Mgmt 200-FInal Exam Purdue questions with complete verified solutions already graded A+

1/109

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

110 Terms

liability

an obligation of a company to transfer some economic benefit in the future

Which liabilities require payment in the future?

Accounts payable

Notes Payable

Salaries Payable

When does deferred revenue arise?

when companies receive payment in advance

What is a current liability?

A liability expected to be paid within 1 year of balance sheet date

What is a long-term liability?

payable in more than one year from balance sheet date

What is the operating cycle?

the length in time from spending cash to provide goods/services to a customer until collection of cash from that customer

What does a company with a 3 month operating cycle do with their liabilities?

classifies current liabilities as those due in 1 year

What does a company with a 15 month operating cycle do with their liabilities?

classifies current liabilities as those due within 15 months

What is notes payable?

A written promise made by the business to pay a debt, usually involving interest, in the future.

How to calculate Interest on notes payable?

Face Value x Annual Interest Rate x Fraction of the year

How do you record Notes Payable?

debit cash, credit notes payable

Southwest Airlines borrows $100,000 from Bank of America on September 1,2024, signing a 6%, six-month note for the amount borrowed plus accrued interest due six months later on March 1, 2025.

On September 1, 2024, Southwest will receive $100,000 in cash and record the following:

debit cash 100,000

credit notes payable 100,000

Southwest Airlines borrows $100,000 from Bank of America on September 1,2024, signing a 6%, six-month note for the amount borrowed plus accrued interest due six months later on March 1, 2025.

How do you calculate the Interest for the 6 month period?

100,000 X.06 X 6/12 = 3000

Southwest Airlines borrows $100,000 from Bank of America on September 1,2024, signing a 6%, six-month note for the amount borrowed plus accrued interest due six months later on March 1, 2025.

How do you calculate the Interest for the 4 month period? What would be the Adjusted journal Entry?

100,000 x .06 x 4/12 = 2000, Debit to Interest Expense 2000 and Credit to interest Payable 2000

How do you record the repayment of Notes Payable?

Debit to Notes Payable, Interest Expense, Interest Payable

Credit to Cash

What are the payroll costs for employees?

Federal and state income taxes

FICA taxes

Health, Dental, Disability, Life insurance

Investments in retirement/savings plan

What are the payroll employer costs?

federal and state unemployment taxes

employer matching portion of Social Security and Medicare

Health, Dental, Disability, Life insurance

Contributions to retirements or savings plan

What is the journal entry for employee salary expense, withholdings, and salaries payable?

debit to salaries expense

credit to employee income tax payable, FICA Tax payable, Salaries Payable

What is the journal entry for posting fringe benefits?

Debit to salaries expense

Credit to Fringe Benefits Payable(depending on company)

How do you record employer payroll taxes?

Debit to Payroll Tax Expense

Credit to FICA Tax Payable

Credit to Unemployment Tax Payable

What are some other current liabilities?

- Deferred Revenues

- Sales Tax Payable

- Current portion of long-term debt

how to record deferred revenue

debit to cash, credit to sales revenue

Apple sells gift card to customer for $100

What is the journal entry?

Debit to cash for 100

Credit o deferred revenue for 100

Apple sells gift card to customer for $100

Customer spends $15 of it

what is the journal entry apple makes?

debit to deferred revenue for 15

credit to sales revenue for 15

What account classification is deferred revenue?

liability

What is the journal entry for sales tax payable?

Debit to cash

Credit to sales revenue

Credit to sales tax payable

A customer bought lunch in an airport for $15 plus 10% sales tax

What is the journal entry?

Debit to cash for 16.5

Credit to sales revenue for sales revenue

Credit to sales tax payable for 1.5

Suppose a company has a long-term note payable of $1,000,000. At the balance sheet date, the company determines that $200,000 of the note is due within the next 12 months (2025), while the remaining $800,000 is due in later periods (2026 and beyond). The company needs to reclassify $200,000 of the long-term note to current notes payable

Debit to Notes payable (long term)

Credit to Notes Payable (short term)

What is contingency?

uncertain situations that can result in a win or loss for a company

What is a contingent liability?

existing uncertain situation that might result in a loss

When do you report contingent liabilities?

when a loss is probable and the amount is reasonably estimable

How do you record a Contingent liability?

debit loss

credit contingent liability

If it is probable that Jeeps, Inc., will lose a $100 million lawsuit at some pointin the future, Jeeps records the following entry:

Debit to loss 100 mil

Credit to contingent liability for 100 mil

What is capital structure?

the mixture of debt and equity maintained by a firm

What are the 2 types of capital structure?

debt and Equity financing

What is debt financing?

funds raised through various forms of borrowing that must be repaid

What is equity financing?

obtaining investment from stockholders

Cost of Financing

-Debt: interest expense (tax-deductible)

-Equity: dividends (not tax-deductible)

examples of debt

notes, leases, and bonds

What is one advantage of debt financing?

interest on borrowed funds is tax-deductible

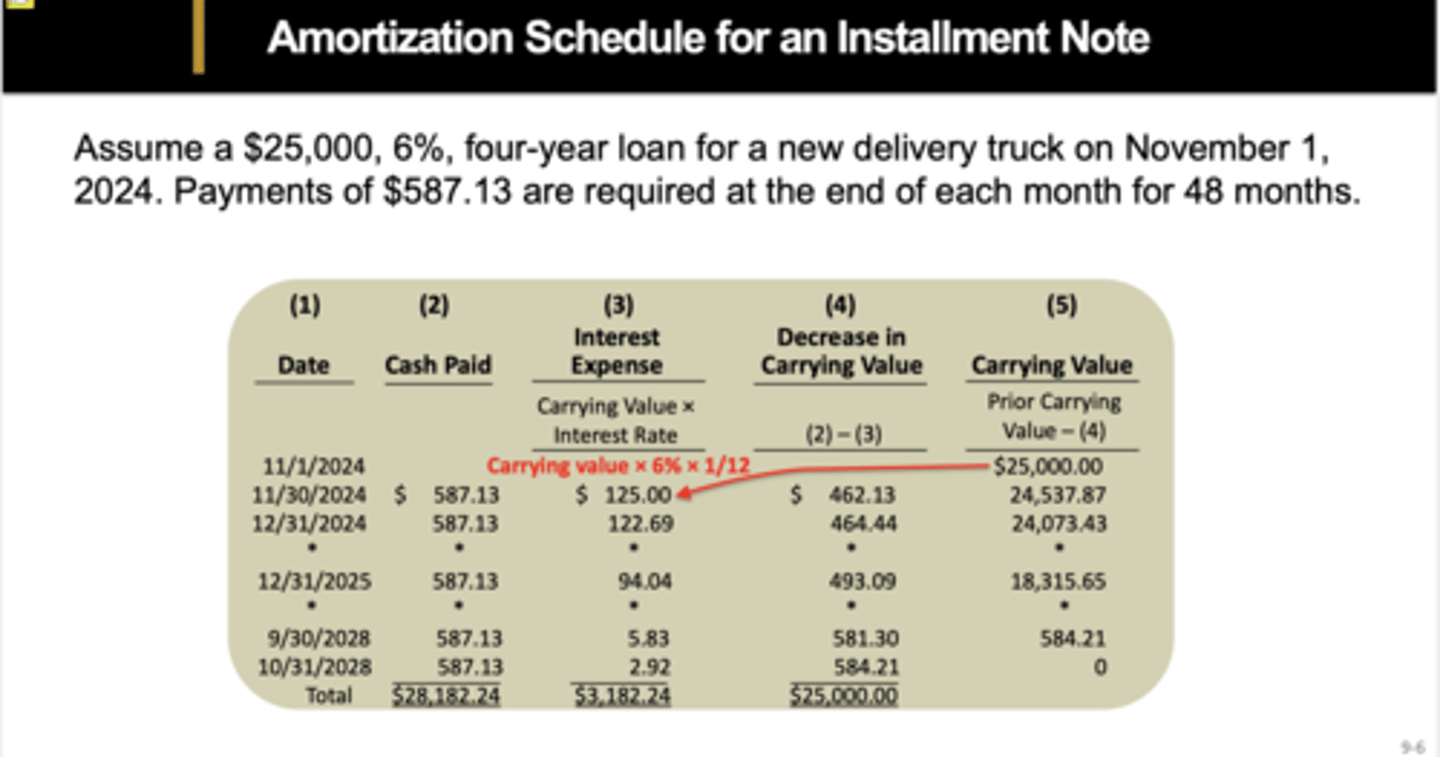

What is an installment note?

a debt that requires the borrower to make equal periodic payments to the lender for the term of the note

What do installment notes include?

interest on borrowed amount

Reduction of outstanding loan balance

How do companies normally borrow cash?

using installment notes

What is the amortization schedule for an installment notes?

Installment note transaction establishment of the note payable

debit to cash

credit to notes payable

what is a lease?

an agreement by which the owner allows users to use an asset for a period of time

What is the transaction for a lease by the owner?

debit to lease asset

credit to lease payable

How do you calculate present value of lease payments?

ordinary annuity x monthly lease payment

What is a bond?

a formal debt instrument issued by a company to borrow money

How to record a bond issue?

debit to cash

credit to bonds payable

How to record an interest payment?

debit to interest expense

credit to cash

how to retire a bond?

debit bonds payable

credit to cash

Future Value

how much the money today will grow in the future

Present Value

the amount of money you would need to deposit now in order to have a desired amount in the future

annuity

payment received every year

What are the characteristics of bonds?

Secured

Unsecure

Term

Serial

Callable

Convertible

Secured Bonds

are backed by collateral

Unsecure Bonds

not backed by collateral

Term Bonds

bonds that all mature at the same time

serial bonds

bonds issues matures in installments

Callable Bonds

Issuing company can pay off bonds early

Convertible Bonds

investor can convert bonds to common stock

Debt to Equity Ratio

the higher debt to equity ratio, the higher the risk of bankruptcey

What are the stages of equity financing?

1) investment by the founders of business

2) investment by friends and family of founders

3) outside investment by "angel" investors and venture capital firms

4) initial Public Offering (IPO)

What are the types of common stock?

authorized, issued, outstanding, treasury

Authorized stock

shares available to sell (issued+unissued)

Issued stock

Shares actually sold (outstanding+treasury)

Outstanding stock

shares issued and held by investors

Treasury stock

shares issued and repurchased by the company

Purchase of Treasury Stock journal Entry

debit treasury stock, credit cash

Resale of treasury stock journal entry(above cost)

debit cash, credit treasury stock, credit additional paid-in capital

Resale of treasury stock journal entry(below cost)

debit cash, debit additional paid in capital, credit treasury stock

Journal entry for authorized stock

no journal entry

journal entry for common stock no par value

debit cash, credit common stock

journal entry for common stock par value

debit cash, credit common stock, credit additional paid-in capital

Journal entry for preferred stock

debit cash

credit preferred stock

credit additional paid in capital

What 2 stocks make up issued stock?

outstanding stock and treasury stock

par value

the amount that an investor pays to purchase a bond and that will be repaid to the investor at maturity

How does preferred stock differ from common stock?

1. Preferred stock allows different voting rights

2. Dividends on preferred stock, if any, may be paid at a fixed rate

3. Preferred stock carries priority over common stock

What are the features of preferred stock?

Convertible- shares can be exchanged for common stock

Redeemable- shares can be returned to the corp. at a fixed price

Cumulative- shares receive priority for future dividends if dividends are not paid in a given year

Why do corporations have treasury stock?

1. to boost underpriced stock

2. to distribute surplus cash without paying dividends

3. to boost earnings per share

4. to satisfy employee stock ownership

Retained Earnings

An amount earned by a corporation and not yet distributed to stockholders.

What is the formula for retained earnings?

all net income - dividends

Does retained earnings differ from cash?

yes

cash dividend

a cash distribution of earnings by a corporation to its shareholders

What is the journal entry for cash dividends?

debit dividends, credit dividends payable

What is the jounral entry for when the dividend gets paid?

debit to dividends payable, credit to cash

Stock dividend

Corporation's distribution of its own stock to its stockholders without the receipt of any payment.

Journal entry for stock dividend

debit used to reduce retained earnings and credit records items distributed (cash or stock)

Stock split

the division of a single share of stock into more than one share

How does a stock split effect SE?

it does not

How does a stock split impact a stock price?

A stock split lowers the stock price

How do you calculate stockholders equity?

Stockholders' Equity = Common Stock + Retained Earnings

Operating Activities

cash receipts and cash payments for transactions relating to revenue and expense activities

investing activities

transactions involving the purchase and sale of long-term assets and current investments

Financial Activities

cash inflows and outflows from transactions with creditors and owners

Operating activities involving the indirect method

1. Begin with net income

2. list adjustments to net income to arrive at operating cash flows

3. most popular

4. easier and less costly

Vertical Analysis

expressing each item in a financial statement as a percentage of the same base amount

horizontal analysis

analyzing trends in financial statement data for a single company over time

Formula for horizantal analysis

(current year-base year)/base year