Finance Management Semester Review

1/9

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

10 Terms

You expect to receive $16,275 in 4 years. What is the present value of this amount if the discount rate is 4.25 percent?

$13,779

Sterling Cooper, Inc. invested $500,000 to help fund a company expansion project scheduled for eight years from now. How much additional money will they have eight years from now if they can earn 9 percent rather than 7 percent on this money?

$137,188

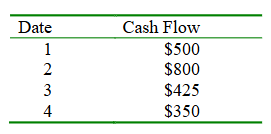

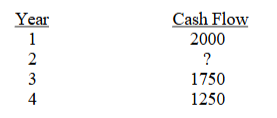

What is the time 4 value of the following cash flows? Assume the interest rate is 8%.

$2371.98

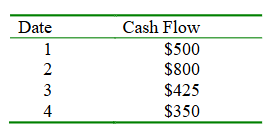

What is the time 0 value of the following cash flows? Assume the discount rate is 10%.

$1206.34

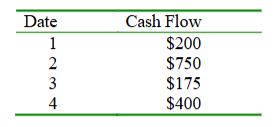

What is the time 2 value of the following cash flows? Assume the interest rate is 7%.

$3633.64

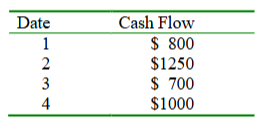

The time 0 value of the following cash flow stream is $5,933.86 when discounted at 11 percent annually. What is the value of the missing cash flow?

$2502.22

On his tenth birthday, Maester Aemon received $100 which he invested at 4.5 percent interest, compounded annually. That investment is now worth $3,000. How old is Maester Aemon today?

87

What is the present value of $9,000 to be received in 4 years, discounted continuously at 6%?

$7128.84

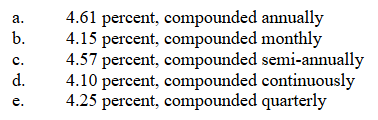

Walter White has $5,600 that he wants to use to open a savings account. There are five banks located in his area. The rates paid by banks A through E, respectively, are given below. Which bank should White select if his goal is to maximize his interest income?

c. 4.57 percent, compounded semi-annually

5/3rd Bank makes you a balance transfer offer. You can pay off your current credit card debt using a line of credit at their bank. The line of credit will charge no interest for 6 months, but there is an upfront fee of 4% for using the line of credit. Assuming that you

pay off the new loan in 6 months, what is the effective annual rate implied by this offer?

8.16%