Financial Analysis Final

1/120

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

121 Terms

Accounting

“The process of identifying, measuring, and communicating economic information for informed judgments and decisions by the users of the information” - American Accounting Association

“A process that helps a business measure its profitability and solvency” - Language of business

Process of identifying, measuring, and communicating economic information to permit informed judgements and decisions by the user’s information. A process that helps a business measure its profitability and solvency

Types of Accounting

Bookkeeping

Financial Accounting

Managerial Accounting

Tax Accounting

Bookkeeping

The systematic collection of financial information.

Financial Accounting

Involves cash flow, balance sheet, and income statement.

Managerial Accounting

Provides strategic information, including budget and competition analysis.

Tax Accounting

Focuses on the taxes a company must pay.

Types of businesses according to the purpose or objective of the organization

Profit Making

Non-for-profit

Governmental

Profit Making

Businesses that offer goods or services to generate income for owners (individual or stockholders)

Non-for-profit

Organizations that provide goods or services without the expectation of generating income

Governmental

Agencies that belong to the state and serve public interests.

Characteristics of the forms of business organizations

Individual

Partnership

Corporation

Individual Business

An unincorporated business owned and managed by a single person.

Partnership

An unincorporated business owned by two or more individuals.

Corporation

A business incorporated under state laws, recognized as a separate legal entity.

According to the types of activities performed by business organizations

Service companies

Merchandising companies

Specialized sectors

Service Companies

Businesses that perform services for a fee.

Merchandising Companies

Businesses that purchase goods for resale.

Specialized Sectors

Industries such as financial services, agriculture, and mining.

Primary objectives of any business

Profitability

Solvency

Profitability

The ability of a business to generate income.

Solvency

The ability of a business to pay its debts as they become due.

Assets (property)

Inventory, cash property of the company

Current Assets

Fixed Assets

Current Assets

Inventory, cash, banks (Activos circulantes, se pueden convertir en dinero mas rapido)

Fixed Assets

Buildings, estate, trucks (activo no circulante)

Liability

Short-term liabilities: Proveedores, cuentas (Deudas a pagar en menos de un año

Long-term liabilities: Cuentas por pagar

Equity

Equity refers to the ownership value in an asset after all liabilities have been deducted. (Dinero de reserve)

The four basic financial statements

balance sheet

income statement

statement of cash flows

statement of retained earnings

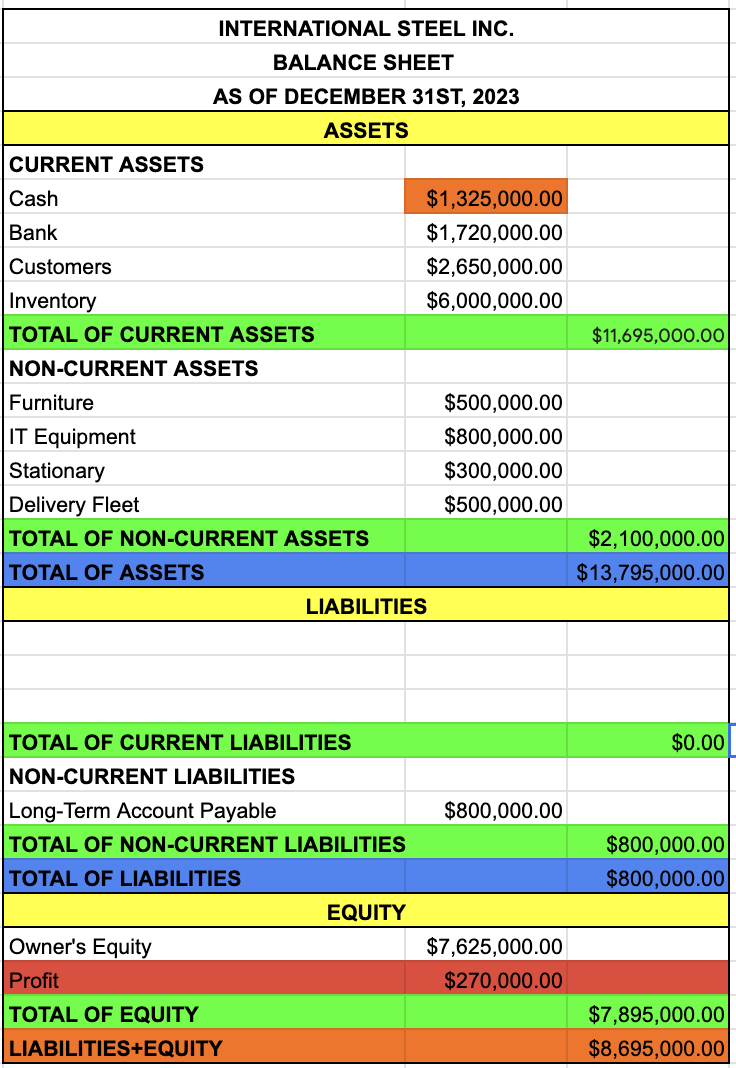

Balance Sheet

A financial statement that lists a company's assets, liabilities, and equity at a specific time.

Income Statement

A report showing a business's profitability over a specific period, also known as a profit and loss statement

Statement of Cash Flows

A report detailing cash inflows and outflows from operating, investing and financing activities

Statement of Retained Earnings

Connects the balance sheet and income statement, showing changes in equity (shows the difference between net income and dividends paid to stockholders

Business Entity

A business organization that exists as an economic unit

A business organization that has an existence of its own, separate from its owners, creditors, etc.

A set of resources with a common goal that is achieved through a decision-making process

Financial Analysis

The process of reviewing financial performance to assess viability, stability, and profitability of a company

Involves breaking down financial data into meaningful insights using financial ratios, trends and forecasts

Determine how well an organization is performing, identify areas for improvement, and predict future financial outcomes

Financial Analysis Provides

Decision making

Performance evaluation

Investment Assessment

Risk management

Strategic planning

Decision making

Financial Analysis gives a foundation for making strategic business decisions, such as whether to invest in a company, expand operations, or cut costs |

Performance evaluation

It helps assess the effectiveness of an organization’s management and operational strategies by comparing financial performance against industry benchmarks or historical data |

Investment Assessment

Inventors use financial analysis to determine whether a campany’s stock is undervalued or overvalued, guiding their investment preferences |

Risk Management

By identifying financial risks and vulnerabilities, financial analysis aids risk management strategies and helps mitigate potential losses |

Strategic Planning

It assists in formulating long-term strategies by forecasting future financial conditions and evaluating the potential impacts of different business decisions |

Key components of financial analysis

Financial statements

Financial ratios

Financial planning and forecasting

Investment analysis

Cost management

Financial statements

Financial statements are the primary sources of data for financial analysis

They provide a picture of a company’s financial health and performance over time

Main Financial Statements

Income statement (profit & loss statement)

Balance sheet (statement of financial postion)

Cash flow statement

Statement of changes in equity

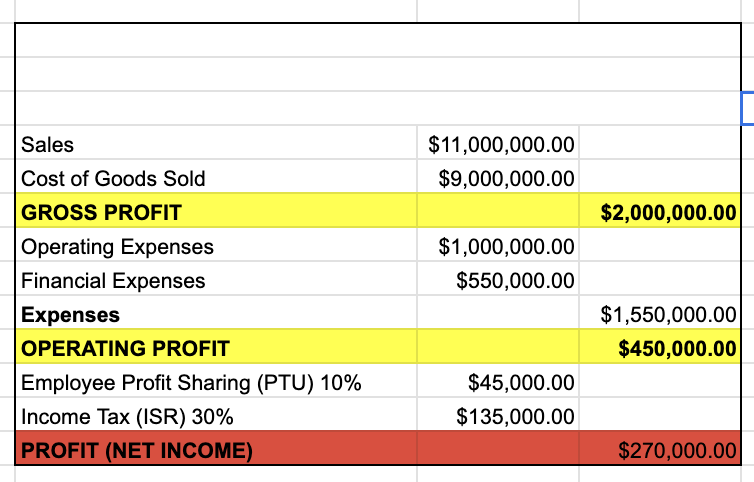

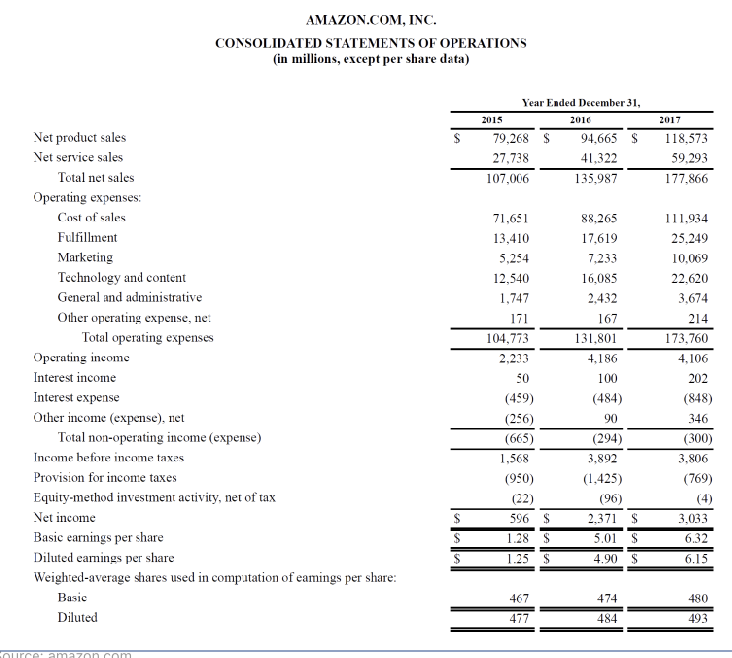

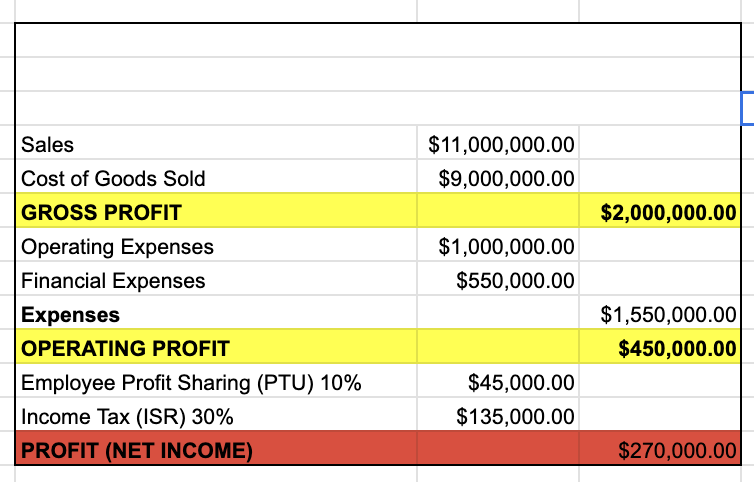

Income statement (profit & loss statement)

The income statement, also known as the profit & loss statement, is a vital financial document that summarizes a company’s revenue, expenses, and profits or losses over a specific period

It provides insights into the organization’s operational efficiency and profitability

Example of income statement

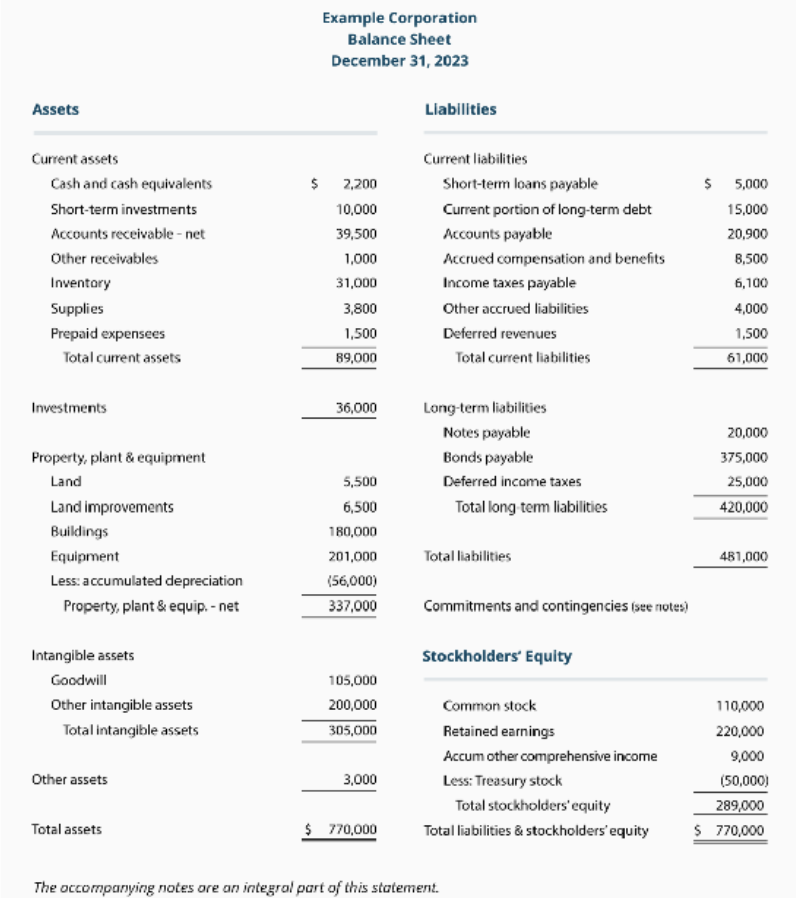

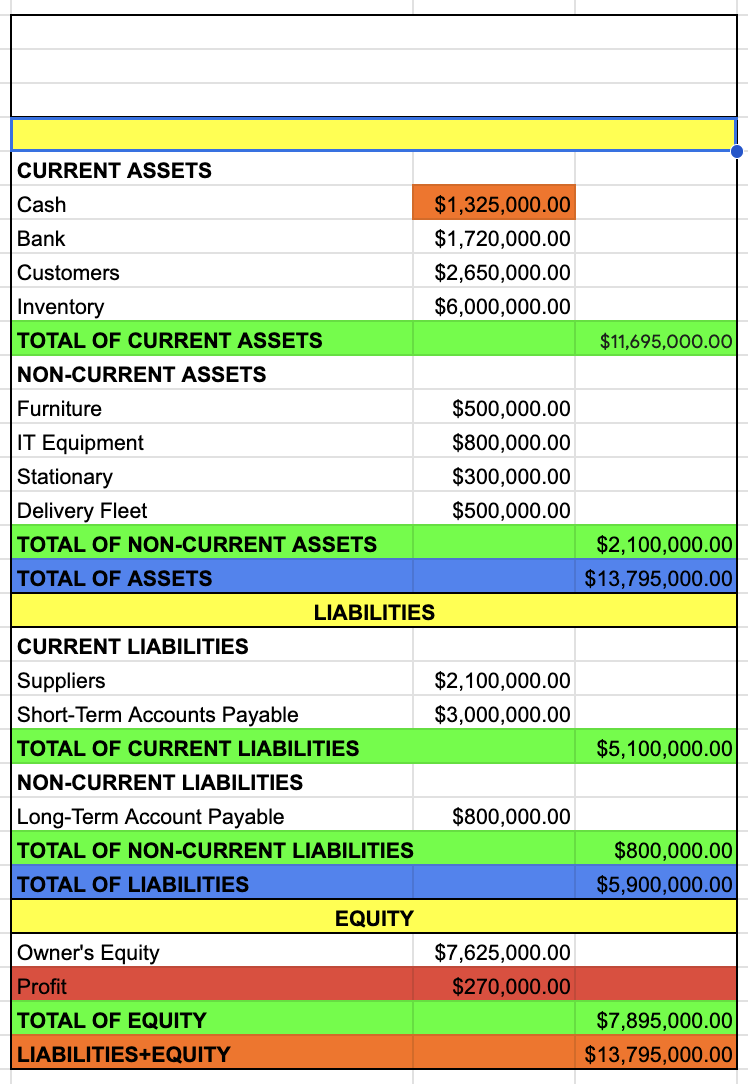

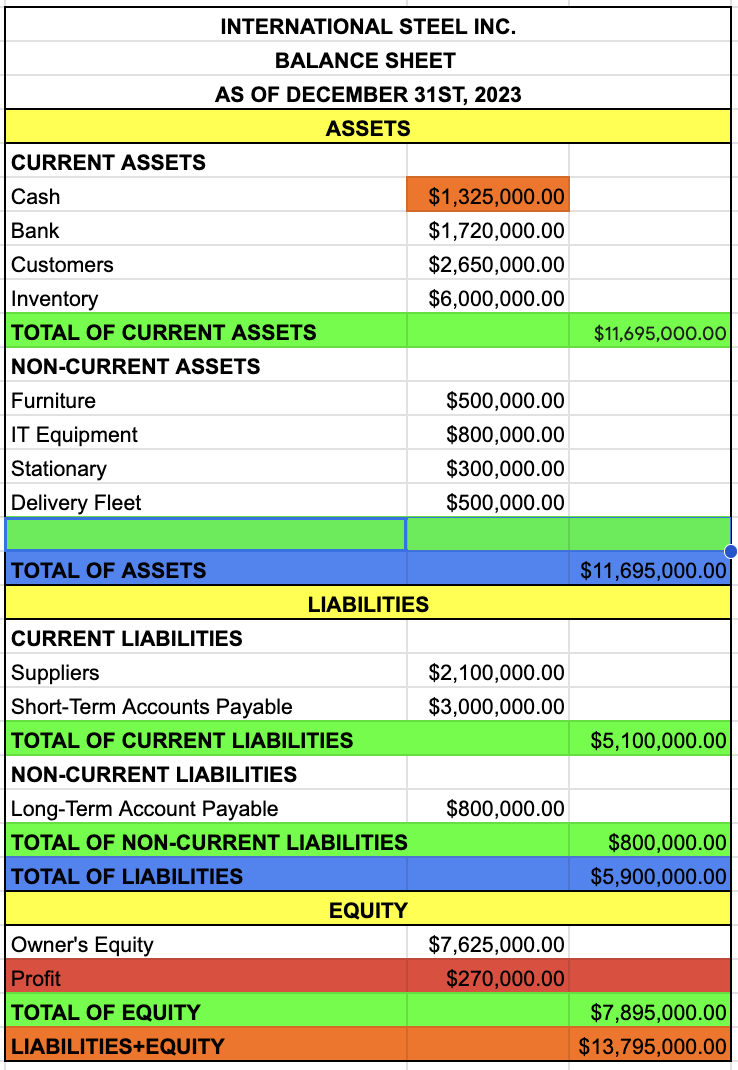

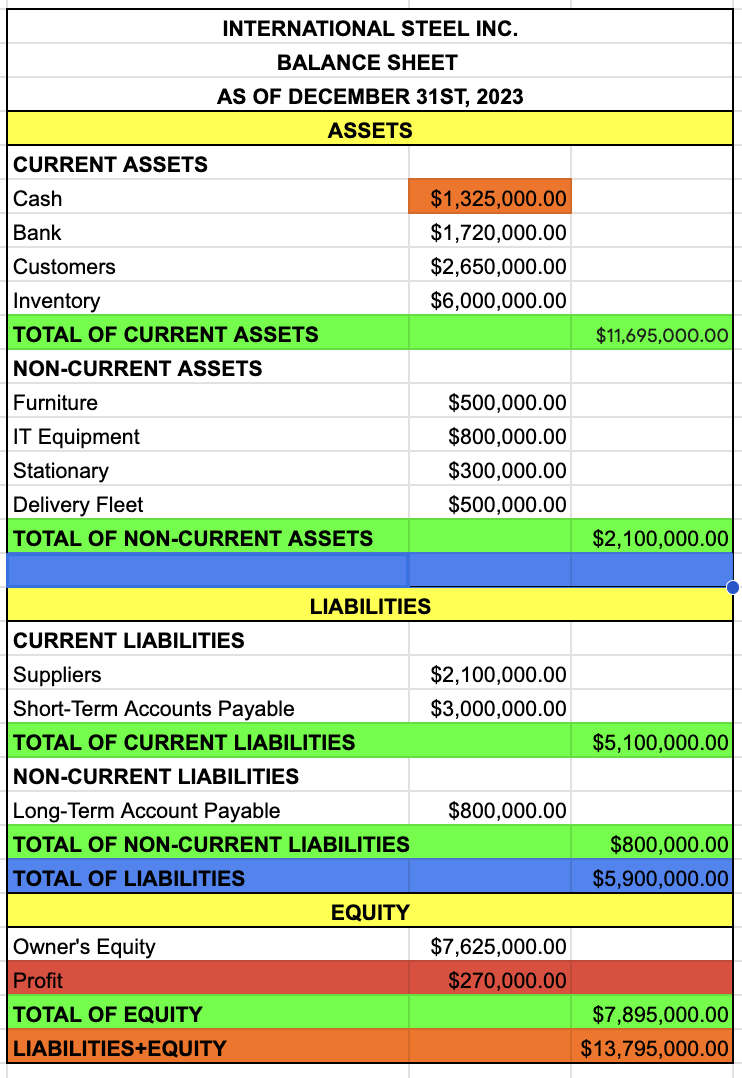

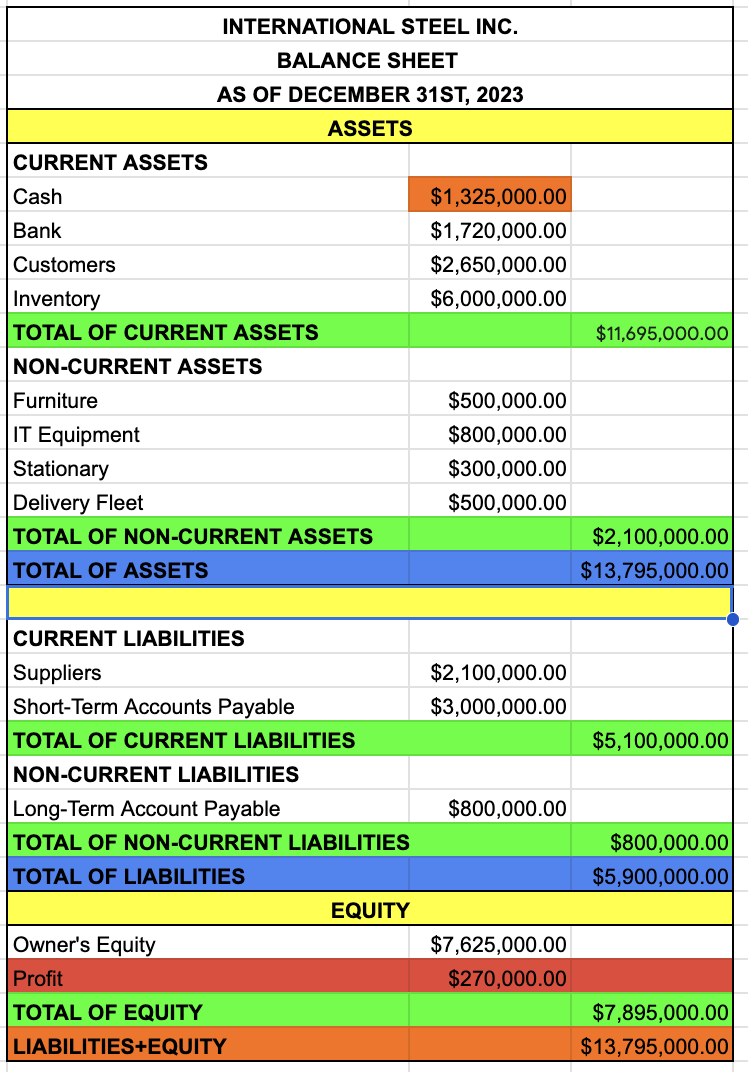

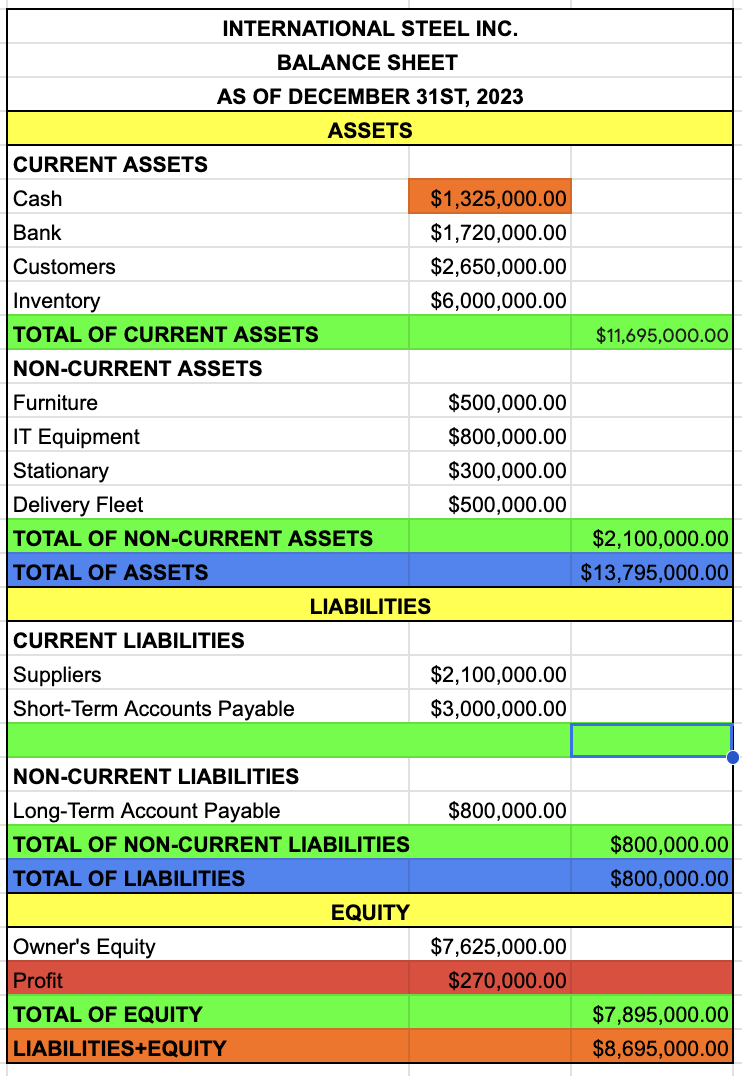

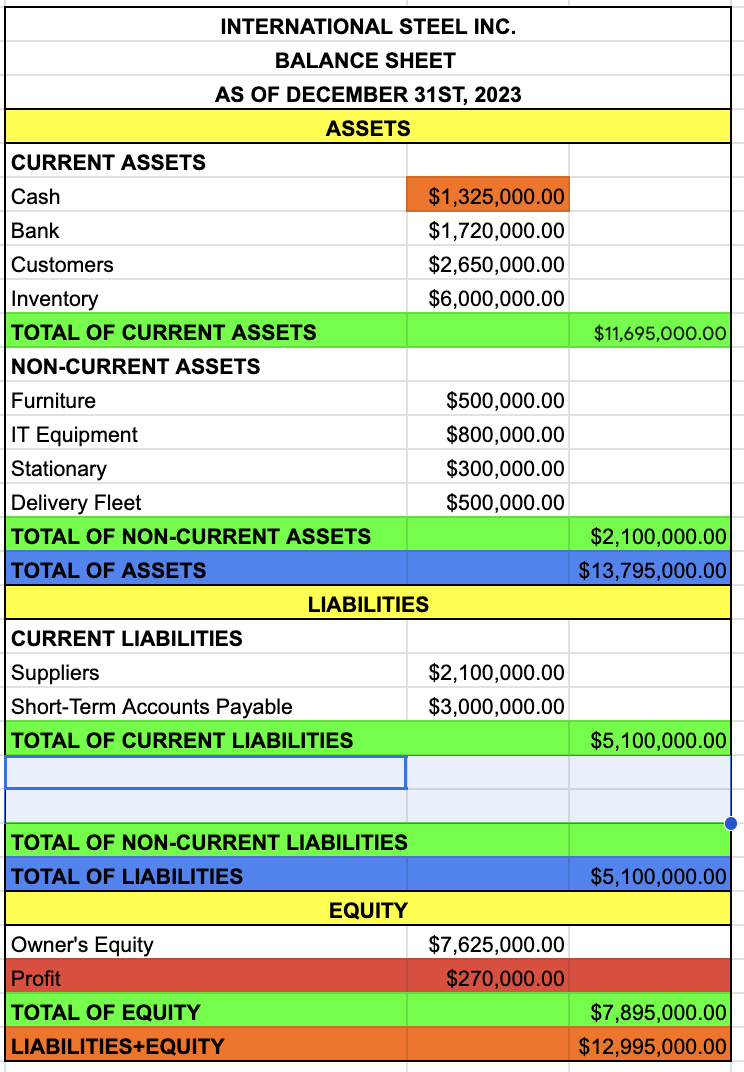

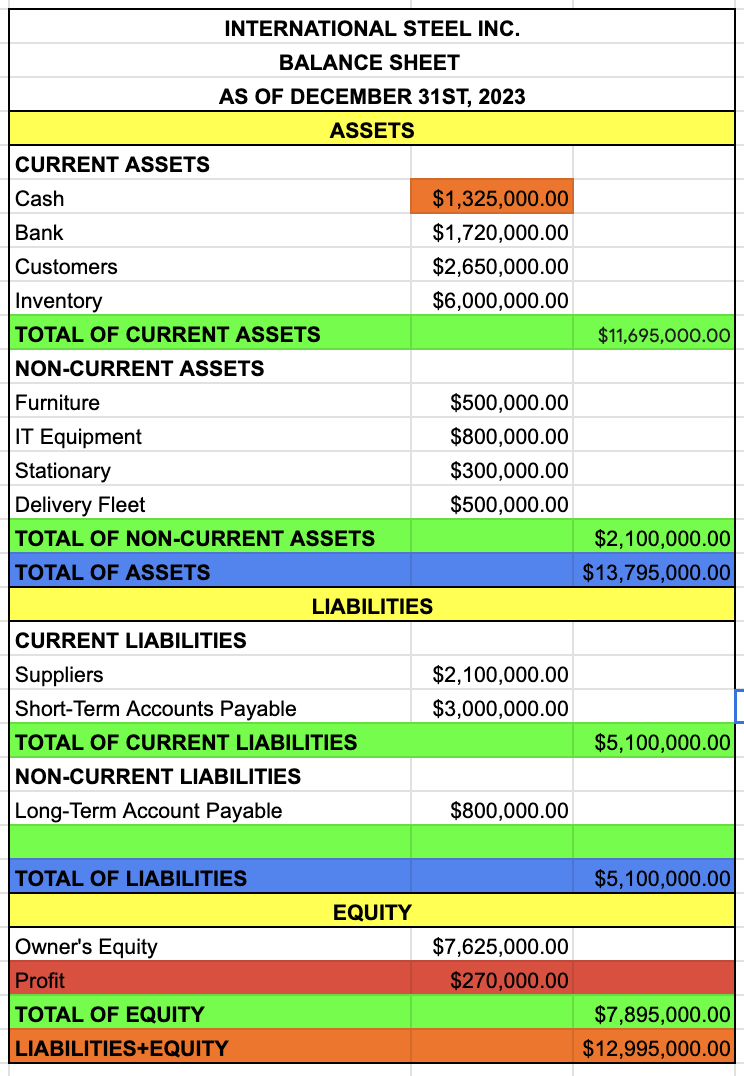

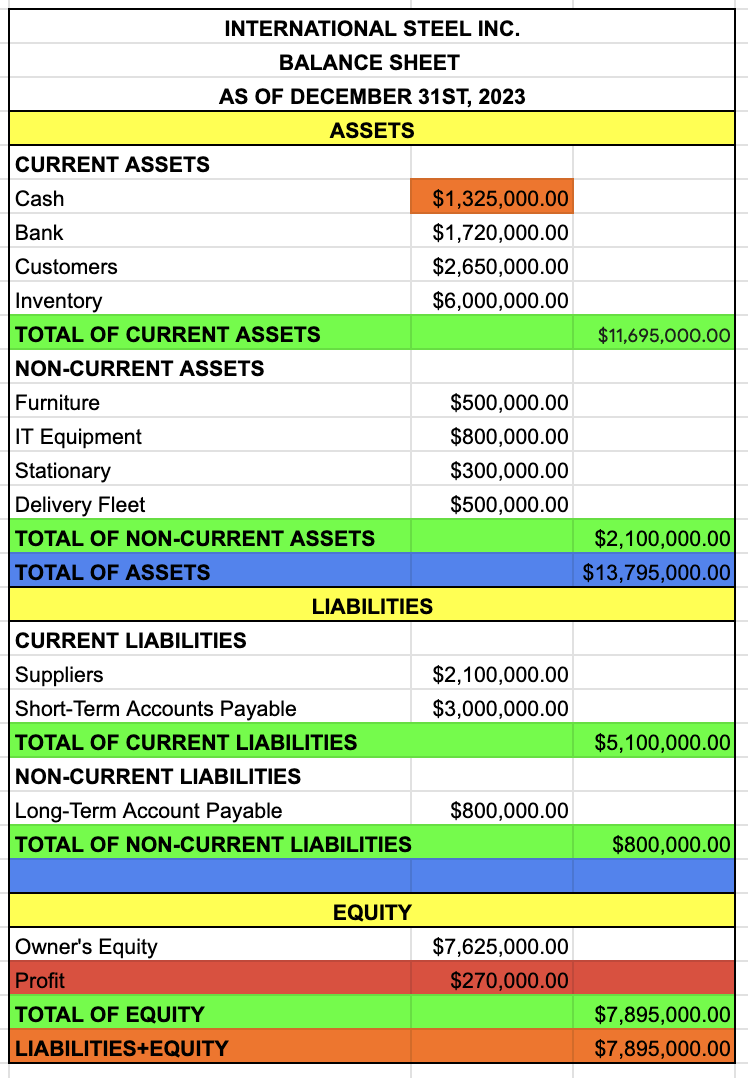

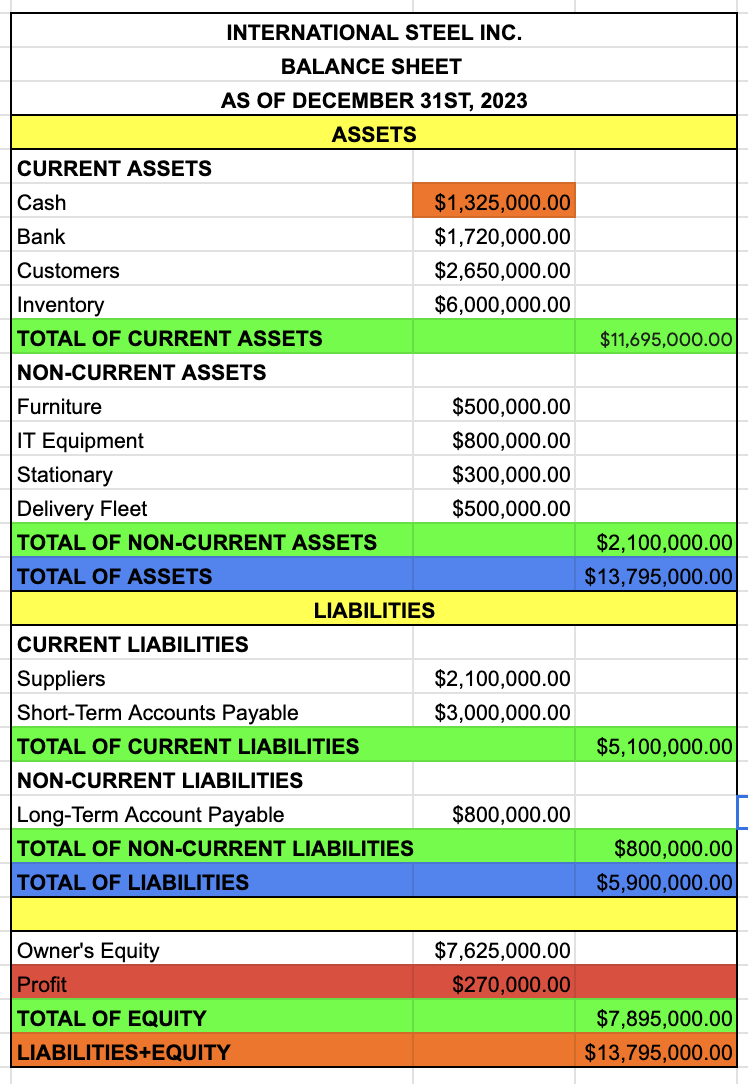

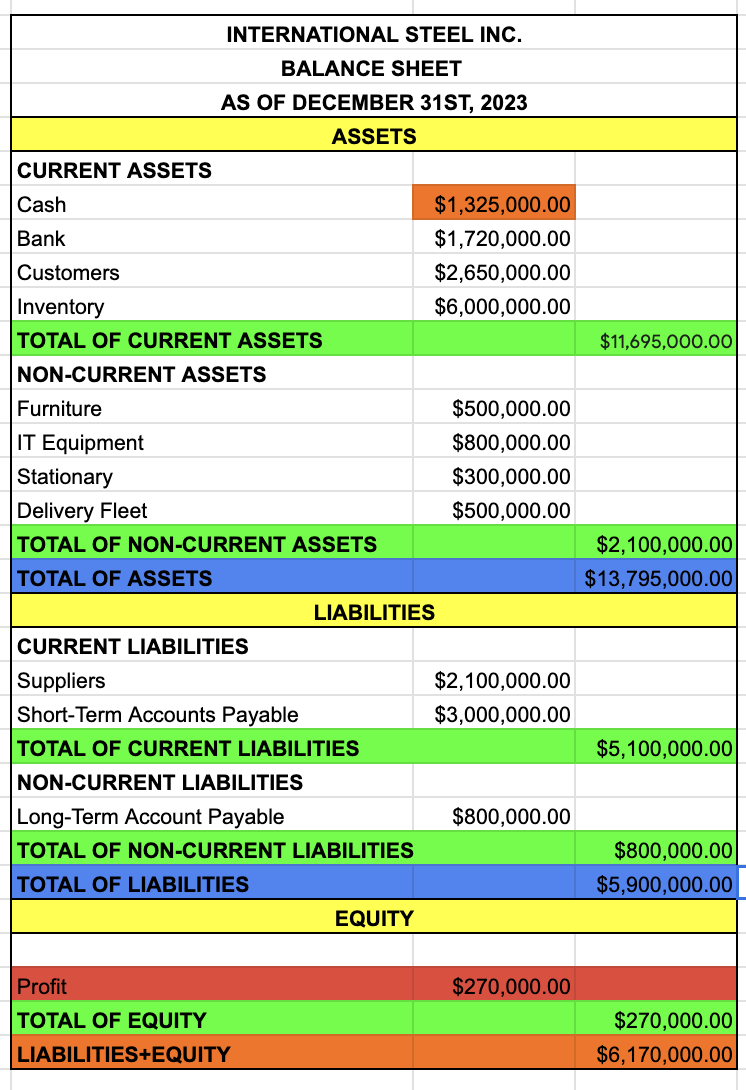

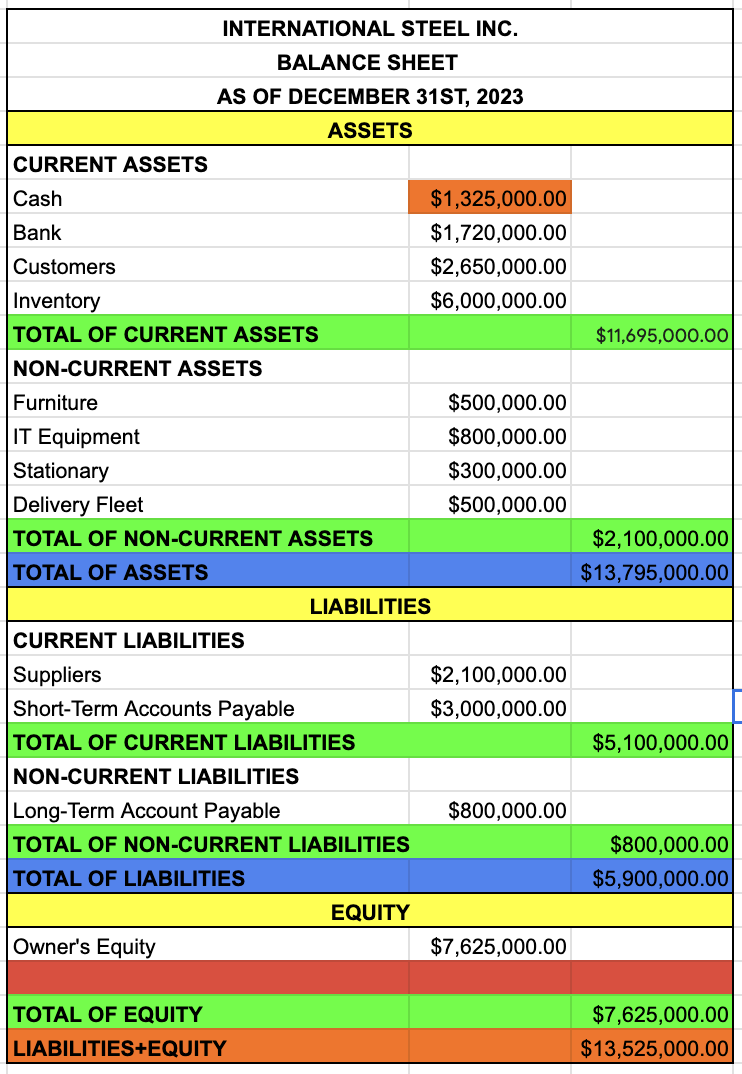

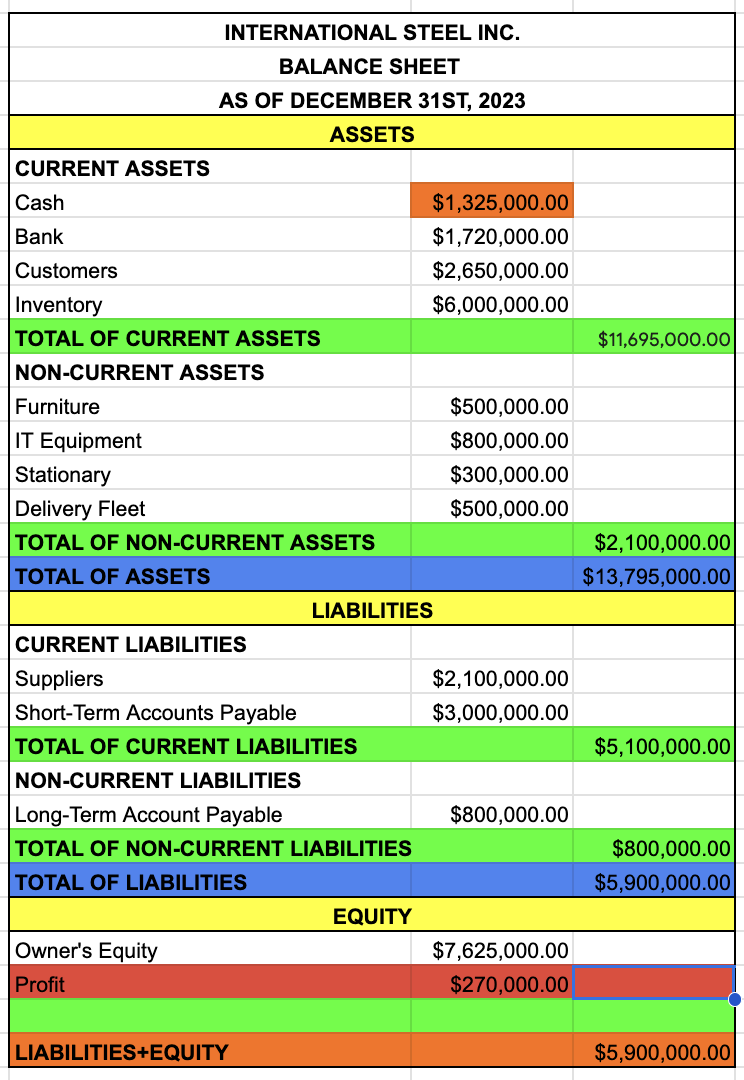

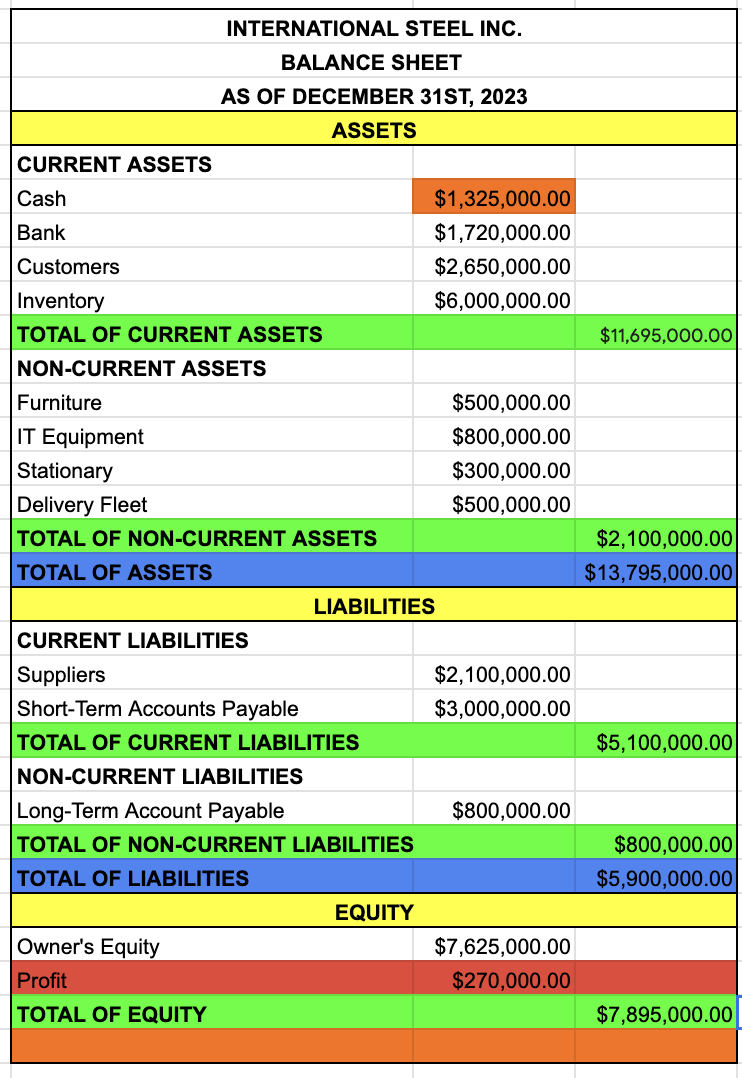

Balance Sheet

Also known as the statement of financial position, gives a snapshot of a company’s financial health at a specific point in time (it is usually a year)

Example of Balance sheet

Cash flow statement

Financial statement that gives a detailed summary of how cash flows into and out of a company over a specific period. It is one of the core financial statements, along with the Balance Sheet and Income Statement, and offers valuable insights into an organization’s liquidity, solvency, and overall financial health

3 segments:

Operating activities: Shows cash flows for the enterprise’s core business operations. It includes cash received from customers and cash paid to suppliers and employees

Investing activities: These activities include cash flows related to the acquisition and disposal of long-term assets

Financing activities: These activities cover cash flows associated with the company’s capital structure and financial decisions

Statement of changes in equity

Also knwon as the statement of stockholders’ equity or statement of retained earnings, they deliver a detailed account of the changes in an organization’s equity over a specific period

It captures how various transactions affect the owner’s equity, helping stakeholders understand movements in the components of equity

4 sections:

Opening balances: Reflects the equity balances at the beginning of the reporting period

Additions: This part details transactions that increase equity

Deductions: Transactions that decrease equity

Closing balances: Equity balances at the end of the reporting period, after all additions and deductions have been accounted for

Financial Ratios

Tools used to analyze an organization’s financial performance and stability, they provide insights into several aspects of a company’s profitability, liquidity, solvency, efficiency, and leverage

Are generally dervied from the financial statements: the balance sheet, the income statement, and the cash flow statement

Profitability Ratios

Metrics evaluating a company's ability to generate profit relative to revenue or assets. Help stakeholders understand how well a company is performing in terms of profit generation and are vital for assessing the financial health of a business

Gross Profit Margin

It measures the percentage of revenue that surpasses the cost of good sold (COGS)

Operating Profit Margin

It measures the percentage of revenue remaining after covering operating expenses but before interest and taxes

Net Profit Margin

It measures the percentage of revenue remaining after all costs, including interest, taxes, and operating cost

Return on Assets (ROA)

It measures how efficiently an organization uses its assets to generate profit

Return on Equity (ROE)

It measures the return on shareholders’ equity and indicates how effectively management is using shareholders’ resources

Liquidity Ratios

Measure an organization’s ability to meet short-term obligations and are essential for assessing financial health, reflect the company’s capacity to transform assets into cash to cover liabilities

Current Ratio

It measures an organization’s ability to pay short-term liabilities with short-term assets (cash, security, rent)

Quick Ratio (Acid-Test Ratio)

The quick ratio assesses an organization’s ability to meet short-term liabilities without relying on inventory sales

Cash Ratio

The cash ratio evaluates an organization’s ability to pay off short-term liabilities with cash and cash equivalents

Net Working Capital Ratio

The net working capital ratio measures the amount of liquid assets available after paying current liabilities

Solvency Ratios

Assess an organization’s ability to meet long-term obligations and assess its overall financial stability. These ratios help investors and creditors understand whether an enterprise can sustain operations over the long term and manage its debt

Equity Ratio

The equity ratio measures the proportion of a company’s assets that are financed by shareholders equity. It reflects the percentage of assets funded by equity

Efficiency Ratios

Measure how effectively a company uses its assets to generate revenue.

Asset Turnover Ratio

The asset turnover ratio measures how efficiently an organization uses its assets to generate sales revenue

Inventory Turnover Ratio

The inventory turnover ratio measures how many times an enterprise’s inventory is sold and replaced over a period

Leverage Ratios

Assess the degree to which a company relies on borrowed resources.

Debt-to-Assets Ratio

Like the debt ratio, this metric provides insight into the proportion of total assets financed through debt, highlighting the extent of financial leverage

Generation of Financial Information

The process of creating and compiling financial data and reports for decision-making, analysis, and communication within an organization or to external stakeholders

Typically involves collecting, processing, and presenting financial data in a structured format

What involves generating financial information?

Compliance and audit

6 stages to be created:

Data collection

Data processing

Report generation

Analysis and Interpretation

Communication

Data Collection

The first stage in generating financial information, involves source identification and verification.

Source Identification: Identifying and gathering data from various sources, such as financial transactions, accounting records, and operational data

Data Entry: Recording financial transactions into accounting systems or spreadsheets

Verification: Ensuring the accuracy and completeness of the collected data

Data Processing

Involves classification, aggregation, and analysis of financial data.

For it is important to follow this order:

Classification: Sorting data into categories like revenue, expenses, assets, and liabilities

Aggregation: Summarizing data to form financial statements and reports

Analysis: Applying accounting principles and methods to process data (ex. adjusting entries, accruals)

Report Generation

The creation of financial statements and management reports.

For report generation financial experts elaborate:

Financial Statements:

Income statement: Summarizes revenue, expenses, and profits over a period

Balance Sheet: Provides a snapshot of assets, liabilities, and equity at a specific date

Cash Flow Statement: Shows cash inflows and outflows from operating, investing, and financing activities

Management Reports:

Detailed reports for internal use, such as budget vs. actual performance, variance analysis, and departmental financial performance

External Reports:

Annual Reports: Comprehensive reports for shareholder and the public, often including statements, management discussion, and analysis

Regulatroy Fillings: Reports required by regulatory bodies, such as SED filings for public companies

Analysis and Interpretation

Involves financial analysis, ratio analysis, and forecasting.

Financial Analysis

Ratio analysis: Calculating financial ratios (ex. liquidity, profitability) to asses performance

Trend analysis: Analyzing historical data to identify patterns and trends

Variance analysis: Comparing actual performance to budgeted figures to understand deviations

Forecasting

Budgeting: Creating financial plans and projections for future periods

Scenario Planning: Developing different financial scenarios based on varying assumptions

Communication

Sharing financial information internally and externally.

A crucial aspect in generating financial information is how well it is communicated, there are two types of communications:

Internal Communication: Sharing financial information with management and staff to support decision-making and operational planning

External Communication: Presenting financial information to investors, regulators, and other stakeholders through formal reports and disclosures

Compliance and Audit

Ensuring adherence to standards and verifying accuracy of financial information.

Financial information must have:

Compliance: Ensuring that financial information adheres to accounting standards and regulatory requirements

Audit: Reviewing financial information to verify accuracy and completeness, often performed by external auditors

Different tools and techniques to generate financial information

Three very important are:

Accounting software

Spreadsheet software

Data visualization tools

Accounting Software

Tools used for managing financial data and reports.

Spreadsheet Software

Applications for organizing and analyzing financial data.

Data Visualization Tools

Software that helps present financial data in a visual format.

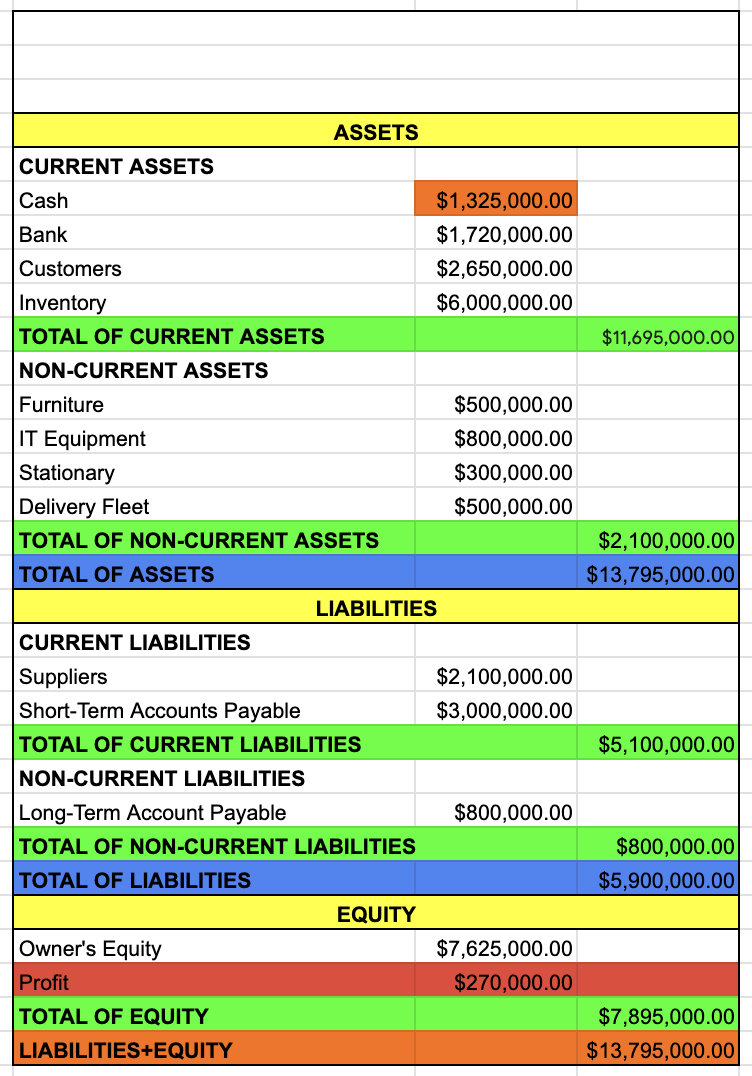

name of the company

BALANCE SHEET

date

ASSETS

CURRENT ASSETS

CASH

BANK

CUSTOMERS

INVENTORY

TOTAL OF CURRENT ASSETS

CASH + BANK + CUSTOMERS + INVENTORY

NON-CURRENT ASSETS

FURNITURE

IT EQUIPMENT

STATIONARY

DELIVERY FLEET

TOTAL OF NON-CURRENT ASSETS

FURNITURE + IT EQUIPMENT + STATIONARY + DELIVERY FLEET

TOTAL OF ASSETS

TOTAL OF CURRENT ASSETS + TOTAL OF NON-CURRENT ASSETS

LIABILITIES

CURRENT LIABILITIES

SUPPLIERS

SHORT-TERM ACCOUNTS PAYABLE

TOTAL OF CURRENT LIABILITIES

SUPPLIERS + SHORT TERM ACCOUNTS PAYABLE

NON-CURRENT LIABILITIES

LONG-TERM ACCOUNT PAYABLE

TOTAL OF NON-CURRENT LIABILITIES

LONG-TERM ACCOUNT PAYABLE

TOTAL OF LIABILITIES

TOTAL OF CURRENT LIABILITIES + TOTAL OF NON-CURRENT LIABILITIES

EQUITY

OWNER’S EQUITY

PROFIT

TAKE IT FROM THE INCOME STATEMENT

TOTAL OF EQUITY

OWNER’S EQUITY + PROFIT

LIABILITIES + EQUITY

COMPANY

INCOME STATEMENT

DATE

SALES

COST OF GOODS SOLD