Management: Exam One

1/148

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

149 Terms

Scarcity

Implies that we can't do everything that we want.

How does economics relate to "scarcity"?

Studies human behavior in how we make choices for things that we chose to spend our limited resources to produce or obtain.

Markets

Any structure that allows buyers and sellers to exchange any type of goods, services and information.

Supply

The amount of a good that is available.

Demand

The amount of a good that is desired.

Macroeconomics

"Macro" addresses the behavior of the market for more than one good.

example - looking at more than one specific good (i.e. generic 'atorvastatin' by Greenstone AND Lipitor)

Microeconomics

"Micro" addresses the behavior of the market for a single specific good

example - just one product (i.e. generic 'atorvastatin' by Greenstone)

Market Failure

Markets function efficiently ONLY with open access to information and no barriers to entry.

Oligopolies

A market structure in which a few firms dominate.

Monopolies

A market structure where a single seller controls the entire market.

Information Asymmetry

Information selectively hidden.

Barriers to Entry

Legal or "other" means to limit competitors (i.e. patent)

Externalities

Costs that are a consequence of production or use of a good, but are not included in market price

examples - pollution, deforestation, costs to treat advanced state medication conditions in the ED

Public Goods

Markets may undersupply goods that are socially desirable for all or most members of society

examples - roads, U.S. Army, health care services)

What does the "balance sheet" tell you?

High level overview of the financial health of the organization.

What three components make up a "balance sheet"?

1. assets

2. liabilities

3. owners equity

What does the "income statement" tell you?

Can determine if the company is profitable ("Is the business making money?").

What two components make up an "income statement"?

1. sales/revenue (usually "net")

2. costs/expenses

What does the "statement of owners equity" tell you?

Quick look at how much has been "kept" for the organization and how much is shared w/ owners.

What two components make up an "statement of owners equity"?

Profit and transactions AND what's left over ("owner's stake")

What does the "statement of cash flow" tell you?

Used to track flow of cash

separated by general activities like operations, investments, and financing

Time Value of Money

The value of money changes over time!

What concept does "inflation" and "investment" display?

Time Value of Money

Inflation

Money can be worth less overtime due to inflation

$1 item at 2% inflation in 10 years will cost $1.22

Investment

Money can be worth more overtime due to investment

If you invest $1 at 1% interest, in 10 years, you will have $1.10

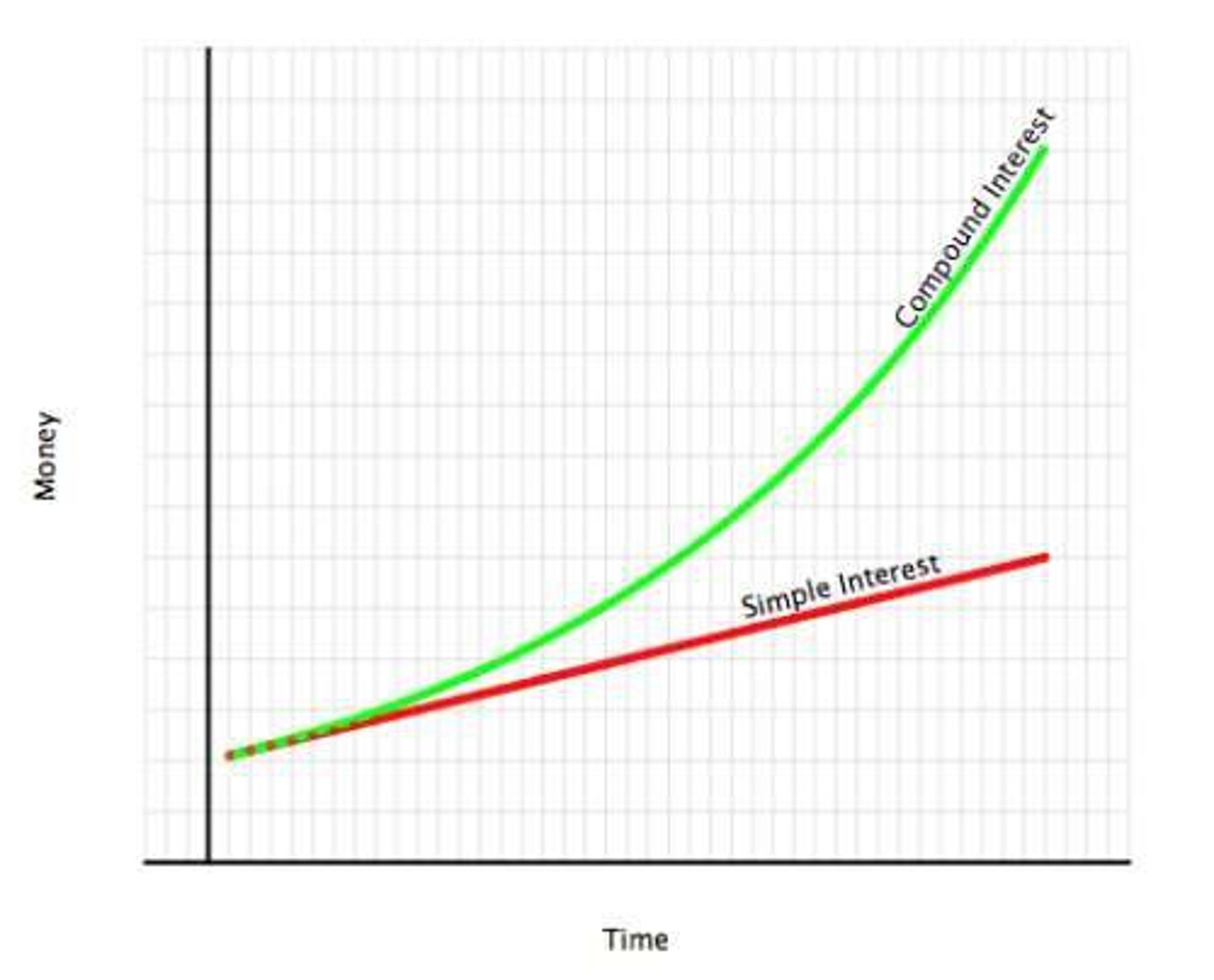

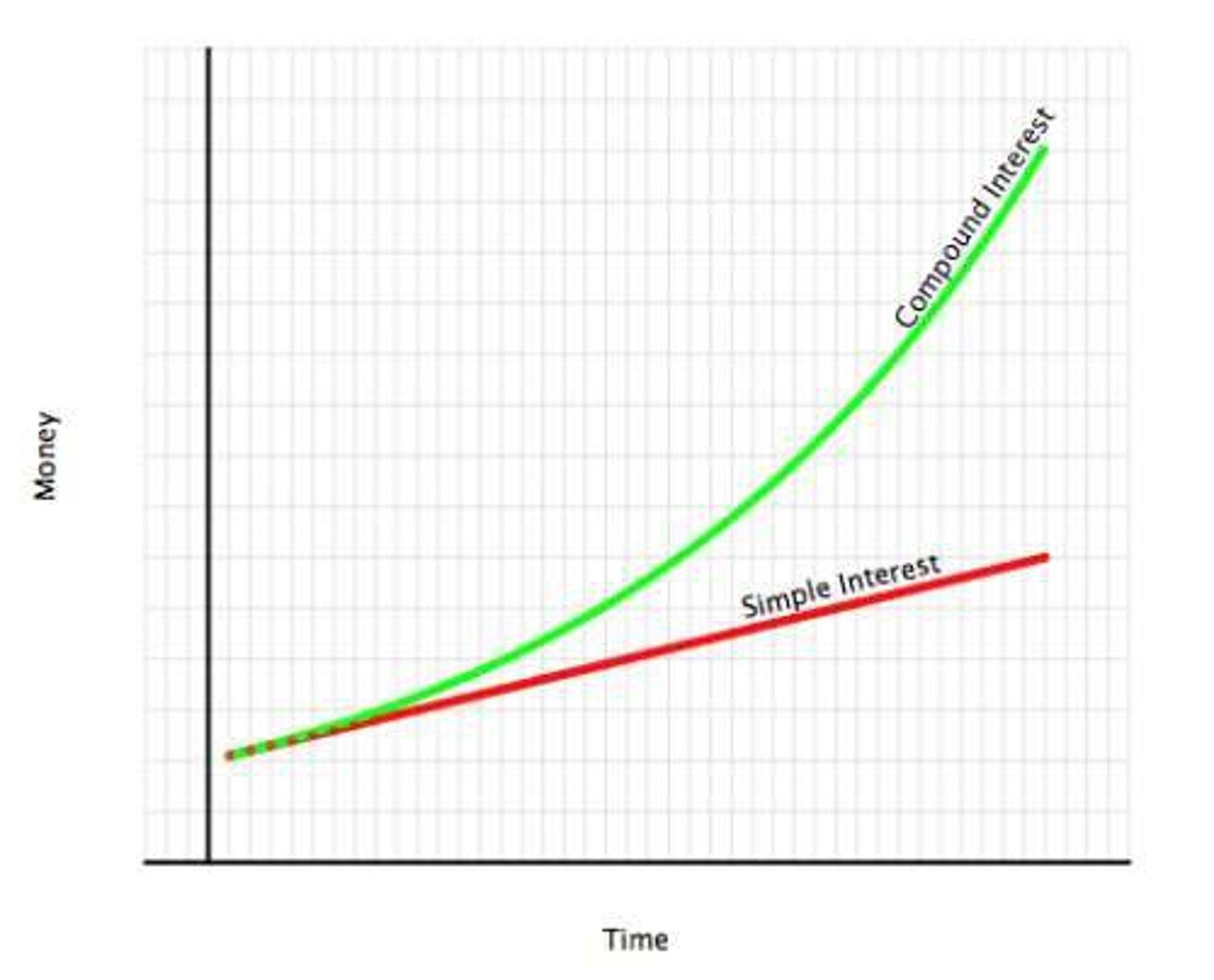

Simple interest

Does NOT take into account earned interest. Only based on original principal (starting amount).

Compound interest

Does take into account earned interest. Includes (1) original principal + (2) any previously earned interest.

Risk

Level of risk is reflected in 'interest rate'

↑ risk = ↑ interest rate

Expenditures

Investments over time

example -

costs of running a pharmacy like paying for a pharmacist's salary

Net present value

Determine present value of each year of stream (includes time AND discount rate)

Vertical analysis

Compared to others in the market

Horizontal analysis

Observes same company/market but over time

Liquidity

Ability to meet short term cash requirements

Solvency

Ability to meet long term debt requirements and long term operations

Profitability

Ability to generate profits from investments in organization

Current Ratio

Current Assets / Current Liabilities

Indication: Ability to pay short term debt

Acid Test

(Cash + Accounts Receivable + Short Term Investments) / Current Liabilities

Indication: ability to pay short term debt without a "fire sale"

Debt Ratio

Total Debt / Total Assets

Indication: long-term liquidity

Debt-Equity Ratio

Total Liabilities / Total Owner Equity

Indication: owners reliance on credit

Interest Coverage Ratio

Pre-tax, pre-interest income/ Interest expense

Indication: ability to pay interest on debt

Net Income Ratio

Net Income / Net Sales

Indication: profitability of sale activities

Return on Assets (ROA)

Net Income / Average Total Assets

Indication: profitability of all assets

Return on Equity (ROE)

Net Income / Average Owner Equity

Indication: profitability of investments

Earnings per Share

Net Income / Shares Outstanding

Indication: amount of profit earned for each share of stock

P-E Ratio

Market Price of Stock / Earnings per Share

Indication: amount investors will pay for $1 of earnings

Dividends per Share

Dividends / Shares Outstanding

Indication: cash amount company pays out to shareholders per share

Dividend Yield

Dividend / Stock Price

Indication: return on investment from dividends (relative to stock)

Scientific Management

Focus on efficiency and productivity

Find the 'best way' to do a task

Bureaucratic and Administrative Management

Focus on structure and organization

Rules, hierarchy, and clear roles

Human Relations Movement

Focus on motivation and relationships

People matter (motivation isn't just money)

Systems Theory

Focus on holistic, interconnected view of business

Organization is a system w/ feedback loops

7 Essential Management Competencies

1. organizational knowledge

2. human resource management

3. communication

4. organizing meetings

5. planning for crises

6. time management

7. "managing up"

Organizational knowledge

Knowledge of organizational context and environment

Human resource management

Motivate and engage employees

Planning for crises

Anticipate what can go wrong and devise strategies to deal with such occurrences

Third Party Payments

Major third-party payers for retail pharmacies include private and public payers

Private: PBMs (CVS Caremark), health insurance companies

Public: Medicare, Medicaid

How do retail pharmacies get paid?

prescription payments (product cost + dispensing fee)

paid by PBMs, Medicare Part D, cash payments

How do LTC facilities get paid?

Medications reimbursement (similar to retail pharmacy)

paid by PBMs and Medicare Part D

How do hospitals get paid?

1. Diagnosis-related group (DRG)

2. Part of hospital stay reimbursement

3. Outpatient/infusion medications

paid by private insurance, Medicare, Medicaid

Wholesale Acquisition Cost (WAC)

The price paid by a retailer or pharmacy to purchase a drug from a wholesaler.

Average Manufacturers' Price (AMP)

The average price paid to manufacturers by wholesalers for drugs distributed to retail pharmacies.

Average Wholesale Price (AWP)

A benchmark used to determine the price of drugs, often considered to be higher than actual market prices.

Actual Acquisition Cost (AAC)

The actual cost that a pharmacy pays for a drug, including discounts and rebates.

Estimated Acquisition Cost (EAC)

An estimate of the price a pharmacy pays for a drug, used for reimbursement calculations.

Maximum Allowable Cost (MAC)

The maximum price that a payer will reimburse for a specific drug.

Retail Pharmacy Reimbursement

The payment made to pharmacies for dispensing medications to patients.

Medicare

A federal health insurance program for individuals aged 65 and older.

Medicare Part A

hospital (inpatient) insurance

Medicare Part B

medical (outpatient) insurance

Medicare Part C

managed care health plans offered to medicare beneficiaries under the medicare advantage program

Medicare Part D

prescription drugs

Medicaid

A state and federal program providing health coverage for low-income individuals.

How do third party payers work to control medication costs for their beneficiaries?

1. Patient cost sharing

2. Generic substitution

3. Quantity limits

4. Mail order

5. Step therapy

6. Prior authorizations

Medication Therapy Management (MTM)

Services designed to optimize therapeutic outcomes for patients through improved medication use.

What are some of the issues related to reimbursement?

1. Inadequate dispensing fees

2. Growth of required mail order pharmacies

3. Issues w/ PBM transparency

4. Diagnosis-related group reimbursement

Diagnosis-related group (DRG) reimbursement

A payment system where hospitals are reimbursed a fixed amount based on the patient's diagnosis.

note: can cause reimbursement issues because pharmacy might not get reimbursed for the total amount of medications because the amount is fixed

Direct and indirect reimbursement fees (DIR Fees)

Fees charged to pharmacies that can reduce the amount they are reimbursed for medications.

Rebates

Payments made to pharmacy benefit managers (PBMs) to incentivize the use of specific medications.

What is the largest investment for most businesses?

inventory (usually at least ~75%)

Cost of goods sold (COGS)

The total cost of purchasing the goods that were sold during a specific period.

What are some important factors when purchasing inventory for a business?

- Products

- Quantity

- Time

- Price

- Vendor

Cash discount

Reduction in price for prompt payment

Product bundling

Reduction in price of one item gained by simultaneously purchasing another product (often related)

Minimum purchasing

Reduction in price of a featured generic or brand medication along w/ a minimum generic order (required to buy a minimum amount!)

What are some factors related to vendor selection?

- Delivery schedule

- Frequency of out-of-stock situations

- Breadth of merchandise lines and assortments

- Assistance with product placement and floor layout

- Available technology and other services

- Returned goods policies

- Financing and credit terms and options

- Purchasing Decisions

Visual Inventory Control Method

Uses physical cues and real-time visual data for stock management

Periodic Inventory Control Method

Involves physical inventory counts at set intervals

Perpetual Inventory Control Method

Provides continuous, real-time tracking of inventory levels through digital systems

Inventory Turnover Rate (ITOR)

Measures how many times a company sells and replaces its inventory over a specific period

Ideally, a turnover rate will be relatively high (~12-15)

What does a high ITOR indicate?

- ↓ investment in inventory (frees cash for other services/activities)

- ↑ return on inventory investment

- Possible out-of-stock situations (if ITOR is too high)

What are three examples of "out of stock" costs?

1. Cost to obtain quickly

2. Loss of 'business' (if the pt moves to another pharmacy)

3. Loss of patient (if there was a critical medication not available)

What are four available technologies to assist with inventory management?

- Barcoding

- Point of sale scanners

- Radio frequency identification (RFID)

- Inventory management software

Declarations page

States the limits for each coverage under the policy.

Aggregate limit

Max insurance will pay regardless of the number of total claims in a policy period.

Per occurrence limit

Max insurance will pay for claims stemming from a single event.

Common policy conditions

Provisions for interrupting the policy.

Property coverages

Covers buildings and personal property.

Commercial liability coverages

Includes bodily injury, covered contract, personal and advertising injury, and product liability.

Medical payments coverage

Provides money for first aid and medical care to individuals injured on business property.

Fire coverage

Pays for damages to buildings rented or loaned due to fire or explosion.