Market Power Overview

1/32

Earn XP

Description and Tags

Market Structures, Profit Maximisation, Perfect Competition

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

33 Terms

What are market structures?

The characteristics of a market affecting firm behaviour and outcomes

What are features of market structures?

Number of buyers/sellers

Size of firms

Type of product → homogenous/differentiated

Barriers to entry and exit

Degree of competition

What are the types of market structures?

Perfect competition

Imperfect competition

Monopolistic competition

Oligopoly

Monopoly

What is perfect competition?

Many firms

No market power

Homogenous goods

What is monopolistic competition?

Many firms

Slight market power due to product differentiation

What is a oligopoly?

Few large firms dominate

High interdependence

What is a monopoly?

Single firm dominates

Significant market power

What is market power?

A firm’s ability to influence price and output

How does market power lead to market failure?

Price manipulation

Output restriction

Lack of allocative/productive efficiency

How is market power measured by?

Market share

Concentration ratios

Barriers to entry

High market power → less competition, potential inefficiency

Lower market power → more competition, efficient outcomes

What are the key characteristics of perfect competition?

Many buyers and sellers → price takers

No barriers to entry/exit → easy market access

Perfect knowledge → full information on prices

Homogenous products → no brant loyalty

Firms cannot influence price → P = AR = MR = Demand

Allocative efficiency

Productive efficiency

Dynamic efficiency is unlikely due to lack of abnormal profits

What is allocative efficency?

AR = MC

What is productive efficiency?

MC = AC

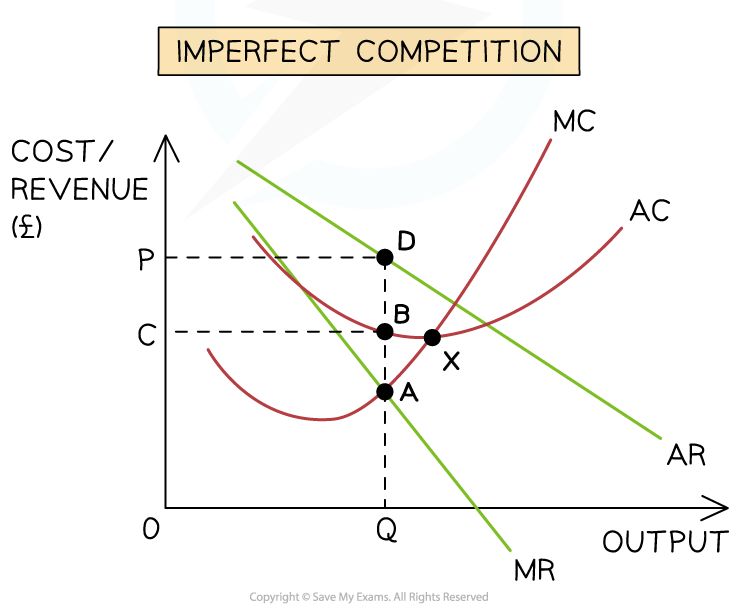

What are characteristics of an imperfect competition diagram?

Firm is a price maker → downward sloping demand and revenue curves

Produces at MC = MR (profit maximisation)

Not productively efficient: AC > MC

Not allocatively efficient: AR > MC

Likely dynamically efficient due to reinvested profits and innovation

What are explicit costs?

Direct payments (eg. wages, raw materials)

What are implicit costs?

Opportunity costs (eg. forgone interest from investment)

Entrepreneurs consider implicit costs when deciding whether to reallocate resources

What are total costs (TC)?

Explicit + implicit costs

What is profit?

Total revenue (TR) - Total costs (TC)

What is normal profit?

TR = TC → breakeven

What is abnormal profits?

TR > TC

What is losses?

TR < TC

What is the profit maximisation rule?

Firms aim to maximise profit to benefit stakeholders via dividends or rising share prices

What are dividends?

Distribution of earnings from a company to its stakeholders

When is profit maximised?

MC = MR → no extra profit from producing another unit

MC < MR → produce more, profit increases

When is profit not maximised?

MC > MR → firms stop producing, loss on extra units

Why may firms not always know where MC = MR?

Frequent cost changes (short term)

Consumer disruption from regular price shifts (short term)

Regulatory constraints (long term)

What is the formula for average cost (AC)?

Total costs / output

What is the formula for average revenue?

Total revenue / output

How do you calculate per unit profit?

Average revenue - average costs

How does profit maximisation work in perfect competition?

Firms produce where MC = MR

Short run, firms can make

Abnormal profit: AR > AC

Losses: AR < AC

Long run, firms always make normal profits due to:

No barriers to entry/exit

New firms enter if profits exist → shifts supply right → price falls

Firms exit if losses occur → shifts supply left → price rises

What are some diagram notes for perfect competition?

Short run abnormal profit: AR > AC at MC = MR

Short run losses: AR < AC at MC = MR

Long run equilibrium: AR = AC - P, normal profit only

Supply shifts adjust market price until normal profit is restored

What is the link between efficiency in perfect competition?

Allocative efficiency: P = AR = MC → resources maximally allocated

Productive efficiency: MC = AC → lowest average cost, no resource waste

Long run: perfect competition achieves both efficiencies

What is the profit maximisation point?

MC = MR