FI 301 Test One

0.0(0)

Card Sorting

1/134

Earn XP

Description and Tags

Last updated 9:57 PM on 2/11/23

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

135 Terms

1

New cards

Financial market

A market in which financial assets (securities) such as stocks and bonds can be purchased or sold

2

New cards

Funds are transferred when one party purchases financial assets previously held by another party.

Financial market

3

New cards

Role of Financial Markets

Financial markets transfer funds from those who have excess funds to those who need funds.

4

New cards

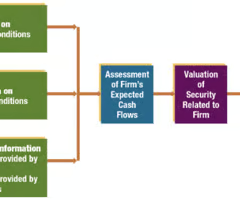

Surplus units

participants who receive more money than they spend, such as investors

5

New cards

Deficit units

participants who spend more money than they receive, such as borrowers

6

New cards

Securities

represent a claim on the issuers

7

New cards

Deb securities

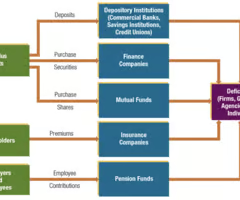

debt (a.k.a credit or borrowed funds) incurred by the issuer

8

New cards

Equity securities

(a.k.a. stocks) represent equity or ownership in the firm

9

New cards

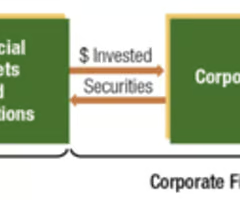

Accommodating Corporate Finance Needs

The financial markets serves as the mechanism whereby corporations (acting as deficit units) can obtain funds from investors (acting as surplus units).

10

New cards

Accommodating Investment Needs

Financial institutions serve as intermediaries to connect the investment management activity with the corporate finance activity.

11

New cards

How Financial Markets Facilitate Corporate Finance and Investment Management

12

New cards

Primary markets

facilitate the issuance of new securities

13

New cards

Secondary markets

facilitate the trading of existing securities, which allows for a change in the ownership of the securities

14

New cards

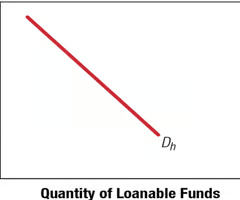

Liquidity

the degree to which securities can easily be liquidated (sold) without loss of value

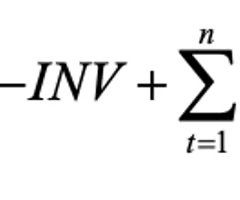

15

New cards

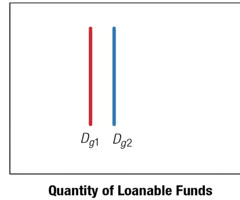

If securities are illiquid how does that affect investors?

They might can't find a willing buyer for the security in the secondary market and may have to sell the security at a large discount just to attract a buyer

16

New cards

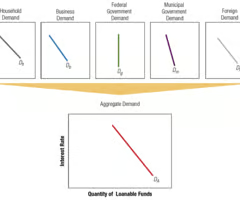

What can securities be classified as?

* Money market securities

* Capital market securities

* Derivative Securities

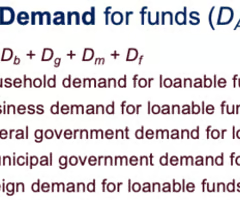

* Capital market securities

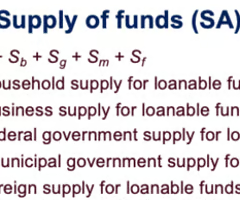

* Derivative Securities

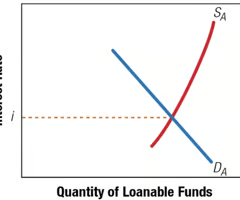

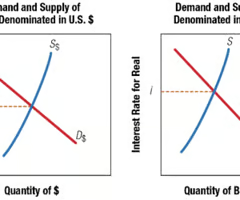

17

New cards

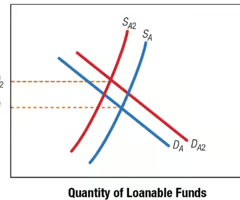

Money Market Securities

Money markets facilitate the sale of short-term debt securities by deficit units to surplus units.

(Debt securities that have a maturity of one year or less.)

(Debt securities that have a maturity of one year or less.)

18

New cards

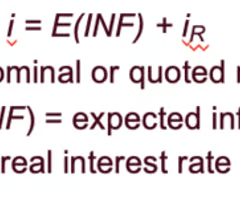

Capital market securities

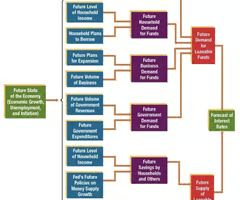

facilitate the sale of long-term securities by deficit units to surplus units

19

New cards

Bonds

long-term debt securities issues by the Treasury, government agencies, and corporations to finance their operations (Capital market securities)

20

New cards

Mortgages

Long-term debt obligations created to finance the purchase of real estate (Capital market securities)

21

New cards

Mortgage-backed securities

debt obligations representing claims on a package of mortgages (Capital market securities)

22

New cards

Stocks

Represent partial ownership in the corporations that issued them

(Capital market securities)R

(Capital market securities)R

23

New cards

Derivative securities

financial contracts whose values are derived from the values of underlying assets

24

New cards

Speculation

allow an investor to speculate on movements in the value of underlying assets without having to purchase those assets (Derivative securities)

25

New cards

Risk management

financial institutions and other firms can use derivative securities to adjust the risk of their existing investments in securities (Derivative securities)

26

New cards

Valuation of securities: impact of information on valuation

* estimate future cash flows by obtaining information that may influence a stock's future cash flows

* use economic or industry information to value a security

* use published opinions about the firm's management to value a security

* use economic or industry information to value a security

* use published opinions about the firm's management to value a security

27

New cards

Use of Information to Make Investment Decisions

28

New cards

Valuation of securities: impact of the internet on valuation

* more timely pricing

* more accurate pricing

* more informative pricing

* more accurate pricing

* more informative pricing

29

New cards

Valuation of securities: impact of behavioral finance on valuation

Various conditions can affect investor psychology

30

New cards

Behavioral finance

the application of psychology to make financial decisions

31

New cards

Uncertainty surrounding valuation of securities

limited information leads to uncertainty in the valuation of securities

32

New cards

Securities Regulations on Financial Disclosure: Required Disclosure

The Securities Act of 1933

\

intended to ensure complete disclosure of relevant financial information on publicly offered securities and to prevent fraudulent practices in selling these securities

\

intended to ensure complete disclosure of relevant financial information on publicly offered securities and to prevent fraudulent practices in selling these securities

33

New cards

Securities Regulations on Financial Disclosure: Required Disclosure

The Securities Exchange Act of 1934

extended the disclosure requirements to secondary market issues

extended the disclosure requirements to secondary market issues

34

New cards

Securities Regulations on Financial Disclosure: Regulatory Response to Financial Reporting Scandals

The Sarbanes-Oxley Act of 2002

\

required that firms provide more complete and accurate financial information

\

required that firms provide more complete and accurate financial information

35

New cards

International Financial Markets

Financial markets vary across the world in terms of:

* Degree of financial market development

* Volume of funds transferred from surplus to deficit units

* Degree of financial market development

* Volume of funds transferred from surplus to deficit units

36

New cards

International Integration of Financial Markets

under favorable economic conditions this allows governments and corporations easier access to funding from creditors or investors in other countries

37

New cards

Role of Foreign Exchange Market

International financial transactions normally require the exchange of currencies and this facilitates this exchange

38

New cards

Financial institutions are needed to resolve the limitations caused by _________ such as limited information regarding the creditworthiness of borrowers.

market imperfections

39

New cards

Role of Depository Institutions

accept deposits from surplus units and provide credit to deficit units through loans and purchases of securities

* offer liquid deposit accounts to surplus units

* provide loans of the size and maturity desired by deficit units

* accept the risk on loans provided

* have more expertise in evaluating creditworthiness

* diversify their loans among numerous deficit units

* offer liquid deposit accounts to surplus units

* provide loans of the size and maturity desired by deficit units

* accept the risk on loans provided

* have more expertise in evaluating creditworthiness

* diversify their loans among numerous deficit units

40

New cards

Role of Depository Institutions: Commercial Banks

* most dominant type of depository institution

* transfer deposit funds to deficit units through loans or purchase of debt securities

* Federal Funds Market: facilities the flow of funds between depository institutions

* transfer deposit funds to deficit units through loans or purchase of debt securities

* Federal Funds Market: facilities the flow of funds between depository institutions

41

New cards

Role of Depository Institutions: Savings Institutions

* a.k.a. thrift institutions and include Savings and Loans (S&Ls) and Savings Banks

* concentrate on residential mortgage loans

* concentrate on residential mortgage loans

42

New cards

Role of Depository Institutions: Credit Unions

* nonprofit organizations

* restrict business to its members with a common bond

* restrict business to its members with a common bond

43

New cards

Role of Non-depository Institutions: Finance companies

obtain funds by issues securities and lend the funds to individuals and small businesses

44

New cards

Role of Non-depository Institutions: Mutual funds

sell shares to surplus units and use the funds received to purchase a portfolio of securities

45

New cards

Role of Non-depository Institutions: Securities firms

provide a wide variety of functions in markets

(Broker, Underwriter, Dealer, Advisory)

(Broker, Underwriter, Dealer, Advisory)

46

New cards

Role of Non-depository Institutions: Insurance companies

provide ______ policies that reduce the financial burden association with death, illness, and damage to property

\

charge premiums and invest in financial markets

\

charge premiums and invest in financial markets

47

New cards

Role of Non-depository Institutions: Pension funds

manage funds until they are withdrawn for retirement

48

New cards

Financial institutions

facilitates the flow of funds from individual surplus units (investors) to deficit units

49

New cards

Comparison of Roles among Financial Institutions

50

New cards

Role of Financial Institutions: Institutional Role as a Monitor of Publicly Traded Firms

Since insurance companies, pension funds, and some mutual funds are major investors in stocks, they can influence the management of publicly traded firms.

\

By serving as activist shareholders, they can help ensure that managers of publicly held corporations make appropriate decisions that are in the best interest of the shareholders.

\

By serving as activist shareholders, they can help ensure that managers of publicly held corporations make appropriate decisions that are in the best interest of the shareholders.

51

New cards

Relative Importance of Financial Institutions

* Households with savings are served by depository institutions.

* Households with deficient funds are served by depository institutions and finance companies.

* Several agencies regulate the various types of financial institutions, and the various regulations may give some financial institutions a comparative advantage over others.

* Households with deficient funds are served by depository institutions and finance companies.

* Several agencies regulate the various types of financial institutions, and the various regulations may give some financial institutions a comparative advantage over others.

52

New cards

Institutional Sources and Uses of Funds: Commercial banks

Source: Deposits from households, businesses, and government agencies

\

Use: Purchases of government and corporate securities; loans to businesses and households

\

Use: Purchases of government and corporate securities; loans to businesses and households

53

New cards

Institutional Sources and Uses of Funds: Savings institutions

Source: Deposits from households, businesses, and government agencies

\

Use: Purchases of government and corporate securities; mortgages and other loans to households; some loans to businesses

\

Use: Purchases of government and corporate securities; mortgages and other loans to households; some loans to businesses

54

New cards

Institutional Sources and Uses of Funds: Credit unions

Source: Deposits from credit union members

\

Use: Loans to credit union members

\

Use: Loans to credit union members

55

New cards

Institutional Sources and Uses of Funds: Finance companies

Source: Securities sold to households and businesses

\

Use: Loans to households and businesses

\

Use: Loans to households and businesses

56

New cards

Institutional Sources and Uses of Funds: Mutual funds

Source: Shares sold to households, businesses, and government agencies

\

Use: Purchases of long-term government and corporate securities

\

Use: Purchases of long-term government and corporate securities

57

New cards

Institutional Sources and Uses of Funds: Money market funds

Source: Shares sold to households, businesses, and government agencies

\

Use: Purchases of short-term government and corporate securities

\

Use: Purchases of short-term government and corporate securities

58

New cards

Institutional Sources and Uses of Funds: Insurance companies

Source: Insurance premiums and earnings from investments

\

Use: Purchases of long-term government and corporate securities

\

Use: Purchases of long-term government and corporate securities

59

New cards

Institutional Sources and Uses of Funds: Pension funds

Source: Employer/employee contributions

\

Use: Purchases of long-term government and corporate securities

\

Use: Purchases of long-term government and corporate securities

60

New cards

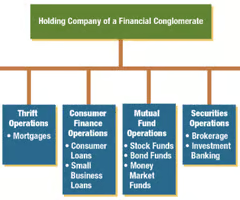

Organizational Structure of Financial Conglomerate

Typical organizational structure of a financial conglomerate

\

Operations of each type of financial service are commonly managed separately, a financial conglomerate offers advantages to customers who prefer to obtain all of their financial services from a single financial institution.

\

Operations of each type of financial service are commonly managed separately, a financial conglomerate offers advantages to customers who prefer to obtain all of their financial services from a single financial institution.

61

New cards

Global Consolidation of Financial Institutions

Many financial institutions have expanded internationally to capitalize on their expertise.

62

New cards

Systemic Risk

the spread of financial problems among financial institutions and across financial markets that could cause a collapse in the financial system

63

New cards

Example of Systemic Risk

During the credit crises of 2008 and 2009, mortgage defaults affected financial institutions in several ways.

* Many financial institutions that originated mortgages shortly before the crisis sold them o other financial institutions.

* Many other financial institutions that invested in mortgage-backed securities received lower payments as mortgage defaults occurred.

* Some financial institutions (esp securities funds) relied heavily on short-term debt to finance their operations and use their holdings of mortgage-backed securities as collateral.

* As mortgage defaults increased, there was an excess of unoccupied housing.

* Most financial institutions that invested heavily in equities experienced large losses on their investments during the credit crisis.

* Many financial institutions that originated mortgages shortly before the crisis sold them o other financial institutions.

* Many other financial institutions that invested in mortgage-backed securities received lower payments as mortgage defaults occurred.

* Some financial institutions (esp securities funds) relied heavily on short-term debt to finance their operations and use their holdings of mortgage-backed securities as collateral.

* As mortgage defaults increased, there was an excess of unoccupied housing.

* Most financial institutions that invested heavily in equities experienced large losses on their investments during the credit crisis.

64

New cards

Loanable Funds Theory

the market interest rate is determined by the factors that control the supply of and demand for loanable funds

Explains:

* Movements in the general level of interest rates in a particular country

* Why interest rates among debt securities of a given country vary

Explains:

* Movements in the general level of interest rates in a particular country

* Why interest rates among debt securities of a given country vary

65

New cards

Household Demand for Loanable Funds

Finances housing expenditures as well as the purchase of automobiles and household items

66

New cards

Relationship between Interest Rates and Household(Dh)/Business(Db) Demand for Loanable Funds

Inverse relationship between the interest rate and the quantity of loanable funds demanded

67

New cards

Business Demand for Loanable Funds

* demand a greater quantity of loanable funds at any given point in time if interest rates are lower

* based on the number of projects that add value to the firm (projects that have positive NPVs)

* based on the number of projects that add value to the firm (projects that have positive NPVs)

68

New cards

Shifts in Demand for Loanable Funds

NPV: net present value of project

INV: initial investment

CFt: cash flow in period *t*

*k*: required rate of return on project

INV: initial investment

CFt: cash flow in period *t*

*k*: required rate of return on project

69

New cards

Government Demand for Loanable Funds

* demands loanable funds when planned expenditures are not covered by incoming revenues

* interest inelastic (insensitive to interest rates)...Expenditures and tax policies are independent to interest rates. Expenditures and tax policies are independent of the level of interest rates.

* interest inelastic (insensitive to interest rates)...Expenditures and tax policies are independent to interest rates. Expenditures and tax policies are independent of the level of interest rates.

70

New cards

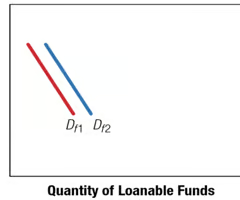

Impact of Increased Government Deficit on the Government Demand for Loanable Funds

71

New cards

Foreign Demand for Loanable Funds

* country's demand for foreign funds depends on the interest rate differential between the two

* greater the differential, the greater the demand for foreign funds

* Quantity of U.S. loanable funds demanded by foreign governments will be inversely related to U.S. interest rates.

* greater the differential, the greater the demand for foreign funds

* Quantity of U.S. loanable funds demanded by foreign governments will be inversely related to U.S. interest rates.

72

New cards

Impact of Increased Foreign Interest Rates on the Foreign Demand for U.S. Loanable Funds

73

New cards

Determination of the Aggregate Demand Curve for Loanable Funds

The sum of the quantities demanded by the separate sectors at any given interest rate.

74

New cards

Supply of Loanable Funds: Households

largest supplier, but some supplied by government units

* more supply at higher interest rates

* supply by buying securities

* more supply at higher interest rates

* supply by buying securities

75

New cards

Supply of Loanable Funds: Effects of the Fed

By affecting the supply of loanable funds, the Fed's monetary policy affects interest rates.

76

New cards

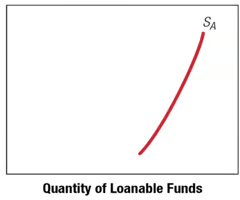

Aggregate Supply Curve for Loanable Funds

The combination of all sector supply schedules along with the supply of funds provided by the Fed's monetary policy.

77

New cards

Equilibrium Interest Rate - Algebraic Presentation

Aggregate Demand for Funds (Da)

Aggregate Demand for Funds (Da)

Da = Dh + Db + Dg + Dm + Df

Dh: household demand for loanable funds

Db: business demand for loanable funds

Dg: federal government demand for loanable funds

Dm: municipal government demand for loanable funds

Df: foreign demand for loanable funds

Dh: household demand for loanable funds

Db: business demand for loanable funds

Dg: federal government demand for loanable funds

Dm: municipal government demand for loanable funds

Df: foreign demand for loanable funds

78

New cards

Equilibrium Interest Rate - Algebraic Presentation

Aggregate Supply for Funds (Sa)

Aggregate Supply for Funds (Sa)

Sa = Sh + Sb + Sg + Sm + Sf

Sh: household supply for loanable funds

Sb: business supply for loanable funds

Sg: federal government supply for loanable funds

Sm: municipal government supply for loanable funds

Sf: foreign supply for loanable funds

Sh: household supply for loanable funds

Sb: business supply for loanable funds

Sg: federal government supply for loanable funds

Sm: municipal government supply for loanable funds

Sf: foreign supply for loanable funds

79

New cards

Equilibrium Interest Rate - Graphical Presentation

\

Combining aggregate demand and aggregate supply curves allows comparison of total amount demanded to total amount supplied.

\

At equilibrium interest rate *i*, the supply of loanable funds is equal to the demand for loanable funds.

\

At interest rate above *i*, there is a surplus of loanable funds.

\

At interest rate below *i*, there is a shortage of loanable funds.

Combining aggregate demand and aggregate supply curves allows comparison of total amount demanded to total amount supplied.

\

At equilibrium interest rate *i*, the supply of loanable funds is equal to the demand for loanable funds.

\

At interest rate above *i*, there is a surplus of loanable funds.

\

At interest rate below *i*, there is a shortage of loanable funds.

80

New cards

Impact of economic growth on interest rates

Puts upward pressure on interest rates by shifting demand for loanable funds outward

81

New cards

Impact of Inflation on Interest Rates

Puts upward pressure on interest rates by shifting supply of funds inward and demand for funds outward.

82

New cards

Impact of an Increase in Inflationary Expectations on Interest Rates

83

New cards

Impact of Monetary Policy on Interest Rates

When the Fed reduces/increases the money supply it reduces/increases the supply of loanable funds, putting upward/downward pressure on interest rates.

84

New cards

Impact of the Budget Deficit on Interest Rates: Crowding-out Effect

Given a certain amount of loanable funds supplied to the market, excessive government demand for funds tends to "crowd out" the private demand for funds as the Treasury issues more and more securities to finance deficits.

85

New cards

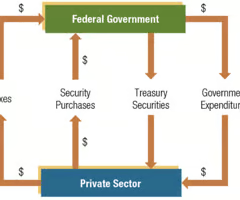

Flow of Funds between the Federal Government and the Private Sector

86

New cards

Impact of Foreign Flows of Funds on Interest Rates

Interest rate for a certain currency is determined by the demand for funds in that currency and the supply of funds available in that currency.

87

New cards

Forecasting Interest Rates: Net Demand (ND)

Da = Dh + Db + Dg + Dm + Df

Dh: household demand for loanable funds

Db: business demand for loanable funds

Dg: federal government demand for loanable funds

Dm: municipal government demand for loanable funds

Df: foreign demand for loanable funds

\

Sa = Sh + Sb + Sg + Sm + Sf

Sh: household supply for loanable funds

Sb: business supply for loanable funds

Sg: federal government supply for loanable funds

Sm: municipal government supply for loanable funds

Sf: foreign supply for loanable funds

Dh: household demand for loanable funds

Db: business demand for loanable funds

Dg: federal government demand for loanable funds

Dm: municipal government demand for loanable funds

Df: foreign demand for loanable funds

\

Sa = Sh + Sb + Sg + Sm + Sf

Sh: household supply for loanable funds

Sb: business supply for loanable funds

Sg: federal government supply for loanable funds

Sm: municipal government supply for loanable funds

Sf: foreign supply for loanable funds

88

New cards

Future Demand for Loanable Funds Depends on future:

* foreign demand for U.S. funds

* household demand for funds

* business demand for funds

* government demand for funds

* household demand for funds

* business demand for funds

* government demand for funds

89

New cards

Future Supply of Loanable Funds depends on:

* future supply by households and others

* future foreign supply of loanable funds in the U.S.

* future foreign supply of loanable funds in the U.S.

90

New cards

Framework for Forecasting Interest Rates

91

New cards

Why Debt Security Yields Vary

Yields on debt securities are affected:

* credit (default) risk

* liquidity

* tax status

* term to maturity

* credit (default) risk

* liquidity

* tax status

* term to maturity

92

New cards

Credit (default) Risk

Investors must consider the -creditworthiness of the security issuer.

* All else being equal, securities with a higher degree of default risk must offer higher yields.

* Especially relevant for longer term securities.

* All else being equal, securities with a higher degree of default risk must offer higher yields.

* Especially relevant for longer term securities.

93

New cards

Use of Rating Agencies to Assess Credit Risk

Rating Agencies: Investors can personally assess the creditworthiness of corporations that issue bonds, but they may prefer to rely on bond ratings provided by rating agencies.

94

New cards

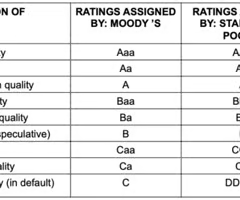

Rating Classifications by Rating Agencies

95

New cards

Credit Ratings and Risk Premiums over Time

Rating agencies can change bond ratings over time in response to changes in the issuing firm's financial condition.

96

New cards

Accuracy of Credit Ratings

The ratings issues by the agencies are opinions, not guarantees. Bonds that are assigned a low credit rating experience default more frequently than bonds assigned a high credit rating, which suggests that the rating can be a useful indicator of credit risk. Credit rating agencies do not always detect firms' financial problems.

97

New cards

Oversight of Credit Rating Agencies

The Financial Reform Act of 2010 established an Office of Credit Ratings within the Securities and Exchange Commission in order to regulate credit rating agencies. Rating agencies must establish internal controls.

98

New cards

The lower a security's _______ the higher the yield preferred by an investor.

Liquidity

Debt securities with a short-term maturity or an active secondary. market have greater liquidity.

Debt securities with a short-term maturity or an active secondary. market have greater liquidity.

99

New cards

Tax Status

* Investors are more concerned with after-tax income.

* Taxable securities must offer a higher before-tax yield.

* Taxable securities must offer a higher before-tax yield.

100

New cards

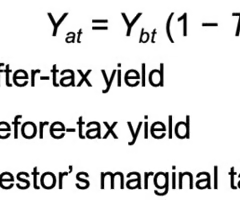

Formula for Expected Yields After-Tax