microeconomics ch 17 financial markets

1/45

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

46 Terms

venture capital

firms that make financial investments in new companies that are still relatively small in size, but that have potential to grow substantially

do more than just supply money to small startups

also provide advice on potential products, customers, and key employees

2 main borrowing methods

banks

bonds

a financial contract where a borrower agrees to repay the amount that it borrowed and also an interest rate over a period of time in the future

corporate bond

a bond issued by firms that wish to borrow

municipal bond

a bond issued by cities that wish to borrow

state bond

issued by US states that wish to borrow

treasury bond

issued by the federal govt through the US dept of the treasury

bond

specifies an amount that one will borrow

the interest rate that one will pay

time until repayment

bondholder

anyone who owns a bond and receives the interest payments

private company

a firm frequently owned by the ppl who generally run it on a day to day basis

sole proprietorship

partnership

can also be a corporation but w/ no publicly issued stock

sole proprietorship

company run by an individual as opposed to a group

partnership

a company run by a group as opposed to an individual

public company

a firm that has sold stock to the public, which in turn investors then can buy and sell

shareholders own a ? company

corporate governance

the name economists give to the institutions that are supposed to watch over top executives

financial intermediary

an institution that receives money from savers and provides funds to borrowers

in a financial capital market, a bank would be the ex.

banks

financial intermediary bc they stand btw savers and borrowers

savers place deposits w/ banks and then receives interest payments and withdraw money

borrowers receive loans from banks, and repay the loans with interest

checking account

facilitates transactions by giving easy access to money, either by writing a check or by using a debit card

pays little or no interest

debit card

a card which works like a credit card, except that purchases are immediately deducted from your checking acct rather than billed separately thru a credit card company

savings acct

pays some interest rate, but getting the money typically requires you to make a trip to the bank, an automatic teller machine, or accessing the funds electronically

certificate of deposit CD

a mechanism for a saver to deposit funds at a bank and promise to leave them at the bank for a time, in exchange for a higher interest rate

US govt treasury bond

an extremely safe borrower, so it can pay a relatively low interest rate

high yield or junk bonds

bonds that offer high interest rates to compensate for their relatively high chance of default

face value

amount that the bond issuer or borrower agrees to pay the investor

coupon rate

the interest rate paid on a bond

usually semi annual, but can be paid at different times throughout the year

maturity date

when the borrower will pay back its face value as well as its last interest payment

present value

a bond’s current price at a given time

most that buyer would be willing to pay for a given bond

may or may not be the same as face value

bond yield

the rate of return of a bond is expected to pay at the time of purchase

bonds

low to moderate rate of return

low to moderate risk

moderate liquidity

interest rates

the ? for corporate bonds and US treasury bonds (“notes”) rise and fall together

depending for borrowers and lenders in financial markets for borrowing

corporate bonds always pay higher ? to make up for the higher risk they have of defaulting compared with US govt

stocks

rate of return on a financial investment in a share

dividends paid by firm

capital gain achieved by selling the stock for more than you paid

different ways to measure overall performance of stock market

based on averaging different subsets of companies’ stock prices

ex.,

dow jones industrial average

standard & poor’s 500

wilshire 5000

capital gain

income resulting from the sale of an asset, such as a stock or bond

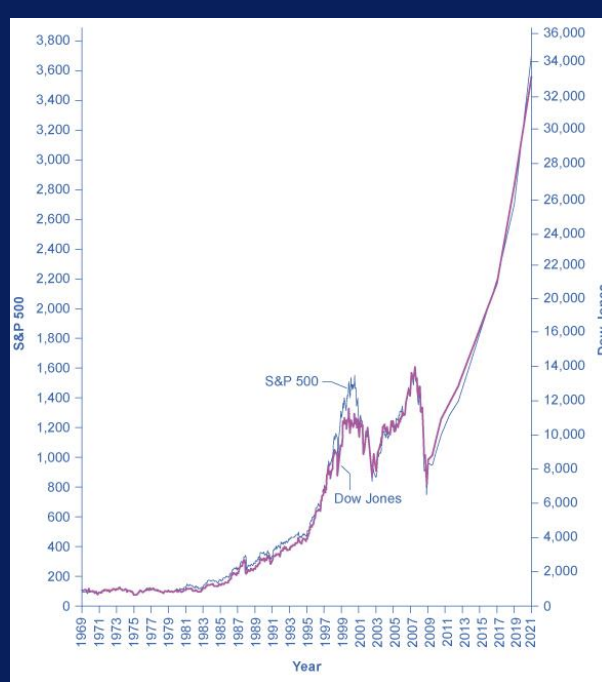

dow jones and s&p 500

stock prices rose dramatically from the 1980s up to about 2000

from 2000-2013, stock prices bounced up and down, but ended up at about the same level

since 2009, both indexes have mostly increased..

investing in stocks

rate of return over time will be high, the risks are high (esp in short run), liquidity is high

diversification

buying stocks or bonds from a wide range of companies to reduce the level of risk

can help to cancel out extreme increases and decreases in value

mutual funds

funds that buy a range of stocks or bonds from different companies

offers investors a diversified portfolio in a single investment

high rates of return over time, risks are high, liquidity is high (provided the mutual fund or stock index fund is readily traded)

risks and returns for an individual ? will be lower than those for an individual stock

index fund

a mutual fund that seeks to mimic a market’s overall performance

equity

the monetary value the owner would have after selling the house and repaying any outstanding bank loans used to buy the house

market value of house-what is still owed to the bank

investment in house

tangibly diff from bank accounts, stocks, and bonds bc a house offers both a financial and a nonfinancial return

part of the return on your investment occurs from your consumption of “housing services” - having a place to live

possibility of capital gain from selling the house in the future for more than one paid for it

tangible assets

gold, silver, precious metals

return on these investments from the saver’s hope of buying low, selling high, and receiving a capital gain

duller commodities

sugar, cocoa, coffee, orange juice, oil, natural gas

return on these investments from the saver’s hope of buying low, selling high, and receiving a capital gain

collectibles

paintings, fine wine, jewelry, antiques, baseball cards

returns both in the form of services or of a potentiall higher selling price in the future

investing in tangible assets

rate of return is moderate

risk is moderate for housing or high if u buy gold or baseball cards

liquidity is low bc it often takes considerable time and energy to sell

random walk with a trend

stock prices shift in response to unpredictable future news

"?” stock prices are just as likely to rise as to fall on any given day

“?” over time, the upward steps tend to be larger than the downward steps, so stocks do gradually climb

gain wealth for many US citizens

complete addt’l education and training

not only good for you, but pays off financially

start saving money early in life

give the power of compound interest a chance

simple interest

an interest rate calculation only on the principal amount

compound interest

an interest rate calculation on the principal plus the accumulated interest