4.1.8 Exchange Rates

1/17

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

18 Terms

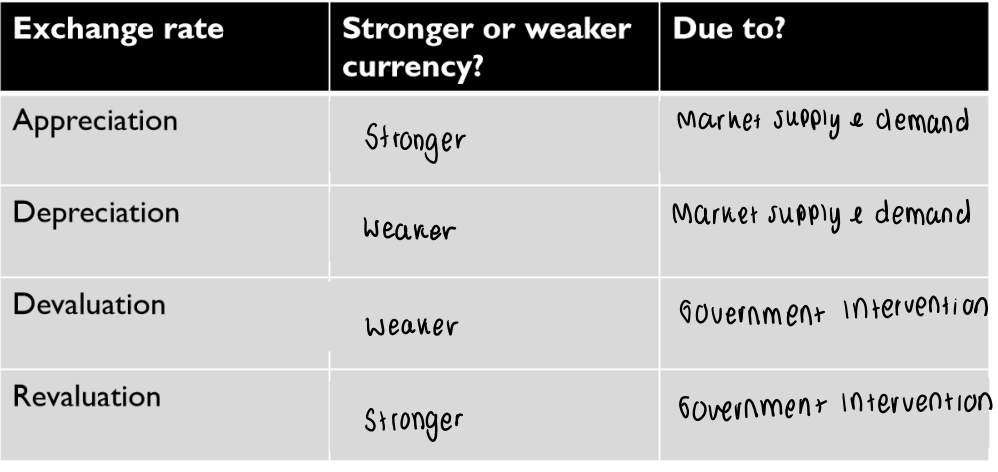

Difference between appreciation, depreciation, revaluation, devaluation?

What are the different types of exchange rate system?

Floating (most common)

ER is determined by market D+S only

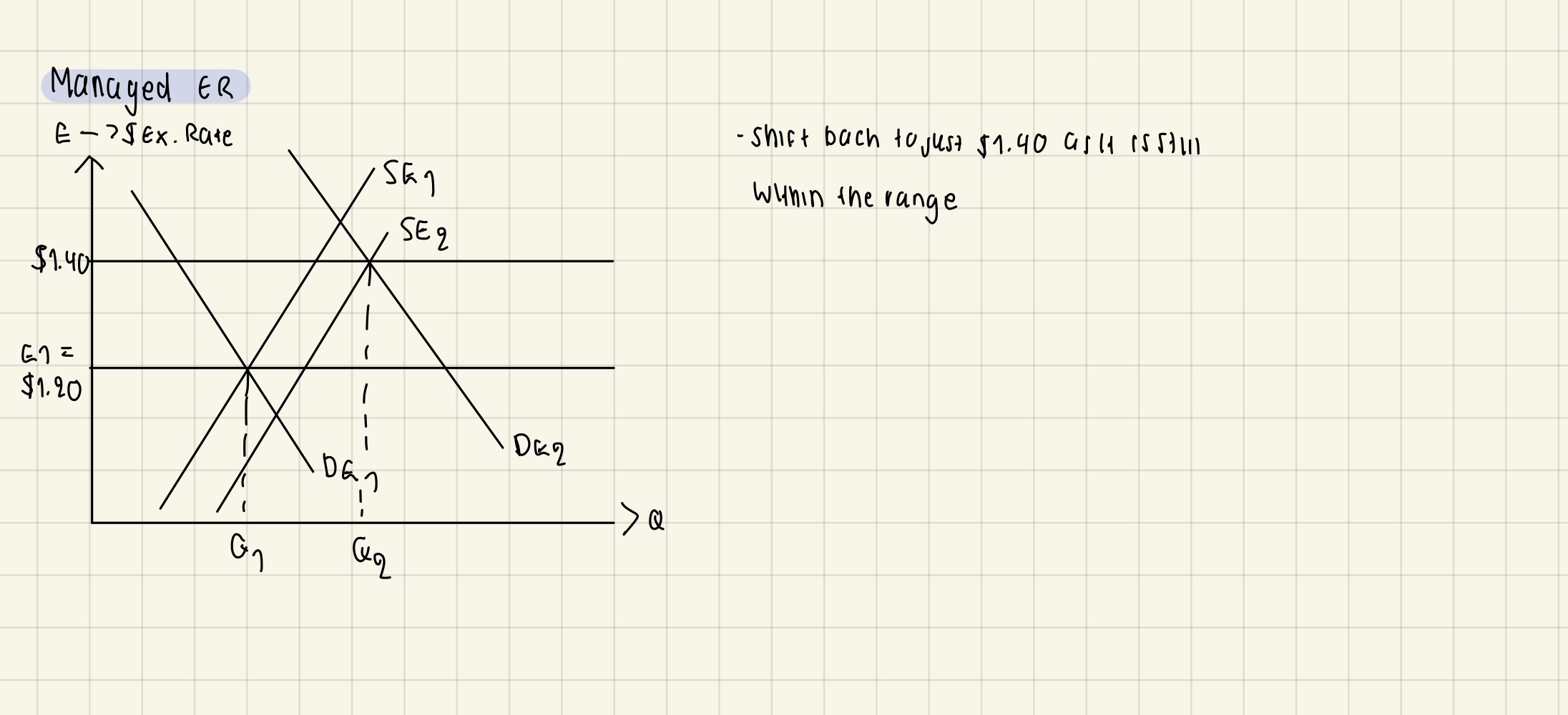

Managed

ER left to float within a range, but government takes actions in emergency situations

Fixed (least common)

Government takes action to keep ER at a certain level

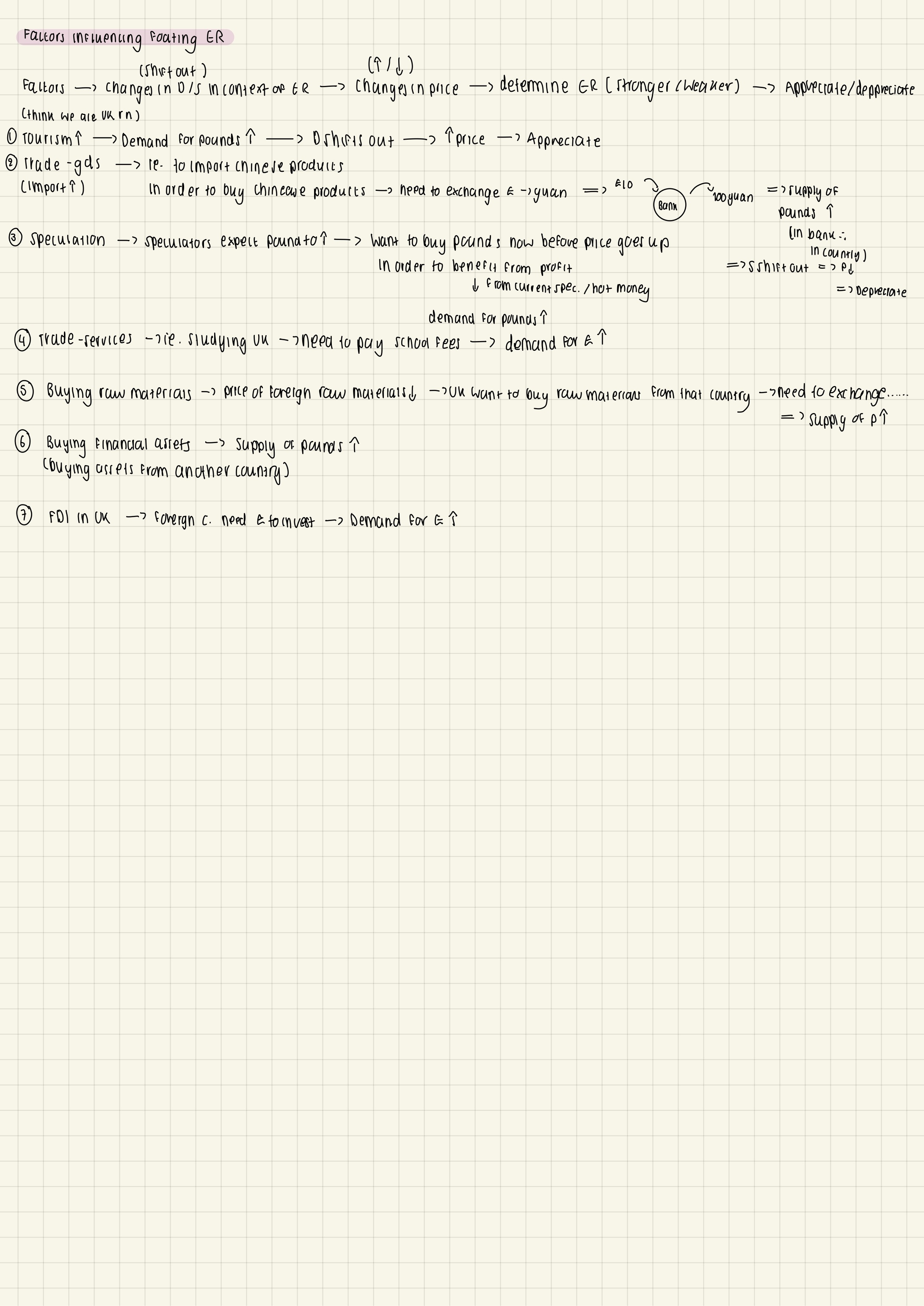

Factors influencing floating exchange rates (Which factors affect supply & demand for a currency?)

Tourism

Trade

Buying Financial assets

Buying raw materials

FDI

Speculation (เก็งกำไร)

Currency speculation = traders make profit by buying/selling currencies at the right time

Hot money = borrow money cheaply in 1 country → deposit at a higher rate in another → make profit

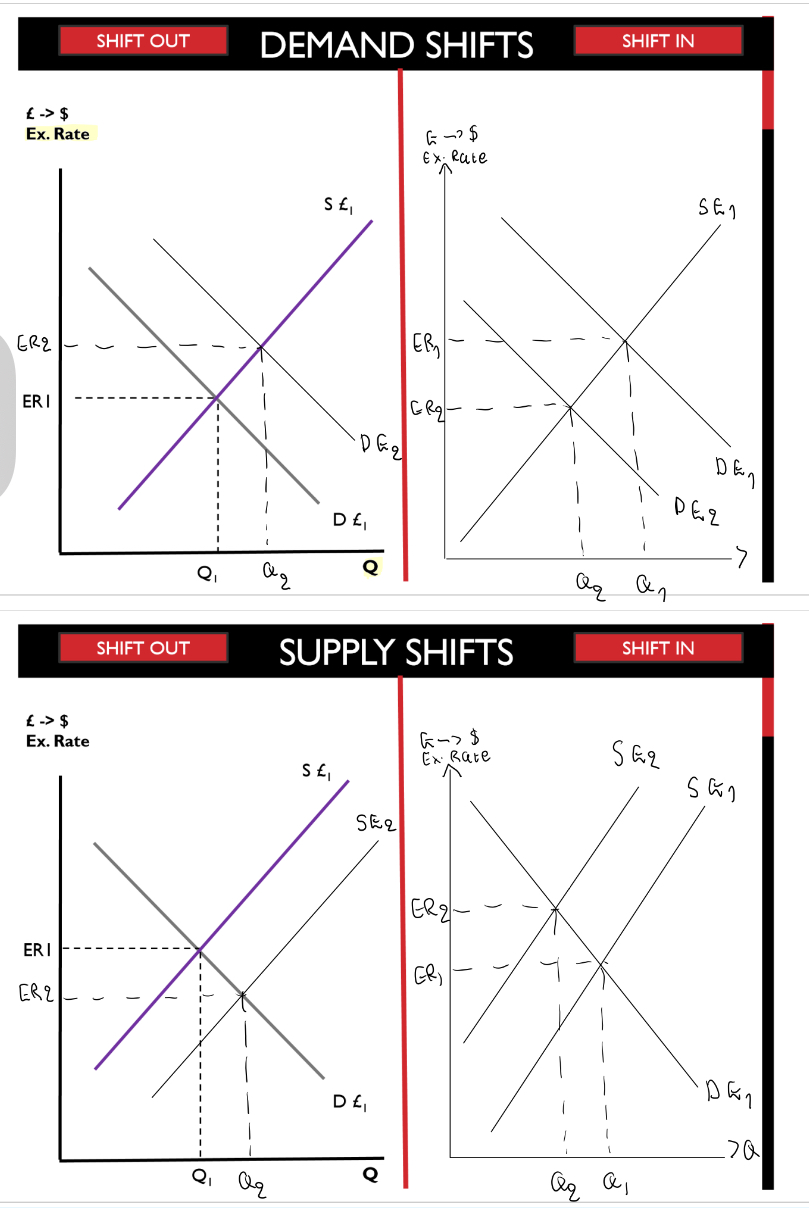

How are exchange rates determined in a floating exchange rate system?

Determined by demand & supply changes

Demand = want to buy the currency

Demand shift out = more people want to buy the currency than before → higher price → stronger ER → appreciate

Supply = want to sell the currency

Supply shift out = more people want to sell the currency than before → lower price → weaker ER → depreciate

Self-correction

This is with floating system - ER automatically stay at a medium level due to self-correction

Eval:

May take long time

A large shock (in ER) may be too large to return to medium level

2 reasons to change ER (cannot wait for autocorrect anymore)

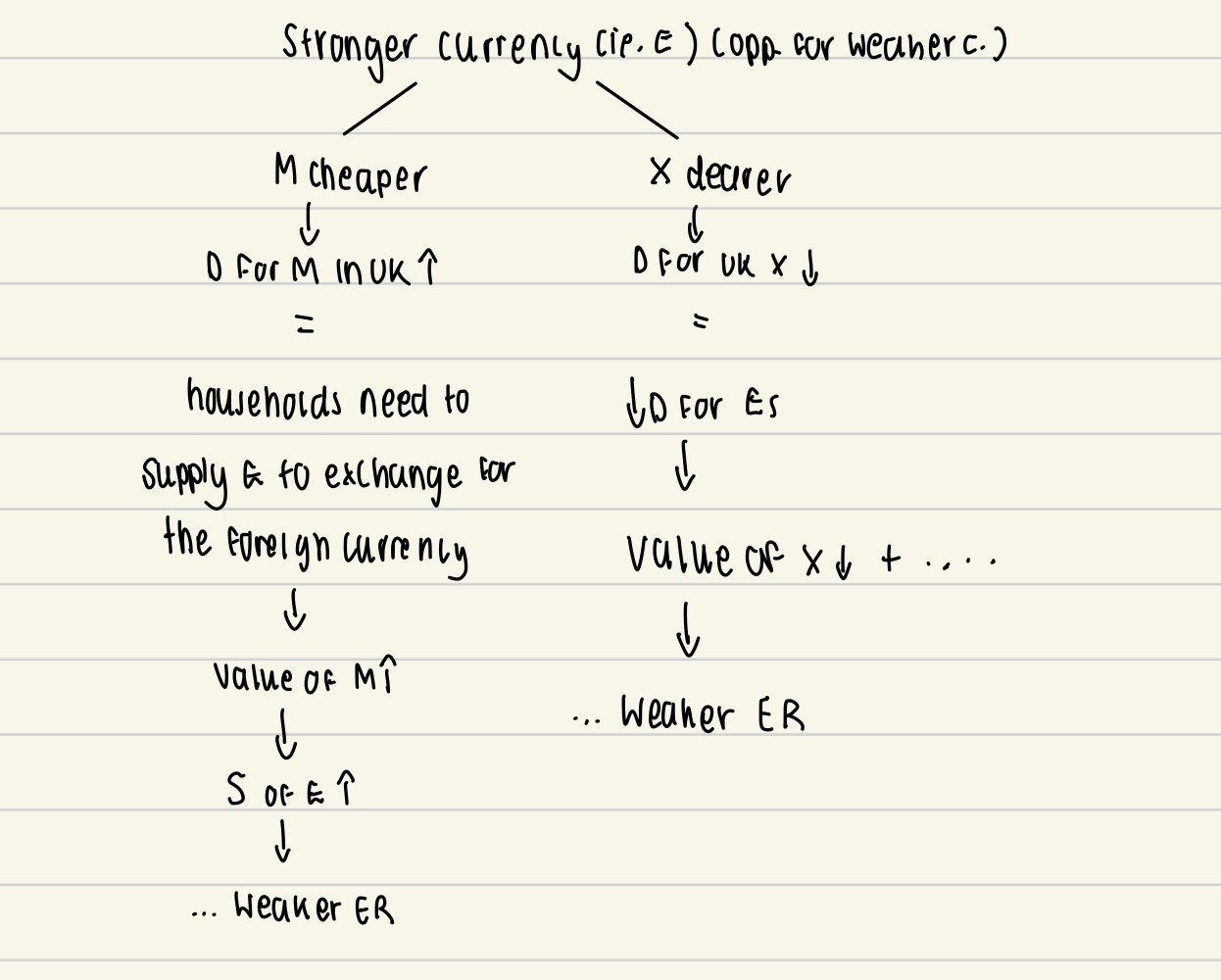

1) To help firms to export more / reduce imports which needs weaker currency (Devaluation by government)

2) Reduce inflation from increased import prices which needs stronger currency

2 methods to change ER but not waiting for autocorrect:

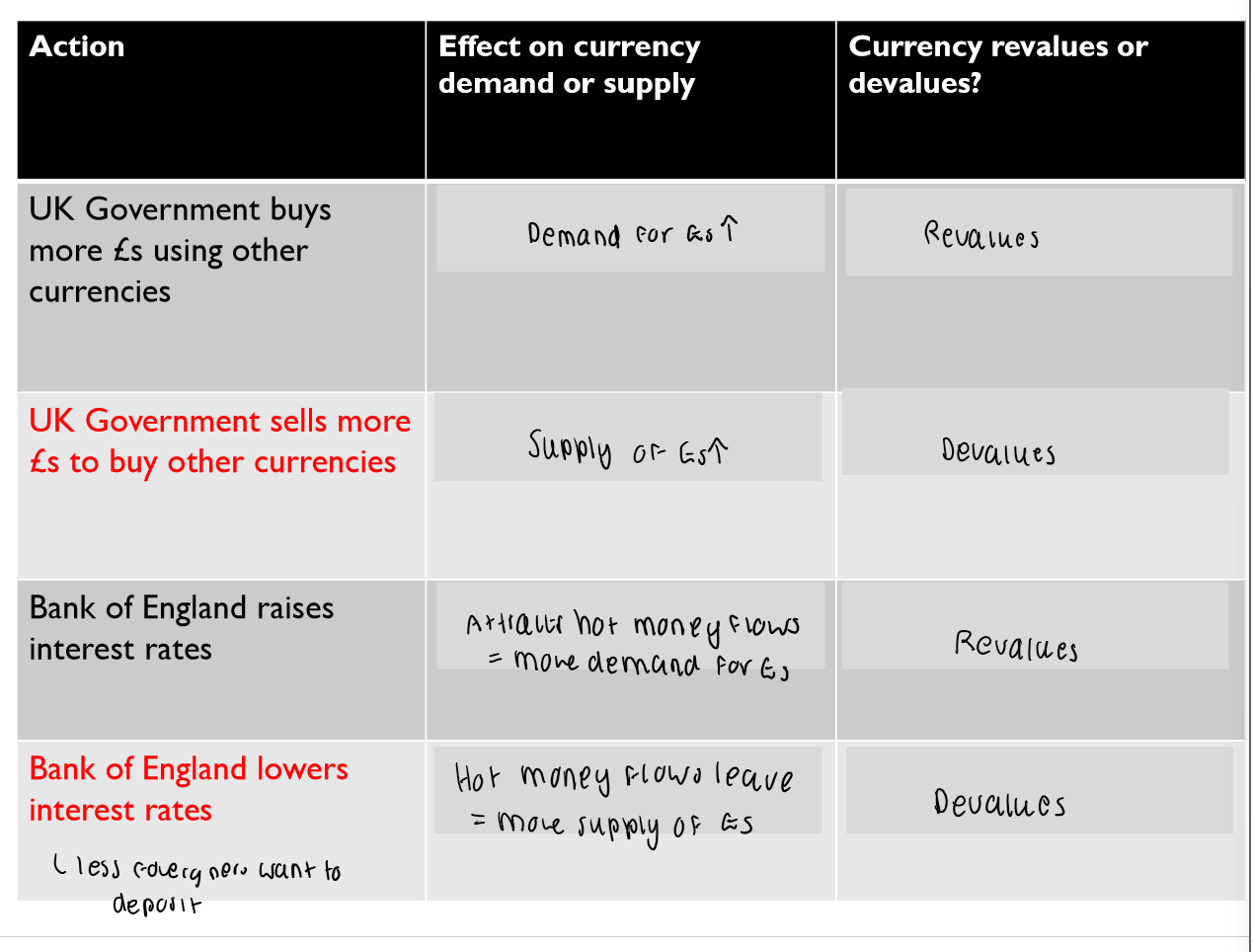

Direct intervention: buy & sell currency at the right time → change ER

Interest rate changes: change base rate to influence hot money → change ER

Government intervention in currency markets through foreign currency transactions & the use of interest rates to influence ER (the policies)

Always link to the effect of ER on X-M / inflation

What are the problems with these policies - with direct intervention (EVAL)

1) Government can try to control an exchange rate, but for big currency markets like GBP/USD, it is very hard / expensive for government to control

Therefore, in short run , speculators will usually control the price day-to-day

2) Problems when getting the currency to trade

If want to sell pounds → print to sell → hyperinflation

If want to buy pounds → need large foreign currency reserves to buy currency → could have used these reserves for something else → opportunity cost

What are the problems with these policies - with interest rates (EVAL)

can conflict with other macro economic objectives

1) If current UK inflation rate was high + government cut IR to weaken ER → currency devalues → weaker pound → (X-M) increases → AD increases → Inflation rise even further

2) If current UK GDP growth was negative + government raise IR to strengthen ER → currency revalues → stronger pound → (X-M) decreases → AD decreases → GDP growth fall further

What are the problems with these policies - with both policies (EVAL)

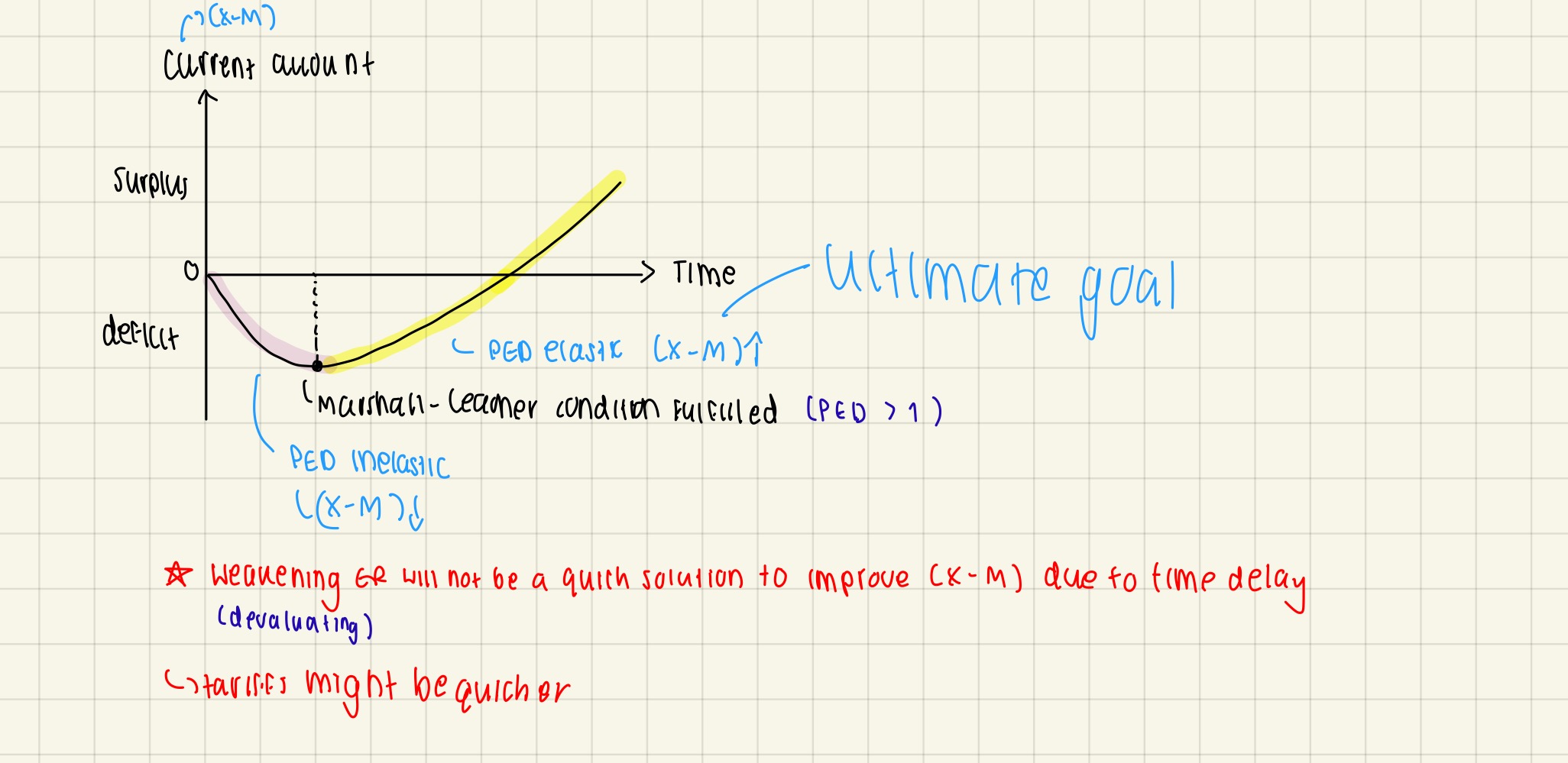

Takes long time for devaluation to take effect

In short run, PED inelastic → imports are still bought → still bought even at higher price as takes time for consumers to respond to price changes, foreigners don’t quickly increase their purchases even though UK goods are cheaper (export prices cheaper) → X-M gets worse initially

In long run, opposite to above (X-M) increase as ppl starts to notice the change

Impact of changes in exchange rates on: the current account of the balance of payments - The Marshall-Lerner condition & J curve effect

With weaker ER, X-M will only improve if PED for X & M add up to greater than 1 (elastic)

Diagram for government control of exchange rates in a fixed system

Diagram for government control of exchange rates in a managed exchange system

Impact of changes in exchange rates on: economic growth, unemployment & inflation

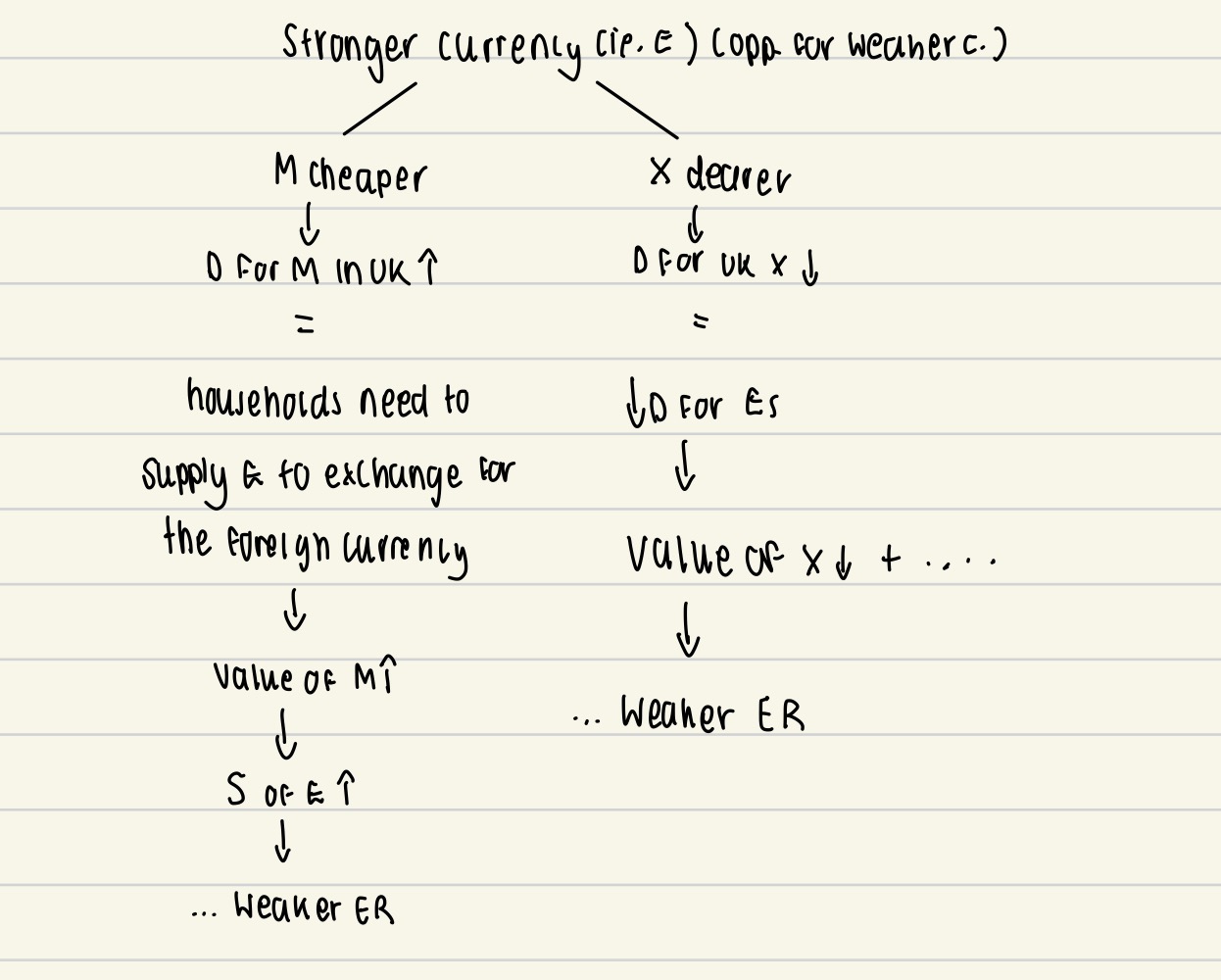

Stronger ER (pounds)

AD decreases so

GDP growth decreases → Unemployment increases

Inflation decreases

Weaker ER (opposite effect)

Impact of changes in exchange rates on FDI flows

Stronger exchange rate → less FDI as foreign firms have to find more domestic currency to invest in UK

Ie. if ER is £1 to 1.2 euros

Factory costs 10 million in pounds

Therefore it costs 12 million euros for BMW (has to pay)

If ER increases to £1 to 1.5 euros

Factory now costs 15 million euros for BMW (has to pay more so less likely to buy it)

Weaker exchange rate → more FDI

Therefore, this encourages government to try to weaken ER (devaluation) to encourage more FDI to stimulate economy

What is competitive devaluation/depreciation

= A weaker ER for 1 country means a stronger ER for the other

ie. if 1USD = 7RMB (ER1)

then 1RMB = 1/7USD = 0.14USD

if ER1 weakens to ER2: 1USD = 6RMB

then 1RMB = 0.17USA

Therefore, weaker ER for USD but stronger ER for RMB (China)

Therefore, better X-M for USD but worse for China

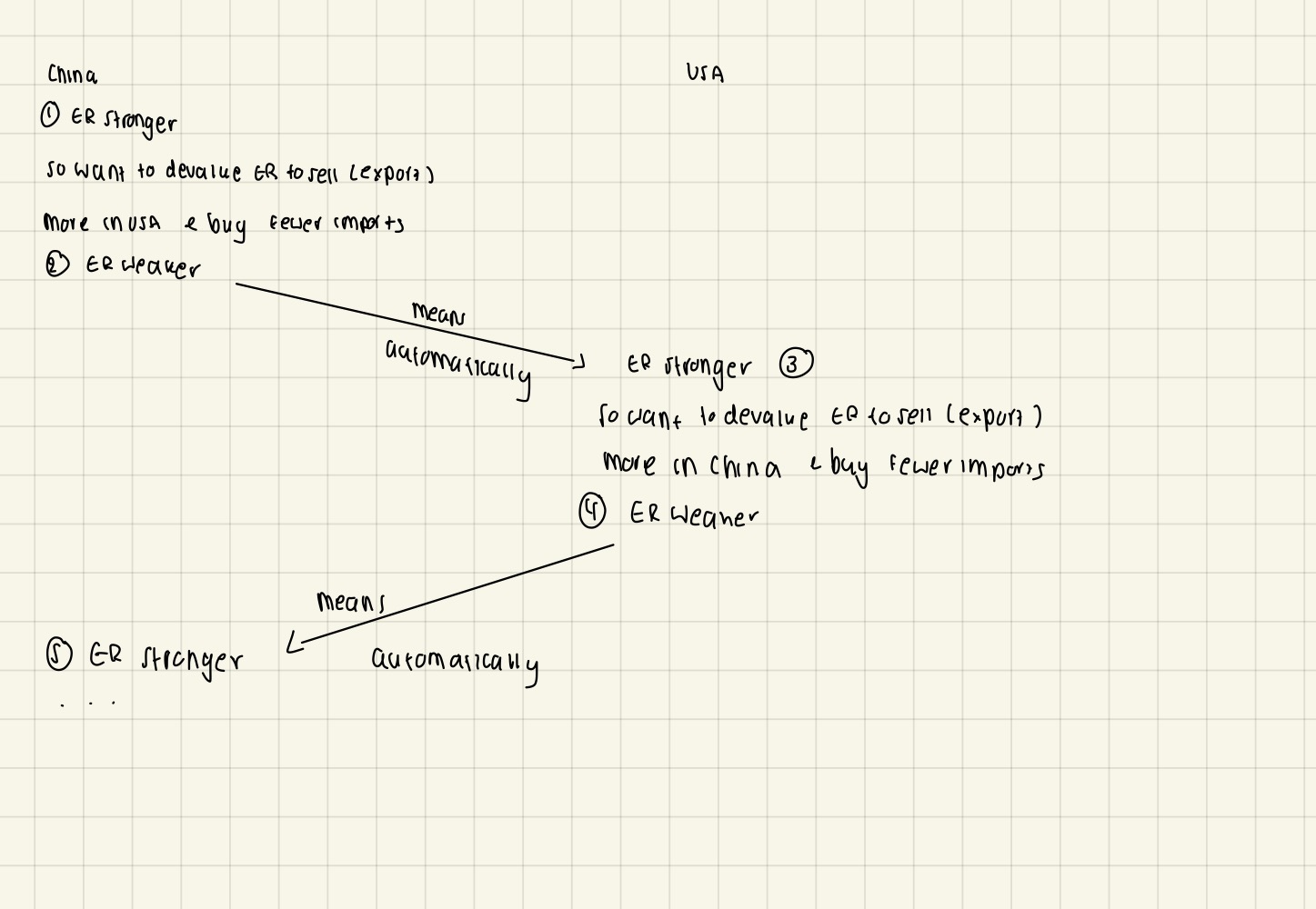

Consequences of competitive devaluation/depreciation

When a country devalues its ER → improves their net trade (more exports, less imports) but worsens it for the other country (as its ER become automatically stronger)

This incentivises the other country to devalue to improve their net trade → worsen it for the first country as its ER become automatically stronger

This cycle could continue indefinitely

This results in

no trade improvement for either

very volatile ERs for both countries

Conclusion: another reason for a government not to intervene to control their ER

Linking exchange rate to current account of the balance of payment (4) (asks in relation to US & pounds)

Depreciation = weaker ER for pounds → goods now appear cheaper to US consumers → increase in international competitiveness + increase in demand for exports → more exports, less imports → current account improves