Final Micro Exam Review

1/87

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

88 Terms

Which of the following is(are) true concerning monopoly?

(A) All of the statements are true.

B) Barriers to entry prevent other firms from entering the industry.

(C) Monopoly is at the opposite end of the spectrum from a perfectly competitive firm.

D) A monopoly has no rivals

(a) All of the statements are true.

Conditions that prevent the entry of new firms in a monopoly market are:

A) production controls. B) labor market stipulations. C) barriers to entry. D) terms of sale.

terms of sale.

(C) barriers to entry

A natural monopoly exists whenever a single firm:

A) has gained control over a strategic input of an important production process.

B) experiences economies of scale over the entire range of production that is relevant to its market.

C) is owned and operated by the federal or local government.

D) is investor-owned but has been granted the exclusive right by the government to operate in a market

B) experiences economies of scale over the entire range of production that is relevant to its market.

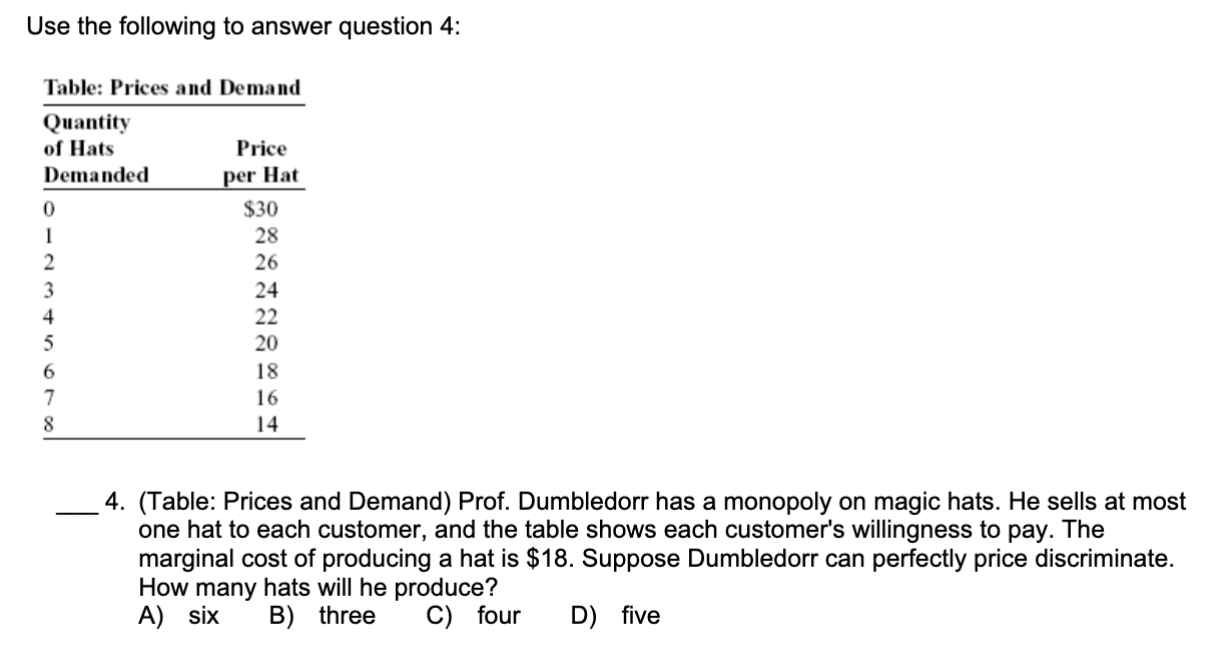

Table: Prices and Demand) Prof. Dumbledorr has a monopoly on magic hats. He sells at most one hat to each customer, and the table shows each customer's willingness to pay. The marginal cost of producing a hat is $18. Suppose Dumbledorr can perfectly price discriminate. How many hats will he produce?

Remember that price discrimination takes all of the willingness to pay until it reaches marginal cost!

A) six

B) three

C) four

D) five

A) six

All of the following are examples of price discrimination except:

A) generally lower prices at Wal-Mart than at Target.

B) cheaper air fares if the traveler stays over a Saturday.

C) discounts for families with young children at motels.

D) discounts for senior citizens at the movies.

A) generally lower prices at Wal-Mart than at Target.

If a monopolist can engage in perfect price discrimination, then:

A) consumer surplus is maximized.

B) producer surplus is minimized.

C) the government may impose fines on the monopolist.

D) it produces at the socially efficient level

D) it produces at the socially efficient level

In general, economists are critical of monopoly where____ exist(s).

A) only a few firms

C) persistent economies of scale

B) no natural monopoly

D) a natural monopoly

B) no natural monopoly

An oligopoly knows that its ________ affect its ________ and that the ________ of its rivals will affect it.

A) price increases; total revenue in the long run only; large but not small price changes

B) actions rarely; rivals; actions

C) actions; rivals; reactions

D) price changes; total revenue in a positive way; reactions

C) actions; rivals; reactions

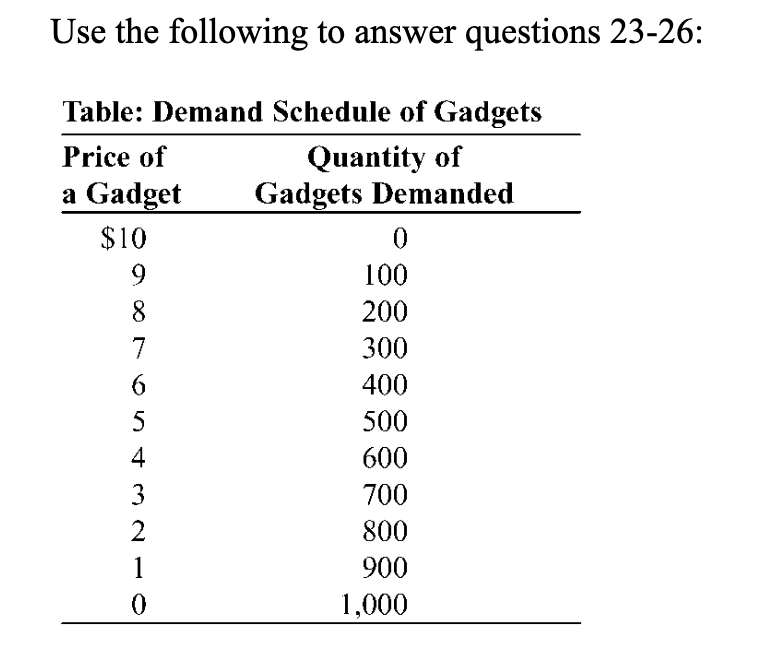

The market for gadgets is dominated by two producers, Margaret and Ray. Each firm can produce gadgets at marginal costs of approximately zero dollars. The table shows the market demand schedule for gadgets and the total revenue of the industry at each point on the market demand curve. If these two producers acted independently to maximize profit (separate), total industry output would be ________. If these two producers formed a cartel (together) and acted to maximize total industry profits, total industry output would be ________.

In other words. What is the industry output when they’re separate vs together?

A) 100 gadgets; 50 gadgets. C) 0 gadgets; 5 gadgets

B) 1,000 gadgets; 500 gadgets D) 5 gadgets; 10 gadgets

B) 1,000 gadgets; 500 gadgets

Which of the following would make it difficult for oligopolists to collude?

A) Oligopolists usually produce a homogeneous product.

B) There are few firms in the market.

C) There are few buyers in the market.

D) The oligopolists have similar costs of production.

C) There are few buyers in the market.

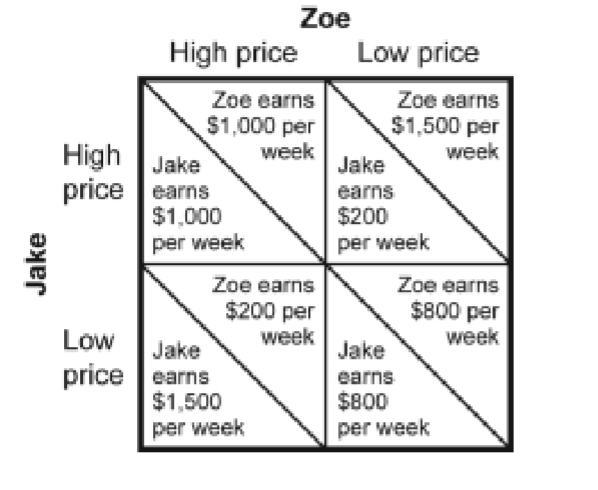

Figure: Payoff Matrix for Jake and Zoe) Look at the figure Payoff Matrix for Jake and Zoe. Jake and Zoe are the only producers of slushies in their tourist town. Each week, each decides whether to price high or price low for the following week. The figure shows the profit per week earned by their two firms. What is the Nash equilibrium for Jake and Zoe?

A) Jake prices high; Zoe prices low.

C) Jake prices high; Zoe prices high.

B) Jake prices low; Zoe prices low.

D) Jake prices low; Zoe prices high.

B) Jake prices low; Zoe prices low.

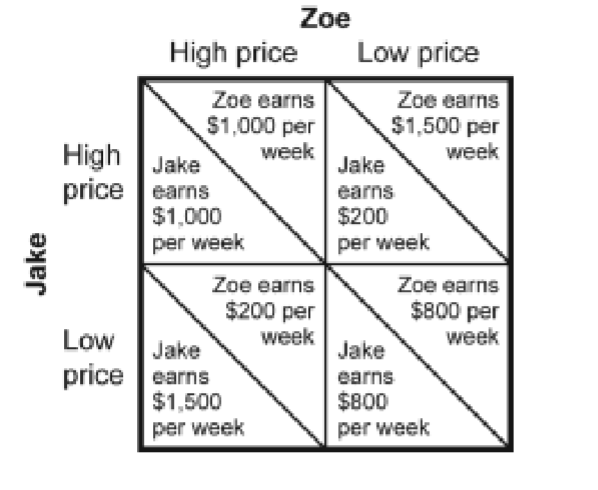

Look at the figure Payoff Matrix for Jake and Zoe. Jake and Zoe are the only producers of slushies in their tourist town. Every week, each decides whether to price high or price low for the following week. The figure shows the profit per week earned by their two firms. Suppose the firms each decide to price high initially and adopt a tit-for-tat strategy for the following weeks. After a few weeks, how much profit would each firm make per week?

A) Jake's profit = $1,500; Zoe's profit = $200.

B) Jake's profit = $800; Zoe's profit = $800.

C) Jake's profit = $200; Zoe's profit = $1,500.

D) Jake's profit = $1,000; Zoe's profit = $1,000

D) Jake's profit = $1,000; Zoe's profit = $1,000

In the classic prisoners' dilemma with two accomplices in crime, the dominant strategy for each

individual is to:

A) confess.

B) confess only if the other confesses.

C) This game does not have a dominant strategy.

D) not confess.

A) confess.

An action is a dominant strategy when it is a player's best action:

A) given certain profit-maximizing actions of other players.

B) if there is only one other competitor.

C) regardless of the actions by other players.

D) assuming the other players do not correctly anticipate the action.

C) regardless of the actions by other players.

The women's dress industry is monopolistically competitive. This means that the following condition applies to this industry:

A) There is freedom of entry but not exit in this industry.

B) Prices tend to be lower than if the dress industry approximated perfect competition.

C) Dresses tend to be differentiated among the many sellers serving this market.

D) There are thousands of dress suppliers, all selling identical products.

C) Dresses tend to be differentiated among the many sellers serving this market.

Defenders of advertising argue that it:

A) facilitates the concentration of monopoly power.

B) seeks to persuade, rather than inform, buyers.

C) encourages artificial product differentiation.

D) provides education and information about products.

D) provides education and information about products.

The excess capacity in monopolistic competition may be viewed as:

A) the advantage of monopolistic competition over monopoly.

B) the reason P = MR = MC in monopolistic competition.

C) the cost of product diversity.

D) efficient

C) the cost of product diversity.

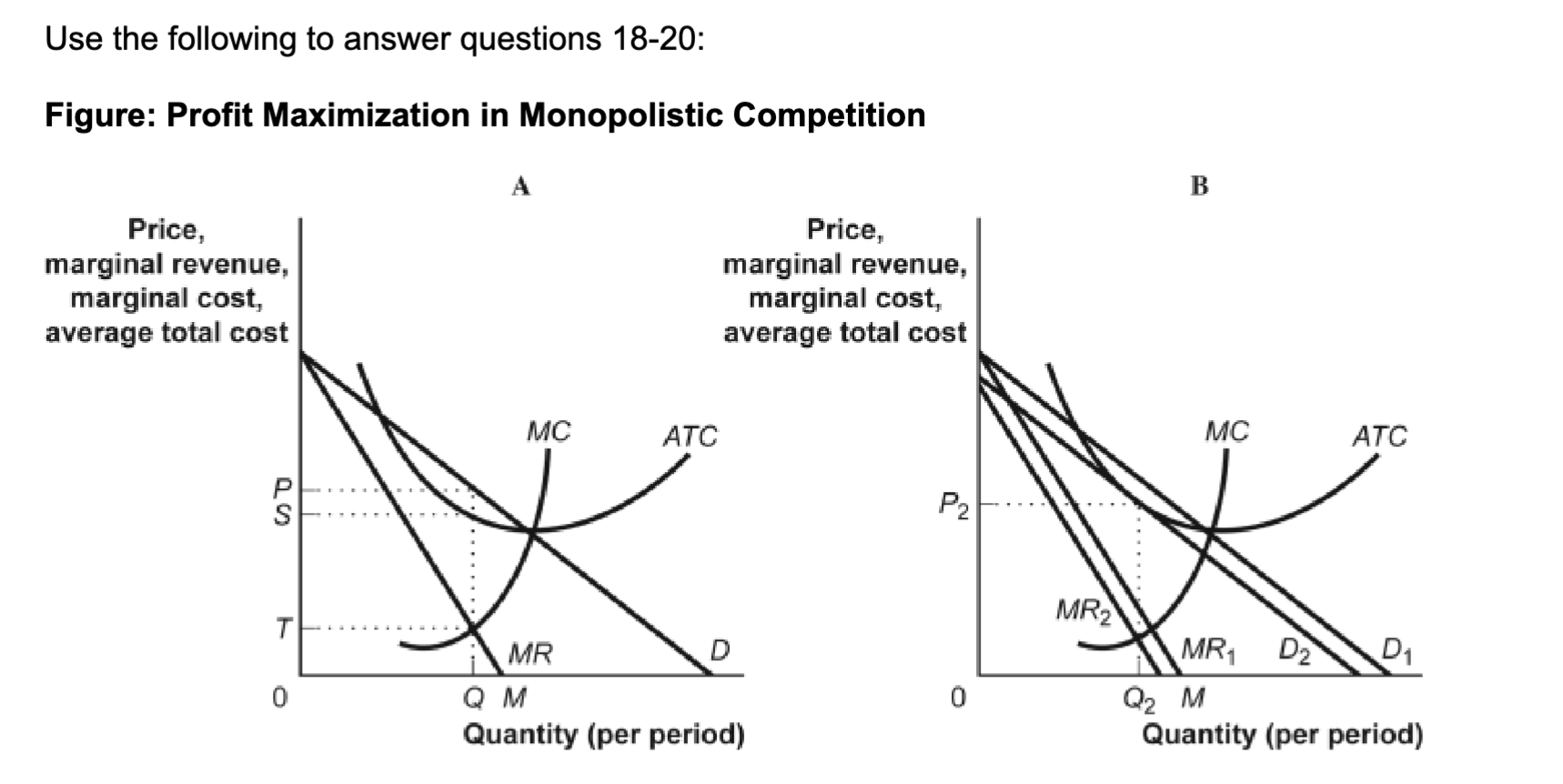

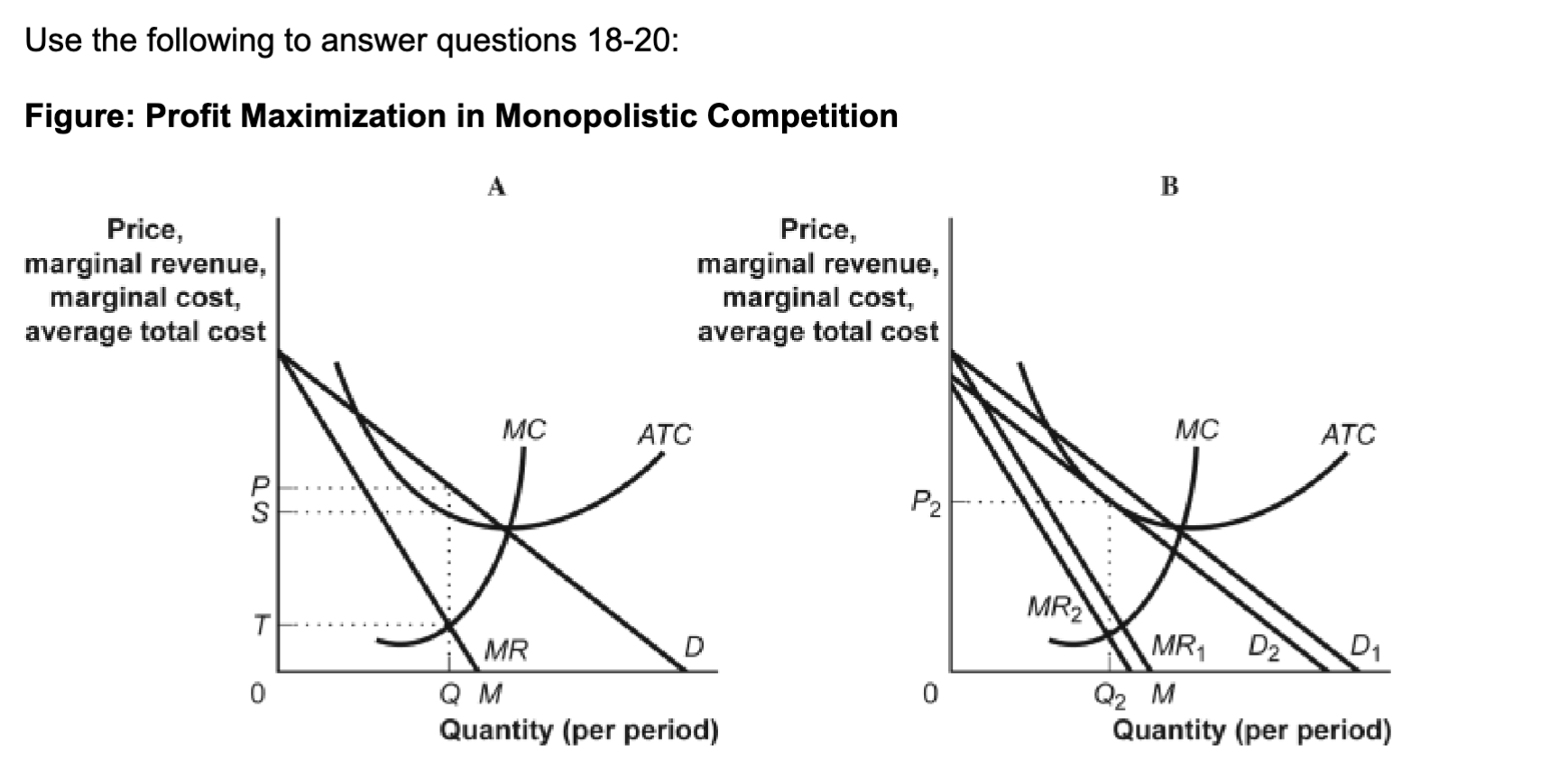

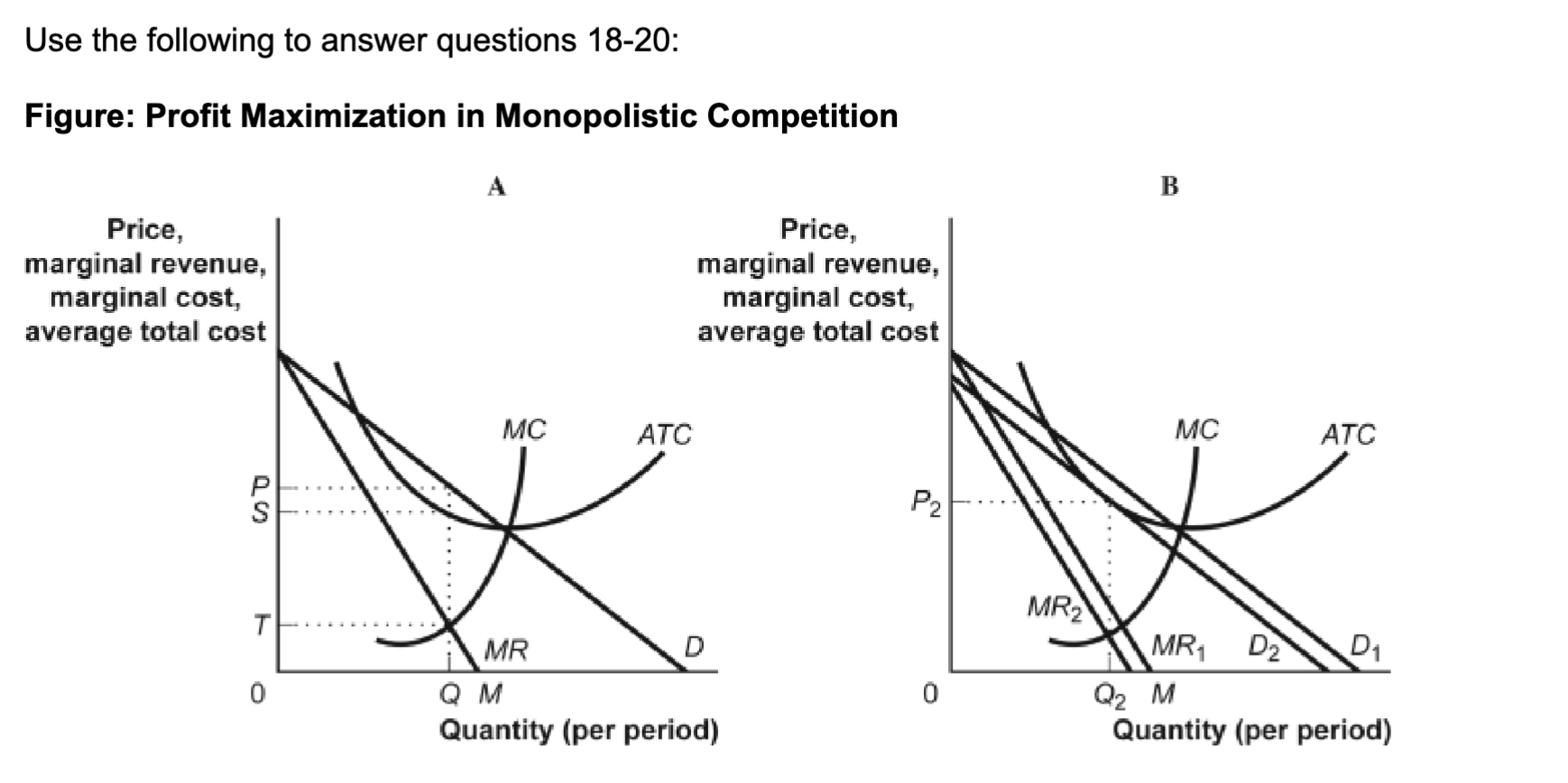

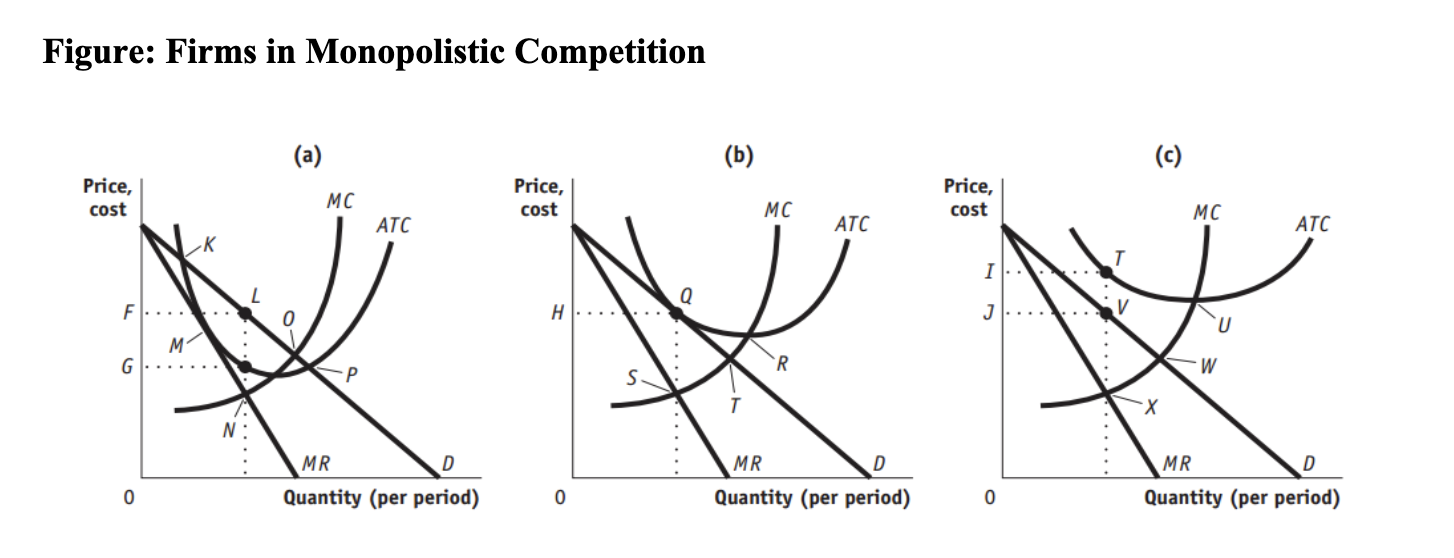

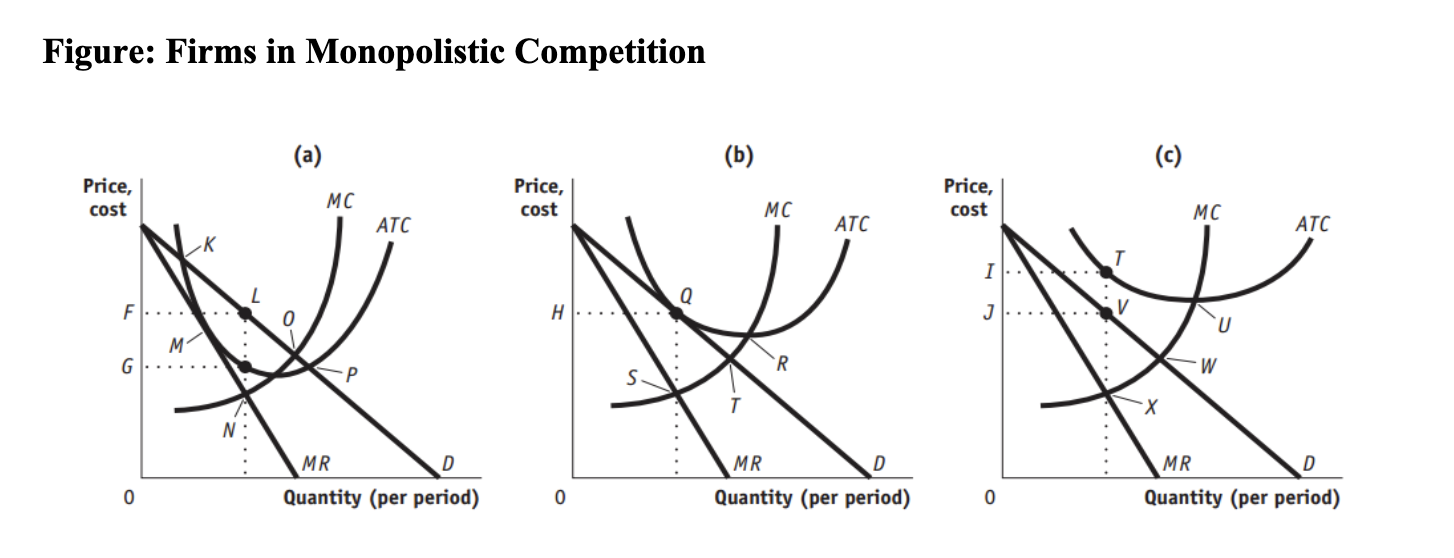

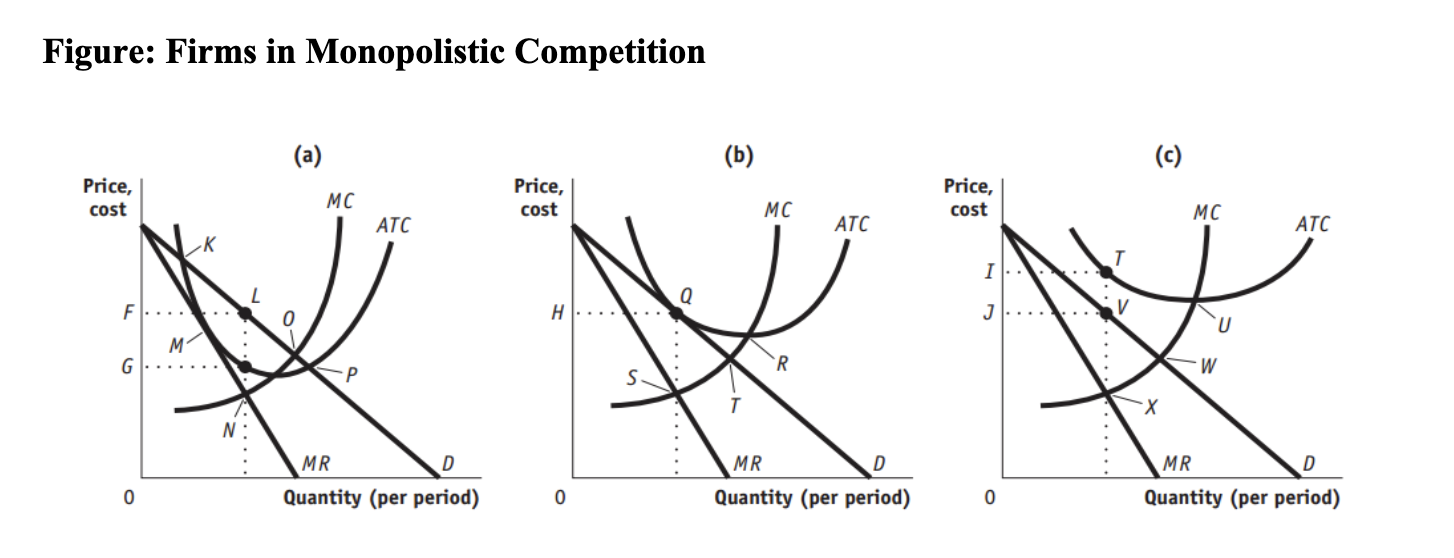

(Figure: Profit Maximization in Monopolistic Competition) In panel A, the profit-maximizing price and quantity are _____ and_____.

A) T; Q

B) P; Q

C) S; M

D) P; M

B) P; Q

In monopolistic competition, long-run

equilibrium is characterized by:

A) profit maximization, which occurs where P = MR = MC.

B) P = MR.

C) P > MR.

D) P < MR.

C) P > MR.

In panel B, the long-run equilibrium will

result in:

A) economic profits = 0 and a tangency of the ATC curve with the MR curve.

B) economic profits = 0.

C) accounting profits = 0.

D) a tangency of the ATC curve with the MR curveR curve.

B) economic profits = 0.

The restaurant industry is characterized by excess capacity. This means that:

A) the restaurants are producing less than their profit-maximizing level.

B) restaurants are producing more than their profit-maximizing level.

C) the quantity of restaurant meals supplied exceeds the quantity of restaurant meals demanded.

D) the profit-maximizing level is less than the level that minimizes average total costs

D) the profit-maximizing level is less than the level that minimizes average total costs

The marginal social benefit of pollution:

A) is easy to estimate, since polluters are required to file this information in their tax returns.

B) is equal to the marginal social cost of pollution, since benefits to producers are equal to costs to consumers.

C) can be measured as the additional gain to society from one additional unit of pollution.

D) is zero, since pollution is not beneficial

C) can be measured as the additional gain to society from one additional unit of pollution.

If drivers decide to make phone calls without considering the costs imposed on others, the:

A) marginal social cost curve will lie below the marginal cost of production curve.

B) number of phone calls made while driving will be above the socially optimal quantity.

C) marginal social benefit curve will lie below the marginal social cost curve.

D) number of phone calls made while driving will be below the socially optimal quantity

B) number of phone calls made while driving will be above the socially optimal quantity.

When individuals take external costs and benefits into account:

A) they internalize the externality.

B) the government needs to intervene in the market.

C) the market will not reach an efficient solution.

D) there are no external costs.

A) they internalize the externality.

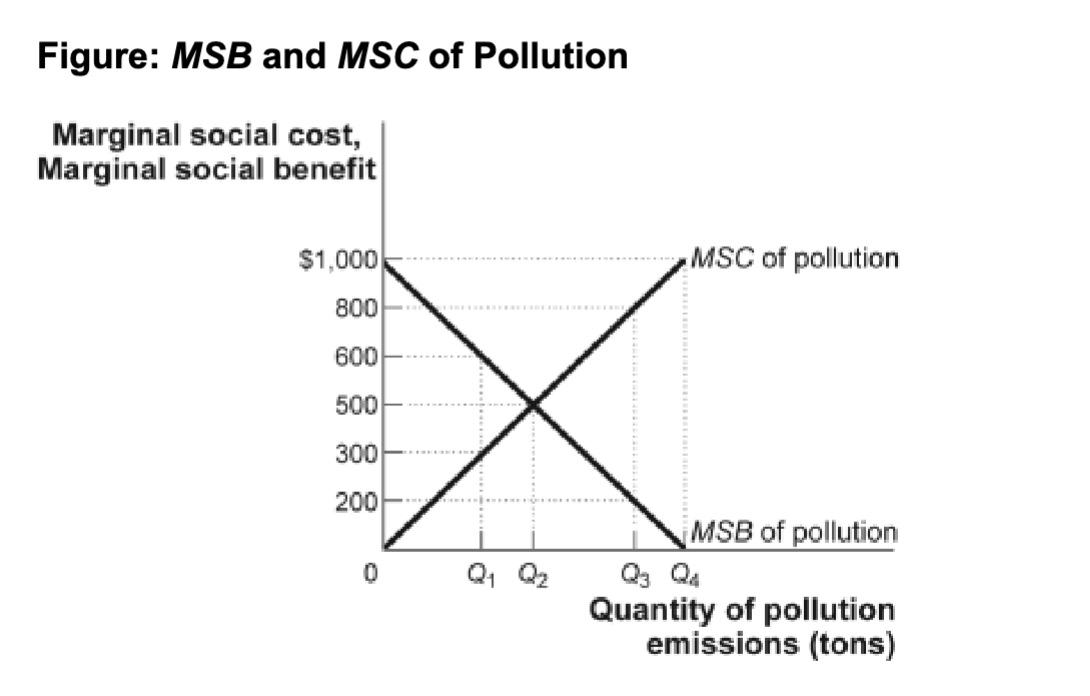

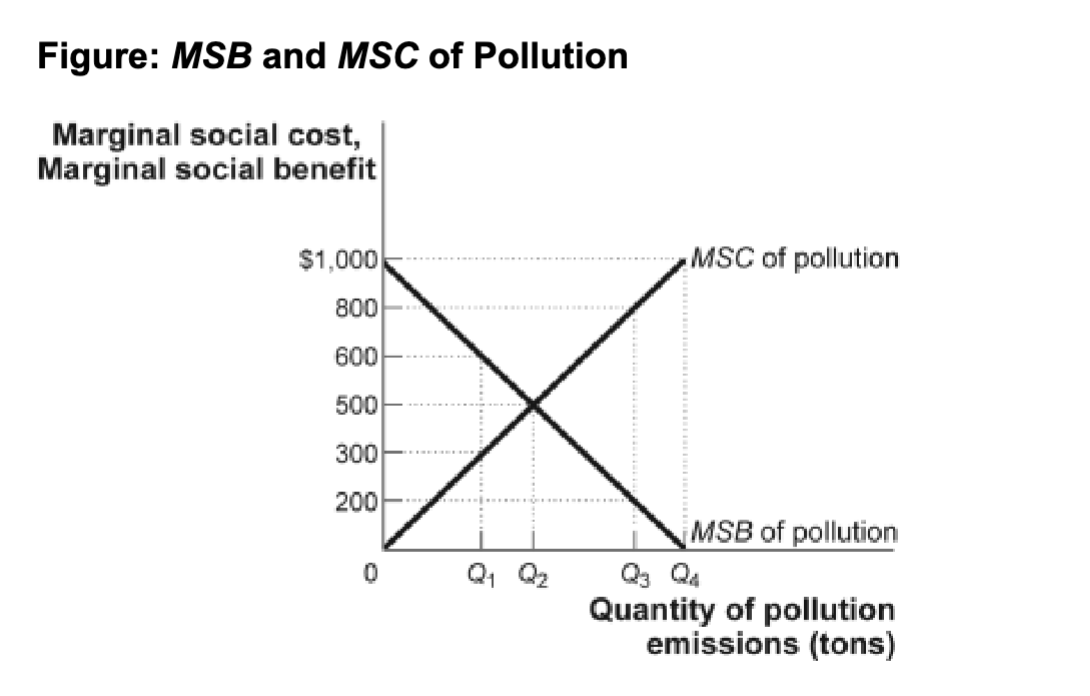

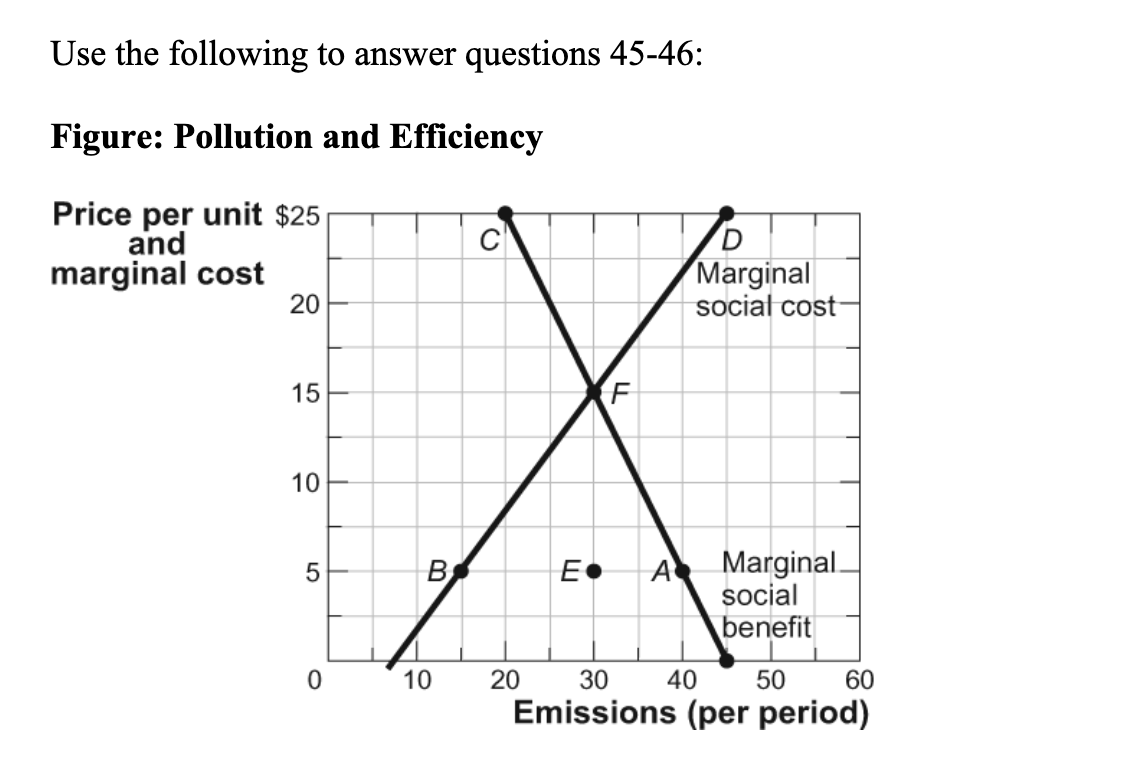

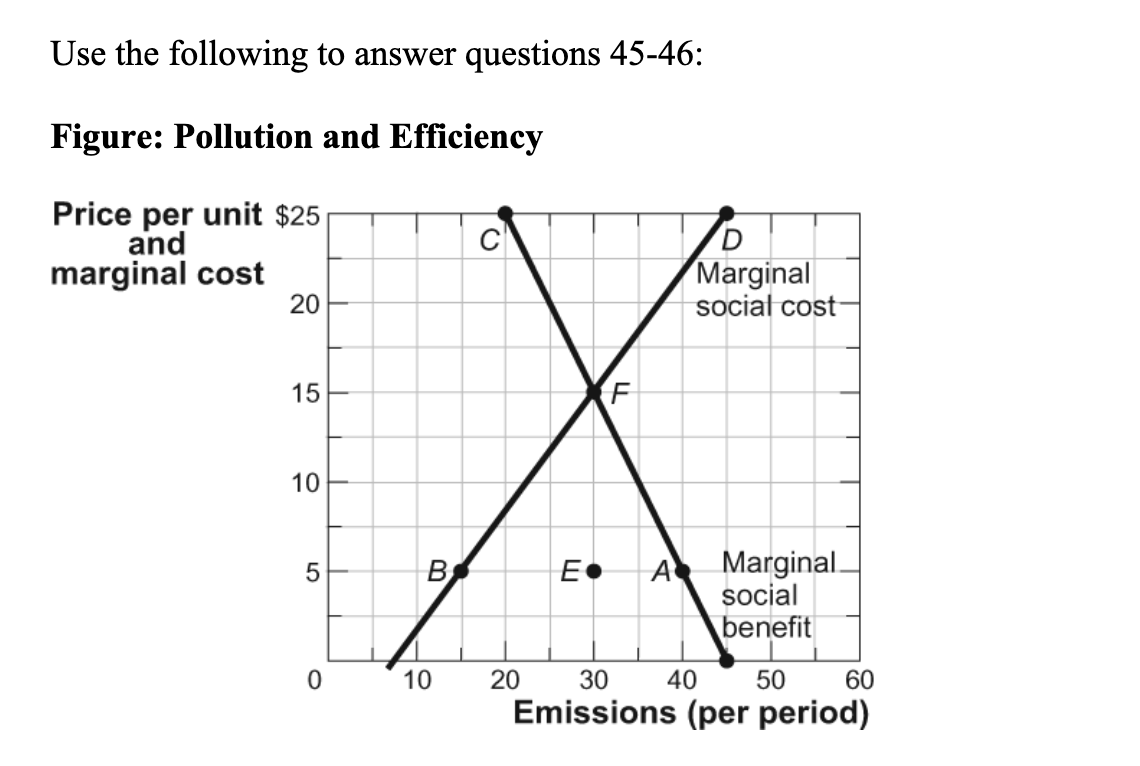

(Figure: MSB and MSC of Pollution) The graph shows the marginal social cost and marginal social benefit of pollution. What level of pollution represents the level that would be emitted in a market economy without government regulation?

A) Q3

B) Q1

C) Q4

D) Q2

C) Q4

Figure: MSB and MSC of Pollution) The graph shows the marginal social cost and marginal social benefit of pollution. What level of pollution represents the socially optimal level?

A) Q4

B) Q3

C) Q1

D) Q2

D) Q2

A Pigouvian subsidy (there are taxes and subsidies) is:

A) designed to encourage activities generating external benefits.

B) appropriate when the marginal social cost curve is above the marginal cost of production curve.

C) appropriate when the marginal social cost curve and the marginal social benefit curve intersect at an inefficient level.

D) designed to discourage activities generating externalities

A) designed to encourage activities generating external benefits.

One of the reasons community colleges receive government subsidies is that it is believed that education creates ________, and therefore without subsidies the quantity produced would be

________ the socially optimal quantity.

A) negative externalities; greater than

C) positive externalities;less than

B) no externalities; less than

D) positive externalities; greater than

C) positive externalities ; less than

The free-rider problem is a direct result of:

A) full-cost pricing.

C) marginal-cost pricing.

B) horizontally summed supply curves.

D) the inability to exclude nonpayers.

D) the inability to exclude nonpayers.

An inefficient allocation of resources will occur when:

A) no alternative exists that would increase the welfare of society.

B) decision makers are not faced with the full benefits and costs of their choices.

C) there are clearly defined property rights.

D) decision makers are faced with the full costs and benefits of their actions.

B) decision makers are not faced with the full benefits and costs of their choices.

Public goods differ from common resources in that:

A) both are excludable, but public goods are nonrival in consumption while common resources are rival in consumption.

B) both are nonexcludable, but public goods are nonrival in consumption while common resources are rival in consumption.

C) both are rival in consumption, but public goods are nonexcludable while common resources are excludable.

D) both are nonrival in consumption, but public goods are excludable while common resources are nonexcludable.

B) both are nonexcludable, but public goods are nonrival in consumption while common resources are rival in consumption.

The best example of a good whose consumption is nonexclusive is:

A) a bicycle.

B) a yard.

C) national defense.

D) a house

C) national defense.

If the marginal benefit received from a good is less than the marginal opportunity cost of production, (MB< MOC) then:

A) the market is producing too little of the good.

B) society's well-being cannot be improved by changing production.

C) society's well-being can be improved if production increases.

D) society's well-being can be improved if production decreases.

D) society's well-being can be improved if production decreases.

If the market supply and demand curves for a common resource include all costs, then:

A) there is an external cost to society from the common resource.

B) the common resource will be underused.

C) the common resource will be overused.

D) the common resource will be used at the socially optimal level.

D) the common resource will be used at the socially optimal level.

Pharmaceutical companies typically face very high fixed costs when developing new drugs. The marginal cost of producing a drug after development is very low. (high FC, then low MC after development) When these companies set price and output to maximize profit, patients pay a ________ price for ________ amounts of the drug than are socially optimal.

A) higher; lower

B) lower; lower

C) higher; higher

D) lower; higher

End of pt 1

A) higher; lower

Price takers are individuals in a market who:

A) select a price from a wide range of alternatives.

B) select the lowest price available in a competitive market.

C) select the average of prices available in a competitive market.

D) have no ability to affect the price of a good in a market.

D) have no ability to affect the price of a good in a market.

The assumptions of perfect competition imply that:

A) individuals in the market determine the market price.

B) firms in the market accept the market price as given.

C) there will be no new competition due to natural monopolies.

D) the price will be decreasing yearly

B) firms in the market accept the market price as given.

The perfectly competitive model does NOT assume:

A) a great number of buyers.

B) easy entry to and exit from the market.

C) a standardized product.

D) that firms attempt to maximize their total revenue

D) that firms attempt to maximize their total revenue

A competitive firm operating in the short run is maximizing profits and just breaking even. Its costs include a monthly state license fee of $100 that must be paid for as long as the firm operates. If the license fee is raised to $150, what should the firm do to maximize profits in the short run?

A) increase price

B) increase output

C) reduce output

D) not change output

D) not change output

When economic profits in an industry are zero:

A) firms are really doing badly.

B) firms are doing as well as they could do in other markets.

C) firms should exit so they can make an economic profit in some other market.

D) the industry is not in long-run equilibrium.

B) firms are doing as well as they could do in other markets.

A perfectly competitive industry is said to be efficient because the:

A) marginal cost of production of the last unit of output is minimized in the long run.

B) product is standardized across firms in the industry.

C) average total cost of production of the industry's output is minimized in the long run.

D) market price of the good is equal to economic profit for all firms in the industry.

C) average total cost of production of the industry's output is minimized in the long run.

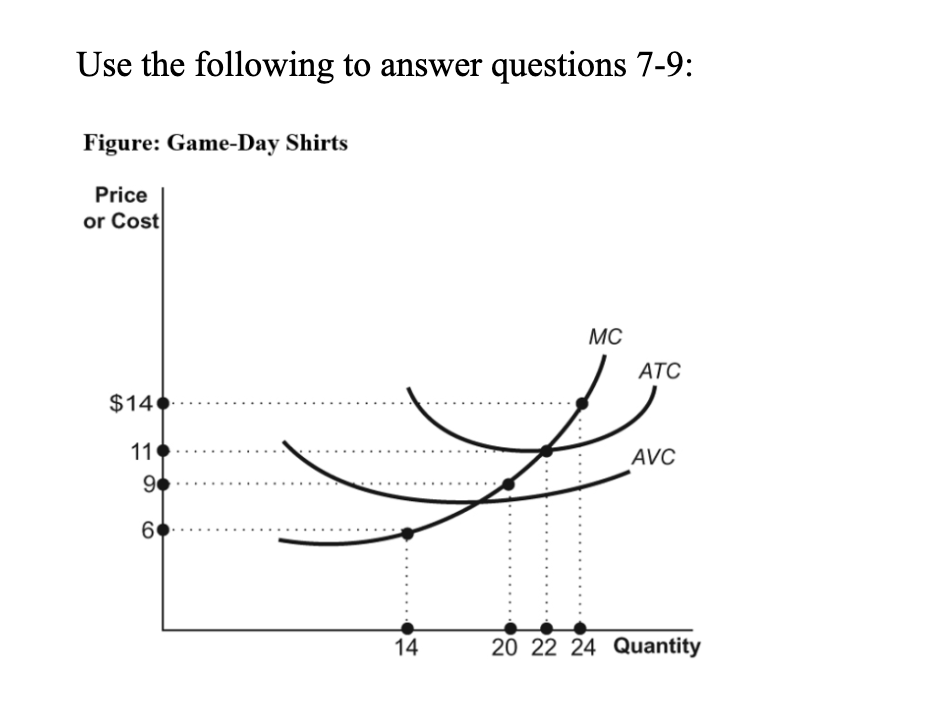

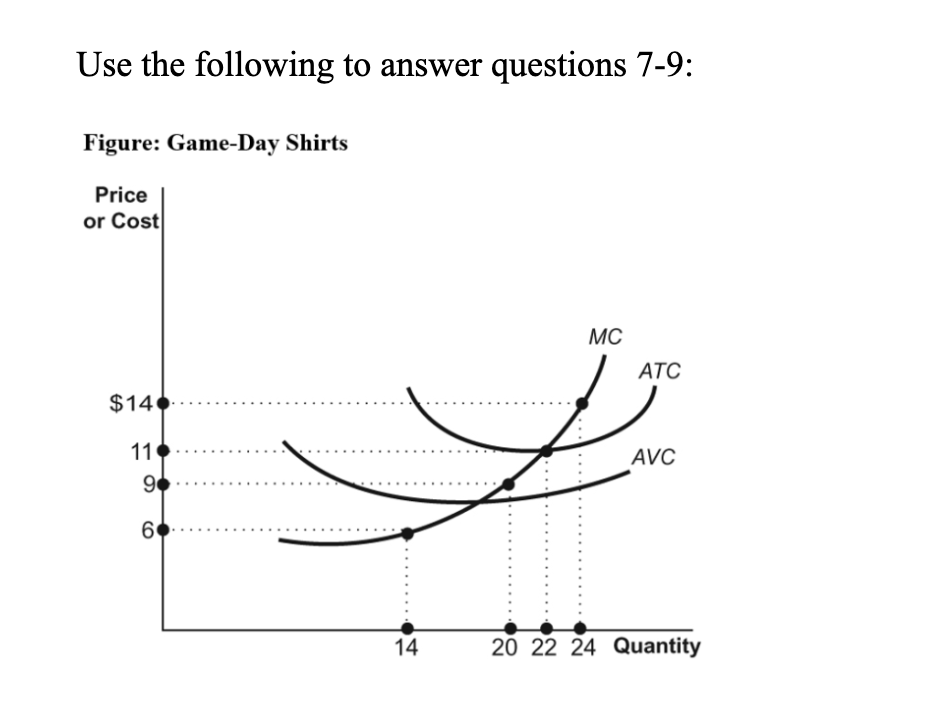

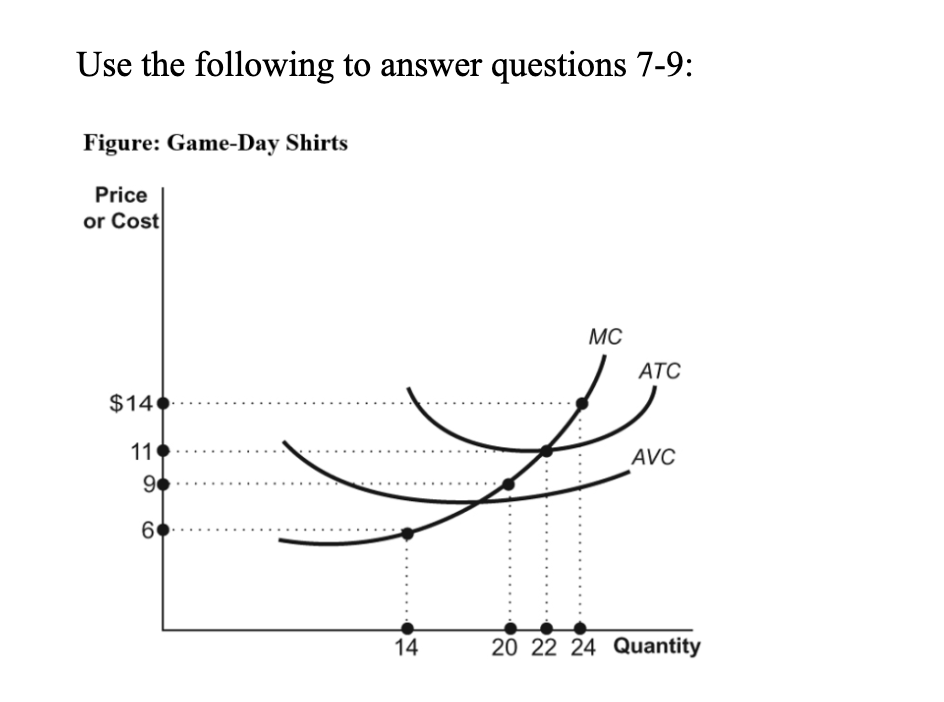

(Figure: Game-Day Shirts) Use Figure: Game-Day Shirts. Rick is one of 10 vendors who sell game-day T-shirts at football games in a perfectly competitive market. His costs are identical to the costs of the other 9 vendors. If the price of a shirt is $14, the short-run industry supply will be____ shirts.

A) 140

B) 200

C) 220

D) 240

D) 240

Rick is one of 10 vendors who sell game-day T-shirts at football games in a perfectly competitive market. His costs are identical to the costs of the other 9 vendors. If the price of a shirt is $9, the short-run industry supply will be ___ shirts.

A) 140

B) 200

C) 220

D) 240

B) 200

Use Figure: Game-Day Shirts. Rick is one of 10 vendors who sell game-day T-shirts at football games in a perfectly competitive market. His costs are identical to the costs of the other 9 vendors. When the industry is in long-run equilibrium, the price of each shirt will be _____, and the total quantity supplied in the market will be _____.

A) $6; 0

B) $9; 200

C) $11; 220

D) $14; 240

C) $11; 220

In the long run, each firm in a perfectly competitive industry will:

A) earn only enough to cover the opportunity costs of all resources used in production.

B) produce where MR is greater than MC.

C) differentiate its goods.

D) increase its price

A) earn only enough to cover the opportunity costs of all resources used in production. 0 economic profit

In contrast with perfect competition, a monopolist:

A) produces more at a lower price.

B) produces where MR > MC, and a perfectly competitively firm produces where P = MC.

C) may have economic profits in the long run.

D) earns zero economic profits in the long run.

C) may have economic profits in the long run.

Because monopoly firms are price setters, they:

A) can sell more only by lowering the price.

B) sell more at higher prices than at lower prices.

C) take the market-determined price as given and sell all they can at that price.

D) charge the highest possible price.

A) can sell more only by lowering the price.

If a monopolist is producing a quantity where MC = P, then profit:

A) is maximized.

B) is maximized only if MR = P.

C) can be increased by increasing production.

D) can be increased by decreasing production.

D) can be increased by decreasing production.

If a monopoly has a linear demand curve and is producing at the profit-maximizing level of output, at that level of output, demand is:

A) price-elastic.

B) price-inelastic.

C) perfectly price-inelastic.

D) price unit-elastic.

A) price-elastic.

Suppose a perfectly competitive market is suddenly transformed into one that operates as a monopoly market. We would expect price to _____, output to _____, consumer surplus to _____, producer surplus to _____, and deadweight loss to _____.

A) rise; fall; rise; rise; fall

B) rise; fall; fall; fall; rise

C) rise; fall; fall; rise; rise

D) fall; rise; rise; fall; fall

C) rise; fall; fall; rise; rise

One government policy for dealing with natural monopoly is to:

A) impose a price floor to eliminate the deadweight loss.

B) impose a price ceiling to reduce economic profit.

C) break it up into smaller firms.

D) impose fines on the monopolist.

B) impose a price ceiling to reduce economic profit.

To practice effective price discrimination, a monopolist must be able to:

A) estimate its own production and cost functions.

B) avoid charging too low a price.

C) prevent the resale of goods among groups of buyers.

D) calculate the income level of each buyer in the market.

C) prevent the resale of goods among groups of buyers.

The strategy that is NOT an example of price discrimination is:

A) discounts for senior citizens at the movies.

B) discounts for families with young children at motels.

C) generally lower prices at Walmart than at Target.

D) cheaper air fares if the traveler stays over a Saturday.

C) generally lower prices at Walmart than at Target.

If a monopolist is producing a quantity that generates MC = MR, then profit:

A) is maximized.

B) is maximized only if MC = P.

C) can be increased by increasing production.

D) can be increased by decreasing production.

A) is maximized.

Which Herfindahl–Hirschman index is MOST likely to indicate a perfectly competitive market?

A) 100

B) 1,800

C) 10,000

D) 100,000

A) 100

The owners of the gas stations in a town are trying to set up a cartel that will raise the price of gasoline. Which scenario will INCREASE the chances that the cartel will fail because of cheating by the owners?

A) All of the gas stations face the same costs.

B) There are only a few gas stations.

C) The gas stations are producing as much as they can.

D) The gas stations vary in terms of the services that they provide.

D) The gas stations vary in terms of the services that they provide.

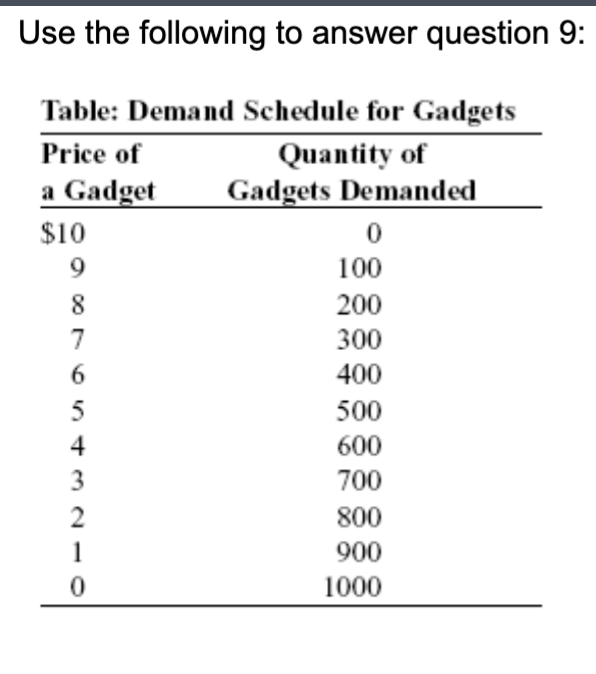

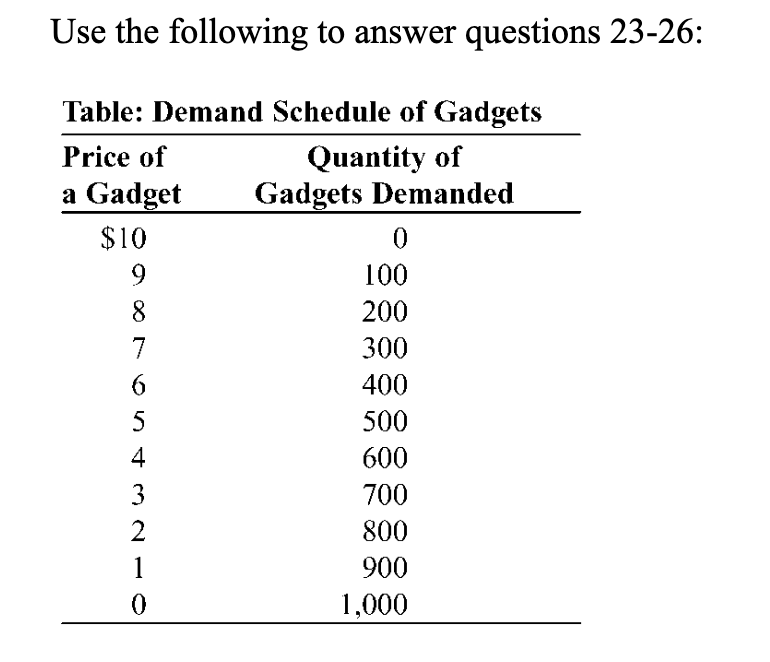

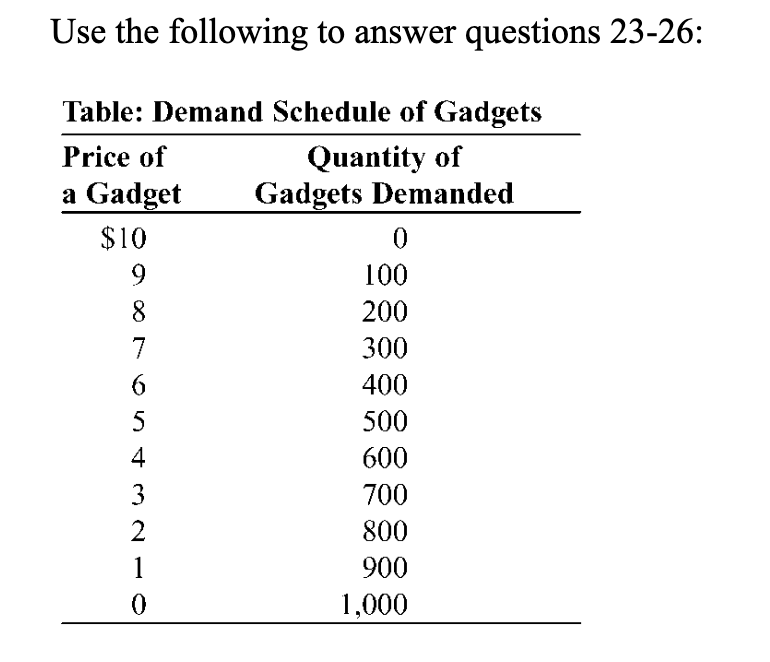

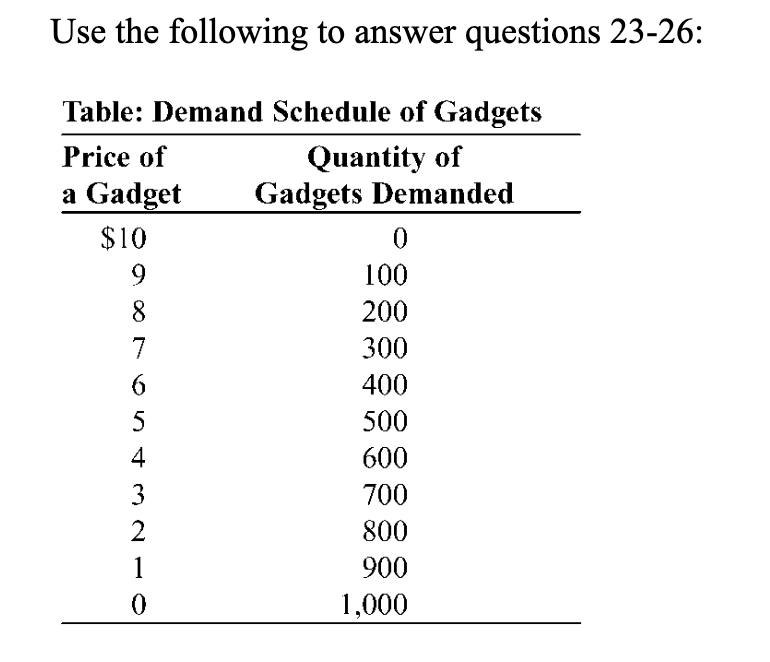

(Table: Demand Schedule of Gadgets) Use Table: Demand Schedule of Gadgets. The market for gadgets consists of two producers, Margaret and Ray. Each firm can produce gadgets with no marginal cost or fixed cost. If these two producers formed a cartel and acted to maximize total industry profits, total industry output would be _____, and the price would be _____.

They’re asking for industry (cartel) price and output!

A) 1,000; $10

B) 100; $9

C) 400; $6

D) 500; $5

D) 500; $5

The market for gadgets consists of two producers, Margaret and Ray. Each firm can produce gadgets with no marginal cost or fixed cost. If these two producers formed a cartel, split the production of output equally, and acted to maximize total industry profits, each firm's output would be _____, and each firm's profit would be _____.

(They’re asking for output and profit as a cartel.)

A) 500; $2,500

B) 250; $1,250

C) 1,000; $500

D) 1,000; $10,000

B) 250; $1,250

The market for gadgets consists of two producers, Margaret and Ray. Each firm can produce gadgets with non marginal cost or fixed cost. Suppose that these two producers have formed a cartel, agreed to split production of output evenly, and are maximizing total industry profits. If Margaret decides to cheat on the agreement and sell 100 more gadgets, the market price of gadgets will be:

since they are already profit maximizing at price of $5 and output of 500, she produces output by herself of 500 plus 100, so price = 4 and output = 600!

A) $4.

B) $5.

C) $6.

D) $7.

A) $4.

The market for gadgets consists of two producers, Margaret and Ray. Each firm can produce gadgets with no marginal cost or fixed cost. Suppose that these two producers have formed a cartel, agreed to split production of output evenly, and are maximizing total industry profits. If Margaret decides to cheat on the agreement and sell 100 more gadgets but Ray continues to sell 250 gadgets, Ray's profits will be:

A) $1,400.

B) $1,250.

C) $1,000.

D) $400.

C) $1,000.

Gary's Gas and Frank's Fuel are the only two providers of gasoline in their town. Gary and Frank decide to form a cartel. Later, Gary summarizes his pricing strategy as, “I'll cheat on the cartel because, regardless of what Frank does, cheating gives me the best payoff.” This is an example of:

A) a dominant strategy.

B) a tit-for-tat strategy.

C) an irrational strategy.

D) product differentiation.

A) a dominant strategy.

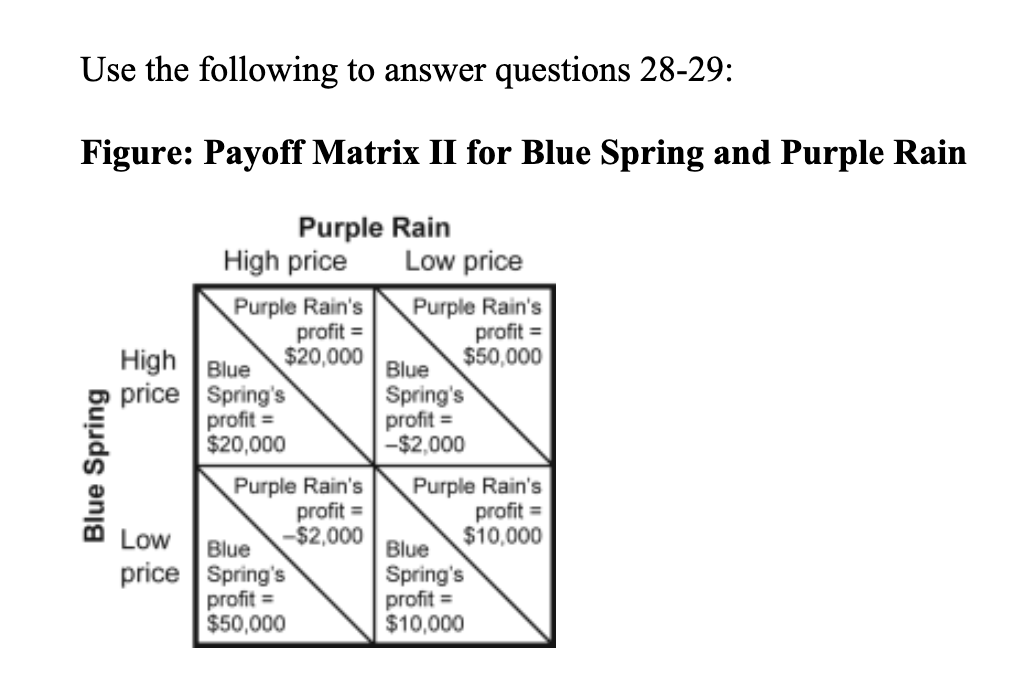

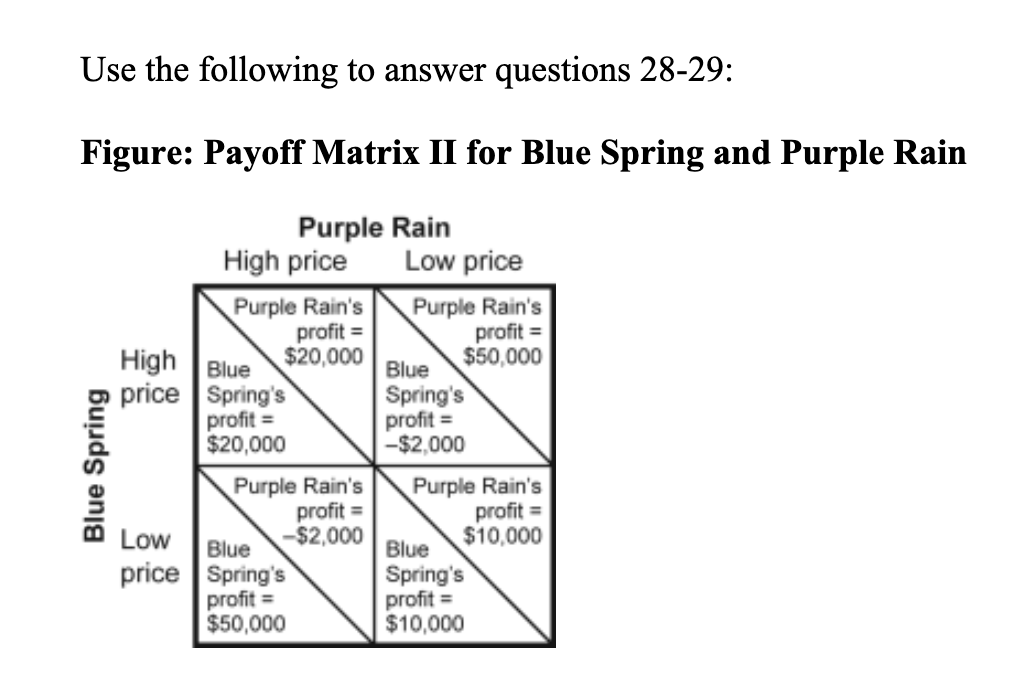

(Figure: Payoff Matrix II for Blue Spring and Purple Rain) Use Figure: Payoff Matrix II for Blue Spring and Purple Rain. The figure describes two producers of bottled water. The Nash equilibrium in the figure is reached when Blue Spring charges ___ price and Purple Rain charges a _____ price.

A) high; high

B) low; low

C) high; low

D) low; high

B) low; low

(Figure: Payoff Matrix II for Blue Spring and Purple Rain) Use Figure: Payoff Matrix II for Blue Spring and Purple Rain. The figure describes two producers of bottled water. Suppose Blue

Spring charges a high price and Purple Rain does the same. In the next period, Blue Spring charges a low price and Purple Rain incurs a loss. If Purple Rain responds with a tit-for-tat strategy, it will:

A) always charge a low price—the same as its dominant strategy.

B) make random changes in its price so that Blue Spring is left with no systematic strategy.

C) charge a low price in the next period and thereafter charge the same price that Blue Spring charged in the previous period.

D) always charge a high price.

C) charge a low price in the next period and thereafter charge the same price that Blue Spring charged in the previous period.

Tacit collusion is relatively easy for oligopolists if:

A) they are producing many different products.

B) there are only a few firms in the industry.

C) they are selling their product to only a few large buyers.

D) barriers to entry into the industry are low.

B) there are only a few firms in the industry.

For the monopolistically competitive, wild-caught seafood market, the demand curve for any individual firm is _____, and there are _____ producers of seafood.

A) downward sloping; few

B) upward sloping; many

C) vertical; few

D) downward sloping; many

D) downward sloping; many

If a monopolistically competitive firm is producing the profit-maximizing level of output and is earning an economic profit in the short run:

A) price is less than average total costs. P<ATC

B) price is less than marginal cost. P<MC

C) marginal revenue is less than marginal cost. MR<MC

D) marginal revenue equals marginal cost. MR = MC

D) marginal revenue equals marginal cost. MR = MC

To maximize profits, a firm in monopolistic competition should produce such that marginal cost:

A) equals average total cost.

B) is greater than marginal revenue.

C) equals marginal revenue.

D) equals price.

C) equals marginal revenue.

Monopolistically competitive firms have zero economic profits in the long run because of:

A) excess capacity.

B) price wars among firms.

C) easy entry and exit.

D) excessive advertising.

C) easy entry and exit.

In monopolistic competition:

A) firms may advertise to increase demand for their product.

B) entry of new firms shifts the demand curve for existing firms to the right.

C) when some firms exit, the demand curve for the firms that remain in the industry shifts to the left.

D) firms earn large economic profits in the long run

A) firms may advertise to increase demand for their product.

(Figure: Firms in Monopolistic Competition) Use Figure: Firms in Monopolistic Competition. In panel (B) of the figure, the profit-maximizing quantity of output is determined by the intersection at point:

A) Q.

B) R.

C) S.

D) T.

C) S

Figure: Firms in Monopolistic Competition) Use Figure: Firms in Monopolistic Competition. A positive economic profit will be earned if the profit-maximizing price is _____ in panel _____.

A) F; (A)

B) G; (A)

C) H; (B)

D) I; (C)

A) F; (A)

(Figure: Firms in Monopolistic Competition) Use Figure: Firms in Monopolistic Competition. There will be a negative economic profit (or an economic loss) earned at the profit-maximizing price _____ in panel _____.

A) G; (A)

B) H; (B)

C) I; (C)

D) J; (C)

D) J; (C)

The restaurant industry is characterized by excess capacity. This means that:

A) restaurants are producing more than their profit-maximizing level.

B) the profit-maximizing level is less than the level that minimizes average total costs.

C) restaurants are producing less than their profit-maximizing level.

D) the quantity of restaurant meals supplied exceeds the quantity of restaurant meals demanded.

B) the profit-maximizing level is less than the level that minimizes average total costs.

Some economists think that advertising is a waste of resources because:

A) rational consumers end up spending too little on brand names.

B) consumers may buy things they do not need.

C) advertising creates excess capacity.

D) advertising leads to lower costs for goods and services

B) consumers may buy things they do not need.

Which example illustrates a negative externality?

A) high prices for necessities such as drinking water in the aftermath of a natural disaster

B) the risks to nonsmokers from second-hand smoke

C) the increased risk of a traffic accident to an individual who uses a cell phone while driving

D) unemployment in the steel industry caused by low prices of imported (external) steel

B) the risks to nonsmokers from second-hand smoke

The efficient quantity of pollution emissions occurs where:

A) there is absolutely no damage done to a pristine environment.

B) government forces zero pollution to occur, no matter what the cost.

C) the marginal social benefits of pollution exceed the marginal social costs of pollution.

D) the marginal social benefit of pollution is equal to the marginal social cost of pollution

D) the marginal social benefit of pollution is equal to the marginal social cost of pollution

An industry with production that generates external costs produces a quantity of output that is:

A) socially optimal.

B) smaller than the socially optimal quantity.

C) larger than the socially optimal quantity.

D) socially optimal if a specific subsidy is given to buyers.

C) larger than the socially optimal quantity.

The Coase theorem states that, in the presence of externalities, a market economy will:

A) always reach an efficient solution.

B) never reach an efficient solution.

C) reach an efficient solution if transaction costs are sufficiently low and property rights are well-defined.

D) reach an efficient solution only in the case of government regulation.

C) reach an efficient solution if transaction costs are sufficiently low and property rights are well-defined.

(Figure: Pollution and Efficiency) Use Figure: Pollution and Efficiency. In this market, in which sulfur emissions are a result of production, if ___ units of emissions are produced, then ___.

A) 30; it would be efficient

B) 30; MSB > MSC

C) 45; total cost would equal total benefits

D) 45; MSC = 0

A) 30; it would be efficient

Figure: Pollution and Efficiency) Use Figure: Pollution and Efficiency. In this market, in which sulfur emissions are a result of production, too much pollution is found when the price is _____ and the quantity is _____.

There are low benefits and high costs!

A) $5; 15

B) $5; 40

C) $25; 20

D) $5; 30

B) $5; 40

If government officials set an emissions tax too high:

A) there will be too little pollution.

B) there will be too much pollution.

C) the marginal social cost of pollution will exceed the marginal social benefit of pollution.

D) pollution will be unabated.

A) there will be too little pollution.

When the government attempts to reduce climate change by establishing a minimum level of fuel efficiency on new cars, it is using a(n):

A) environmental standard.

B) emissions tax.

C) Pigouvian tax.

D) tradable emissions permit.

A) environmental standard.

An advantage of tradable emissions permits is that:

A) pollution costs are easier to measure than are emissions taxes.

B) nondegradable pollutants can be more easily controlled than can degradable pollutants.

C) the value that future generations place on pollution damages can be determined.

D) they provide incentives for firms to develop technologies that are less polluting.

D) they provide incentives for firms to develop technologies that are less polluting.

Positive externalities:

A) are similar to negative externalities in their ease of measuring marginal benefits.

B) are likely to be solved with the use of a Pigouvian tax.

C) are difficult to measure since marginal social benefits are hard to observe.

D) result from greater than optimal production of a good.

C) are difficult to measure since marginal social benefits are hard to observe.

The Herfindahl–Hirschman index is a measure of concentration found by:

squaring the percentage market share of each firm in the industry and then summing the squared market shares.

Tacit collusion in an industry is limited by:

a large number of firms and the bargaining power of buyers.

As the number of firms in an oligopoly decreases:

firms are more likely to engage in tacit collusion.