deadweight Losses)

reductions of combined consumer and producer surplus, result from both underproduction and overproduction

At equilibrium price and quantity in a competitive market, marginal benefit is ________ to marginal cost?

equal to

Cost-Benefit Analysis

a decision-making process in which you compare what you will sacrifice and gain by a specific action

Externalities

occur when some of the costs or benefits of a good or service are passed onto or "spill-over to" someone other than the immediate buyer or seller

___________ externalities cause supply-side market failures?

negative

___________ externalities cause demand-side market failures?

positive

Optimal Reduction of an Externality

occurs when society's marginal cost and marginal benefit of reducing that externality are equal

Real GDP (Gross Domestic Product)

measures the value of final goods and services produced within the borders of a country during a specific period of time, typically a year; adjusted for inflation

Nominal GDP (Gross Domestic Product)

totals the dollar value of all goods and services produced within the borders of a country using current prices during the year that the products were produced; can increase from one year to the next, EVEN if there is no new output; doesn't account for inflation

Inflation

increase in the overall level of prices

Saving

occurs when current consumption is less than current output

Investment

when resources are devoted to increasing future output

Households

source of savings

Banks

collect savings of households and reward savers with interest, dividends, and sometimes capital gains; lend funds to businesses, which invest in capital goods

Demand Shock

unexpected changes in the demand for goods and services; more prevalent since prices of many goods and services are inflexible

Supply Shock

unexpected changes in the supply of goods and services

Inventory

store of output that has been produced but not yet sold

Flexible Prices

product prices that freely move upward or downward when product demand or supply changes; examples: corn, oil, airline tickets, natural gas

Sticky Prices

prices that do not always adjust rapidly to maintain equality between quantity supplied and quantity demanded; examples: final goods

National Income Accounting

measures the economy's overall performance

Gross Domestic Product (GDP)

primary measure of the economy's performance is its annual total output of goods and services, or aggregate output; only counts FINAL goods and excludes non-production transactions

Intermediate Good

products that are purchased for resale or further processing/manufacturing; example: crude oil

Final Good

products that are purchased by their end user; example: gasoline used for transport

Non-production Transactions

not included in GDP:

-public transfer payments (social security, welfare)

-private transfer payments (Christmas gifts)

-stock market transactions (doesn't contribute to output)

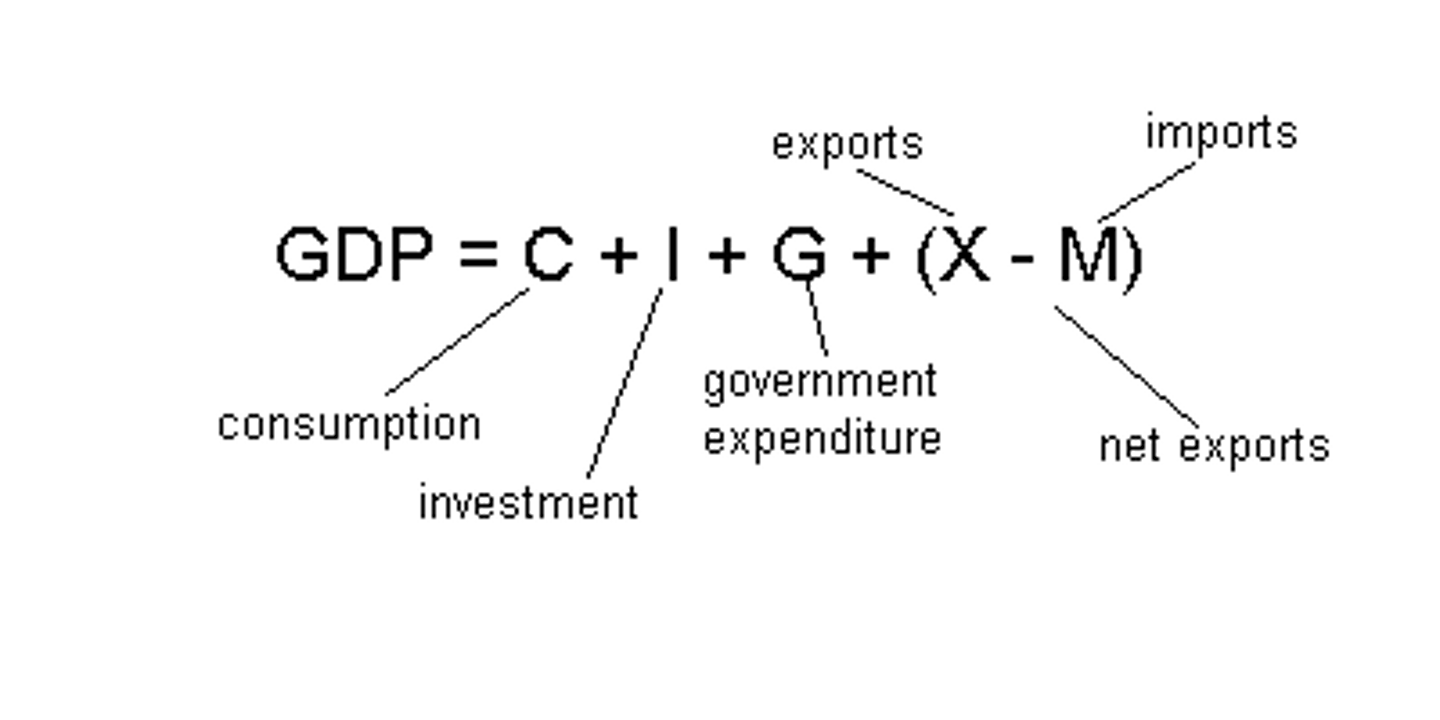

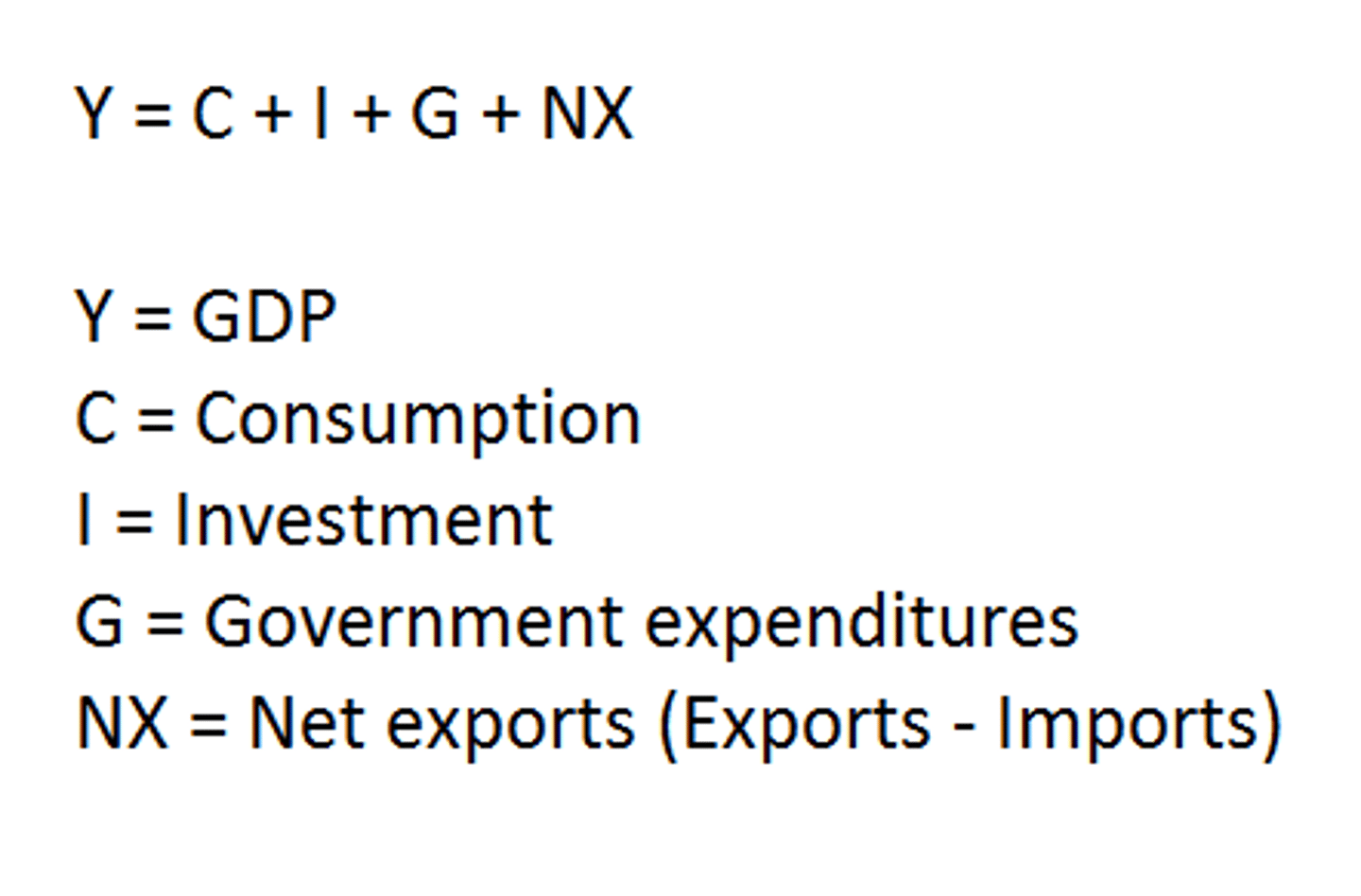

Expenditures Approach

looking at GDP as the sum of all money spent in buying it; "output approach"

Income Approach

looking at GDP in terms of income derived or created from producing it; "earnings approach"

Expenditures Approach to GDP

GDP = consumption + investment + government purchase + net exports

Income Approach to GDP

GDP= wages + rents + interest + profits + statistical adjustments

Personal Consumption (C)

includes all expenditures by households on goods and services; 10% of expenditures are on durable goods, 30% spent on nondurables, and 60% spent on services

Gross Private Domestic Investment (I)

all final purchases of machinery, equipment, and tools by business enterprises (investment of private business, not government agencies)

Government Purchases (G)

government consumption expenditures and gross investment (not including gov. transfer payments)

Net Exports

Net Exports = Exports - Imports

National Income

the total of all sources of private income (employee compensation, rents, interest, proprietors' income, and corporate profits) plus government revenue from taxes on production and imports

Consumption of Fixed Capital

the huge depreciation charge made against private and publicly owned capital each year

Personal Income

includes all income received, whether earned or unearned

Net Domestic Product

NDP = GDP - depreciation

Disposable Income

personal income less personal taxes; DI= Consumption + Savings

Price Index

a measure of the price of a specified collection of goods and services, called a "market basket," in a given year as compared to the price of an identical (or highly similar) collection of goods and services in a reference year.