2.5 - a/symmetric information, market structures, profit & loss, game theory, collusive and non-collusive, concentration ratio

1/39

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

40 Terms

perfect/ symmetric information

all consumers and producers have equal access to all relevant information

optimal decision-making

imperfect/ asymmetric information

one party in a transaction has more/ better information than the other

suboptimal decision-making

government responses to assymetric information

regulation

provision of information

licensure (obtaining a license by service/ good provider)

private responses to asymmetric information

screening/ research by buyers

signalling by sellers

eg. warranties, brand name, service records

moral hazard

one party takes risks

doesn’t face full costs of the risks

the full costs are borne by the other party

eg. insurance

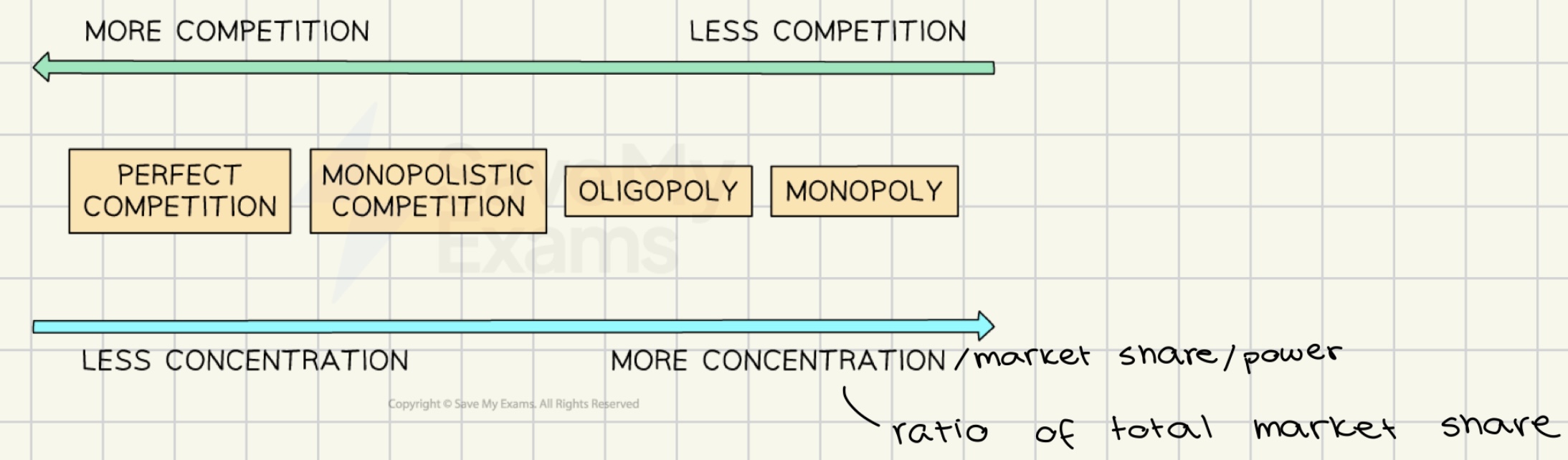

market structures

perfect competition

imperfect competition

monopolistic competition

oligopoly

monopoly

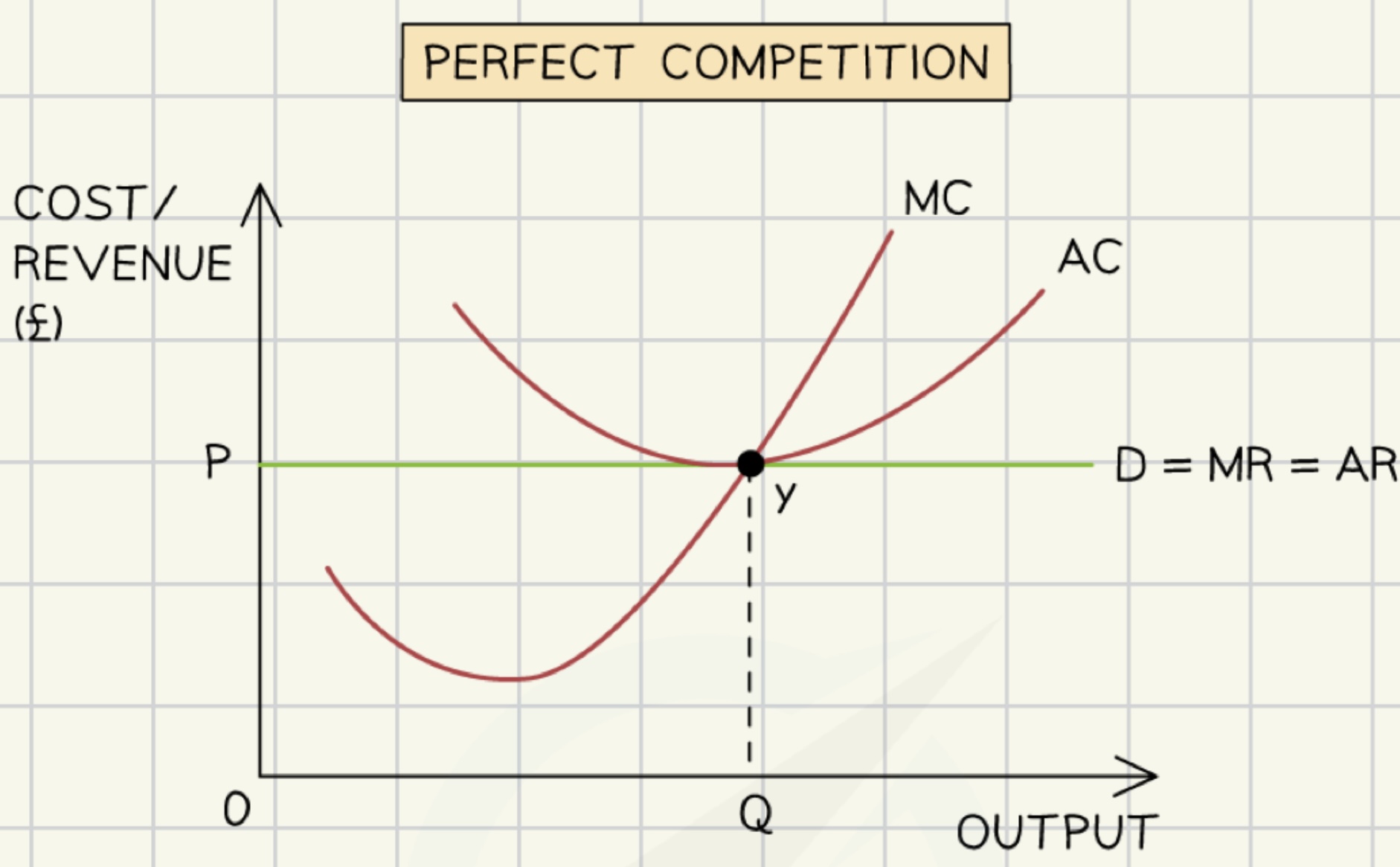

perfect competition

many small firms

homogeneous products

no barriers to entry or exit

no market power

perfect knowledge

perfect competition

leading to optimal outcomes for consumers and producers.

eg. agriculture

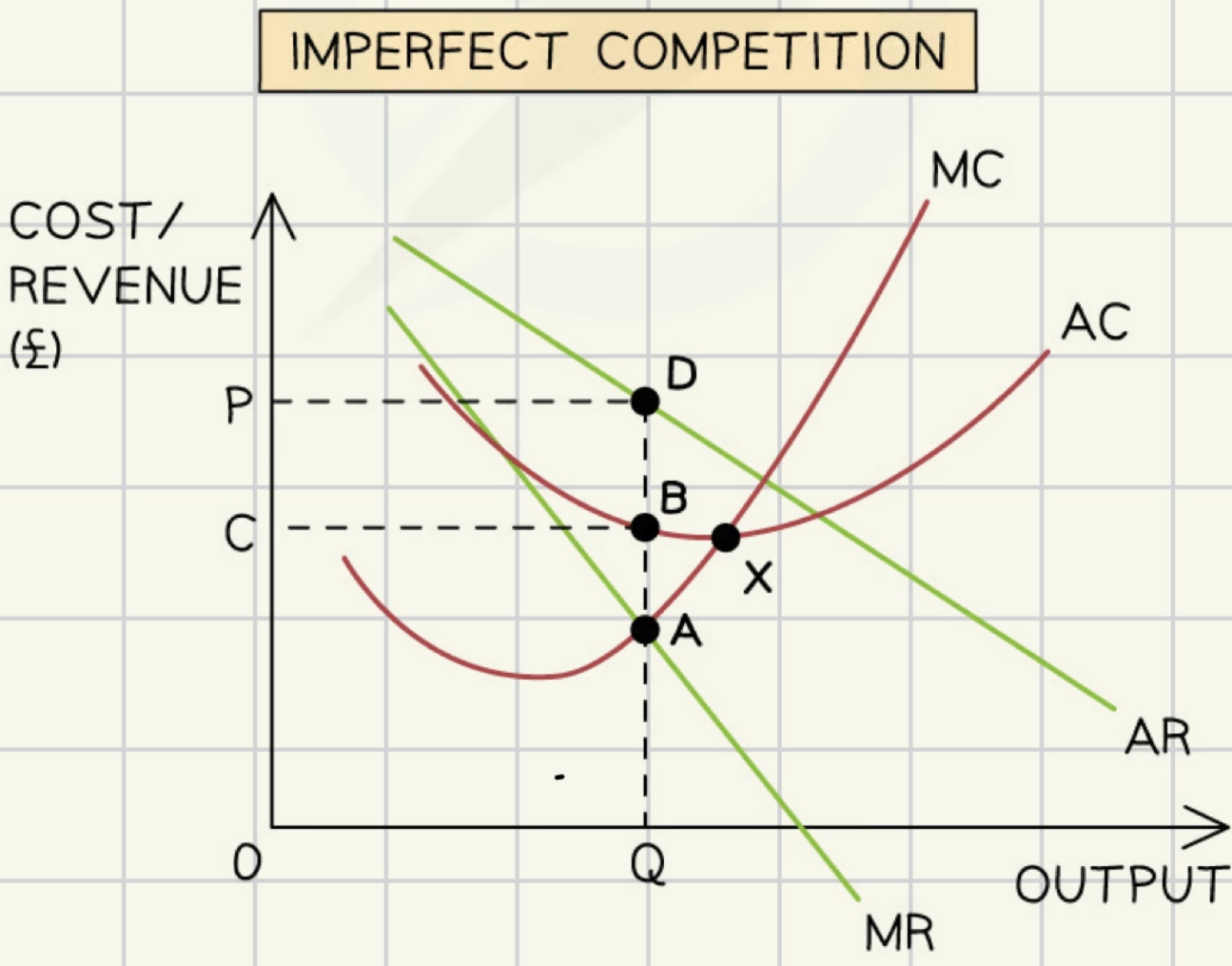

imperfect competition

market structure where individual firms have

some control over price

product differentiation

potentially inefficient outcomes.

monopolistic competition

many relatively small companies

differentiated products

low barriers to entry

some market power

imperfect knowledge among consumers

good amount of competition

eg. restaurants, computer games, books, furniture

oligopoly

few large companies

mutual interdependence

differentiated or homogeneous products

high barriers of entry

significant market power

imperfect knowledge

some competition

eg. cars,household appliances, detergents, cereal

monopoly

one large company

unique product

no close substitutes

high to impossible barriers of entry

complete market power

imperfect knowledge

no competition

eg. public utilities

marginal costs MC

change in total costs resulting from additional unit produced

marginal revenue MR

the increase in revenue resulting from an additional unit produced

abnormal profit in perfect competition

in short run

profits will always return to long term equilibrium

total revenue > total costs

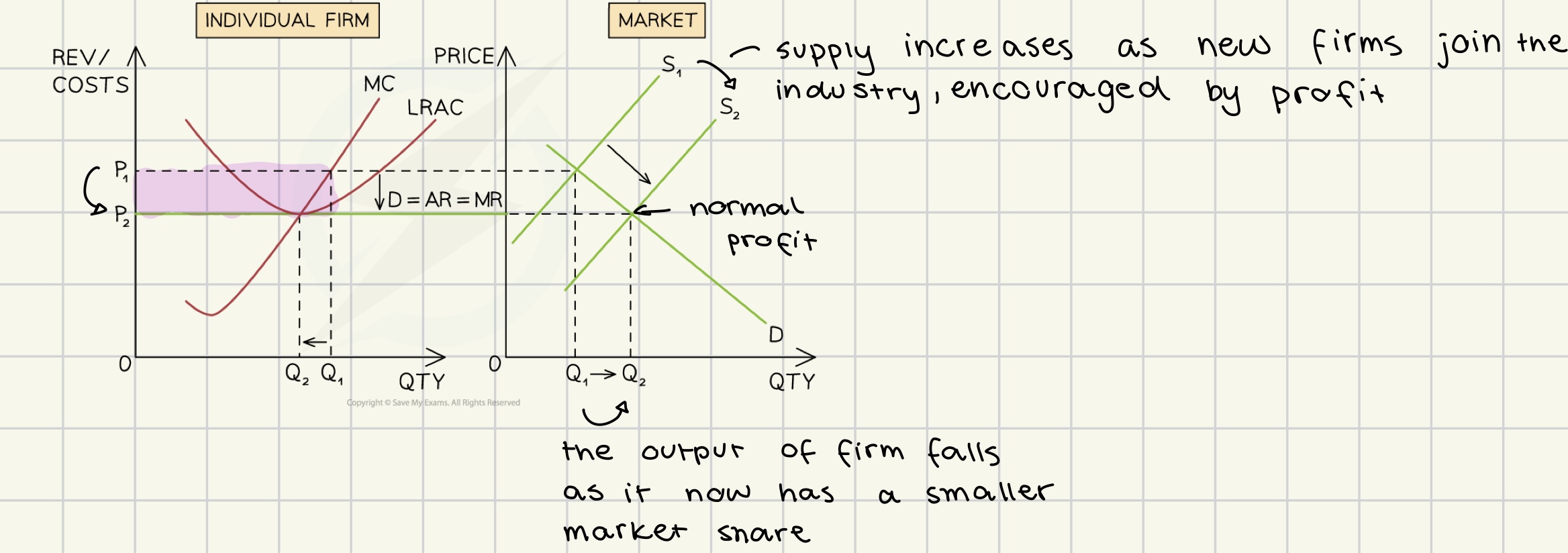

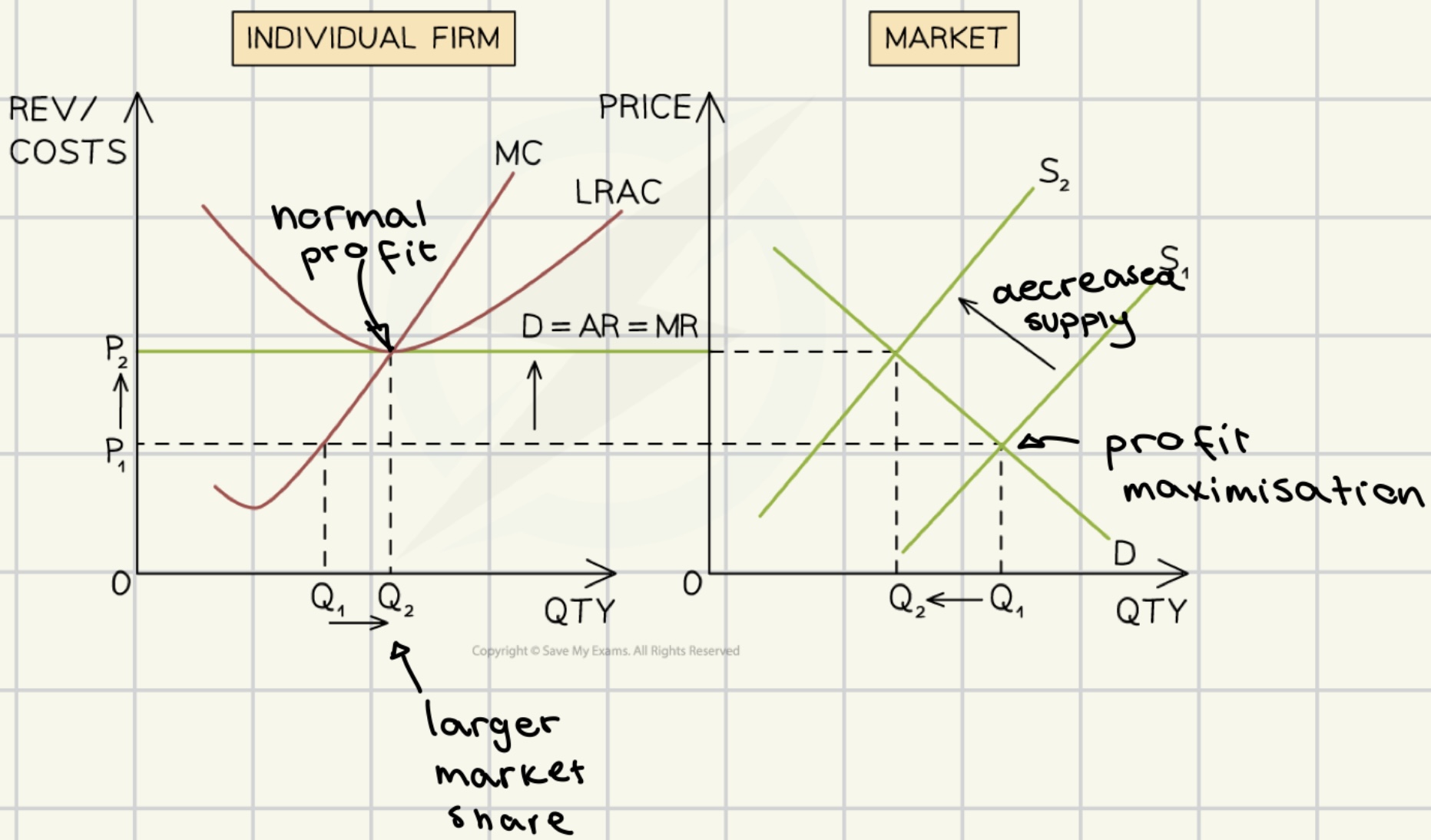

moving abnormal profit to normal profit in long run for perfect competition

abnormal profit → -firms making abnormal profit loose $ - new entrants attracted by profit opportunities -no barriers to entry → normal profit → - firms making losses leave - firms that stay make more profit → abnormal profit ….

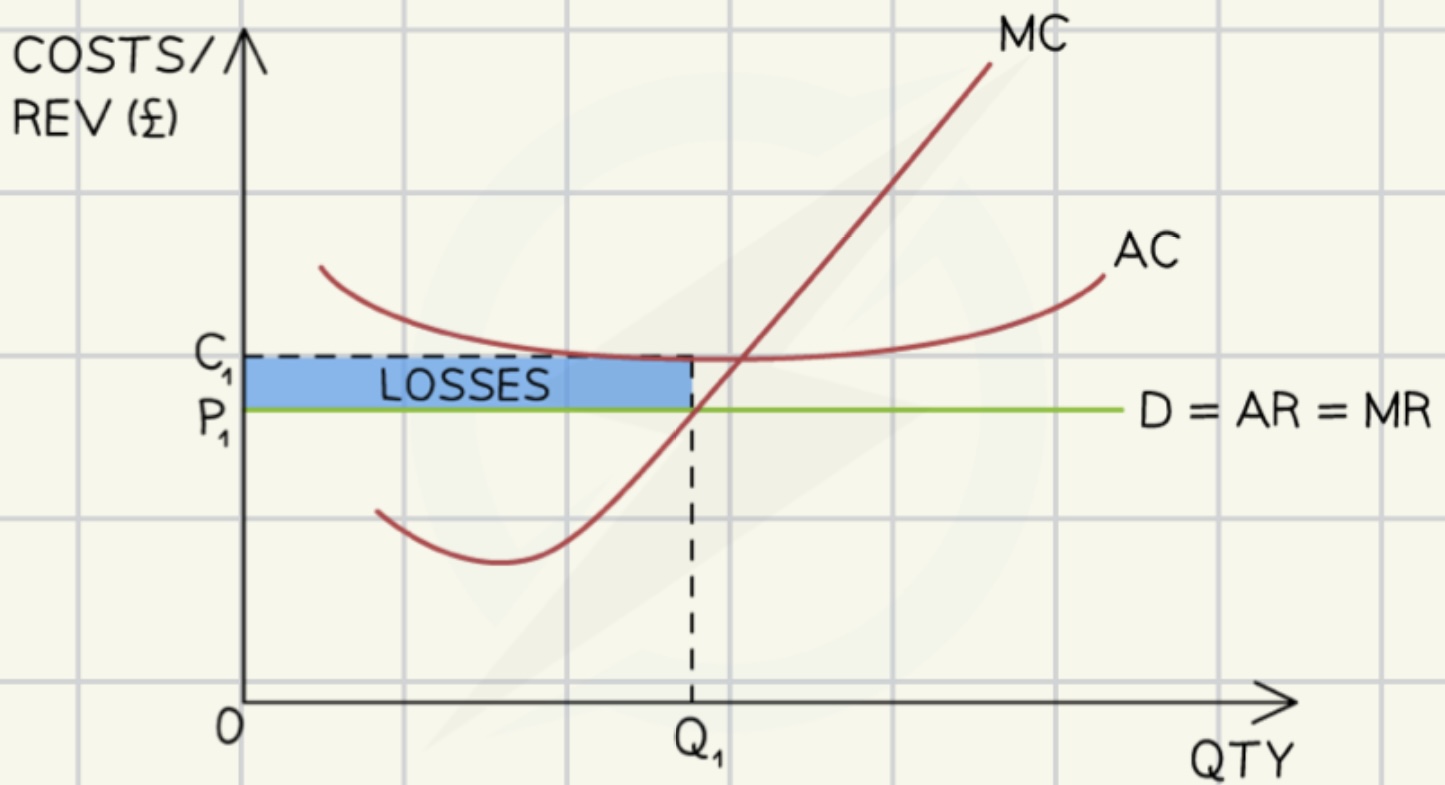

profit loss in short run in perfect competition

total revenue < total costs

moving from loss in short term to normal profits in long run in perfect competition

if firms in perfect competition make losses in the short run they will shut down

shut down rule:

if average revenue = average costs, the firm should shut down

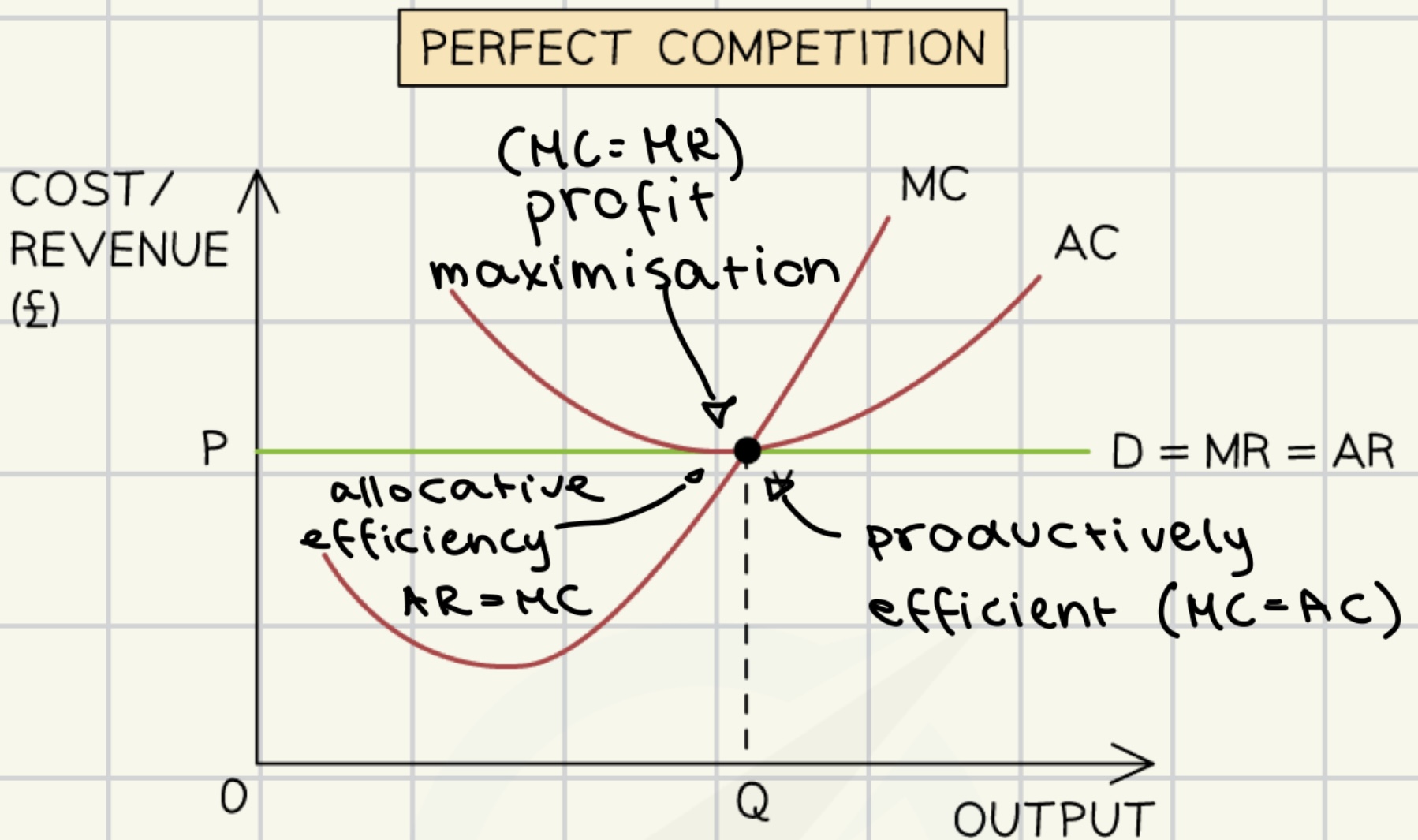

allocative efficiency in perfect competition

allocative efficiency → AR=MC

consumers and producers get maximum possible benefits

no excess demand/supply

no one can be better off without the other being worse off

average costs are minimised

no waste

high productivity

barriers to entry for monopoly

monopoly → 25% or more of the market

legal (patent/license/ copyright)

aggressive competition

economies of scale of existing companies

control of scarce resources

natural/ cost barriers

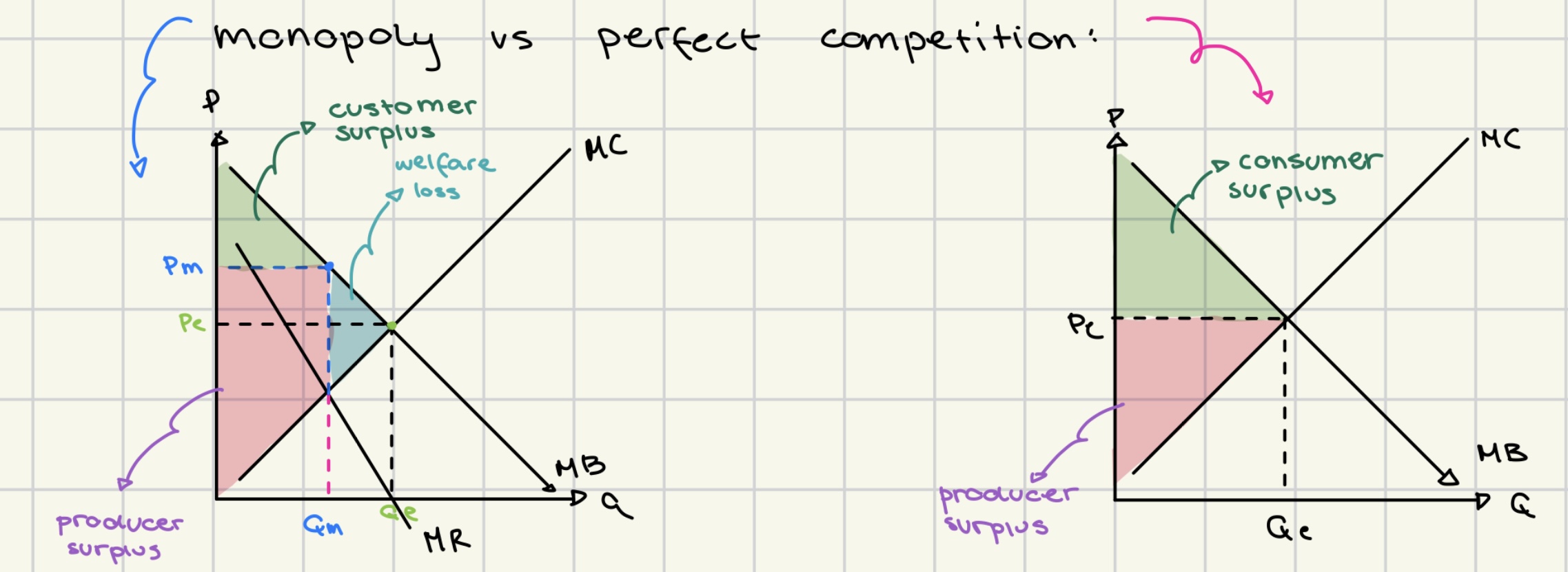

monopoly vs perfect competition graphs

benefits of monopoly

super profit allows investment in research and development

may have lower prices

economies of scale

natural monopoly

disadvantages of monopolies

no need to be more efficient

stifled innovation

no incentive to improve quality

higher price

lower output

loss of consumer and producer surplus

welfare loss

allocative inefficiency

market failure

negative impact on distribution of income

ways of dealing with monopolies

anti- trust laws to break up a monopoly

mandatory pricing regulations imposed by governments

price controls

competition policies

natural monopoly

when a single firm can provide a good or service at

lower cost than multiple competing firms

due to high fixed costs and economies of scale.

reasons for economies of scale

specialisation of labor

specialisation of management

bulk buying

financing economies

spreading of costs

reasons for diseconomies of scale

co-ordination and monitoring difficulties

communication difficulties

poor worker motivation

oligopoly strategic behavior (due to interdependence)

based on plans of action that take into account rivals’ possible courses of action

incentives in oligopoly market

conflicting incentives

incentive to collude (agreement between firms to limit competition between them)

incentive to compete/ cheat

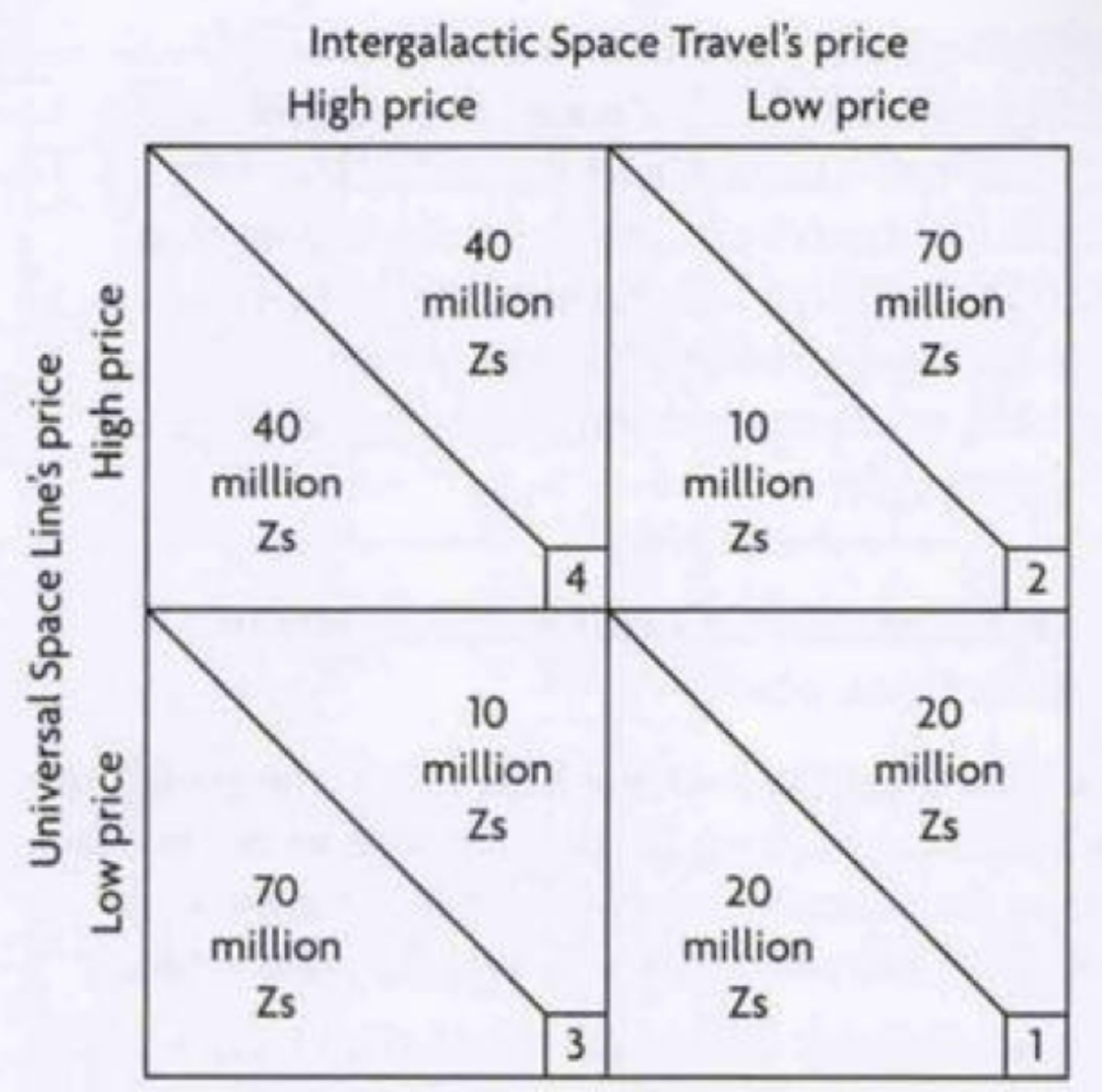

game theory

analyses and displays the behavior of decision-makers who are dependent on each other

their behavior may trigger price wars

game theory graph/ payoff matrix

Nash equilibrium

final position that results from the game

non-price competition in oligopoly

product development

advertising

branding

quality customer services

warranties

provision of credit

discounts on upgrades

collusive oligopoly

a market structure where firms collude to

limit competition

increase market power

maximize joint profits.

eg. cartels → OPEC

ILLEGAL due to its anti-competitive nature.

informal collusion

where firms coordinate their actions

without a formal agreement,

through signaling

tacit understandings

to achieve similar objective

price leadership collusion

informal collusion

one leading firm sets prices that other firms in the industry follow

effective coordination of pricing strategies

without explicit agreements.

non-collusive oligopoly

firms compete without colluding, resulting in

independent pricing

independent production decisions.

concentration ratio

a measure of the market share held by the largest firms in an industry

concentration ratio ↑ = competition in industry ↓

** if 4 largest firms control 40% of the output an industry is considered oligopolistic

weakness and usefulness of concentration ratios

do not reflect competition from abroad

no indication of the importance of firms in global market

do not account for competition from other industries

do not distinguish between different possible sizes of largest firms

disadvantages of oligopoly

welfare loss

allocative inefficiency

market failure

higher prices and lower quantities of output than under competitive conditions

loss of consumer surplus due to higher prices

negative impacts on the distribution of income

possibly less innovative

benefits of oligopoly

economies of scale due to large size

product development and technical innovations due to high abnormal profits

improved efficiency and lower costs

increased product variety