Gap & Go Trading Strategies Study Flash Cards

1/24

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

25 Terms

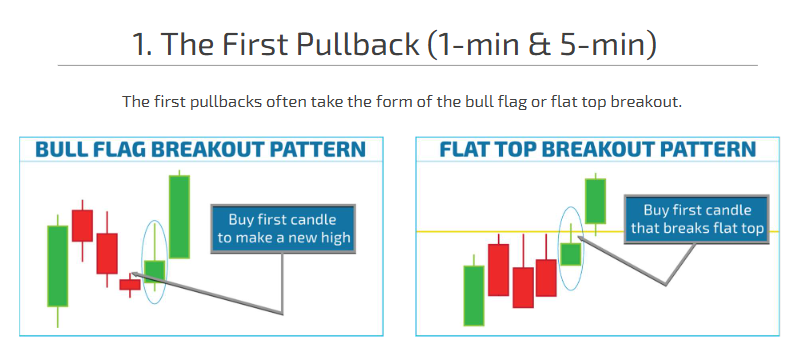

Where is your entry on the first and second pullback? How can an early entry be triggered?

First candle makes a new high (apex point of bull flag/flat top pattern)

breaking through a psychological level below the apex (half dollar/whole dollar) or by surge in buying (level 2)

Why is an early entry preferred for the first and second pullback?

To mitigate the risk of bull traps and false breakouts.

NOTE: Price should move up immediately

What is the profit target range for optimal profit-taking? When should you take partial profit? (First and Second Pullback)

The profit target range is 10-20-40 cents, focusing on retesting the high of the day and breakout price squeezes.

Take partial profit during the first momentum surge. High of day is the main target.

What are some risk factors to consider when trading strong flag patterns? (First and Second Pullback)

Lower risk with tight stops on strong flag patterns, but possible risks include secondary offerings or shelf registrations

Where should your stop loss be? (First and Second Pullback)

low of the last 5-minute candle or arbitrary stops (5-10-20 cents)

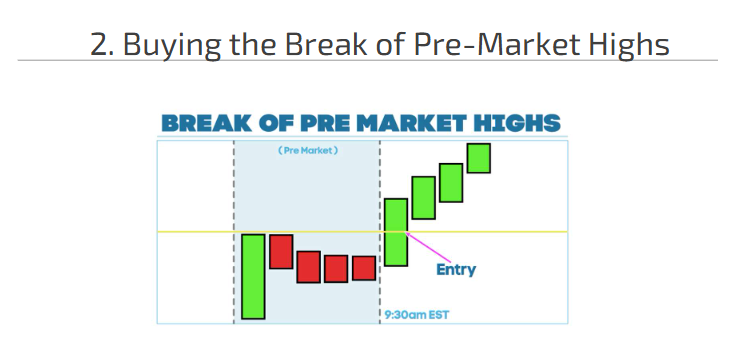

What is the entry strategy for trading at pre-market highs? (Break of Pre-Market Highs)

Enter based on the break of pre-market highs, which captures strength and attracts attention from other traders

Fits the "buy high, sell higher" strategy

What is the target profit range for a successful trade? (Break of Pre-Market Highs)

Look for continuation and a potential profit of 15-25 cents

Based on breakout or bailout criteria

What are the risk factors of the Break of Pre-Market Highs?

If stock hesitates post-entry, may exit quickly to avoid false breakouts

More aggressive trading in leading gapper conditions (lower floats, hot markets).

High potential for false breakouts due to the extended nature of gap scanners.

Where should a Stop Loss be set? (Break of Pre-Market Highs)

Set losses at the low of the last 5-minute candle or at arbitrary stops of 5-10-20 cents

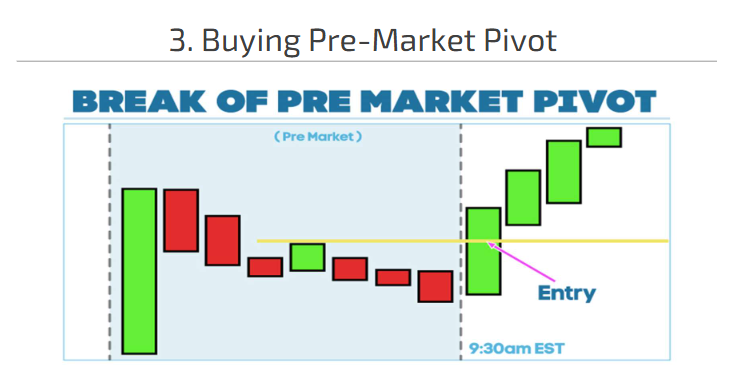

What is the entry price on the Break of Pre-Market Pivot?

Entry Price:

Entry near the pivot Level

May require early entry to anticipate the break

What is the target for this setup? What is your profit target? What principles should you utilize on your exits? (Break of Pre-market Pivot)

Aim for retest of high of day; large surges common in hot markets.

10-20-40 cents; utilize breakout or bailout principles for exits

BREAKOUT OR BAILOUT!

What are the risk that you should consider? (Break of Pre-market Pivot)

Weakness suggested by prior price action; avoid if too choppy/stair stepping down a little bit

Where should a Stop Loss be set? (Break of Pre-market Pivot)

Set to low of last 5-min candle or arbitrary stops at (5-10-20 cents).

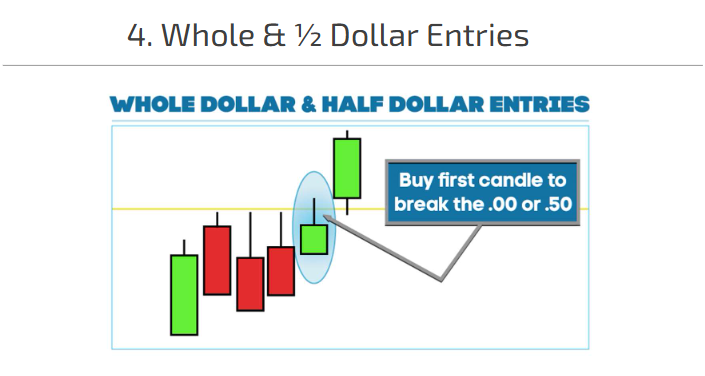

What is the strategy for entering trades near half/whole dollar levels? Why buy near psychological resistance points in trading? (Half and Whole Dollars)

Enter near half/whole dollar levels, anticipating quick increases upon breaking these levels.

Buying near these psychological resistance points can yield additional profits on strong movement

What is the target profit range? (Half and Whole Dollars)

Continuation for 15-25 cent moves; must maintain above entry levels.

What risk is associated with trading around half and whole dollar levels? (Half and Whole Dollars)

Half dollars and whole dollars are psychological level of resistance. When they do break, the break is quick

False breakouts can occur; especially critical in higher-priced stocks.

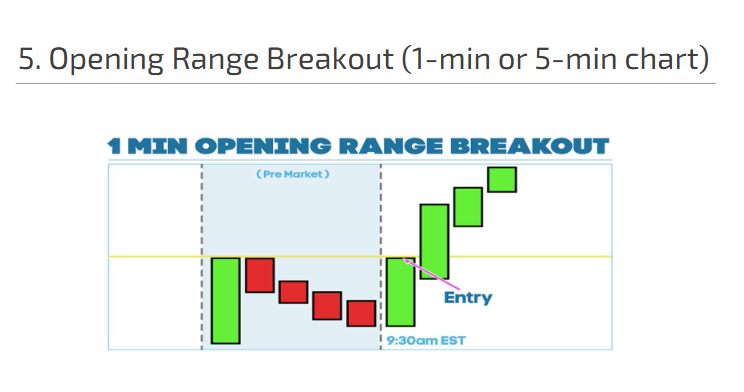

What is the entry strategy for the Opening Range Breakout (ORB)?

Target the high of the opening range for entry; this strategy works better on stocks that are grinding with higher floats.

What is the typical target for a 1-minute Opening Range Breakout (ORB)?

The typical target for a 1-minute ORB is to retest the high of the day, or at least 15-20 cents.

What is the typical target and profit target for a 1-minute Opening Range Breakout (ORB)?

The target of a 1-minute ORB is typically a retest of the high of day, or at least 15-20 cents.

10-20-40 cents. Breakout or bailout is still a good rule of thumb

What can large ranges in 1-minute candles indicate in trading? (ORB)

They can lead to premature stops and indicate weakness if there is a lack of early movement.

What’s the stop loss on the ORB?

Low of the opening 1-min candle or arbitrary stops (5-10-20 cents).

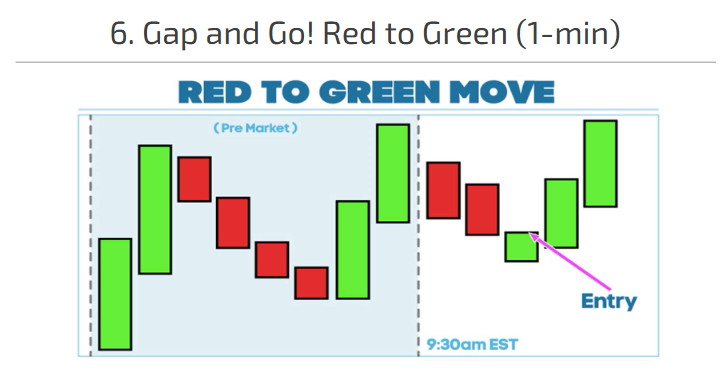

What does an entry that indicates potential bull trap or explosive move signify?

What is considered a desirable target & profit target for red to green setup?

Progress through high of day to pre-market highs is considered a desirable target.

10-20-40 cents. Breakout or Bailout!

What are the risk factors trading the red to green setup?

Watch for false breakouts post initial strength; stop losses should be tight

What’s the stop loss on the red to green setup?

Keep tight stops since the early weakness is a warning indicator. Stops at 5-10-20 cents.