5. Continued Control of Cash (Petty Cash System of Control)

1/32

Earn XP

Description and Tags

Starts fro the section Petty Cash System of Control under Control of Cash

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

33 Terms

What does a company do to avoid writing checks for small amounts?

A company sets up a petty cash system.

What are petty cash payments?

Small payments for items such as shipping fees, minor repairs, and low-cost supplies.

A petty cash funds requires estimating what?

The amount of small payments to be made during a short period such as a week or month.

After estimating the amount of small payments to be made during a short period what happens?

A check is then drawn by the company cashier for an amount slightly in excess of the estimated amount.

What happens after the check is drawn by the company cashier?

The check is cashed and given to an employee called the petty cashier or petty cash custodian.

What does the petty cashier do?

Keeps the cash safe, makes payments from the fund, and keeps records of it in a secure petty cashbox.

When a cash payment is made, what does the person receiving payment do?

Signs a prenumbered petty cash receipt, also called a petty cash ticket.

Where does the petty cash receipt go?

It is placed in the petty cashbox with the remaining money.

When using the petty cash system of control, what makes up the total fund amount?

Total of all receipts plus the remaining cash.

Review figure 8.2 under Petty Cash System of Control and example.

When is the petty cash fund reimbursed?

The petty cash fund is reimbursed when it is nearing zero and at the end of an accounting period.

Who and what do they do to the paid receipts?

The petty cashier sorts the paid receipts by the type of expense or account and then totals the receipts.

Who does the petty cashier give all paid receipts to?

The company cashier.

What does the company cashier do after receiving all the paid receipts?

They stamp all receipts paid so they cannot be reused, files them for recordkeeping, and gives the petty cashier a check.

What happens when the check that the company cashier gives the petty cashier is cashed?

When this check is cashed and the money placed in the petty cashbox, the total money in the petty cashbox is restored to its original amount. The fund is now ready for a new cycle of petty cash payments.

What is the entry to record the setup of a petty cash fund, assume for $75?

debit Petty Cash and credit Cash.

After the petty cash fund is established, the Petty Cash account is not debited or credited again unless…

the amount in the fund is changed.

Review petty cash payments report and example under Petty Cash System of Control.

Why is a petty cash fund usually reimbursed at the end of an accounting period?

So that expenses are recorded in the proper period, even if the fund is not low on money.

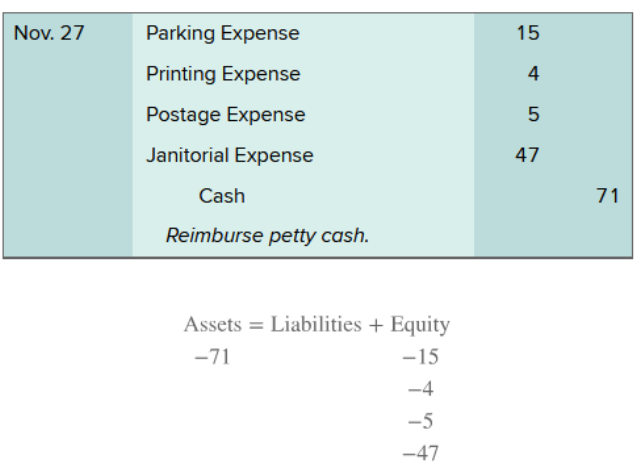

What is the entry to record the reimbursement of the petty cash fund (assuming no errors)?

debit the specific expenses and credit Cash.

When is a decision made to increase or decrease a petty cash fund?

When reimbursing it.

If a company decides to increase its petty cash fund when it reimburse the fund, what are the entries required to do?

1. Reimburse the fund as usual by debiting expenses and crediting cash

2. Increase the fund amount by debiting Petty Cash by the amount the company wants to increase. and credit Cash by the same amount.

If a company wants to increase its petty cash fund from $75 to $100 what entry should be made?

debit Petty Cash by $25 and credit cash $25.

If a company wants to decrease its petty cash fund from $75 to $55 what entry should be made?

debit Cash by $20 and credit Petty Cash by $20

What mistake can cause the petty cash fund to be short?

Sometimes a petty cashier fails to get a receipt for payment or overpays for the amount due. When this occurs and the fund is later reimbursed, the petty cash payments report plus the cash remaining will not equal the fund balance.

Sometimes a petty cashier fails to get a receipt for payment or overpays for the amount due. When this occurs and the fund is later reimbursed, the petty cash payments report plus the cash remaining will not equal the fund balance. How is this shortage recorded?

As an expense in the reimbursing entry with a debit to Cash Over and Short account.

How do we record the reimbursement of a petty cash fund (assuming cashier fails to get receipt for payment or overpays for the amount due)?

Debit all expenses, debit/credit Cash Over and Short by shortage or overage amount compared to the full amount the petty cash fund should be, credit Cash for amount of all expenses totaled plus the Cash Over and Short amount (not the amount remaining in the petty cash fund before replenishment).

Review Summary of petty cash accounting chart.

What is the entry to reimburse a $200 petty cash fund when its payments report shows $178 in repairs expense and only $15 cash remains?

debit Repairs expense $178, debit Cash Over and Short $7, credit Cash $185 (calculating by: total of all expenses + cash over and short amount).

Explanation: $178 in repairs expense + $15 cash remaining = 193. Short 7 dollars of $200 so we debit Cash Over and Short by $7.

What type of account is the petty cash fund?

An asset account.

What financial statement is the petty cash fund reported on?

The balance sheet.

Any person wishing to use funds from a petty cash fund must do what?

They must complete a petty cash receipt.

Review Need-To-Know 8-3