Battery Storage Quiz 2

1/50

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

51 Terms

When was the first rechargeable lithium-ion battery commercialized? By what company and for what application?

1991 Sony Camcorders

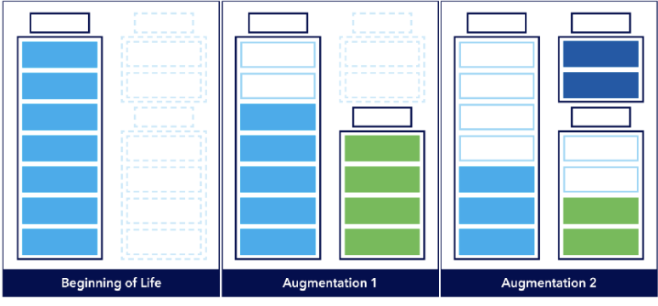

Augmentation

BESS augmentation is the process of adding battery capcity as the battery system ages

Augmentation Plan for BESS Capacity Maintenance

When does it occur?

What needs to be considered?

Occurs at the preliminary design stage

Considerations:

Allocate space for future batteries

Ensure BOP (Balance of Plant) and auxiliary systems have sufficient capacity for expansion

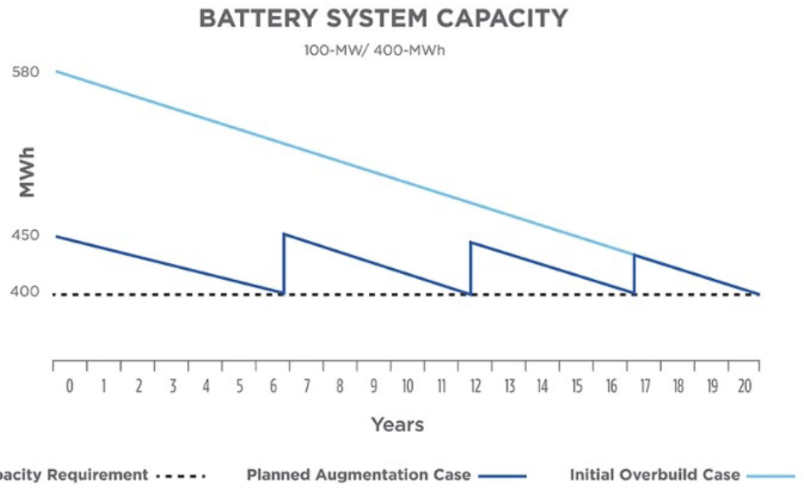

Difference between planned augmentation and initial overbuild?

Planned Augmentation Case: Batteries are added over time as capacity degrades

Initial Overbuild Case: Extra batteries are installed at the beginning to offset future degradation

Lithium-ion Sales by Market

Passenger EV’s

Stationary Storage

Consumer Electronics

Comercial EVs

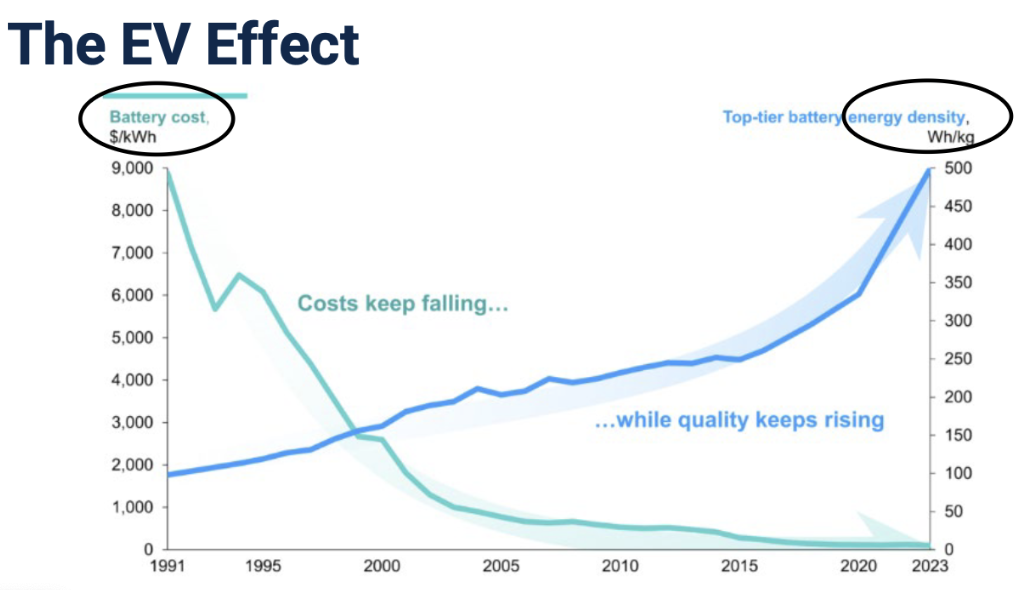

The EV Effect

As EVs become more popular, battery costs decrease and battery energy density/quality rises

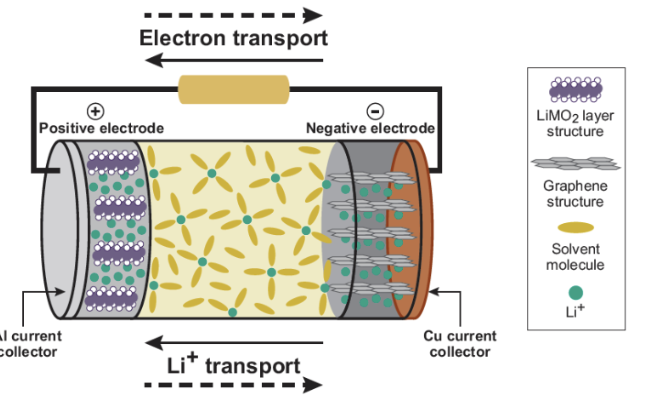

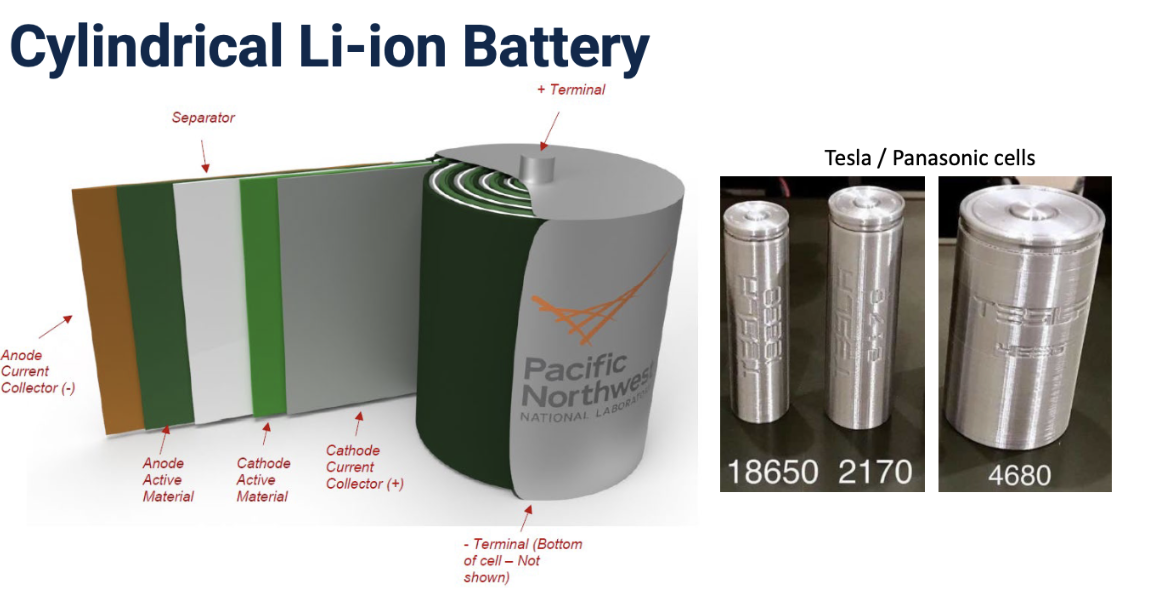

Lithium-Ion Battery Schematic

What are the key components?

How does it work (charge/discharge)

Anode (-): Graphite (stores Li⁺ during charging)

Cathode (+): LiCoO₂, NMC, or LiFePO₄ (releases Li⁺ during charging)

Electrolyte: Lithium salt solution (moves Li⁺ between anode and cathode)

Separator: Prevents short circuits, allows Li⁺ flow (A thin porous membrane that prevents the anode and cathode from touching)

Current Collectors: Copper (-) & Aluminum (+) (Conducts electrons to the external circuit)

Charging: Li⁺ moves cathode → anode, electrons flow via circuit

Discharging: Li⁺ moves anode → cathode, electrons power device

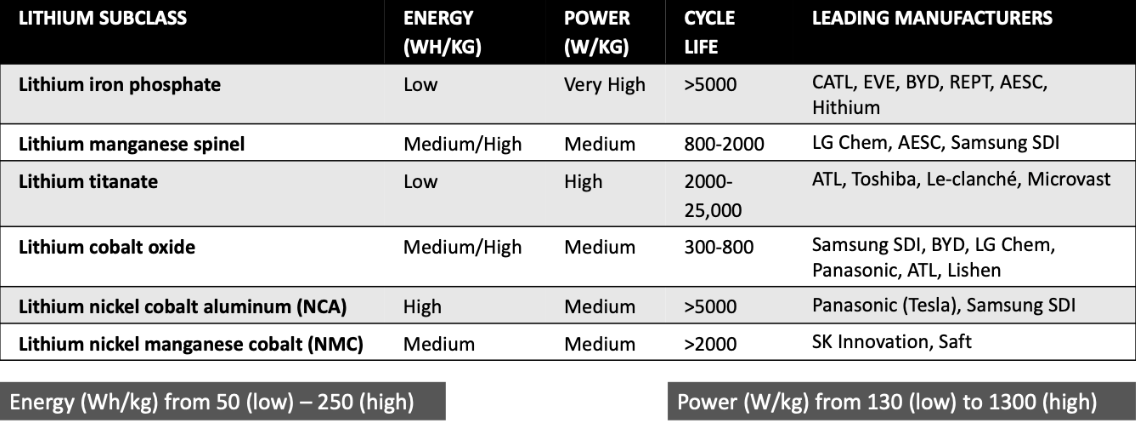

Lithium-ion Family

Lithium Nickel Maganese Cobalt Oxide is the most common

Lithium Iron Phospahte domminates current market

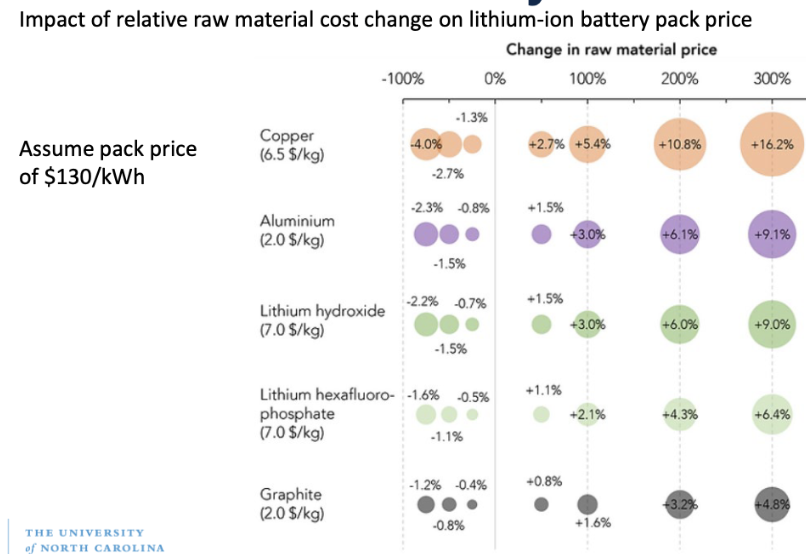

LFP Price Sensitivity

How factors like raw material costs, supply chain dynamics, market demand, technology advancements, and government policies impact the price of lithium iron phosphate batteries.

LFP battery pack prices are most sensitive to copper, aluminum, and lithium hydroxide cost, while NMC is sensitive to the cathode materials, nickel, and cobalt

Cylindrical Lithium-Ion Batteries

Round, tube-like shape, commonly used in electronics and EV’s (Tesla)

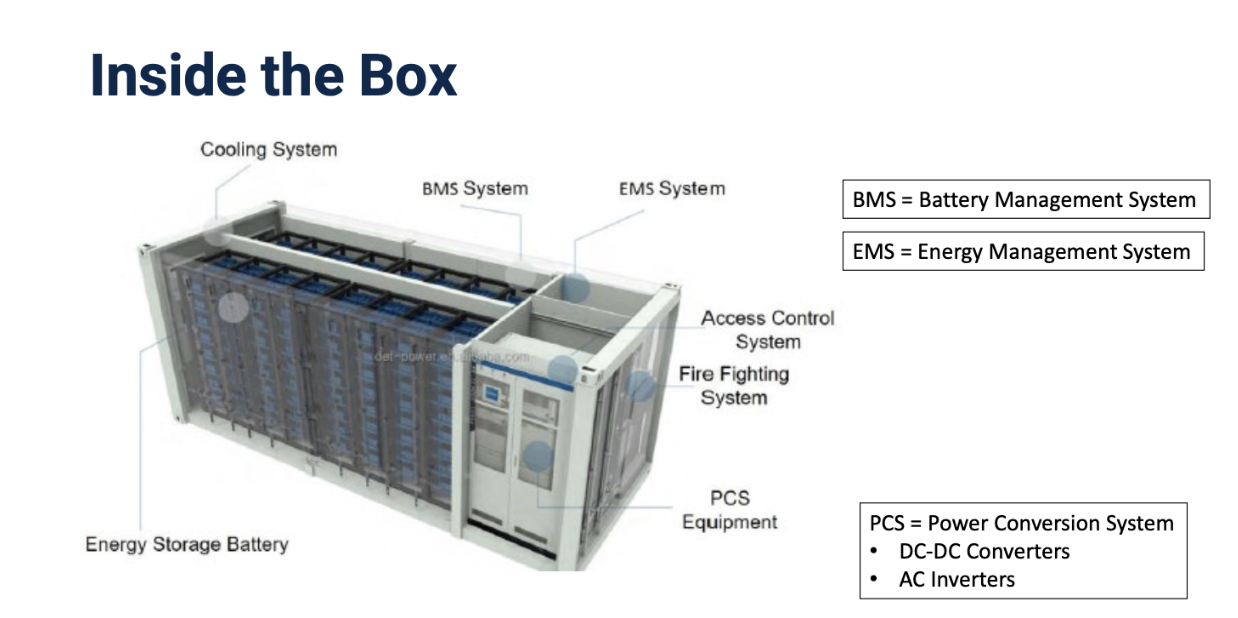

A 20ft container lithium-ion battery system is a compact, modular energy storage unit

LFP

2-hour: 7,300 cycles

60% SOH (State of Health) at EOL (End of Life) means that at the end of the battery’s expected lifespan, it will retain 60% of its original capacity.

Max Energy Capacity: 5 MWh

2 hour discharge duration

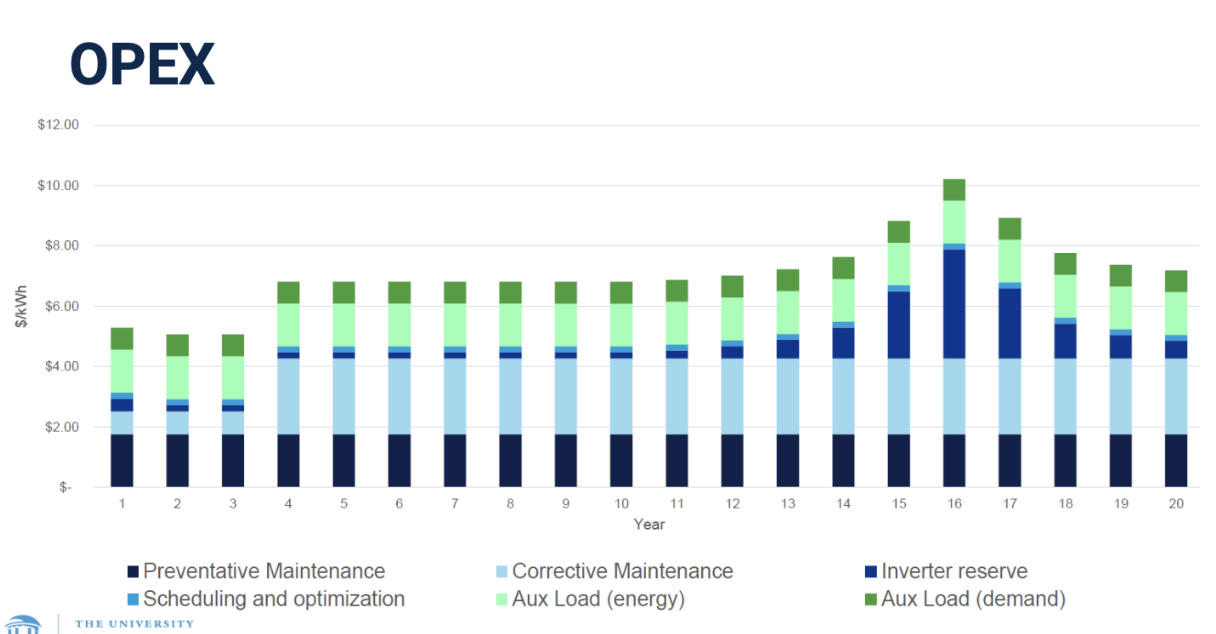

OPEX of Lithium-Ion Batteries

The ongoing costs required to operate and maintain a system

Should BESS aux loads go up or down over time for an individual battery system?

Auxiliary loads should go up over time because, as the battery degrades, more heat is generated, requiring increased air conditioning (AC) to cool the system.

Aux: cooling systems, controllers/monitoring systems, ventilation

What are some factors that impact li-ion battery degradation?

Temperature (extreme heat or cold)

Charge/discharge cycles (frequent cycling degrades capacity)

Average State-of-Charge (SOC): How full the battery is on average. Keeping the battery too full or too empty can cause it to wear out faster.

SOC Swing: The difference between the highest and lowest charge levels the battery experiences. If the battery’s charge fluctuates a lot, it degrades faster.

C-Rate: How quickly the battery is charged or discharged. Charging or using the battery too quickly can wear it down.

Thermal Runaway

A battery generates more heat than it can dissipate, causing a chain reaction that leads to even more heat (faster the chemical reactions occur, more heat produced). This can result in the battery overheating, catching fire, or even exploding.

Storage Ratio

The total storage capacity divided by total generation capacity within a hybrid type.

E.g. A 40 MW solar plus storage project has a storage ratio of only 25%.

meaning: storage component is 10 MWac compared to solar 40 MWac)

How do energy storage projects make money? Who pays the project owner?

Energy Toll Agreement - A contract between a utility and an energy provider (such as an energy storage project or a power plant) where the utility pays for the right to use the energy storage or generation capacity at a set price.

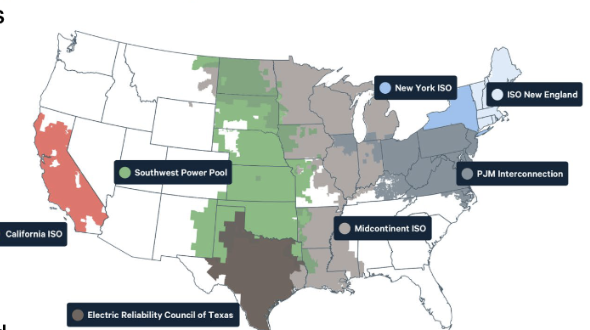

Energy Arbitrage – The project buys electricity when it’s cheap and stores it, then sells it when prices are higher. Revenue is paid by the RTO (Regional Transmission Organization) or ISO (Independent System Operator).

Resource Adequacy – The project provides capacity to ensure grid reliability. Utilities or RTO/ISO pay for maintaining available energy storage to meet peak demand.

Ancillary Services – The project offers grid support services like frequency regulation or voltage control. Typically, the RTO/ISO pays, although utilities may pay in rare cases.

Types of Revenue

Contracted Revenue

Merchant Revenue

Contracted Revenue: Revenue earned through long-term contracts or agreements with a buyer

Predictable, stable income (guaranteed payments)

Fixed price ($/MWh) for net energy at delivery point

Merchant Revenue: Revenue earned by selling electricity or services directly into the open market without a long-term contract. (ISO/RTO)

Provides higher potential income, but also more risk since prices can fluctuate.

Day ahead Energy and Real Time Energy

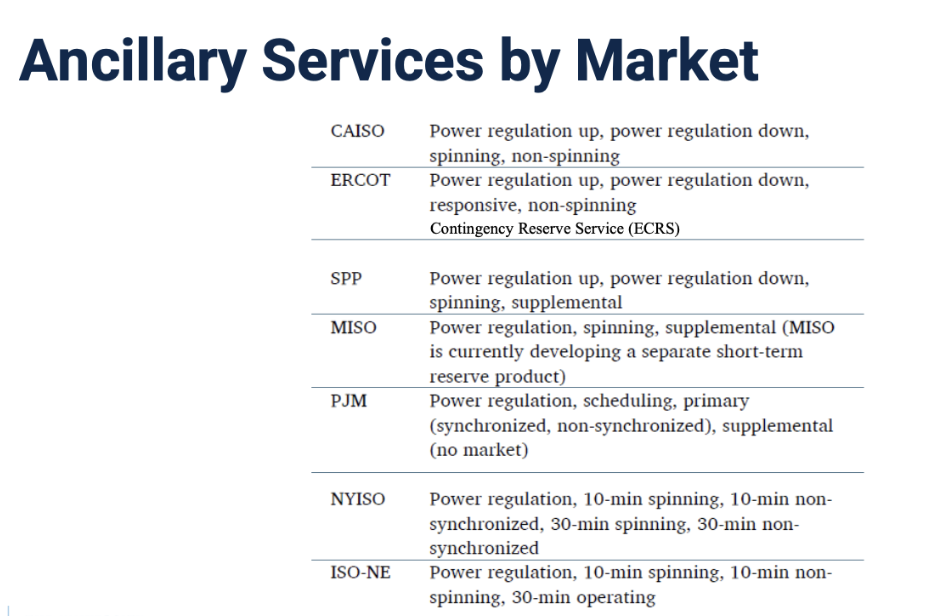

Ancillary Services

ISO vs RTO

ISO (Independent System Operator)

RTO (Regional Transmission Operator)

Both are non-profit entities managing the grid in deregulated, competitive markets.

Instead of a single utility owning everything, RTOs/ISOs manage through price signals and different entities own generation and transmission.

Price signals: indicators in the market that communicate the cost of electricity or energy service at any given time

Open access to transmission was a key change that made this possible.

Locational Marginal Prices (LMP) are used to determine the cost of the next MWh to serve the grid.

Benefits: cost savings, economies of scale, regional efficiencies

Energy Arbitrage

Arbitrage revenue is generated by charging during periods of low wholesale electricity demand and dispatching at peak hours — buying low and selling high.

With solar plus storage, this implies accumulating energy during the day, when insolation is at its highest, to discharge in late afternoon, early evening.

Price Volatility

The degree of variation in the price of electricity over time.

High volatility means large price swings within a short time (we want because more money for energy storage)

ISOs and RTOs that have a resource adequacy market give BESS the opportunity to earn capacity revenue.

Resource adequacy requires having enough energy resources available to meet future energy demand.

ISOs ensure there’s enough energy capacity by securing energy resources for a recurring fee (paid monthly based on the amount of energy capacity provided)\

The fee for providing capacity is similar to a subscription model, where the BESS owner gets a steady, predictable income for their service over a long period

Ancillary Services

Keep the electric grid reliable by providing backup support when needed

Frequnecy Regulation: helps balance supply and demand by adjusting power output to fix small, short-term energy imbalances

Black-Start: help restart the grid, bringing power back on in stages.

Contingency Reserves: reserves act as backups. If a power source fails, spinning reserves (online generation) and non-spinning reserves (stored energy) are used to fill the gap.

Value Stacking

Earning multiple revenue streams from the same energy asset by participating in different energy markets or providing various services.

Buy electricity when it’s cheap and sell it when it’s more expensive

Provide frequency regulation to help balance grid supply and demand.

Offer capacity to ensure there’s enough energy available during peak demand

What are the benefits of pairing solar plus storage? What are the drawbacks

Benefits:

Reduced development and O&M costs: Sharing infrastructure between solar and storage reduces overall costs for building and operating the system.

Shared CAPEX (Capital Expenditure): Both solar and storage can use the same facilities, making it more cost-effective to install.

Increased capacity value: The combination allows for greater use of the solar power, even when the sun isn’t shining, improving the value of the energy generated (shift solar to higher value periods).

Drawbacks:

Shared Point of Interconnection (POI) limit: Both systems may have to share the same connection to the grid, potentially limiting the amount of power that can be injected into the grid.

Must site storage next to generation vs. load: The storage needs to be located near the solar generation site, which may not always align with demand (load) centers, requiring additional infrastructure.

Charging tied to solar schedule: The storage system must be charged when solar power is available, limiting flexibility compared to standalone storage systems.

Co-located vs Full Hybrid

Colocated means the same technology (e.g., solar + storage) is in one location (2 POIs), while hybrid means different types of energy systems are integrated together (1 POI).

Time Shifting

Storing energy during low-demand periods (when electricity is cheaper) and using or selling it during high-demand periods (when electricity prices are higher)

Inverter Loading Ratio

DC Capacity of Solar Panels / AC Capacity of Inverter

DC vs. AC Coupled

In a DC-coupled system, both the solar panels and battery storage are connected through the direct current (DC) side, before the inverter.

The solar panels produce DC power, which is fed into the battery for storage. The inverter then converts the DC power to AC power for use in the home or grid.

In an AC-coupled system, the solar panels and battery storage are connected on the AC side, meaning each component (solar, inverter, battery) has its own separate inverter.

The solar panels generate DC power, which is converted to AC power by the inverter. The battery is connected to its own AC inverter, and energy is stored or used as AC.

Behind the Meter

Energy generation and storage sytens that are installed on the cutomer’s side, rather than being directly connected to the utility grid.

Attachment Rate

Indicates the percentage of new residential solar installs that also include a battery.

Drivers:

Direct incentives for storage

Transitions away from net metering

Grid service opportunities

Grid reliability concerns

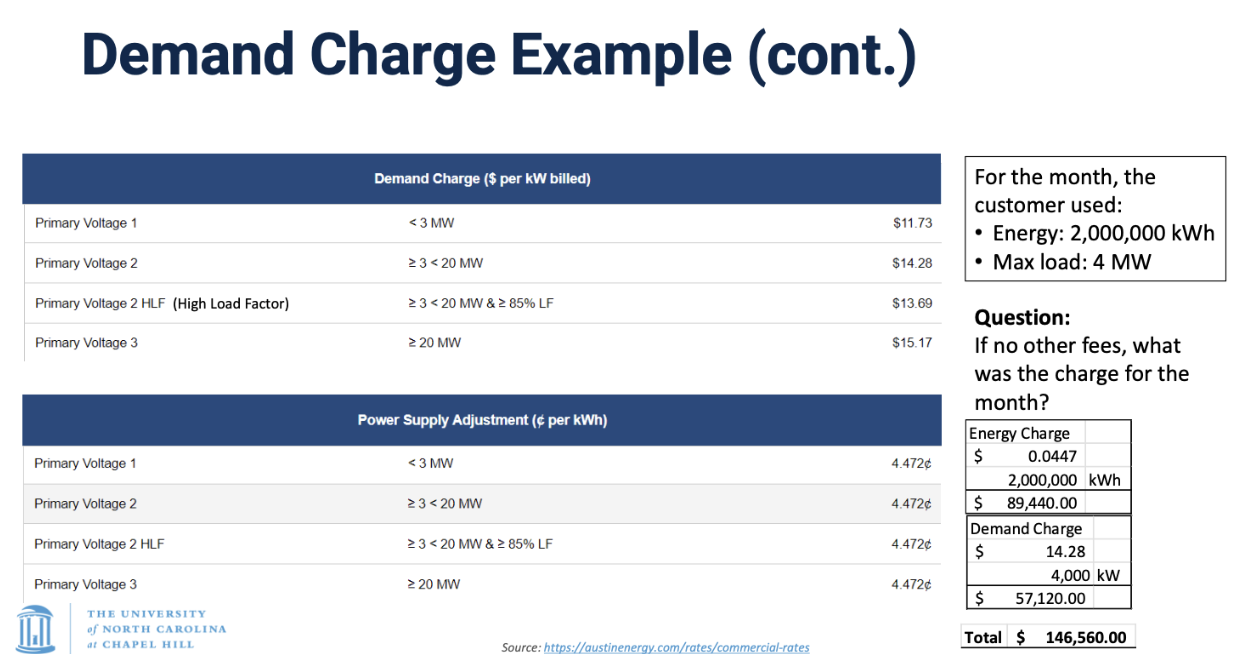

Demand Charge

a fee that commercial and industrial electricity customers pay based on their highest level of electricity usage (demand) within a billing cycle (peak power usage).

Typically account for 30-50% of a businesses’ total utility bill

Demand Charge = [max power for the month (in kW)] x [Demand charge (in $)]

Allows a utility to recover the cost of maintaining, upgrading, and building the grid based on customer’s contribution to peak load.

Coincident Peak Demand Charges

Fees based on a customer’s electricity usage during the highest demand period for the entire grid or utility system (higher charges).

What is the biggestt risk when ivesting in BTM assets to manage demand charges?

The utility can change the tariff

E.g. A company installs a battery storage system to lower demand charges by discharging power during peak periods.

Later, the utility changes the demand charge structure (e.g., shifting peak hours or reducing demand-based pricing).

The company saves less than expected or may not recover its investment as planned.

What are some examples of BTM devices that can be used to help the electricity grid?

Energy storage, rooftop solar, smart thermostats (HVAC/electric heaters), water heaters, EV chargers, pool pumps, Bitcoin mining

Distributed Energy Resource (DER)

Small-scale energy generation or storage systems that operate at or near the point of use, rather than relying on centralized power plants.

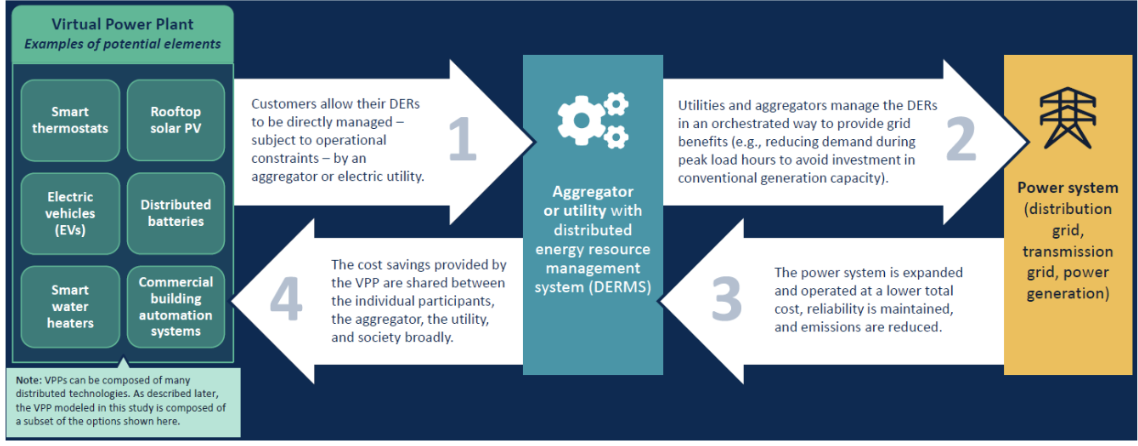

Virtual Power Plants (VPP)

A network of aggregated DERs that are centrally controlled and optimized to function like a traditional power plant in energy markets.

The VPP operator manages these assets as a single entity, balancing supply and demand.

Bitcoin Mining

Process of verifying and adding new transactions to the Bitcoin blockchain while creating new bitcoins as a reward.

Miners solve complex math problems (using computing power) to validate transactions.

The first miner to solve the problem adds a new “block” to the blockchain.

That miner receives a reward in Bitcoin (currently 6.25 BTC per block, as of 2024).

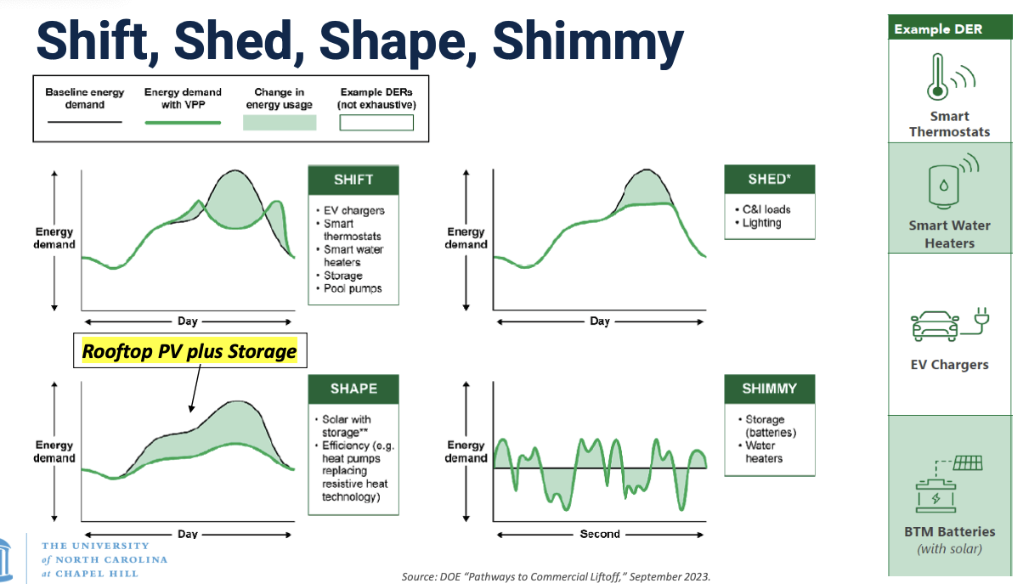

Shed, Shift, Shape, and Shimmy

Shift: move energy consumption from peak to non-peak-hours

Shed: lower electricity consumption by turning off non-essentail devices

Shape: encouraging energy-efficienct appliances to gradually lower average demand

Shimmy: provide quick adjustments to stabilize the grid

Electric Water Heaters

Use electrcity to heat water

Heats water when electricity is cheap

Act as a thermal battery in demand response programs

Heat Pump Water Heaters: extracts heat from the air to heat water

Mid-Atlantic Renewable Energy Coalition (MAREC)

Utility scale solar, wind, and energy storage developers focused on driving renewable energy growth in the Mid-Atlantic Region

Regulated vs. Deregulated markets

Regulated: utilities responsible for electricity generation/transmission/distribution

Deregulated: utilities responsible only for delivering electricity and billing customers

Federal Regulatory Commission (FERC)

Regulates US power industry through oversight of interstate electricity tranmission and wholesale interstate commerce.

They can impact energy storage:

Market access/participation

Grid integration and interconnection

Transmission planning and investments

FERC Order 841 (2018)

Treats energy storage as a generation asset

Allows storage to participate in energy, capacity, and ancillary services markets operated by RTOs and ISOs

RTOs/ISOs were required to develop their own models to facilitate the

participation of storage resources to comply with Order No. 841

FERC Order 2023

Standardizes interconnection rules for all generators, making the process simpler and faster.

Uses a “first ready, first served” approach—projects that are further along get priority.

Allows solar + storage to connect at the same point in the grid under one request.

FERC Order 1920 (2024)

Oversees long term transmission planning and cost allocation

Critical for integrating large-scale storage projects and efficiently transferring electrcity between different regions

Ivestment Tax Credit

Provides credits up to 30% for commercial and utility-scale RE projects; reduces up-front capital costs of a project

State Regulatory Agencies

Regulate electric, gas, telecommunications, water/wasterwater utilities

Procurement Targets

Many states set renewable energy procurement targets to help enhance grid resilience, meet climate goals, and promote economic development

Regulatory Challenges

Lack of clear regulations

Interconnection challenges

Economic barriers

Ownership and market structures

Grid access challenges

Zoning and land use regulations

Environmental permitting

Policy Advocacy

Coalition building and establishing relationships with industry associations,

policymakers, regulators, etc.Supporting research and developing proposals/recommendations

Intervening in regulatory proceedings

Collaborating on advocacy campaigns